In a world with screens dominating our lives however, the attraction of tangible printed materials hasn't faded away. Whether it's for educational purposes such as creative projects or simply adding a personal touch to your home, printables for free have proven to be a valuable resource. We'll dive in the world of "Child Tax Credit 2023 Refund Dates," exploring what they are, how to find them and how they can add value to various aspects of your daily life.

Get Latest Child Tax Credit 2023 Refund Dates Below

Child Tax Credit 2023 Refund Dates

Child Tax Credit 2023 Refund Dates -

Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you may

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

Printables for free cover a broad assortment of printable resources available online for download at no cost. These resources come in many types, such as worksheets templates, coloring pages, and much more. The benefit of Child Tax Credit 2023 Refund Dates is in their variety and accessibility.

More of Child Tax Credit 2023 Refund Dates

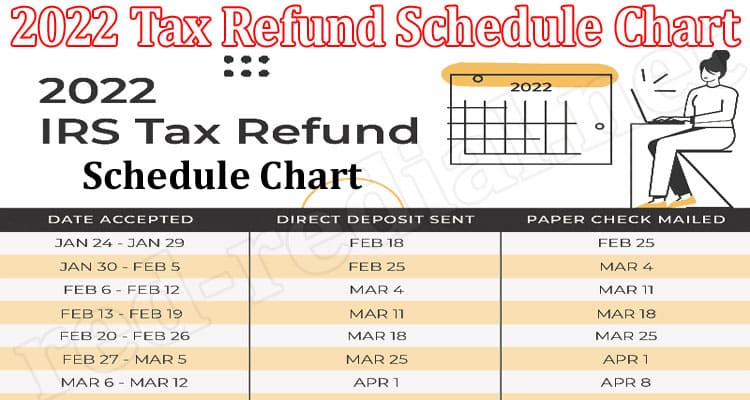

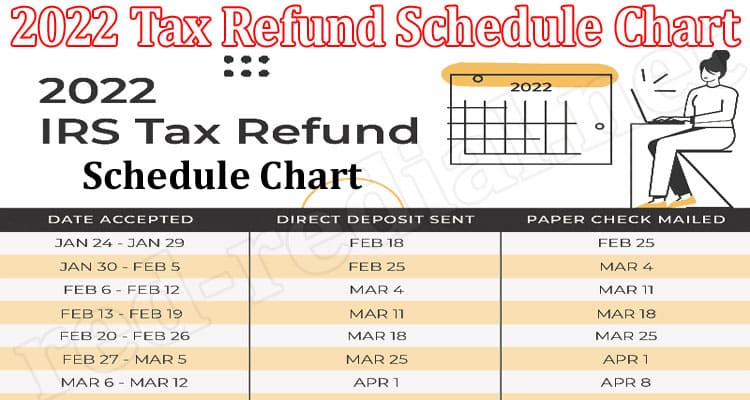

Chart Shows Estimated 2023 IRS Tax Refund Dates When Will You Get

Chart Shows Estimated 2023 IRS Tax Refund Dates When Will You Get

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024 The amount of your Child Tax Credit will be reduced if your adjusted gross income exceeds 400 000 if married filing jointly or 200 000 for all other tax filing statuses

Child Tax Credit 2023 Refund Dates have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Modifications: This allows you to modify printed materials to meet your requirements, whether it's designing invitations, organizing your schedule, or decorating your home.

-

Educational Worth: These Child Tax Credit 2023 Refund Dates offer a wide range of educational content for learners of all ages. This makes these printables a powerful device for teachers and parents.

-

An easy way to access HTML0: You have instant access a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Child Tax Credit 2023 Refund Dates

IRS Tax Refund Calendar 2023 Dates And Deadlines For The Start

IRS Tax Refund Calendar 2023 Dates And Deadlines For The Start

Taxpayers can claim the 2024 child tax credit on the tax return they will file in 2025 If you still need to file your 2023 tax return that was due April 15 2024 or Oct 15 2024 with a

The IRS has announced it will start accepting tax returns on January 23 2023 as we predicted as far back as October 2022 So early tax filers who are a due a refund can often see it as

Since we've got your interest in printables for free and other printables, let's discover where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Child Tax Credit 2023 Refund Dates to suit a variety of objectives.

- Explore categories like decoration for your home, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching tools.

- It is ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a broad selection of subjects, from DIY projects to planning a party.

Maximizing Child Tax Credit 2023 Refund Dates

Here are some ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print out free worksheets and activities to enhance your learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like weddings or birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Child Tax Credit 2023 Refund Dates are an abundance of useful and creative resources that satisfy a wide range of requirements and needs and. Their availability and versatility make them a great addition to both professional and personal lives. Explore the wide world of Child Tax Credit 2023 Refund Dates and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes you can! You can print and download the resources for free.

-

Can I download free printables in commercial projects?

- It's based on the terms of use. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables might have limitations in use. Be sure to check the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- Print them at home with an printer, or go to a local print shop to purchase better quality prints.

-

What software do I need in order to open printables free of charge?

- Most printables come in PDF format, which can be opened with free software such as Adobe Reader.

TAX REFUND 2023 IRS PATH ACT 2023 REFUND DATES SCHEDULE WITH EITC TAX

2023 IRS E File Tax Refund Direct Deposit Dates Where s My Refund

Check more sample of Child Tax Credit 2023 Refund Dates below

IRS Child Tax Credit Portal 2023 Login Advance Update Bank Information

2022 Tax Refund Schedule Chart Mar A Precise Info

IRS 2023 Tax Refund Deposit Dates

Irs Tax Refunds Dates 2022 Veche info 22

IRS Refund Schedule 2023 Tax Refund Dates WITC With Child Tax Credit

Child Tax Credit Xmas Payment Dates 2021 Kitchen Cabinet

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

https://www.cpapracticeadvisor.com/2023/01/30/...

However taxpayers with the Earned Income Tax Credit or Child Tax Credit generally have their refunds delayed by about one month while the IRS confirms eligibility for these credits

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

However taxpayers with the Earned Income Tax Credit or Child Tax Credit generally have their refunds delayed by about one month while the IRS confirms eligibility for these credits

Irs Tax Refunds Dates 2022 Veche info 22

2022 Tax Refund Schedule Chart Mar A Precise Info

IRS Refund Schedule 2023 Tax Refund Dates WITC With Child Tax Credit

Child Tax Credit Xmas Payment Dates 2021 Kitchen Cabinet

2023 Tax Refund Chart Printable Forms Free Online

Estimated IRS Tax Refund Dates Warner Pearson Vandejen Consultants

Estimated IRS Tax Refund Dates Warner Pearson Vandejen Consultants

Tax Refund Dates 2021 Where s My Refund When Am I Going To Get My Tax