In the digital age, when screens dominate our lives and the appeal of physical printed materials isn't diminishing. It doesn't matter if it's for educational reasons and creative work, or simply to add an element of personalization to your home, printables for free are now an essential resource. Through this post, we'll take a dive in the world of "Corporate Income Tax Rebate Singapore," exploring what they are, how to locate them, and the ways that they can benefit different aspects of your daily life.

Get Latest Corporate Income Tax Rebate Singapore Below

Corporate Income Tax Rebate Singapore

Corporate Income Tax Rebate Singapore -

Income derived by companies in Singapore is taxed at a flat rate of 17 The start up tax exemption scheme provides newly incorporated companies some exemption on their taxable profits in their first three years of operation Please refer to IRAS website for more details on the start up tax exemption scheme and the qualifying conditions

A basic guide to learn about Corporate Income Tax in Singapore e g tax rates Year of Assessment filing obligations and tips for new companies

Corporate Income Tax Rebate Singapore provide a diverse variety of printable, downloadable items that are available online at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages, and much more. The attraction of printables that are free is their versatility and accessibility.

More of Corporate Income Tax Rebate Singapore

2022 Singapore Tax Rate How To Calculate Singapore Tax Income Tax

2022 Singapore Tax Rate How To Calculate Singapore Tax Income Tax

Updated Feb 17 2024 12 32 AM SINGAPORE Companies will receive a 50 per cent corporate income tax rebate capped at 40 000 in the year of assessment 2024 This is part of a 1 3

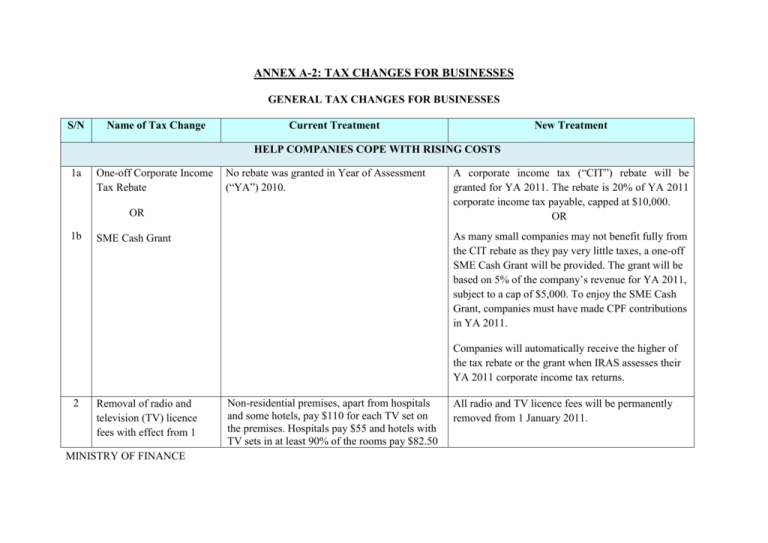

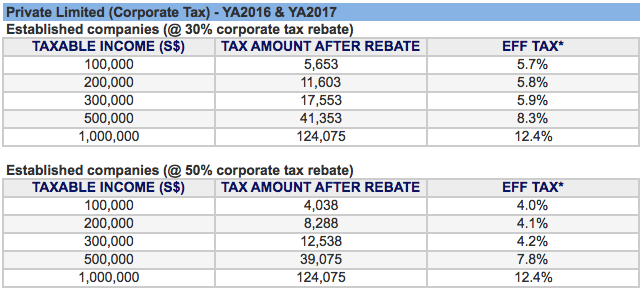

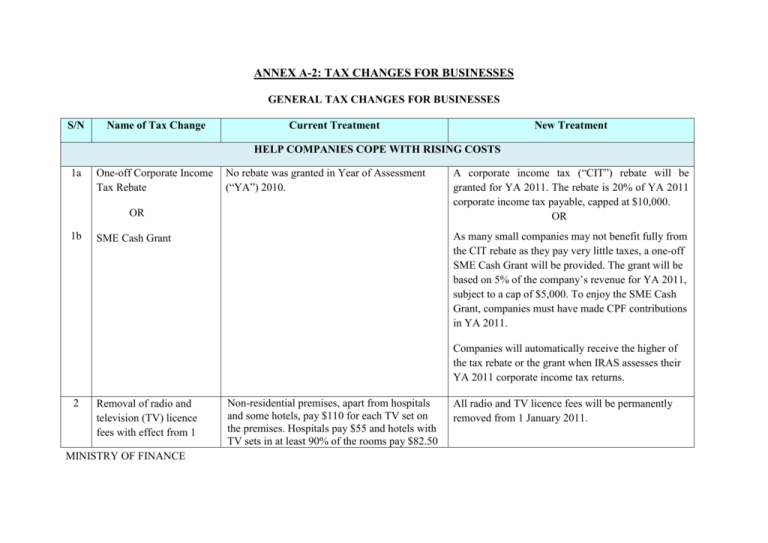

All Singapore companies are eligible for corporate income tax rebate regardless of profit levels or paid up capital amount The following table lists the corporate income tax rebate over the last seven years The corporate tax rebate for YA2020 has not yet been granted but may soon be subject to updates in the upcoming Budget 2020

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization The Customization feature lets you tailor designs to suit your personal needs whether you're designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational value: Downloads of educational content for free cater to learners of all ages, which makes these printables a powerful aid for parents as well as educators.

-

An easy way to access HTML0: Access to various designs and templates cuts down on time and efforts.

Where to Find more Corporate Income Tax Rebate Singapore

Corporate Income Tax Rebate Crowe Singapore

Corporate Income Tax Rebate Crowe Singapore

Corporate income tax CIT Rebate and CIT cash grant for Year of Assessment YA 2024 All companies will enjoy a 50 corporate income tax rebate capped at SGD 40 000 and net of any CIT cash grant received for YA 2024

Corporate Income Tax income CIT Rebate tax corporate Provides support for eligible companies to manage rising costs through CIT Rebate and CIT Rebate Cash Grant 50 of the tax payable in the Year of Assessment 2024 2 000 in CIT Rebate Cash Grant for companies that have hired at least one local employee in 2023

Now that we've piqued your interest in Corporate Income Tax Rebate Singapore We'll take a look around to see where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection with Corporate Income Tax Rebate Singapore for all motives.

- Explore categories like decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets including flashcards, learning materials.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- These blogs cover a broad array of topics, ranging including DIY projects to planning a party.

Maximizing Corporate Income Tax Rebate Singapore

Here are some ideas in order to maximize the use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Corporate Income Tax Rebate Singapore are a treasure trove of practical and imaginative resources which cater to a wide range of needs and interest. Their availability and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the endless world of Corporate Income Tax Rebate Singapore to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes you can! You can print and download these materials for free.

-

Are there any free printables for commercial purposes?

- It's dependent on the particular conditions of use. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright problems with Corporate Income Tax Rebate Singapore?

- Some printables may contain restrictions on use. Be sure to read the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- Print them at home with either a printer at home or in a print shop in your area for high-quality prints.

-

What software do I need to run printables free of charge?

- Most printables come in the PDF format, and is open with no cost software like Adobe Reader.

Singapore Corporate Income Tax Rebate What Do You Need To Know

Income Tax Rebate Astonishingceiyrs

Check more sample of Corporate Income Tax Rebate Singapore below

Singapore Budget 2017 The Corporate Income Tax Rebate

Annexa2 Singapore Budget 2016

How To Reduce Income Tax In Singapore

Corporate Income Tax Filing Obligations What They Are And What

All About The Parenthood Tax Rebate In Singapore 2023

What Are Corporate Tax Exemptions In Singapore

https://www. iras.gov.sg /taxes/corporate-income-tax/...

A basic guide to learn about Corporate Income Tax in Singapore e g tax rates Year of Assessment filing obligations and tips for new companies

https:// premiatnc.com /sg/blog/singapore-corporate...

The Singapore corporate income tax rebate is no longer available for YA 2023 This is based on the Singapore Budget 2023 which was delivered by Singapore s Deputy Prime Minister and Minister for Finance Mr Lawrence Wong on February 14 2023 The corporate income tax rebate is designed to assist businesses that are liable to

A basic guide to learn about Corporate Income Tax in Singapore e g tax rates Year of Assessment filing obligations and tips for new companies

The Singapore corporate income tax rebate is no longer available for YA 2023 This is based on the Singapore Budget 2023 which was delivered by Singapore s Deputy Prime Minister and Minister for Finance Mr Lawrence Wong on February 14 2023 The corporate income tax rebate is designed to assist businesses that are liable to

Corporate Income Tax Filing Obligations What They Are And What

Annexa2 Singapore Budget 2016

All About The Parenthood Tax Rebate In Singapore 2023

What Are Corporate Tax Exemptions In Singapore

Option To Accelerate Claims On Renovation And Refurbishment Costs

Fortune India Business News Strategy Finance And Corporate Insight

Fortune India Business News Strategy Finance And Corporate Insight

How To Reduce Corporate Income Tax In Singapore InTime