In this digital age, in which screens are the norm and the appeal of physical printed materials hasn't faded away. For educational purposes such as creative projects or simply adding an element of personalization to your space, Claim Dependent Spouse Tax Offset are now an essential resource. This article will dive deeper into "Claim Dependent Spouse Tax Offset," exploring what they are, where to get them, as well as how they can add value to various aspects of your life.

Get Latest Claim Dependent Spouse Tax Offset Below

Claim Dependent Spouse Tax Offset

Claim Dependent Spouse Tax Offset -

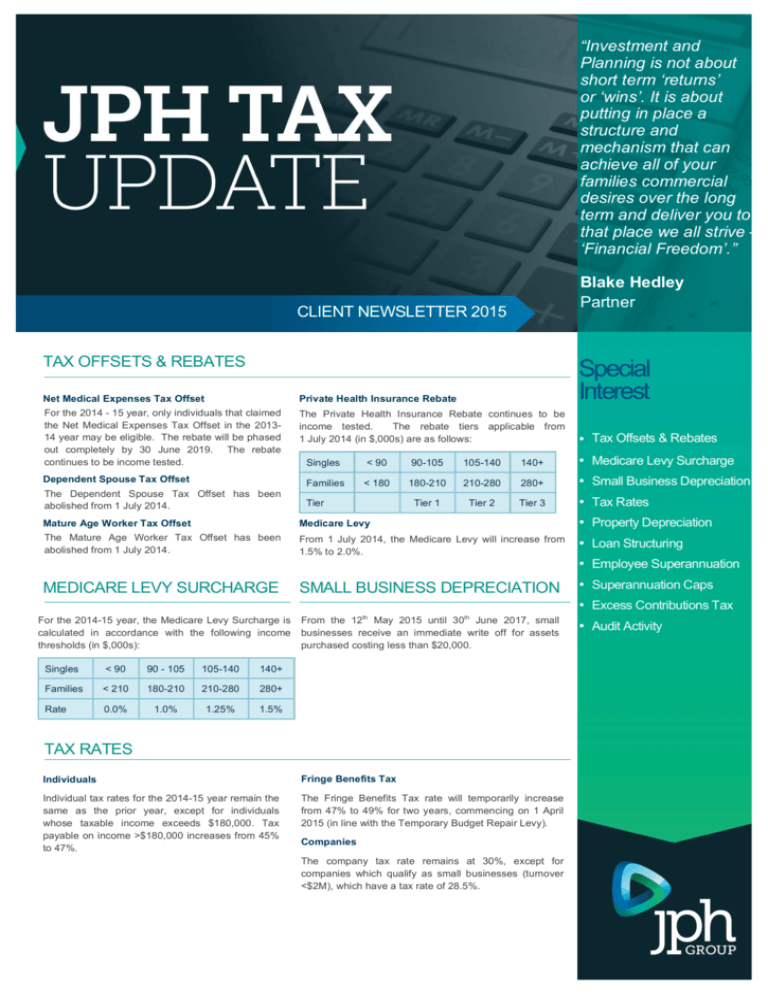

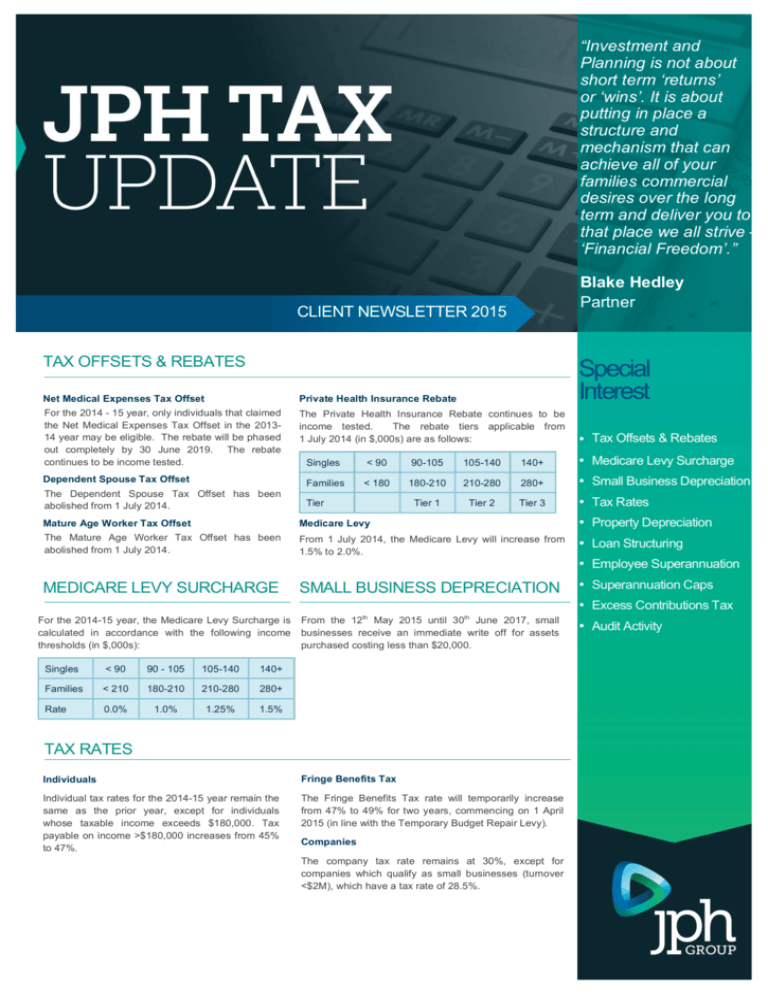

If you re eligible you can generally make a contribution to your spouse s super fund and claim an 18 tax offset on up to 3 000 through your tax return To be eligible for the maximum tax offset which works out to be 540 you need to contribute a minimum of 3 000 and your partner s annual income needs to be 37 000 or less

You may be able to claim either a full tax offset of 540 if you pay 3 000 or more and your spouse earns 37 000 or less partial tax offset if you pay less than 3 000 and your spouse earns more than 37 000 but less than 40 000

Printables for free cover a broad range of downloadable, printable items that are available online at no cost. They come in many forms, including worksheets, templates, coloring pages, and much more. The appealingness of Claim Dependent Spouse Tax Offset lies in their versatility and accessibility.

More of Claim Dependent Spouse Tax Offset

How To Claim A Spouse Super Contribution Tax Offset YouTube

How To Claim A Spouse Super Contribution Tax Offset YouTube

Last updated 31 July 2022 Should you claim a tax offset Check if you are entitled to a tax offset and whether you need to calculate or claim one Calculate an invalid and invalid carer tax offset Check your eligibility for an invalid or invalid carer tax offset and claim it in your withholding declaration

1 19 A taxpayer may receive a reduced amount of Dependant Invalid and Carer Tax Offset if the taxpayer was a member of a Family Tax Benefit Part B family or if the taxpayer or taxpayer s spouse received parental leave payment under the Paid Parental Leave Act 2010 for only part of a year

Claim Dependent Spouse Tax Offset have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: You can tailor designs to suit your personal needs whether you're designing invitations making your schedule, or even decorating your home.

-

Educational Use: Education-related printables at no charge cater to learners of all ages, which makes them an essential tool for parents and teachers.

-

An easy way to access HTML0: instant access numerous designs and templates will save you time and effort.

Where to Find more Claim Dependent Spouse Tax Offset

Spouse Contributions What Are The Benefits AMP

Spouse Contributions What Are The Benefits AMP

The maximum spouse contribution tax offset of 540 is available to you if your spouse s income is 37 000 or less The tax offset then completely phases out once your spouse s income reaches 40 000 for the year The tax offset is calculated as 18 of the lesser of 3 000 reduced by 1 for every 1 of the spouse s income that exceeds 37 000 and

The invalid and invalid carer tax offset is only available for taxpayers who maintain a dependant who is unable to work due to invalidity or carer obligations The seniors and pensioners tax offset is only available for taxpayers who meet certain age and income tests

We've now piqued your interest in printables for free and other printables, let's discover where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection with Claim Dependent Spouse Tax Offset for all purposes.

- Explore categories like interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- Ideal for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- The blogs are a vast selection of subjects, that includes DIY projects to planning a party.

Maximizing Claim Dependent Spouse Tax Offset

Here are some inventive ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities to enhance learning at home also in the classes.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Claim Dependent Spouse Tax Offset are a treasure trove of innovative and useful resources which cater to a wide range of needs and hobbies. Their accessibility and versatility make these printables a useful addition to any professional or personal life. Explore the vast array of Claim Dependent Spouse Tax Offset today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes you can! You can download and print these resources at no cost.

-

Can I download free printables for commercial use?

- It's dependent on the particular conditions of use. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may come with restrictions in use. Always read the conditions and terms of use provided by the designer.

-

How do I print printables for free?

- Print them at home using your printer or visit an in-store print shop to get top quality prints.

-

What program is required to open printables that are free?

- Most printables come as PDF files, which is open with no cost software, such as Adobe Reader.

Spouse Contribution Tax Offset 2022 23 Beach Wealth Advisers

Who Can I Claim As A Dependent On My Tax Return Mighty Taxes

Check more sample of Claim Dependent Spouse Tax Offset below

What Is An Injured Spouse Injured Spouse Tax Eligibility HowStuffWorks

Superannuation Spouse Contribution And Tax Offset Piggy Wise

Who Qualifies As A Dependant Health Plus

How To Claim A Dependent On Your Tax Return SDG Accountants

JPH Group

Six Super Strategies To Consider Before 30 June WL Advisory Super

https://www.ato.gov.au/individuals-and-families/...

You may be able to claim either a full tax offset of 540 if you pay 3 000 or more and your spouse earns 37 000 or less partial tax offset if you pay less than 3 000 and your spouse earns more than 37 000 but less than 40 000

https://atotaxrates.info/tax-offset/dependant-spouse-offset

For those still eligible to claim the maximum dependent spouse tax offset value is 2 471 in 2013 14 2 423 in 2012 13 2 355 in 2011 12 Dependent spouse s income test The value of the offset is reduced by 1 for every 4 by which the adjusted taxable income see below of the dependent spouse exceeds 282

You may be able to claim either a full tax offset of 540 if you pay 3 000 or more and your spouse earns 37 000 or less partial tax offset if you pay less than 3 000 and your spouse earns more than 37 000 but less than 40 000

For those still eligible to claim the maximum dependent spouse tax offset value is 2 471 in 2013 14 2 423 in 2012 13 2 355 in 2011 12 Dependent spouse s income test The value of the offset is reduced by 1 for every 4 by which the adjusted taxable income see below of the dependent spouse exceeds 282

How To Claim A Dependent On Your Tax Return SDG Accountants

Superannuation Spouse Contribution And Tax Offset Piggy Wise

JPH Group

Six Super Strategies To Consider Before 30 June WL Advisory Super

BK Partners Your Chartered Accountant Dependant Tax Offset Changed

Budget Night Accountants

Budget Night Accountants

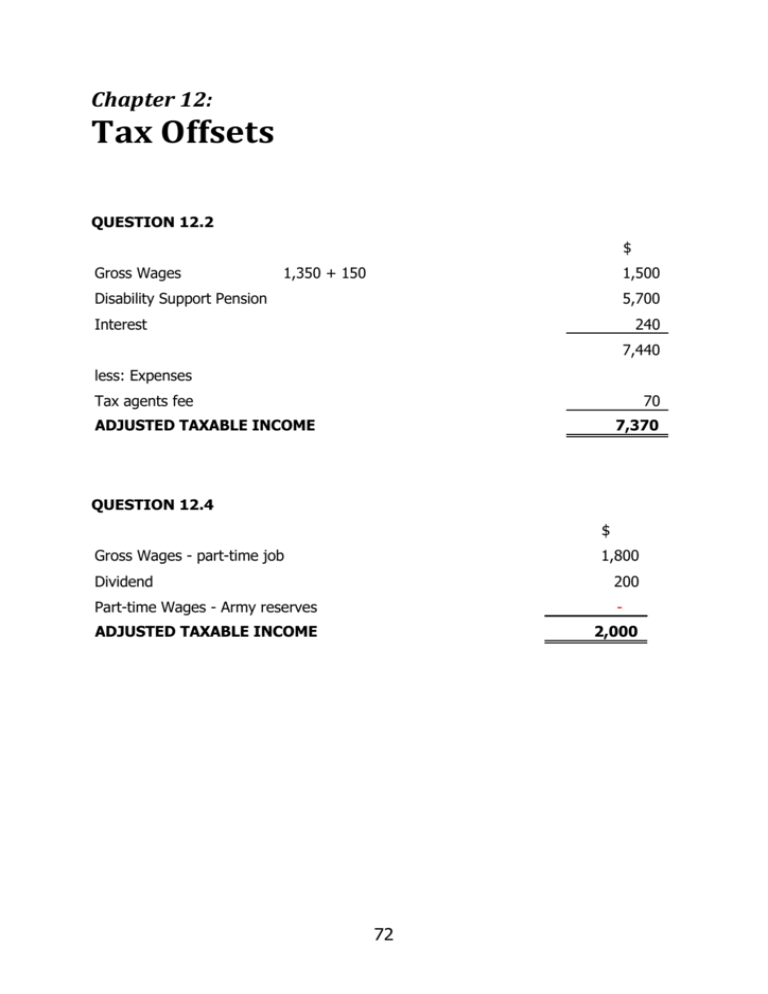

Tax Offsets