In this digital age, where screens dominate our lives however, the attraction of tangible printed material hasn't diminished. In the case of educational materials in creative or artistic projects, or simply to add an individual touch to your space, Claim Vat Back On Mileage are a great source. Here, we'll take a dive in the world of "Claim Vat Back On Mileage," exploring what they are, where they are, and how they can enrich various aspects of your daily life.

Get Latest Claim Vat Back On Mileage Below

Claim Vat Back On Mileage

Claim Vat Back On Mileage -

Treat all of the VAT as input tax and either apply the fuel scale charges or account for VAT on the basis of amounts charged to the employee This option would apply for that

If you drive your own car for business purposes other than a generic commute you can make a claim against the approved mileage allowance payment rate AMAP to get some money back However the amount you can claim will

Claim Vat Back On Mileage cover a large collection of printable resources available online for download at no cost. They are available in numerous styles, from worksheets to templates, coloring pages and much more. One of the advantages of Claim Vat Back On Mileage lies in their versatility as well as accessibility.

More of Claim Vat Back On Mileage

Who Can Claim Vat In South Africa Greater Good SA

Who Can Claim Vat In South Africa Greater Good SA

Employers who are registered for VAT can claim back input tax on the fuel element of any mileage payments they make for business mileage The input tax on mileage payments

As a VAT registered business you are entitled to claim VAT on the fuel element of mileage payments made to employees for business trips How much VAT you can claim depends on the fuel type and engine size of the

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Personalization Your HTML0 customization options allow you to customize printed materials to meet your requirements when it comes to designing invitations making your schedule, or even decorating your home.

-

Educational Value: The free educational worksheets cater to learners of all ages, making the perfect aid for parents as well as educators.

-

It's easy: Access to numerous designs and templates can save you time and energy.

Where to Find more Claim Vat Back On Mileage

How Far Back Can You Claim Vat In South Africa Greater Good SA

How Far Back Can You Claim Vat In South Africa Greater Good SA

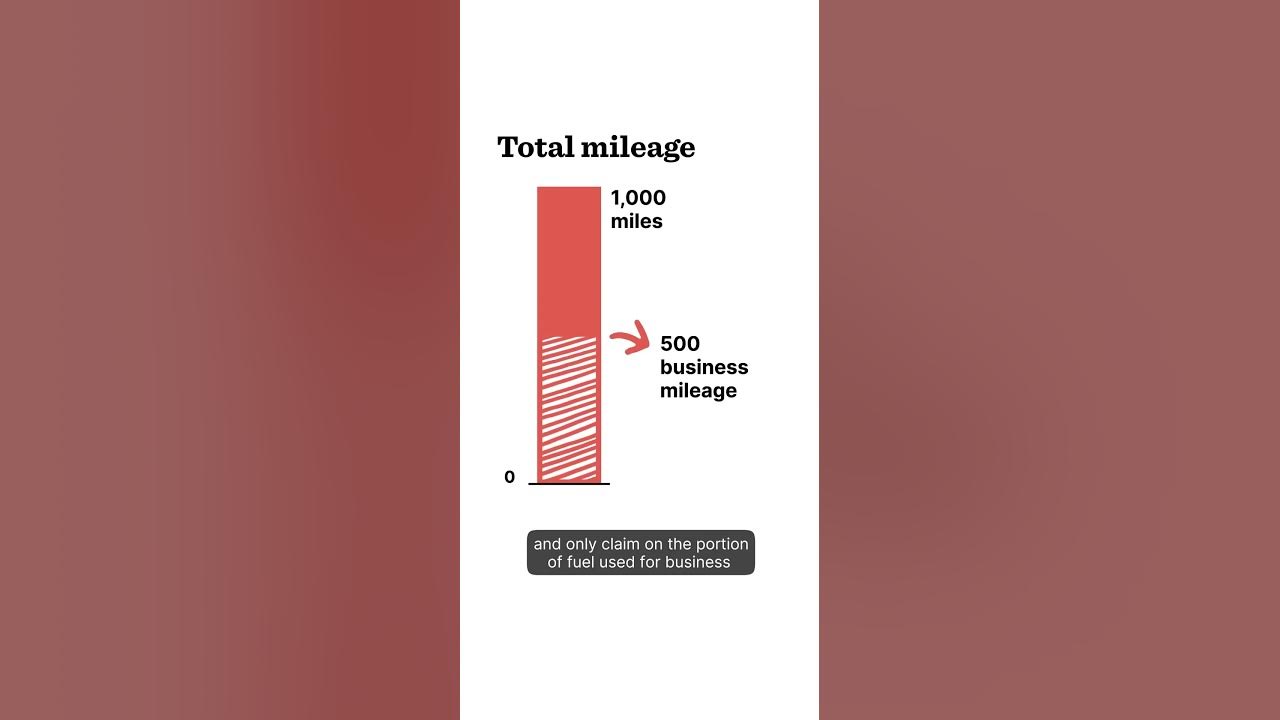

As mentioned in the introduction you can only claim back the VAT on mileage claims which relate to the fuel amount So how much of the 45 pence or 25 pence relates to fuel Fortunately HMRC publish fuel advisory rates

When you provide company cars for your employees you ll be fine if you can show you only claim the VAT on fuel used specifically for business purposes This normally involves keeping petrol receipts and a mileage log

We hope we've stimulated your curiosity about Claim Vat Back On Mileage, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Claim Vat Back On Mileage for various uses.

- Explore categories like decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- The blogs covered cover a wide selection of subjects, including DIY projects to party planning.

Maximizing Claim Vat Back On Mileage

Here are some inventive ways for you to get the best use of Claim Vat Back On Mileage:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print free worksheets to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Claim Vat Back On Mileage are an abundance with useful and creative ideas for a variety of needs and pursuits. Their accessibility and flexibility make these printables a useful addition to each day life. Explore the vast collection of Claim Vat Back On Mileage right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes, they are! You can download and print these materials for free.

-

Does it allow me to use free printables in commercial projects?

- It is contingent on the specific conditions of use. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with Claim Vat Back On Mileage?

- Some printables may contain restrictions concerning their use. Make sure to read the terms of service and conditions provided by the creator.

-

How can I print Claim Vat Back On Mileage?

- Print them at home using an printer, or go to any local print store for the highest quality prints.

-

What software is required to open printables that are free?

- The majority of printed documents are in PDF format, which is open with no cost software such as Adobe Reader.

What Can I Claim Vat Back On In South Africa Greater Good SA

What Can I Claim Vat Back On Self employed 2023 Updated

Check more sample of Claim Vat Back On Mileage below

Can You Claim VAT Back On Fuel YouTube

Can You Claim Back VAT Without Receipt Accountant s Answer

VAT Risk On Mileage Allowances

How To Claim VAT Back On Expenses Finance Blog Bookkeeping Software

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

How Do I Claim VAT Back On My New Build Welsh Oak Frame

https://www.rac.co.uk › ... › claiming-va…

If you drive your own car for business purposes other than a generic commute you can make a claim against the approved mileage allowance payment rate AMAP to get some money back However the amount you can claim will

https://www.freshbooks.com › ... › taxes …

Learn how you can claim back the VAT on mileage expenses Find out about what qualifies for a tax refund while staying compliant with HMRC regulations

If you drive your own car for business purposes other than a generic commute you can make a claim against the approved mileage allowance payment rate AMAP to get some money back However the amount you can claim will

Learn how you can claim back the VAT on mileage expenses Find out about what qualifies for a tax refund while staying compliant with HMRC regulations

How To Claim VAT Back On Expenses Finance Blog Bookkeeping Software

Can You Claim Back VAT Without Receipt Accountant s Answer

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

How Do I Claim VAT Back On My New Build Welsh Oak Frame

Pin On Podcasts

VAT On Leased Cars Can You Claim Back VAT On Car Leasing

VAT On Leased Cars Can You Claim Back VAT On Car Leasing

)

Reclaiming VAT On EVs Can A Business Claim VAT Back On An Electric Car