In the digital age, where screens have become the dominant feature of our lives but the value of tangible printed materials isn't diminishing. No matter whether it's for educational uses for creative projects, simply to add some personal flair to your space, Child Tuition Fee Exemption In Income Tax India are now a useful resource. This article will take a dive into the world of "Child Tuition Fee Exemption In Income Tax India," exploring what they are, how they are, and how they can enhance various aspects of your life.

Get Latest Child Tuition Fee Exemption In Income Tax India Below

Child Tuition Fee Exemption In Income Tax India

Child Tuition Fee Exemption In Income Tax India -

Further you can also make tax deduction claims on tuition fee payment of your child under section 80C of the Income Tax Act 1961 The IT Act allows claiming tax

Allowances for Children s Education and Hostel Expenditure Types of Fee reimbursable under Section 10 14 Non eligibility of tuition fees deduction Section 80C

Child Tuition Fee Exemption In Income Tax India encompass a wide range of downloadable, printable material that is available online at no cost. These materials come in a variety of types, such as worksheets templates, coloring pages, and much more. The appeal of printables for free is in their variety and accessibility.

More of Child Tuition Fee Exemption In Income Tax India

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Deduction for tuition fees u s 80C of the Income Tax Act 1961 is available to Individual Assessee and is not available to HUF

Sending kids to school has an inbuilt tax advantage for parents This is because tuition fee qualifies for tax benefit under Section 80C of the Income tax Act

Printables that are free have gained enormous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Flexible: This allows you to modify printing templates to your own specific requirements such as designing invitations to organize your schedule or even decorating your home.

-

Educational Value: Education-related printables at no charge can be used by students of all ages. This makes these printables a powerful device for teachers and parents.

-

Affordability: You have instant access a variety of designs and templates reduces time and effort.

Where to Find more Child Tuition Fee Exemption In Income Tax India

Sabanci University Turkey Fully Funded Scholarship 2023 Apply By 2 Dec

Sabanci University Turkey Fully Funded Scholarship 2023 Apply By 2 Dec

Relevant Points regarding Deduction u s 80C for Payment of Children Education Fees Eligibility Deduction for Payment of Tuition Fees is only available to an Individual and

The Indian government offers tax benefits on child education fees to encourage a higher literacy rate and child education in India The tuition fees paid by a

Now that we've ignited your interest in Child Tuition Fee Exemption In Income Tax India, let's explore where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection in Child Tuition Fee Exemption In Income Tax India for different needs.

- Explore categories such as decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets including flashcards, learning materials.

- Ideal for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- The blogs are a vast range of interests, that range from DIY projects to party planning.

Maximizing Child Tuition Fee Exemption In Income Tax India

Here are some creative ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home for the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Child Tuition Fee Exemption In Income Tax India are a treasure trove of practical and imaginative resources for a variety of needs and pursuits. Their accessibility and flexibility make they a beneficial addition to both professional and personal life. Explore the vast collection of Child Tuition Fee Exemption In Income Tax India right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Child Tuition Fee Exemption In Income Tax India really gratis?

- Yes, they are! You can download and print these tools for free.

-

Can I make use of free printables for commercial use?

- It is contingent on the specific terms of use. Be sure to read the rules of the creator before using printables for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may come with restrictions on usage. You should read these terms and conditions as set out by the creator.

-

How do I print Child Tuition Fee Exemption In Income Tax India?

- You can print them at home using your printer or visit a local print shop to purchase high-quality prints.

-

What software is required to open printables at no cost?

- The majority are printed in PDF format. They is open with no cost software such as Adobe Reader.

Exemption On Leave Travel Allowance

Sabanci University Scholarships 2023 Study In Turkey

Check more sample of Child Tuition Fee Exemption In Income Tax India below

Sample Letter Exemption Doc Template PdfFiller

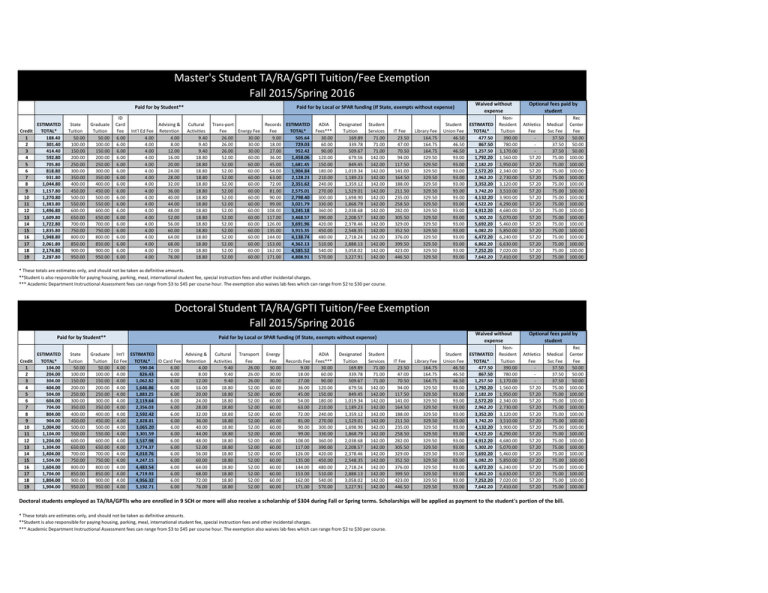

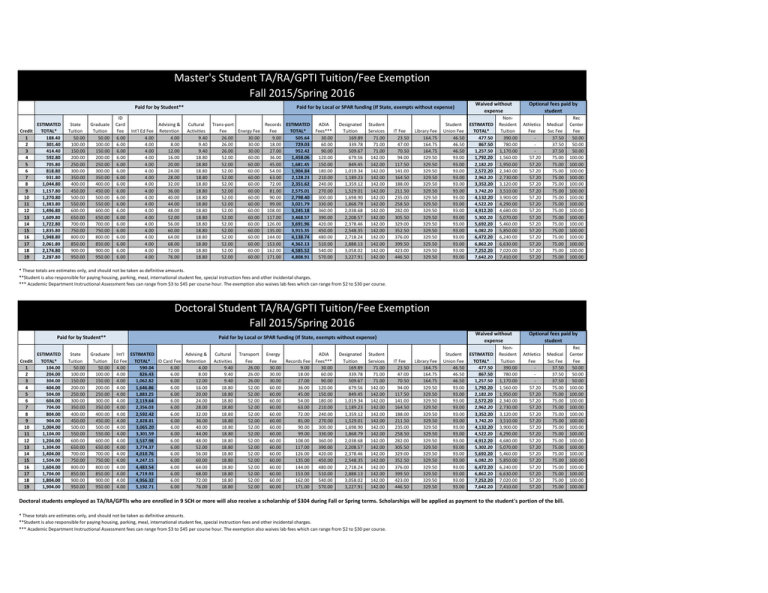

ESTIMATED ID Non Rec

Tuition Fees Exemption In Income Tax 2023 Guide

Get FD Done In These 5 Government Banks Getting The Highest Interest

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

Exemptions Still Available In New Tax Regime with English Subtitles

https://tax2win.in/guide/tution-fees-deduction-under-section-80c

Allowances for Children s Education and Hostel Expenditure Types of Fee reimbursable under Section 10 14 Non eligibility of tuition fees deduction Section 80C

https://instafiling.com/tuition-fees-exemptio…

The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees that parents pay to educate their children Parents can claim up to Rs 1 5 lakh for a tax deduction

Allowances for Children s Education and Hostel Expenditure Types of Fee reimbursable under Section 10 14 Non eligibility of tuition fees deduction Section 80C

The tuition fee deduction from income tax is a provision for claiming a tax deduction for the tuition fees that parents pay to educate their children Parents can claim up to Rs 1 5 lakh for a tax deduction

Get FD Done In These 5 Government Banks Getting The Highest Interest

ESTIMATED ID Non Rec

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

Exemptions Still Available In New Tax Regime with English Subtitles

University Of Montreal Tuition Fee Exemption Scholarships Program

How To Calculate And Use The LTA Allowance

How To Calculate And Use The LTA Allowance

Rumani H c B ng To n Ph n B c C Nh n V Sau i H c C a Ch nh Ph