In this day and age with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. If it's to aid in education for creative projects, just adding the personal touch to your space, Claiming Tax Back On Pension Lump Sum Contribution have become an invaluable source. Here, we'll take a dive deep into the realm of "Claiming Tax Back On Pension Lump Sum Contribution," exploring the benefits of them, where to find them, and how they can be used to enhance different aspects of your lives.

Get Latest Claiming Tax Back On Pension Lump Sum Contribution Below

Claiming Tax Back On Pension Lump Sum Contribution

Claiming Tax Back On Pension Lump Sum Contribution -

How to tell if you re due a pension tax refund You may have been affected by this and could be due a refund from HMRC if you are over 55 the age you re allowed to access your pension pot from and have Taken a taxable lump sum from your pension for the first time OR Withdrawn your whole pension pot at once

If you ve paid too much Income Tax on a flexibly accessed pension payment you can claim a refund if all of the following apply you ve flexibly accessed your pension pot but not emptied it

Printables for free cover a broad collection of printable material that is available online at no cost. These materials come in a variety of forms, like worksheets templates, coloring pages and more. One of the advantages of Claiming Tax Back On Pension Lump Sum Contribution lies in their versatility and accessibility.

More of Claiming Tax Back On Pension Lump Sum Contribution

Prudential To Pay Redress For Pension Lump Sum Debacle Money Marketing

Prudential To Pay Redress For Pension Lump Sum Debacle Money Marketing

However if you are taxed at 40 or 45 for additional rate taxpayers on a portion of your earnings you may essentially still be owed that extra 20 or 25 tax back on your contributions More on how to do this in our How to claim higher rate tax relief on pension contributions article Where do I put pension contributions on my tax return

How to claim tax back on pension drawdown One of the drawbacks of entering into a flexible drawdown is that you may be taxed at the emergency rate of 45 no matter what your usual tax band is To claim tax refund on your pension lump sum you will need either a P53 P53Z P55 or P50Z form You can Don t take our word for it

Claiming Tax Back On Pension Lump Sum Contribution have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Flexible: The Customization feature lets you tailor printables to fit your particular needs whether you're designing invitations and schedules, or even decorating your home.

-

Education Value Educational printables that can be downloaded for free cater to learners of all ages. This makes the perfect tool for parents and educators.

-

An easy way to access HTML0: Fast access many designs and templates is time-saving and saves effort.

Where to Find more Claiming Tax Back On Pension Lump Sum Contribution

Understanding Tax On Pension Lump Sum Withdrawals

Understanding Tax On Pension Lump Sum Withdrawals

Normally you can take 25 of your pension pot as a tax free lump sum with any balance taxable at the taxpayer s marginal rate Since 6 April 2015 it has been possible to flexibly access pension savings in defined contribution schemes on reaching age 55 Flexible access is not available in respect of defined benefit schemes

You can claim any tax relief you re due through your annual tax return or by notifying HMRC and completing a tax review form Paying a lump sum into a pension fund You can choose to pay a lump sum into your pension at any point even if

We hope we've stimulated your interest in printables for free and other printables, let's discover where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of printables that are free for a variety of needs.

- Explore categories like interior decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free including flashcards, learning materials.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a wide range of topics, all the way from DIY projects to planning a party.

Maximizing Claiming Tax Back On Pension Lump Sum Contribution

Here are some inventive ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print worksheets that are free to reinforce learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Claiming Tax Back On Pension Lump Sum Contribution are a treasure trove of practical and imaginative resources designed to meet a range of needs and hobbies. Their availability and versatility make them a fantastic addition to your professional and personal life. Explore the vast world that is Claiming Tax Back On Pension Lump Sum Contribution today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes you can! You can print and download these free resources for no cost.

-

Do I have the right to use free printables for commercial use?

- It's contingent upon the specific conditions of use. Always read the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables could be restricted in use. Always read the terms and condition of use as provided by the creator.

-

How can I print Claiming Tax Back On Pension Lump Sum Contribution?

- Print them at home with either a printer or go to an area print shop for better quality prints.

-

What software do I require to open printables that are free?

- Most printables come as PDF files, which can be opened using free software, such as Adobe Reader.

Pension Tax Refund Claiming Back AccountingFirms

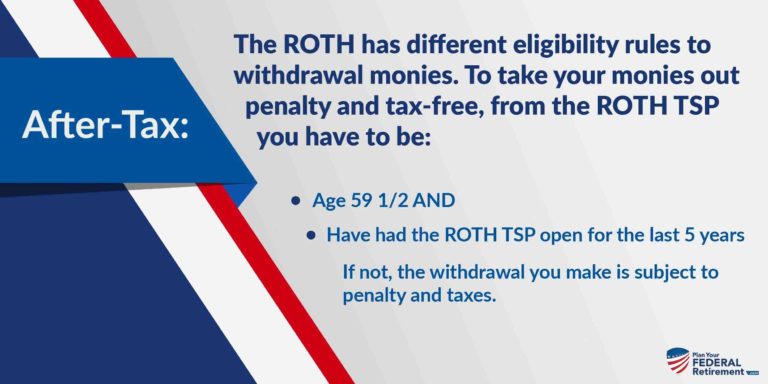

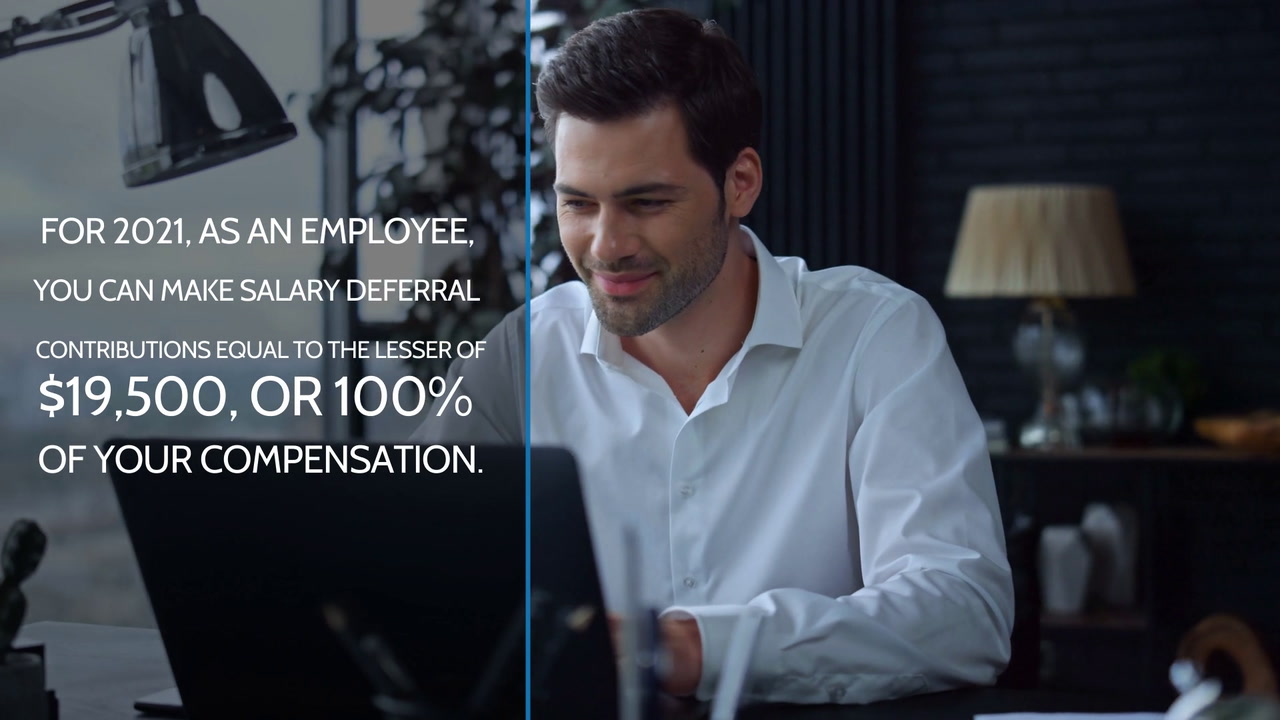

Can I Make A Lump Sum Contribution To TSP Government Deal Funding

Check more sample of Claiming Tax Back On Pension Lump Sum Contribution below

Your Guide To Claiming Tax Back On Postgraduate Fees In Ireland

Tax On Pension Lump Sum Calculator CALCULATORUK FTE

Making The Most Of Your Pension Lump Sum Or Annuity True Wealth Design

Ask Bob Can I Make A Lump Sum Contribution To My 401 k Retirement

Claim Tax Back And Take Care Of Your Retirement This Tax Season

Can I Take My Pension At 55 And Still Work Encinitas Daily News

https://www.gov.uk/guidance/claim-back-tax-on-a...

If you ve paid too much Income Tax on a flexibly accessed pension payment you can claim a refund if all of the following apply you ve flexibly accessed your pension pot but not emptied it

https://assets.publishing.service.gov.uk/...

P53 Claiming back tax paid on a lump sum About this form If you are not a UK resident for tax purposes you do not need to complete this form Instead go to

If you ve paid too much Income Tax on a flexibly accessed pension payment you can claim a refund if all of the following apply you ve flexibly accessed your pension pot but not emptied it

P53 Claiming back tax paid on a lump sum About this form If you are not a UK resident for tax purposes you do not need to complete this form Instead go to

Ask Bob Can I Make A Lump Sum Contribution To My 401 k Retirement

Tax On Pension Lump Sum Calculator CALCULATORUK FTE

Claim Tax Back And Take Care Of Your Retirement This Tax Season

Can I Take My Pension At 55 And Still Work Encinitas Daily News

40 Reduction On Pension Lump Sum Tax Spain Answer Found 2023 Buggol

When Should You Take Out Your 25 Tax free Pension Lump Sum My

When Should You Take Out Your 25 Tax free Pension Lump Sum My

Pension Lump Sum Tax Calculator 5 Of The Best 2020 Financial