In this day and age where screens dominate our lives The appeal of tangible printed materials hasn't faded away. Be it for educational use for creative projects, simply adding an element of personalization to your area, Claiming Vat Back On Mileage Expenses are a great source. Here, we'll take a dive to the depths of "Claiming Vat Back On Mileage Expenses," exploring their purpose, where they are available, and how they can add value to various aspects of your daily life.

Get Latest Claiming Vat Back On Mileage Expenses Below

Claiming Vat Back On Mileage Expenses

Claiming Vat Back On Mileage Expenses -

In some cases if mileage claim rates are low it may work out more expensive to claim the VAT back This VAT reclaim method is one of the easiest for

Well if you re an owner managed business and you or your employees claim the approved mileage rate then the good news is that yes if you re VAT registered and not using the

Claiming Vat Back On Mileage Expenses cover a large range of downloadable, printable materials that are accessible online for free cost. These resources come in various kinds, including worksheets templates, coloring pages and much more. The beauty of Claiming Vat Back On Mileage Expenses is their versatility and accessibility.

More of Claiming Vat Back On Mileage Expenses

Claiming VAT On Mileage Advice For Claiming VAT On Business Mileage

Claiming VAT On Mileage Advice For Claiming VAT On Business Mileage

If you are a VAT registered business paying mileage expense to you or your staff you can claim back VAT on the fuel only portion of the mileage expense but

You may have mileage going back to earlier periods where VAT wasn t claimed Fortunately you are able to go back and reclaim any amounts not previously claimed in the last 4 years

The Claiming Vat Back On Mileage Expenses have gained huge appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization There is the possibility of tailoring designs to suit your personal needs in designing invitations, organizing your schedule, or even decorating your house.

-

Educational Worth: These Claiming Vat Back On Mileage Expenses are designed to appeal to students from all ages, making them a great resource for educators and parents.

-

Affordability: Instant access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Claiming Vat Back On Mileage Expenses

Can You Claim The VAT Back On Staff Expenses HR Blog

Can You Claim The VAT Back On Staff Expenses HR Blog

Input tax is calculated by multiplying the fuel element of the mileage allowance by the VAT fraction VAT rate divided by 100 VAT rate The allowance

For company cars where there is private mileage you can claim back the VAT suffered on fuel and either apply the road fuel scale charges or account for the

We hope we've stimulated your curiosity about Claiming Vat Back On Mileage Expenses Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Claiming Vat Back On Mileage Expenses suitable for many uses.

- Explore categories such as design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets along with flashcards, as well as other learning materials.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- The blogs are a vast range of interests, all the way from DIY projects to planning a party.

Maximizing Claiming Vat Back On Mileage Expenses

Here are some unique ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use printable worksheets for free for reinforcement of learning at home for the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Claiming Vat Back On Mileage Expenses are a treasure trove of practical and innovative resources for a variety of needs and interests. Their access and versatility makes them a great addition to each day life. Explore the vast collection of Claiming Vat Back On Mileage Expenses today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes you can! You can download and print these free resources for no cost.

-

Are there any free printables for commercial purposes?

- It's contingent upon the specific rules of usage. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns when using Claiming Vat Back On Mileage Expenses?

- Certain printables may be subject to restrictions on their use. Check the terms and regulations provided by the designer.

-

How do I print printables for free?

- Print them at home with either a printer at home or in a print shop in your area for better quality prints.

-

What program is required to open Claiming Vat Back On Mileage Expenses?

- The majority of printed documents are in PDF format, which can be opened using free programs like Adobe Reader.

Claiming VAT On Commercial Vehicles

Can You Claim VAT Back On Fuel YouTube

Check more sample of Claiming Vat Back On Mileage Expenses below

Can You Claim Back VAT Without Receipt Accountant s Answer

Is Olbas Oil Good For Asthma KnowYourAsthma

Claiming VAT Back On Bad Debts Tips And Advice

Claiming VAT On Mileage Expenses Tripcatcher

Claiming VAT Back On A Commercial Property Purchase BloomSmith

Claiming VAT Back On Business Expenses In The E U Performance Accountancy

https://www.thefriendlyaccountants.co.uk/claiming...

Well if you re an owner managed business and you or your employees claim the approved mileage rate then the good news is that yes if you re VAT registered and not using the

https://www.rac.co.uk/.../claiming-vat-on-mileage

If you drive your own car for business purposes other than a generic commute you can make a claim against the approved mileage allowance payment rate AMAP to get

Well if you re an owner managed business and you or your employees claim the approved mileage rate then the good news is that yes if you re VAT registered and not using the

If you drive your own car for business purposes other than a generic commute you can make a claim against the approved mileage allowance payment rate AMAP to get

Claiming VAT On Mileage Expenses Tripcatcher

Is Olbas Oil Good For Asthma KnowYourAsthma

Claiming VAT Back On A Commercial Property Purchase BloomSmith

Claiming VAT Back On Business Expenses In The E U Performance Accountancy

.jpg)

Can You Claim Back VAT On Lease Cars ACL Automotive

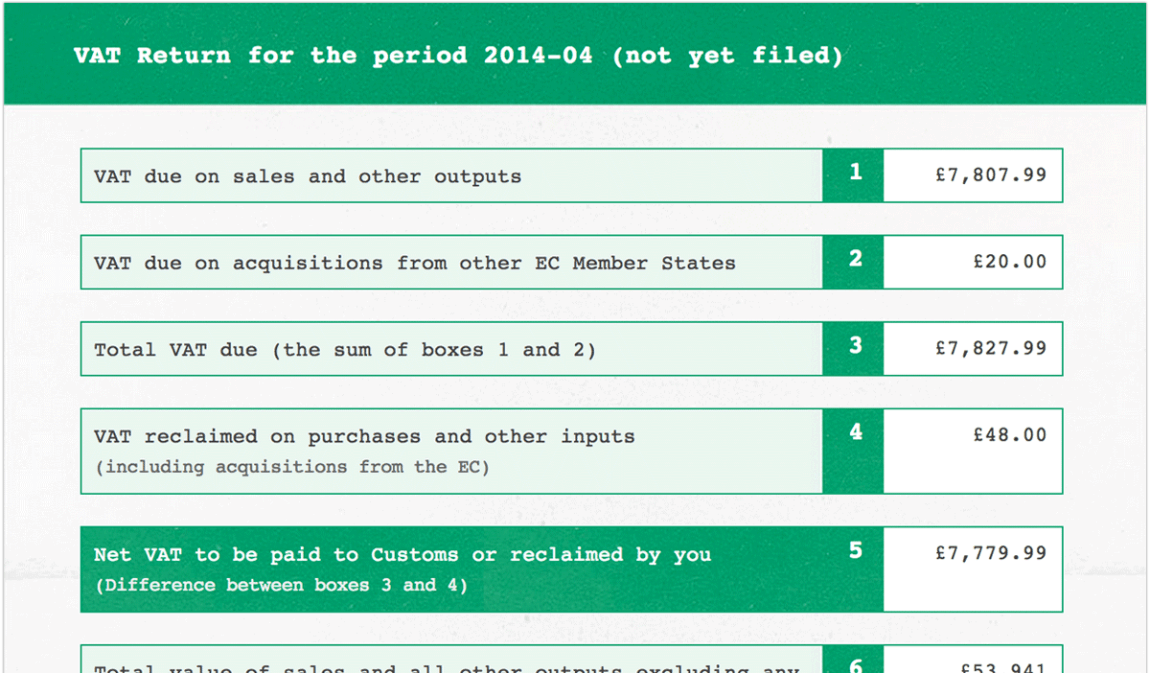

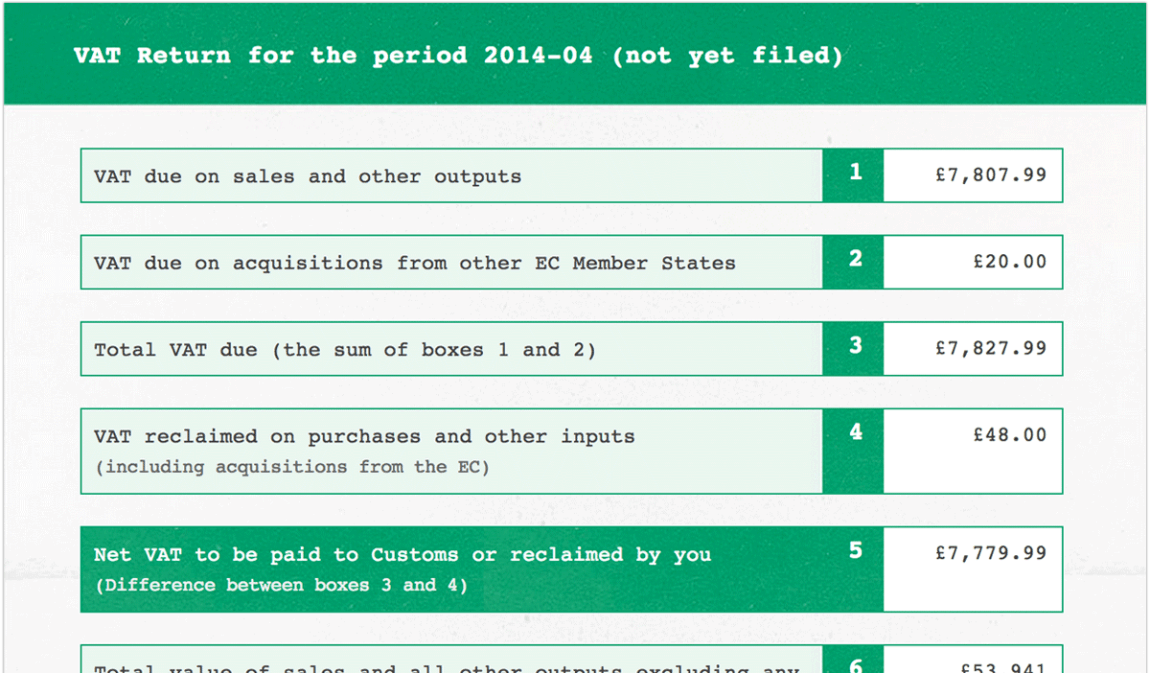

FreeAgent VAT Online Submission 1Stop Accountants

FreeAgent VAT Online Submission 1Stop Accountants

How To Claim VAT Back On Expenses Goselfemployed co