In this day and age in which screens are the norm it's no wonder that the appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses, creative projects, or simply adding the personal touch to your home, printables for free are now a useful resource. With this guide, you'll take a dive to the depths of "Child Tax Credit 2023 Payments," exploring what they are, where to find them, and the ways that they can benefit different aspects of your life.

Get Latest Child Tax Credit 2023 Payments Below

Child Tax Credit 2023 Payments

Child Tax Credit 2023 Payments -

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

For 2023 the initial amount of the CTC is 2 000 for each qualifying child The credit amount begins to phase out where modified AGI income exceeds 200 000 400 000

The Child Tax Credit 2023 Payments are a huge variety of printable, downloadable items that are available online at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and many more. The benefit of Child Tax Credit 2023 Payments lies in their versatility as well as accessibility.

More of Child Tax Credit 2023 Payments

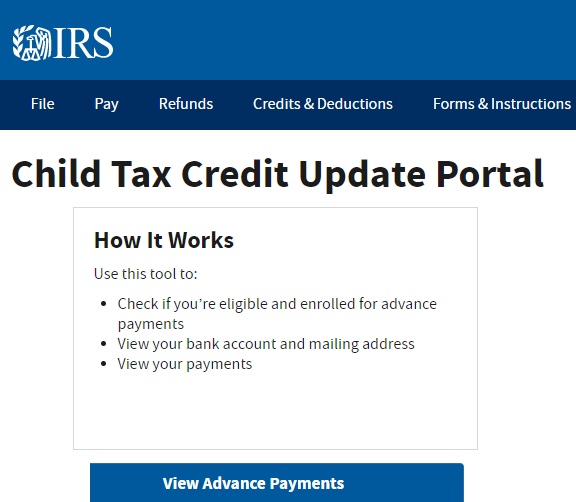

IRS Child Tax Credit Portal 2023 Login Advance Update Bank Information

IRS Child Tax Credit Portal 2023 Login Advance Update Bank Information

Child Tax Credit partially refundable If you have a child you may be eligible for the Child Tax Credit For 2023 the credit is up to 2 000 per qualifying child To qualify a

Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit

The Child Tax Credit 2023 Payments have gained huge recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Modifications: We can customize printing templates to your own specific requirements in designing invitations and schedules, or decorating your home.

-

Education Value Downloads of educational content for free can be used by students of all ages, which makes them an essential tool for teachers and parents.

-

It's easy: The instant accessibility to a variety of designs and templates reduces time and effort.

Where to Find more Child Tax Credit 2023 Payments

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

The Child Tax Credit CTC can reduce the amount of tax you owe by up to 2 000 per qualifying child If you end up owing less tax than the amount of the CTC you may be able to get a refund using the Additional Child Tax

Updated 29 February 2024 These tables show rates and allowances for tax credits Child Benefit and Guardian s Allowance by tax year 6 April to 5 April

In the event that we've stirred your interest in Child Tax Credit 2023 Payments Let's take a look at where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection and Child Tax Credit 2023 Payments for a variety motives.

- Explore categories such as home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- This is a great resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- The blogs covered cover a wide variety of topics, including DIY projects to party planning.

Maximizing Child Tax Credit 2023 Payments

Here are some unique ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to aid in learning at your home as well as in the class.

3. Event Planning

- Designs invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Child Tax Credit 2023 Payments are an abundance of useful and creative resources catering to different needs and passions. Their availability and versatility make them a valuable addition to both professional and personal life. Explore the endless world of Child Tax Credit 2023 Payments right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes they are! You can print and download these resources at no cost.

-

Can I use the free templates for commercial use?

- It's all dependent on the rules of usage. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables may be subject to restrictions regarding their use. Be sure to review the terms and regulations provided by the designer.

-

How do I print Child Tax Credit 2023 Payments?

- Print them at home with any printer or head to an in-store print shop to get more high-quality prints.

-

What program will I need to access printables free of charge?

- The majority of printables are in the format of PDF, which can be opened with free software like Adobe Reader.

Child Tax Credit Going Up In 2022 Latest News Update

How The Advanced Child Tax Credit Payments Impact Your 2021 Return

Check more sample of Child Tax Credit 2023 Payments below

Child Tax Credit January 2022 When Could CTC Payments Start In 2022

Child Tax Credit Income Limit 2023 Credits Zrivo

2021 Child Tax Credit Advances Payment Schedule Atlanta CPA

Are They Doing Child Tax Credit Monthly Payments In 2022 Leia Aqui

2021 Child Tax Credit Payments Does Your Family Qualify

Child Tax Credit Payment Schedule 2022 Child Tax Credit Payment

https://www.irs.gov › forms-pubs › update-to...

For 2023 the initial amount of the CTC is 2 000 for each qualifying child The credit amount begins to phase out where modified AGI income exceeds 200 000 400 000

https://www.irs.gov › newsroom › irs-an…

Eligible families will receive a payment of up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17 The first monthly payment of the expanded and newly advanceable Child

For 2023 the initial amount of the CTC is 2 000 for each qualifying child The credit amount begins to phase out where modified AGI income exceeds 200 000 400 000

Eligible families will receive a payment of up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17 The first monthly payment of the expanded and newly advanceable Child

Are They Doing Child Tax Credit Monthly Payments In 2022 Leia Aqui

Child Tax Credit Income Limit 2023 Credits Zrivo

2021 Child Tax Credit Payments Does Your Family Qualify

Child Tax Credit Payment Schedule 2022 Child Tax Credit Payment

3 Reasons To Opt Out Of The Child Tax Credit Payments EzTaxReturn

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some

2021 Child Tax Credit And Payments What Your Family Needs To Know