In a world where screens rule our lives it's no wonder that the appeal of tangible printed objects hasn't waned. For educational purposes project ideas, artistic or just adding an element of personalization to your area, China Vat Refund For Exporters have become a valuable source. The following article is a take a dive into the sphere of "China Vat Refund For Exporters," exploring their purpose, where to get them, as well as the ways that they can benefit different aspects of your daily life.

Get Latest China Vat Refund For Exporters Below

China Vat Refund For Exporters

China Vat Refund For Exporters -

Most exported services are exempted from VAT not zero rated While exported goods qualify for zero rating the refund rate applicable to the inputs e g raw materials used in the production of those goods may be less than the VAT incurred i e there is

Generally speaking VAT on export is exempt in China and if indirect taxes are imposed on exporters they are eligible for a tax rebate Indeed most exported goods are subject to this relief yet in some categories the amount of refunded tax would be less than the amount of tax paid

China Vat Refund For Exporters provide a diverse array of printable materials that are accessible online for free cost. They come in many formats, such as worksheets, templates, coloring pages, and more. The beauty of China Vat Refund For Exporters is their flexibility and accessibility.

More of China Vat Refund For Exporters

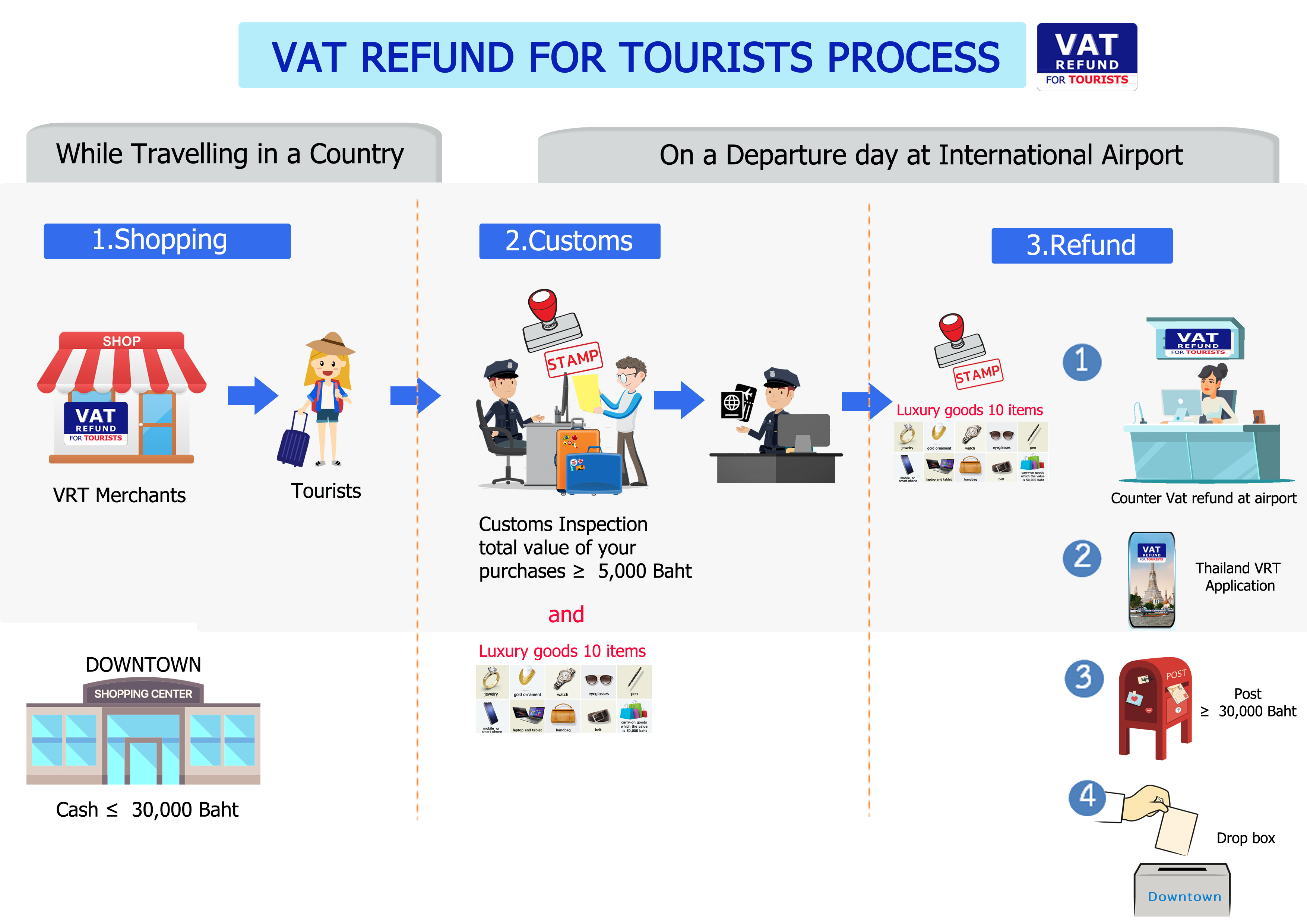

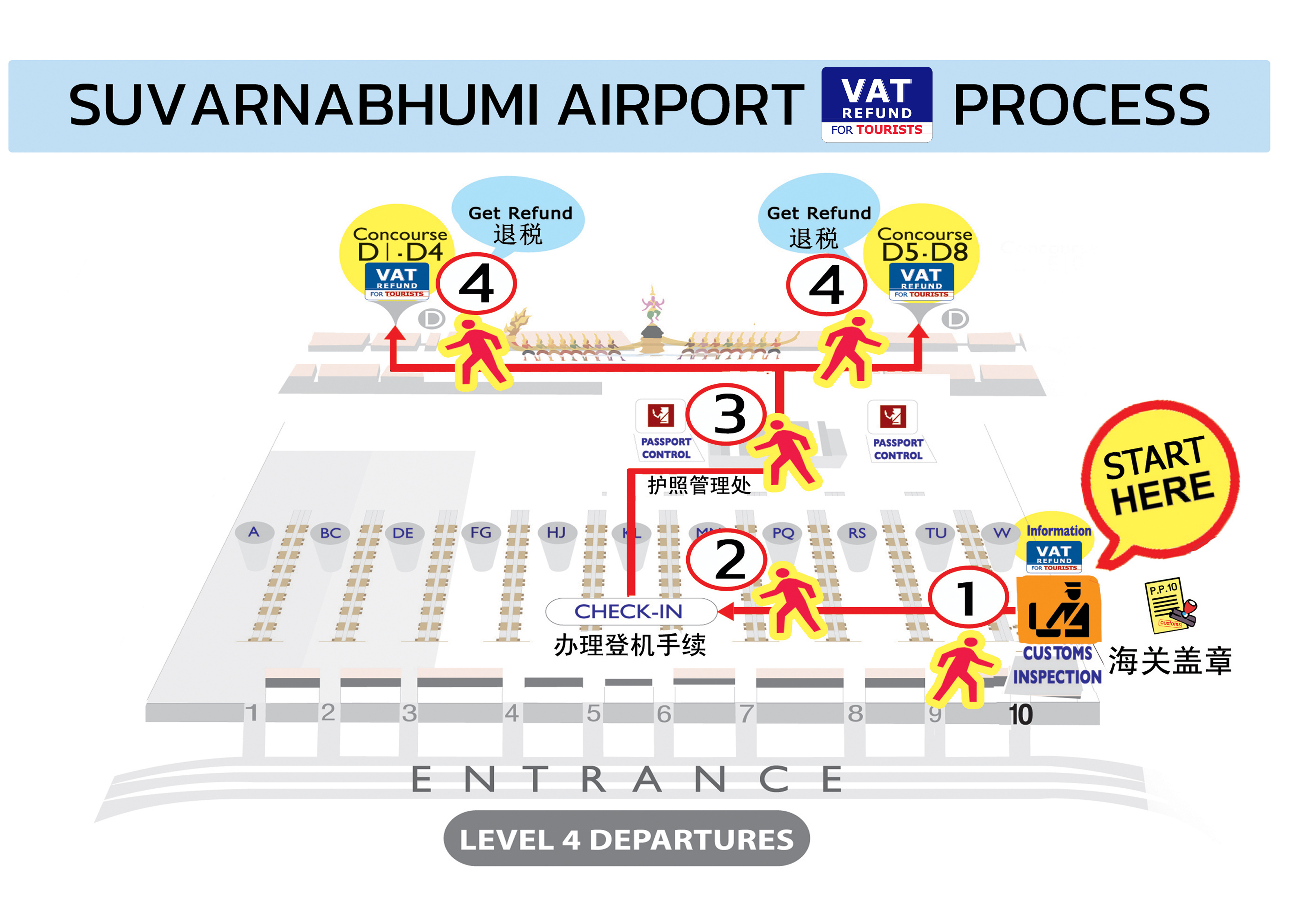

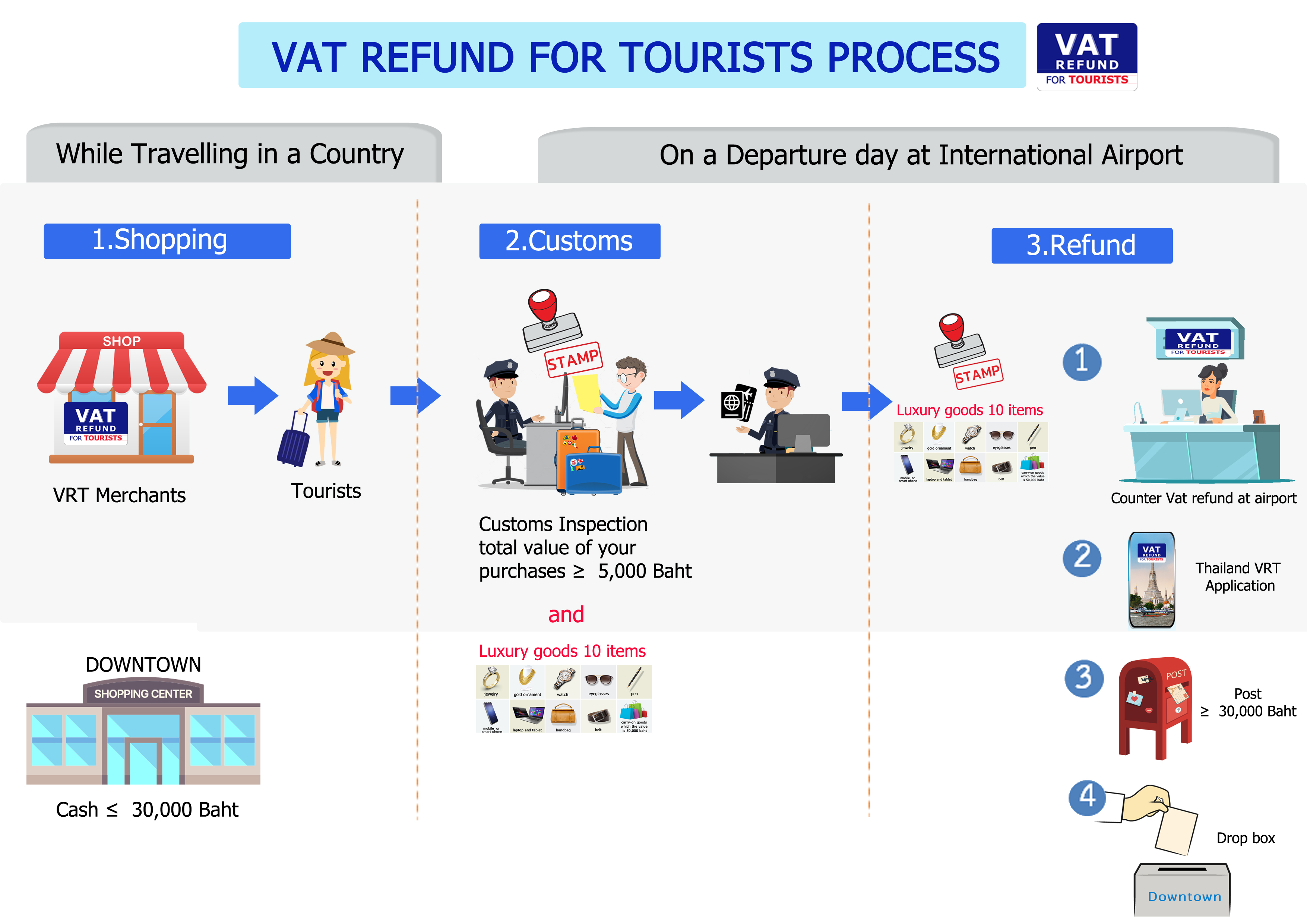

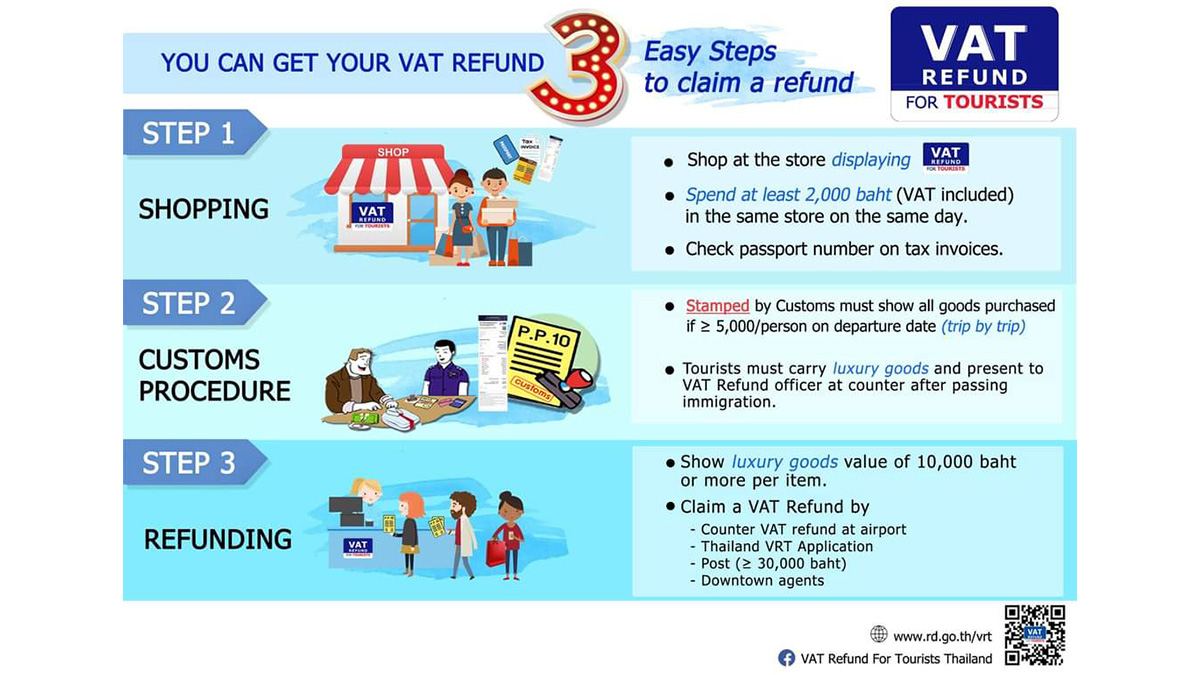

VAT Refund For Tourists Process

VAT Refund For Tourists Process

These measures ensured a timely and accurate export refund for enterprises and relieve their cash flow burden supporting a sustained stable and healthy development of foreign trade Tax authorities across the country have processed a total of 1574 02 billion RMB in export refunded exempted taxes with a year on year increase of 4 8

China s tax rules provide for three export refund treatments the tax exempt treatment the pay first and refund later treatment and the exempt offset refund treatment

The China Vat Refund For Exporters have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

customization: They can make designs to suit your personal needs when it comes to designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Impact: Downloads of educational content for free provide for students from all ages, making the perfect source for educators and parents.

-

Accessibility: The instant accessibility to a plethora of designs and templates saves time and effort.

Where to Find more China Vat Refund For Exporters

VAT Refund

VAT Refund

The announcement explains measures 1 allowing the amount of export VAT refunded to be taken as an input tax deduction 2 treating the export credit insurance claims that foreign trade enterprises obtain as foreign exchange receipts and permitting a tax refund 3 expanding the scope of the departure tax refund regime 4 strengthening

Home NEWS China s export tax refund and exemption reach 1 64t Updated 2022 12 02Source China Daily China s tax department continuously accelerated the export tax refund this year offering powerful support for the steady growth of foreign trade Securities Times reported

In the event that we've stirred your interest in China Vat Refund For Exporters Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of China Vat Refund For Exporters designed for a variety motives.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing including flashcards, learning materials.

- It is ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs covered cover a wide range of topics, starting from DIY projects to party planning.

Maximizing China Vat Refund For Exporters

Here are some inventive ways to make the most use of China Vat Refund For Exporters:

1. Home Decor

- Print and frame stunning artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Use printable worksheets from the internet for teaching at-home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

China Vat Refund For Exporters are a treasure trove of practical and innovative resources catering to different needs and interests. Their accessibility and versatility make them a great addition to both professional and personal life. Explore the vast world of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really available for download?

- Yes you can! You can download and print these materials for free.

-

Can I use the free printables for commercial purposes?

- It depends on the specific terms of use. Always review the terms of use for the creator before using any printables on commercial projects.

-

Are there any copyright issues when you download China Vat Refund For Exporters?

- Certain printables may be subject to restrictions on their use. You should read the terms and conditions provided by the creator.

-

How can I print China Vat Refund For Exporters?

- You can print them at home with printing equipment or visit a local print shop for better quality prints.

-

What software is required to open printables at no cost?

- Most printables come in PDF format. They is open with no cost software such as Adobe Reader.

VAT Refund For Tourists Process

VAT Refund For Tourists Process

Check more sample of China Vat Refund For Exporters below

Vat Refund Calculator StormTallulah

VAT Refund For Tourists Process

VAT Refund For Tourists Process

President Marcos Okays VAT Refund For Foreign Tourists Inquirer News

Exporters To Deduct VAT On Purchases From VAT On Sales Honorary

China Releases CNY 420bn VAT Credits As Economy Slows Vatcalc

https://www.ptl-group.com/guides/chinas-export-fees-and-refunds

Generally speaking VAT on export is exempt in China and if indirect taxes are imposed on exporters they are eligible for a tax rebate Indeed most exported goods are subject to this relief yet in some categories the amount of refunded tax would be less than the amount of tax paid

https://www2.deloitte.com/content/dam/Deloitte/mx/...

Customs commodity code The export VAT refund rates are between 0 percent and 17 percent Where the refund rate is at 17 percent there is a full recovery of the input VAT The export VAT refund scheme is adding a cost for many businesses exporting In practice the non recoverable VAT is passed on along the supply chain To understand the

Generally speaking VAT on export is exempt in China and if indirect taxes are imposed on exporters they are eligible for a tax rebate Indeed most exported goods are subject to this relief yet in some categories the amount of refunded tax would be less than the amount of tax paid

Customs commodity code The export VAT refund rates are between 0 percent and 17 percent Where the refund rate is at 17 percent there is a full recovery of the input VAT The export VAT refund scheme is adding a cost for many businesses exporting In practice the non recoverable VAT is passed on along the supply chain To understand the

President Marcos Okays VAT Refund For Foreign Tourists Inquirer News

VAT Refund For Tourists Process

Exporters To Deduct VAT On Purchases From VAT On Sales Honorary

China Releases CNY 420bn VAT Credits As Economy Slows Vatcalc

Thailand Offers VAT Refund For Tourists TAT Newsroom

VAT Refund For Tourists In Dubai What You Need To Know

VAT Refund For Tourists In Dubai What You Need To Know

Dominican Republic Seeks Public Input On VAT Refund Compensation For