In this digital age, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. No matter whether it's for educational uses such as creative projects or just adding an individual touch to the space, Company Tax Return Losses Schedule can be an excellent resource. Through this post, we'll dive deep into the realm of "Company Tax Return Losses Schedule," exploring what they are, where they can be found, and the ways that they can benefit different aspects of your daily life.

Get Latest Company Tax Return Losses Schedule Below

Company Tax Return Losses Schedule

Company Tax Return Losses Schedule -

Eligible corporate tax entities can claim the loss carry back tax offset by carrying back tax losses made in 2019 20 2020 21 and 2021 22 years to a prior year s income tax

Losses schedule 2022 For use by companies trusts and superannuation funds to assist with completion of 2022 tax returns Last updated 9 June 2022

Company Tax Return Losses Schedule offer a wide assortment of printable documents that can be downloaded online at no cost. These resources come in many designs, including worksheets coloring pages, templates and much more. The appealingness of Company Tax Return Losses Schedule is in their versatility and accessibility.

More of Company Tax Return Losses Schedule

How Tax Losses Carried Forward Can Help You Minimise Tax BOX Advisory

How Tax Losses Carried Forward Can Help You Minimise Tax BOX Advisory

The Losses schedule BP must be lodged with the income tax return for companies funds and trusts where there is a loss amount recorded at any of the losses labels and the

Understanding the requirements for handling company tax losses and how to deal with a current year tax loss in a company For CTR Form it is necessary to visit

Company Tax Return Losses Schedule have risen to immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization: You can tailor the templates to meet your individual needs whether it's making invitations or arranging your schedule or decorating your home.

-

Educational value: Downloads of educational content for free offer a wide range of educational content for learners of all ages, which makes them a valuable source for educators and parents.

-

Easy to use: Instant access to numerous designs and templates saves time and effort.

Where to Find more Company Tax Return Losses Schedule

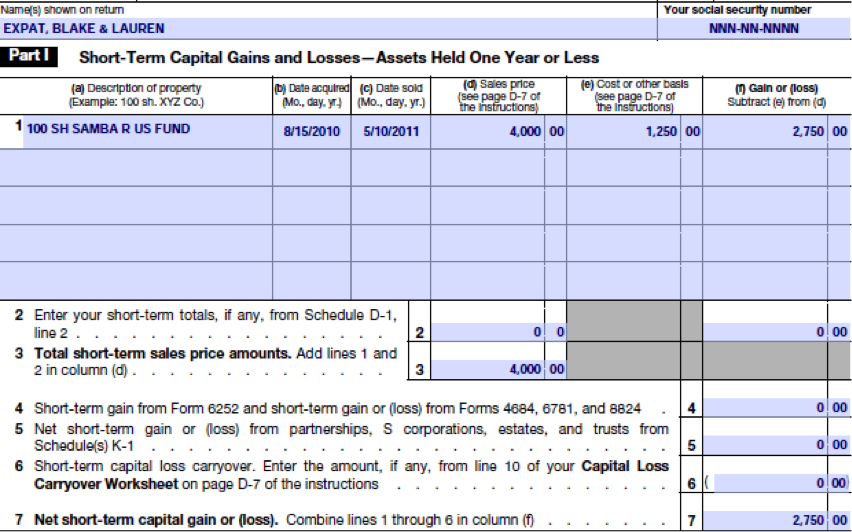

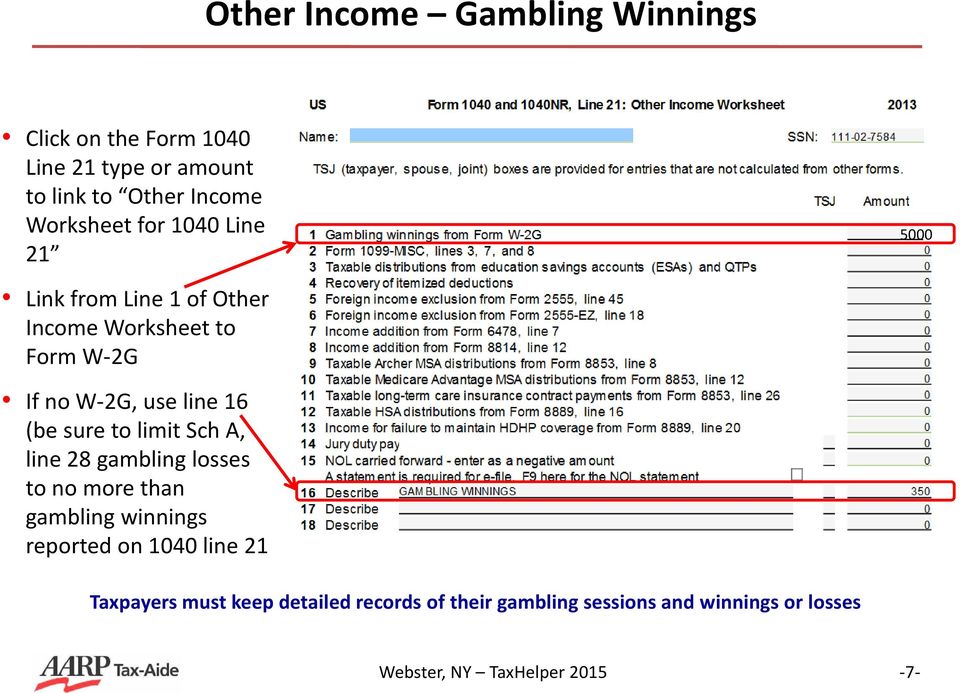

How To Avoid Short Term Capital Gains Treatbeyond2

How To Avoid Short Term Capital Gains Treatbeyond2

Complete Schedule C or other tax form for your business type and enter the net profit or loss on Schedule 1 of Form 1040 or 1040 SR for seniors The

Use these instructions to complete the Losses schedule 2023 if you re a company trust or superannuation fund

If we've already piqued your interest in printables for free Let's find out where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Company Tax Return Losses Schedule for various applications.

- Explore categories such as furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- Perfect for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- The blogs covered cover a wide variety of topics, from DIY projects to planning a party.

Maximizing Company Tax Return Losses Schedule

Here are some creative ways that you can make use of Company Tax Return Losses Schedule:

1. Home Decor

- Print and frame beautiful artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home also in the classes.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Company Tax Return Losses Schedule are a treasure trove of useful and creative resources catering to different needs and interest. Their access and versatility makes them a fantastic addition to every aspect of your life, both professional and personal. Explore the vast array of Company Tax Return Losses Schedule and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes, they are! You can download and print these tools for free.

-

Can I use the free printables for commercial use?

- It depends on the specific usage guidelines. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Are there any copyright rights issues with Company Tax Return Losses Schedule?

- Certain printables may be subject to restrictions in their usage. Make sure you read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- Print them at home using your printer or visit an area print shop for higher quality prints.

-

What program do I need to run printables at no cost?

- The majority of printables are in PDF format. They can be opened using free software such as Adobe Reader.

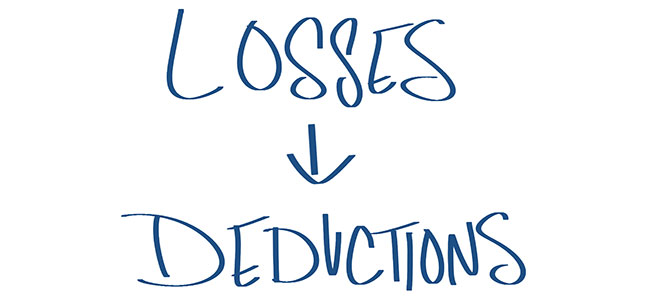

Where To Report Gambling Losses On Tax Return

Net Operating Losses NOLs Formula Calculator

Check more sample of Company Tax Return Losses Schedule below

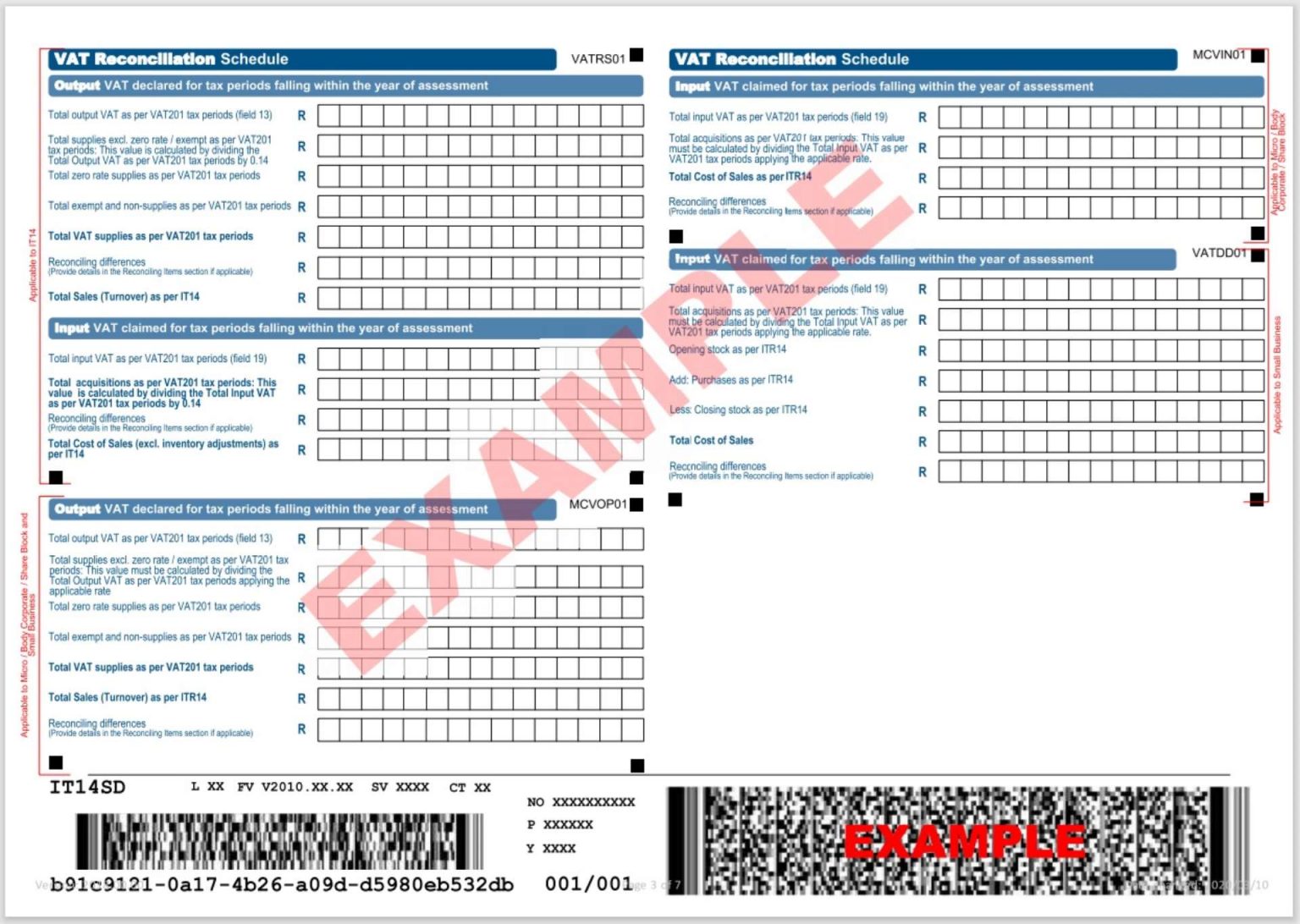

Understanding SARS IT14SD VATSolve

Tax Loss Carryforward NOL How To Report NOL Carryforward YouTube

Attaching A Losses Schedule For An Old Form LodgeiT

How To Disclose Capital Gains In Your Income Tax Return SheInvests

Search Publication

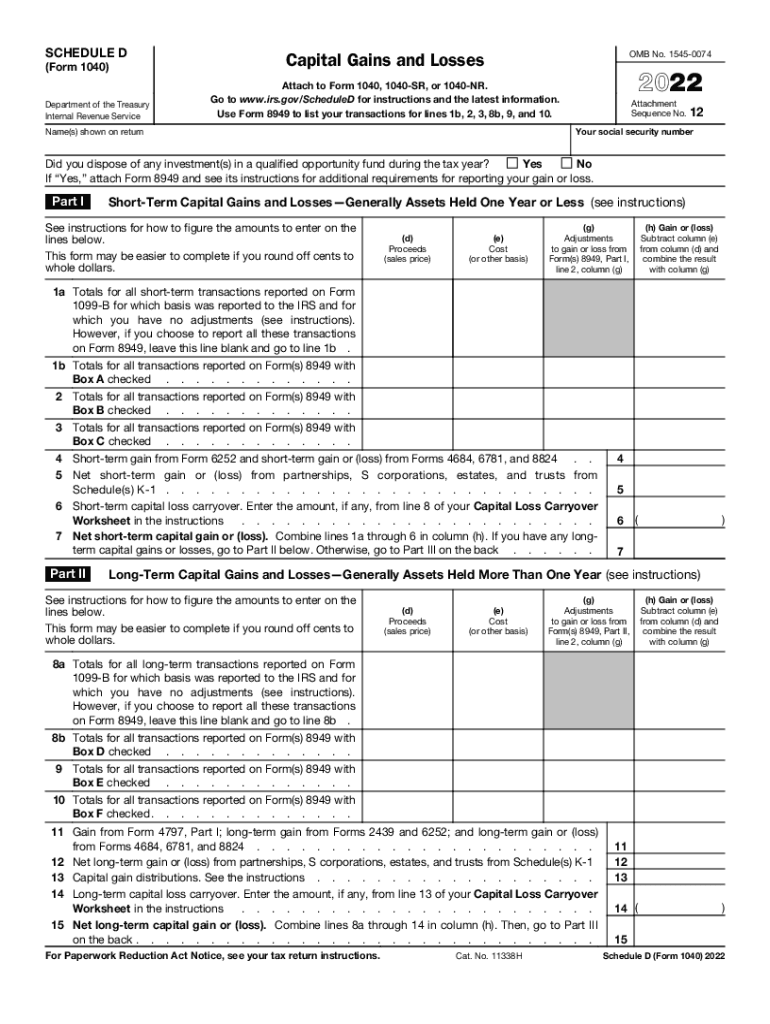

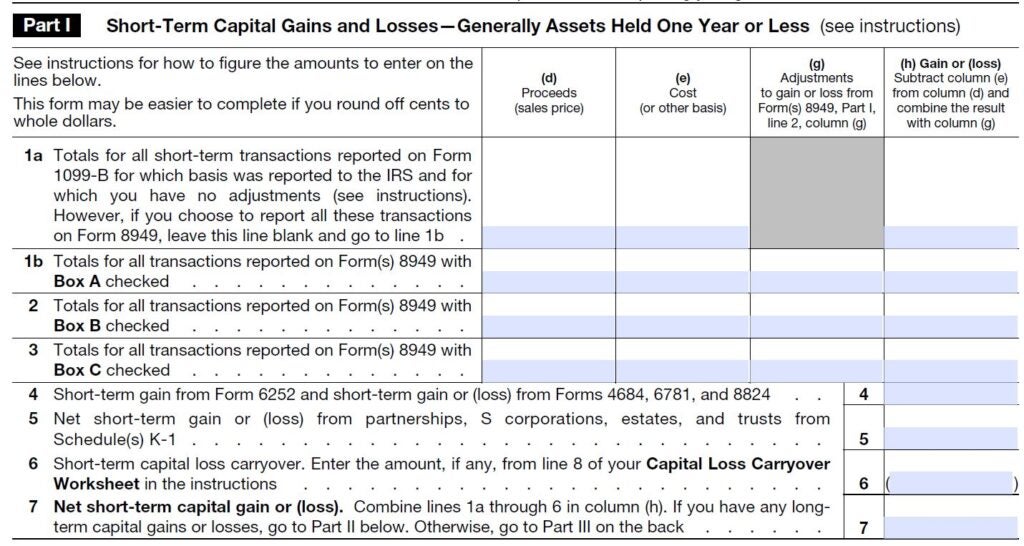

Capital Gains And Losses Schedule D When Filing US Taxes 1040 Form

https://www.ato.gov.au/forms-and-instructions/losses-schedule-2022

Losses schedule 2022 For use by companies trusts and superannuation funds to assist with completion of 2022 tax returns Last updated 9 June 2022

https://tdv.ato.acc.ato.gov.au/forms-and...

If any of the following tests apply to your entity company trust or superannuation fund you must complete and submit a losses schedule with your 2023

Losses schedule 2022 For use by companies trusts and superannuation funds to assist with completion of 2022 tax returns Last updated 9 June 2022

If any of the following tests apply to your entity company trust or superannuation fund you must complete and submit a losses schedule with your 2023

How To Disclose Capital Gains In Your Income Tax Return SheInvests

Tax Loss Carryforward NOL How To Report NOL Carryforward YouTube

Search Publication

Capital Gains And Losses Schedule D When Filing US Taxes 1040 Form

Reporting Gambling Winnings And Losses On Your Tax Return 1040 Blog

How To Report A Stock Loss On An Income Tax Return Finance Zacks

How To Report A Stock Loss On An Income Tax Return Finance Zacks

Where Are Gambling Losses Reported On Schedule A Vcyellow