In the age of digital, where screens have become the dominant feature of our lives and the appeal of physical printed products hasn't decreased. For educational purposes or creative projects, or simply adding some personal flair to your area, Claim Vat Back On Mileage Hmrc have become an invaluable source. We'll dive into the world of "Claim Vat Back On Mileage Hmrc," exploring their purpose, where to find them and how they can be used to enhance different aspects of your lives.

Get Latest Claim Vat Back On Mileage Hmrc Below

Claim Vat Back On Mileage Hmrc

Claim Vat Back On Mileage Hmrc -

Claiming VAT on mileage If you drive your own car for business purposes other than a generic commute you can make a claim against the approved mileage allowance payment rate AMAP to get some money back However the

Input tax is calculated by multiplying the fuel element of the mileage allowance by the VAT fraction VAT rate divided by 100 VAT rate The allowance paid to employees

Claim Vat Back On Mileage Hmrc cover a large variety of printable, downloadable materials that are accessible online for free cost. These resources come in various forms, including worksheets, templates, coloring pages, and many more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Claim Vat Back On Mileage Hmrc

Can You Claim Vat On Fuel South Africa Greater Good SA

Can You Claim Vat On Fuel South Africa Greater Good SA

As long as the mileage allowance paid is at least equal to the advisory fuel rates published by HMRC input VAT can be reclaimed at a rate of 1 6th of the appropriate advisory rate for each

You can also reclaim the VAT on the business element of any fuel purchased by keeping a detailed mileage log You then do the maths to work out how much of the VAT on that

Claim Vat Back On Mileage Hmrc have gained a lot of appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

The ability to customize: We can customize the design to meet your needs, whether it's designing invitations, organizing your schedule, or decorating your home.

-

Educational Value: Education-related printables at no charge are designed to appeal to students from all ages, making them a useful tool for teachers and parents.

-

Easy to use: You have instant access a plethora of designs and templates can save you time and energy.

Where to Find more Claim Vat Back On Mileage Hmrc

How Far Back Can You Claim Vat In South Africa Greater Good SA

How Far Back Can You Claim Vat In South Africa Greater Good SA

HMRC allows them to claim up to 45p per mile for the first 10 000 miles in a tax year and 25p per mile for any additional miles This allowance is designed to cover various

Clearly a claim cannot be supported by a VAT invoice that is dated after the dates covered by the claim This means in practice that it may be advisable for employers to

Since we've got your interest in printables for free Let's find out where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection with Claim Vat Back On Mileage Hmrc for all goals.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- This is a great resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- The blogs covered cover a wide array of topics, ranging including DIY projects to party planning.

Maximizing Claim Vat Back On Mileage Hmrc

Here are some creative ways of making the most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home for the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Claim Vat Back On Mileage Hmrc are an abundance of practical and innovative resources that cater to various needs and hobbies. Their accessibility and flexibility make these printables a useful addition to both professional and personal lives. Explore the endless world of Claim Vat Back On Mileage Hmrc to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes you can! You can download and print these tools for free.

-

Can I use the free printables for commercial purposes?

- It's dependent on the particular terms of use. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables might have limitations regarding usage. You should read the terms and conditions offered by the designer.

-

How do I print Claim Vat Back On Mileage Hmrc?

- Print them at home with a printer or visit an area print shop for the highest quality prints.

-

What program do I require to view printables free of charge?

- The majority of printables are in PDF format, which can be opened using free software like Adobe Reader.

Who Can Claim Vat In South Africa Greater Good SA

What Can I Claim Vat Back On In South Africa Greater Good SA

Check more sample of Claim Vat Back On Mileage Hmrc below

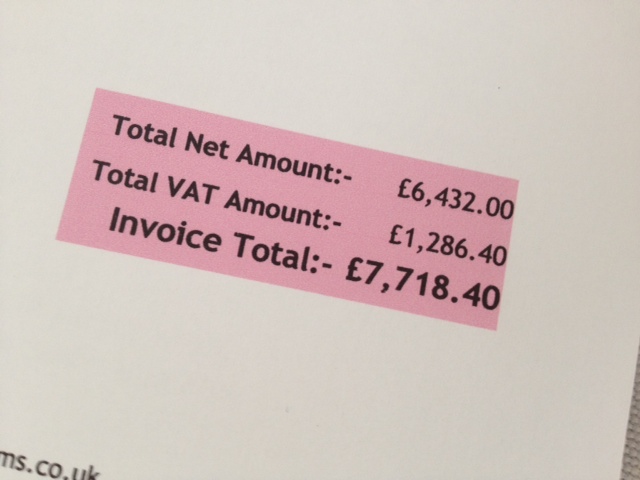

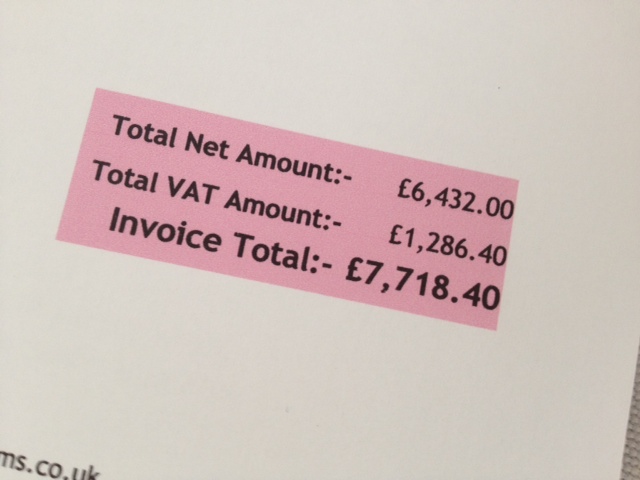

Can You Claim Back VAT Without Receipt Accountant s Answer

Business Spreadsheet Tools Custom Software Development Working Data

Can You Claim VAT Back On Fuel YouTube

How To Claim VAT Back On Expenses Finance Blog Bookkeeping Software

How To Claim Back VAT VAT Guide Xero UK

HMRC Mileage Rates UK 2021 2022 Goselfemployed co

https://www.gov.uk/hmrc-internal-manuals/vat-input-tax/vit55400

Input tax is calculated by multiplying the fuel element of the mileage allowance by the VAT fraction VAT rate divided by 100 VAT rate The allowance paid to employees

https://www.thefriendlyaccountants.co.uk/claiming...

If you have a company car but pay for your own fuel and reclaim mileage from your employer then HMRC publish advisory rates for how much you can claim Now here s the clever bit

Input tax is calculated by multiplying the fuel element of the mileage allowance by the VAT fraction VAT rate divided by 100 VAT rate The allowance paid to employees

If you have a company car but pay for your own fuel and reclaim mileage from your employer then HMRC publish advisory rates for how much you can claim Now here s the clever bit

How To Claim VAT Back On Expenses Finance Blog Bookkeeping Software

Business Spreadsheet Tools Custom Software Development Working Data

How To Claim Back VAT VAT Guide Xero UK

HMRC Mileage Rates UK 2021 2022 Goselfemployed co

8 Bus Mileage Log Template SampleTemplatess SampleTemplatess

Making VAT Less Boring Mary Milton

Making VAT Less Boring Mary Milton

How Do I Claim My Mileage Back From HMRC