In this age of technology, with screens dominating our lives yet the appeal of tangible printed objects hasn't waned. If it's to aid in education for creative projects, simply adding the personal touch to your space, Child Care Tax Return Calculator can be an excellent source. Through this post, we'll take a dive deeper into "Child Care Tax Return Calculator," exploring the different types of printables, where they are available, and ways they can help you improve many aspects of your daily life.

Get Latest Child Care Tax Return Calculator Below

Child Care Tax Return Calculator

Child Care Tax Return Calculator -

Verkko 11 kes 228 k 2021 nbsp 0183 32 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school

Verkko For 2022 the credit for child and dependent care expenses is nonrefundable and you may claim the credit on qualifying employment related expenses of up to 3 000 if you had one qualifying person or 6 000 if you had two or more qualifying persons The maximum credit is 35 of your employment related expenses

Child Care Tax Return Calculator provide a diverse assortment of printable, downloadable materials that are accessible online for free cost. These materials come in a variety of formats, such as worksheets, templates, coloring pages and much more. The benefit of Child Care Tax Return Calculator is their flexibility and accessibility.

More of Child Care Tax Return Calculator

Health Care SGR Law

Health Care SGR Law

Verkko On your tax return you will see a credit of 4 000 to go towards the 9 000 you paid Additionally if your employer provides dependent care assistance on your W 2 then you will be able to exclude a maximum amount of 10 500 or 5 250 if single or separate up from 5 000 and 2 500 respectively from your taxable income on your 2021 Tax Return

Verkko 3 maalisk 2023 nbsp 0183 32 Like dependent care FSAs the dependent care tax credit is for care expenses for children younger than 13 plus minors and adults unable to care for themselves For the 2022 2023 tax year you can claim 3 000 in expenses for one dependent or 6 000 for two or more dependents

Child Care Tax Return Calculator have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

customization: There is the possibility of tailoring printing templates to your own specific requirements whether it's making invitations, organizing your schedule, or even decorating your home.

-

Educational Benefits: Printables for education that are free can be used by students from all ages, making them an essential aid for parents as well as educators.

-

Easy to use: Access to an array of designs and templates saves time and effort.

Where to Find more Child Care Tax Return Calculator

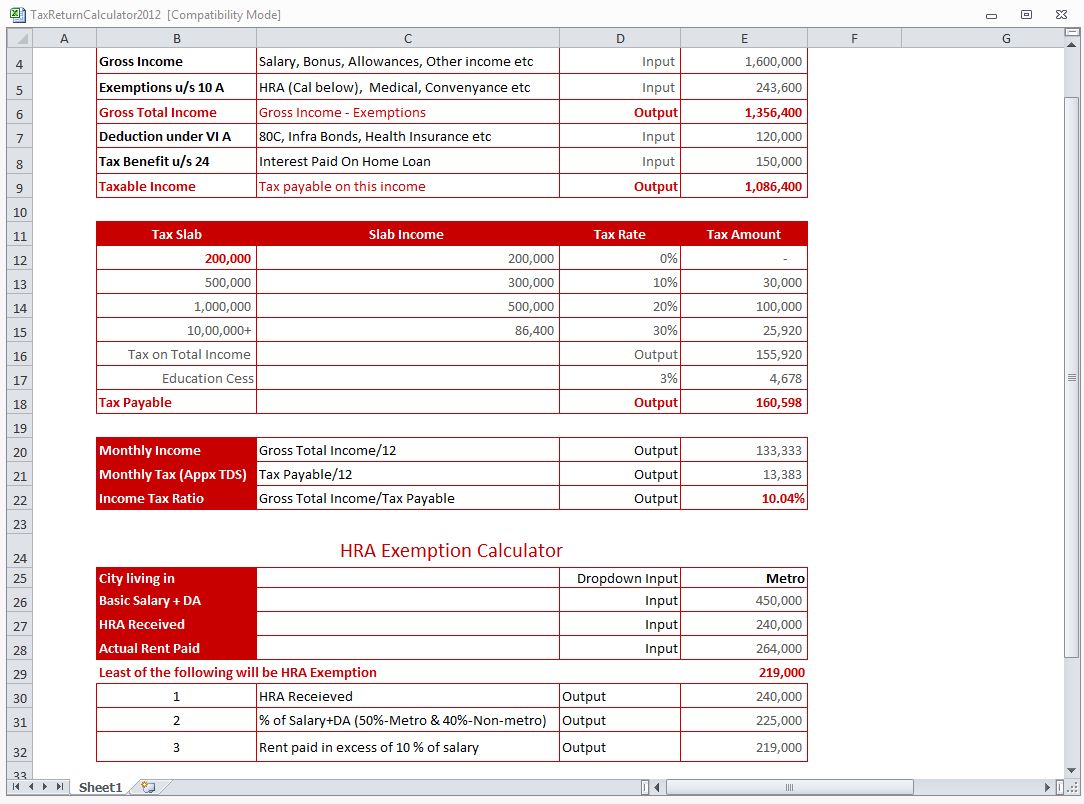

Tax Return Calculator 2012 Tax Calculator 2012

Tax Return Calculator 2012 Tax Calculator 2012

Verkko 30 kes 228 k 2021 nbsp 0183 32 For individuals making less than 40 000 a year or couples filing jointly with less than 60 000 per year you will not need to repay your child tax credit For everyone else the remaining child tax credit to claim in 2021 will be 1800 for children under 6 and 1500 for children 6 to 17 That means that all things being equal the

Verkko Attention This Child Tax Credit Calculator is for tax year 2023 and is being updated as information becomes available This CHILDucator will let you know if you qualify for the Child Tax Credit and or the Other Dependent Tax Credit on your 2023 Tax Return the amounts are also included

After we've peaked your curiosity about Child Care Tax Return Calculator we'll explore the places the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Child Care Tax Return Calculator designed for a variety objectives.

- Explore categories like decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free, flashcards, and learning tools.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- These blogs cover a wide selection of subjects, ranging from DIY projects to planning a party.

Maximizing Child Care Tax Return Calculator

Here are some unique ways of making the most of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Child Care Tax Return Calculator are a treasure trove with useful and creative ideas which cater to a wide range of needs and interest. Their accessibility and flexibility make them a valuable addition to every aspect of your life, both professional and personal. Explore the vast collection of Child Care Tax Return Calculator today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Child Care Tax Return Calculator truly cost-free?

- Yes, they are! You can print and download these items for free.

-

Does it allow me to use free printables in commercial projects?

- It is contingent on the specific conditions of use. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may come with restrictions in use. You should read the terms and conditions set forth by the creator.

-

How do I print printables for free?

- You can print them at home using your printer or visit the local print shop for more high-quality prints.

-

What software do I require to open printables free of charge?

- The majority of PDF documents are provided in the format PDF. This can be opened using free software, such as Adobe Reader.

Child Care Tax Credit Calculator Paradox

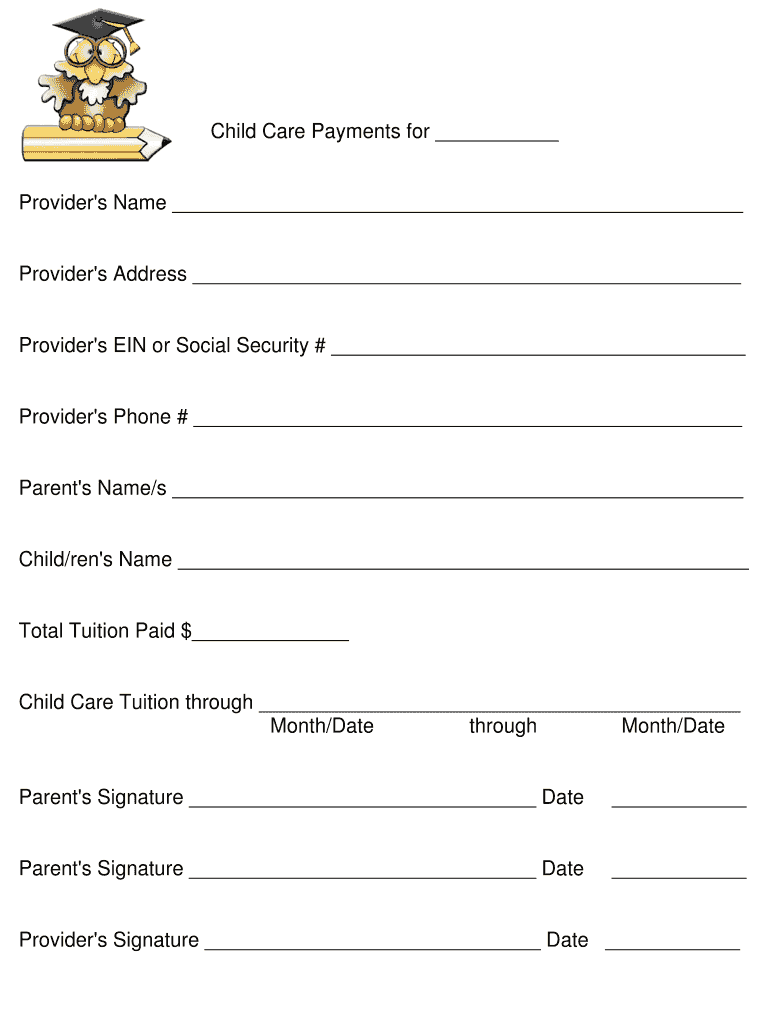

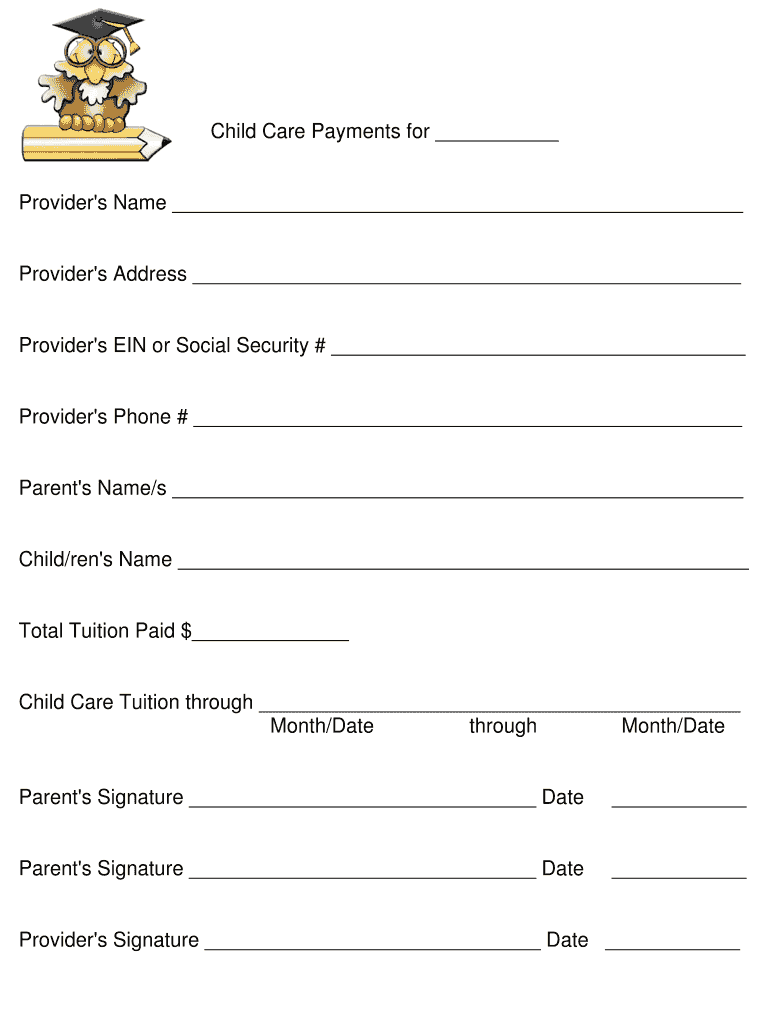

Child Care Year End Tax Statement PDF Form FormsPal

Check more sample of Child Care Tax Return Calculator below

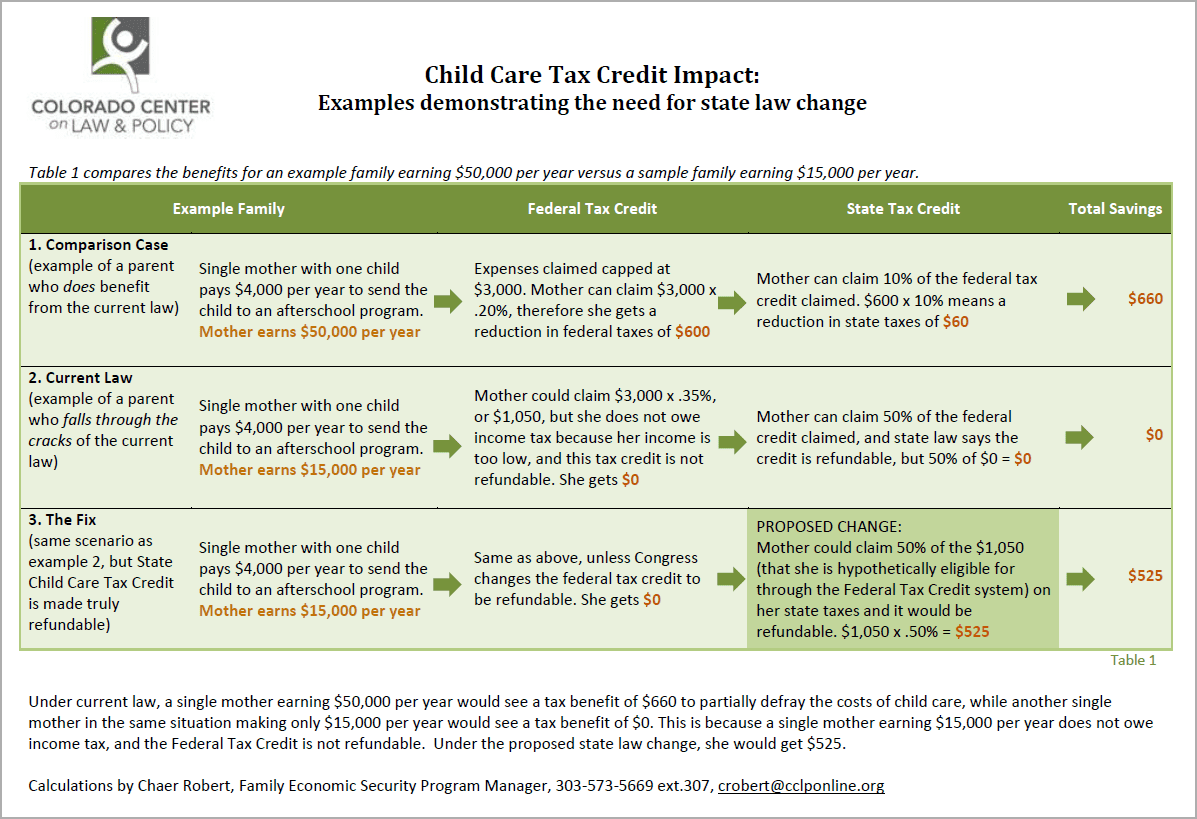

Fixing The Child Care Tax Credit EOPRTF CCLP

Child Care Tax Credit Calculator

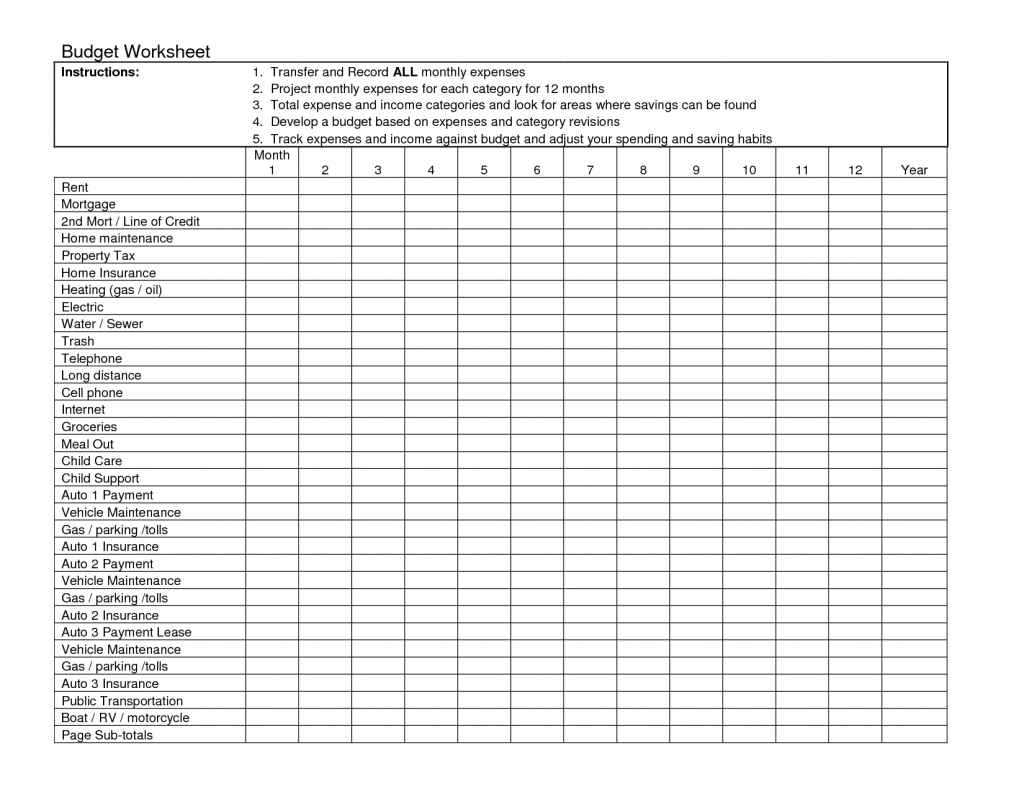

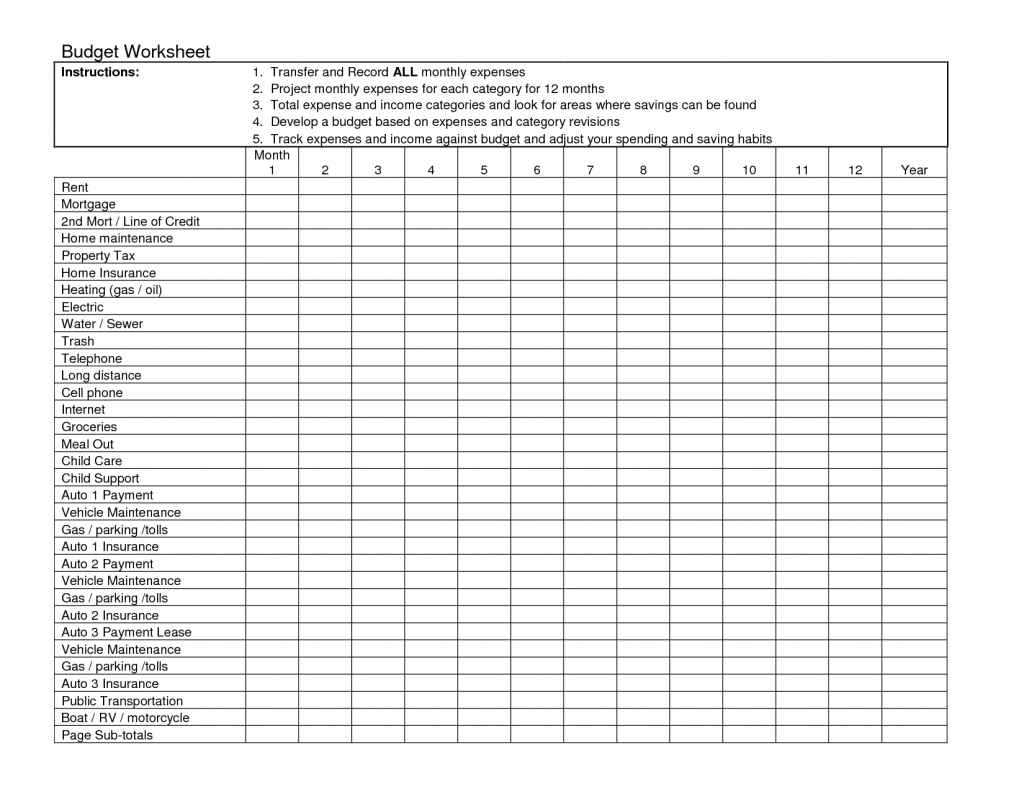

Family Day Care Tax Spreadsheet Pertaining To Child Care Receipt

Daycare Tax Statement PDF Form Fill Out And Sign Printable PDF

Daycare Business Income And Expense Sheet To File Your Daycare Business

https://www.irs.gov/publications/p503

Verkko For 2022 the credit for child and dependent care expenses is nonrefundable and you may claim the credit on qualifying employment related expenses of up to 3 000 if you had one qualifying person or 6 000 if you had two or more qualifying persons The maximum credit is 35 of your employment related expenses

https://www.omnicalculator.com/finance/child-tax-credit

Verkko 5 kes 228 k 2023 nbsp 0183 32 In detail the latest child tax credit scheme allows each family to claim up to 3 600 for every child below the age of 6 and up to 3 000 for every child below the age of 18 However these tax credits begin to phase out at certain income levels depending on your filing status

Verkko For 2022 the credit for child and dependent care expenses is nonrefundable and you may claim the credit on qualifying employment related expenses of up to 3 000 if you had one qualifying person or 6 000 if you had two or more qualifying persons The maximum credit is 35 of your employment related expenses

Verkko 5 kes 228 k 2023 nbsp 0183 32 In detail the latest child tax credit scheme allows each family to claim up to 3 600 for every child below the age of 6 and up to 3 000 for every child below the age of 18 However these tax credits begin to phase out at certain income levels depending on your filing status

Family Day Care Tax Spreadsheet Pertaining To Child Care Receipt

Daycare Tax Statement PDF Form Fill Out And Sign Printable PDF

Daycare Business Income And Expense Sheet To File Your Daycare Business

Earned Income Credit Calculator 2021 DannielleThalia

Top 7 Federal Income Tax Return Calculator Online Local Places Near Me

Top 7 Federal Income Tax Return Calculator Online Local Places Near Me

Child Care Credit Calculator