In a world with screens dominating our lives it's no wonder that the appeal of tangible printed objects isn't diminished. No matter whether it's for educational uses or creative projects, or simply adding an individual touch to your area, Corporate Income Tax Return Singapore are now a useful resource. With this guide, you'll take a dive deep into the realm of "Corporate Income Tax Return Singapore," exploring what they are, how to find them, and ways they can help you improve many aspects of your lives.

Get Latest Corporate Income Tax Return Singapore Below

Corporate Income Tax Return Singapore

Corporate Income Tax Return Singapore -

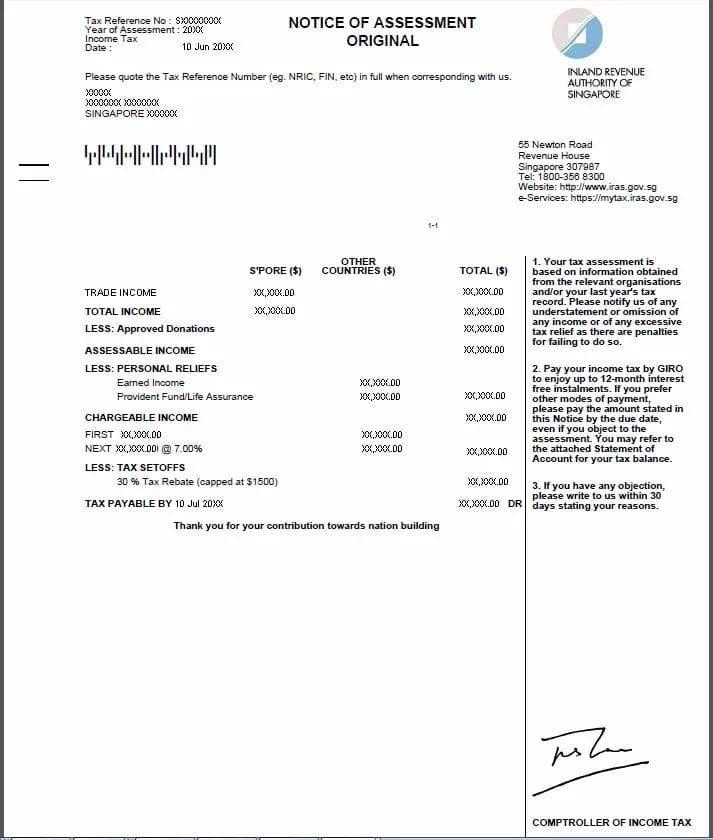

The corporation files an estimate of its income within three months of the end of the accounting period followed by a return of income by 30 November of the tax year and the tax is assessed by the Comptroller of Income Tax All companies are required to

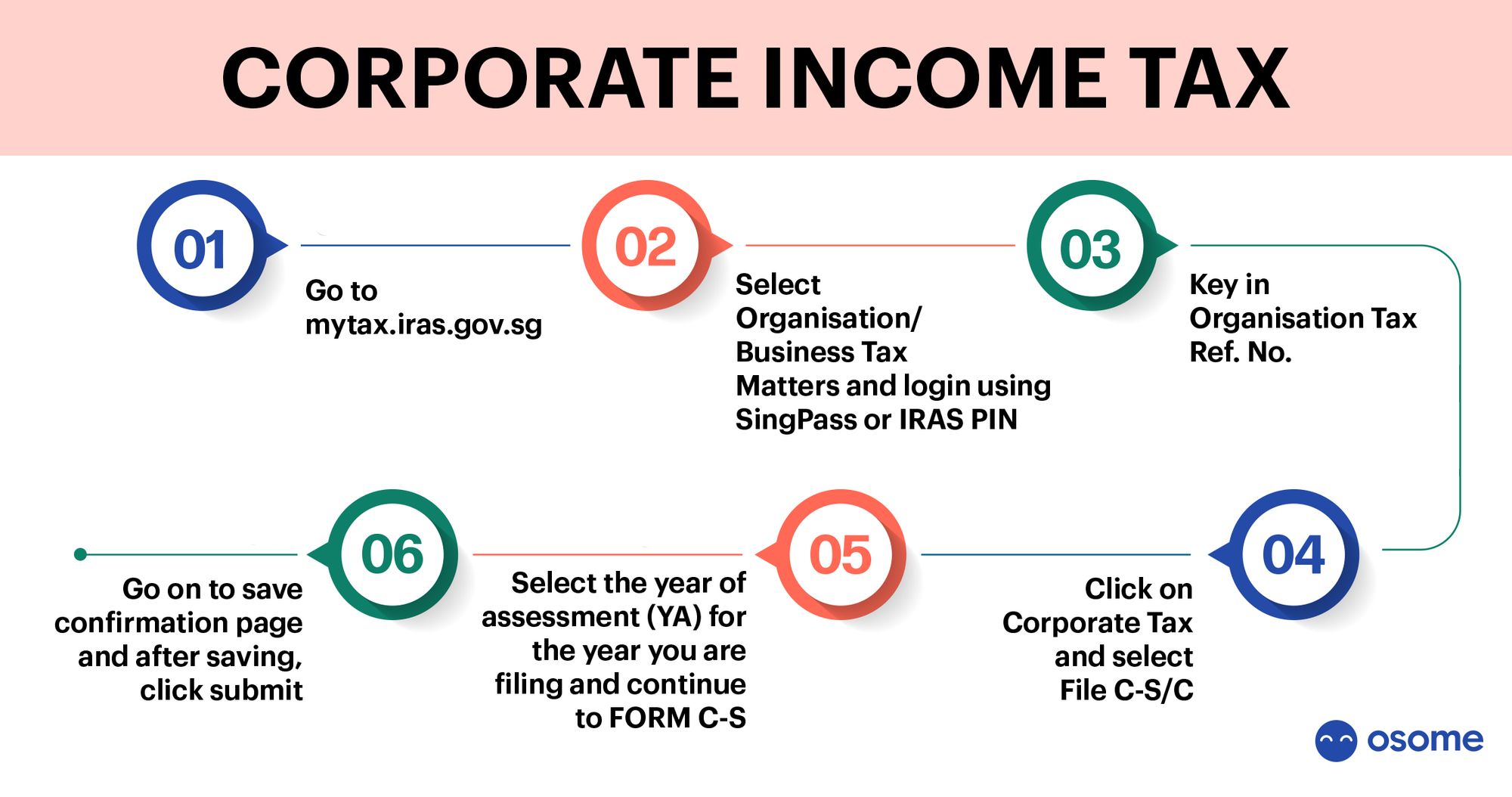

The status of your company s Corporate Income Tax Return and tax assessment can be found at mytax iras gov sg or through the Corporate Income Tax Integrated Phone Service Learn how to check your Form C S Form C S Lite Form C submission and assessment status

Corporate Income Tax Return Singapore provide a diverse assortment of printable items that are available online at no cost. These resources come in various types, like worksheets, templates, coloring pages, and many more. One of the advantages of Corporate Income Tax Return Singapore is their versatility and accessibility.

More of Corporate Income Tax Return Singapore

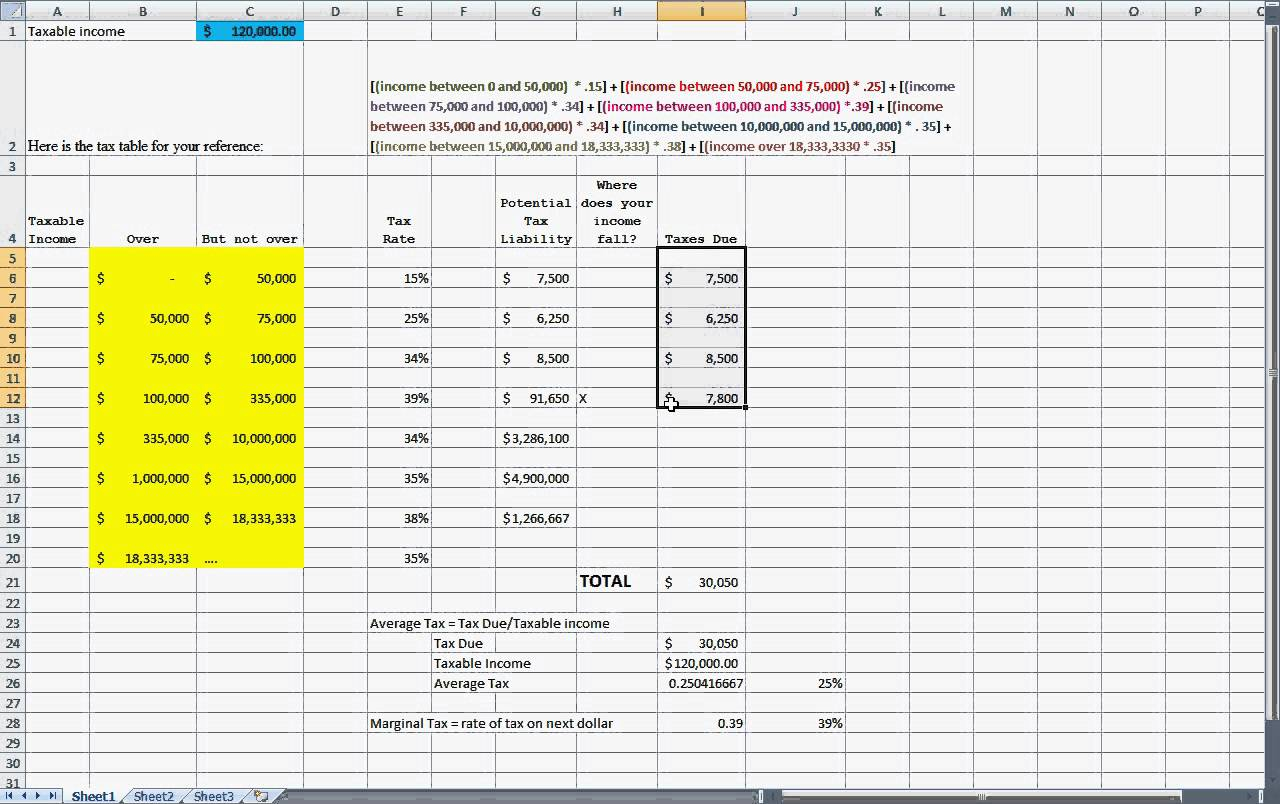

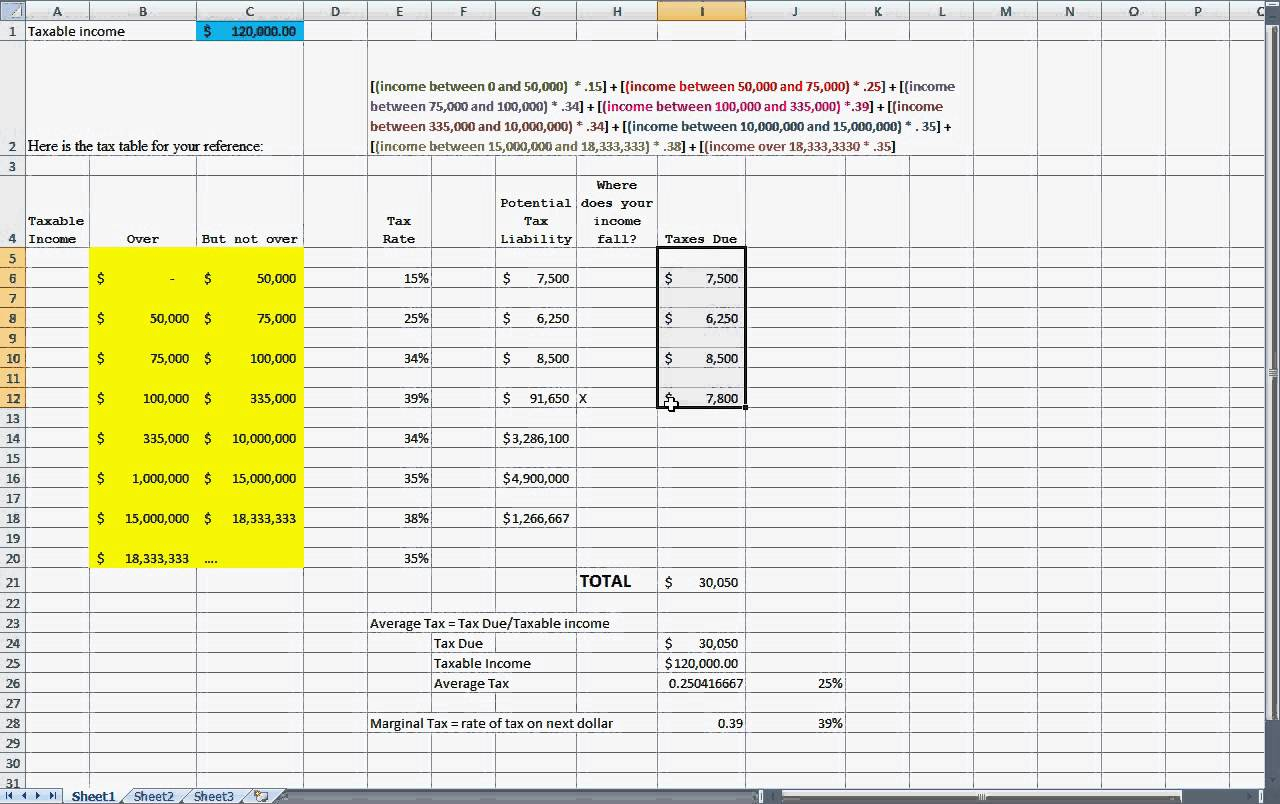

Limited Company Tax Calculator Spreadsheet Db excel

Limited Company Tax Calculator Spreadsheet Db excel

Your company must follow corporate tax filing regulations in Singapore which entail submitting two types of tax returns In certain situations your company might be eligible for a simplified return or even an exemption from filing

You ve gotten past the most difficult part of Corporate Tax Income CIT filing understanding it The next part is a breeze in comparison To file the CIT return you have to first be authorised by your company to act for its CIT matters via Corppass

Corporate Income Tax Return Singapore have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

The ability to customize: Your HTML0 customization options allow you to customize printables to fit your particular needs in designing invitations, organizing your schedule, or even decorating your home.

-

Education Value Educational printables that can be downloaded for free are designed to appeal to students of all ages, making them a great tool for parents and educators.

-

Simple: immediate access a myriad of designs as well as templates can save you time and energy.

Where to Find more Corporate Income Tax Return Singapore

Income Tax Singapore Roscoe Crum

Income Tax Singapore Roscoe Crum

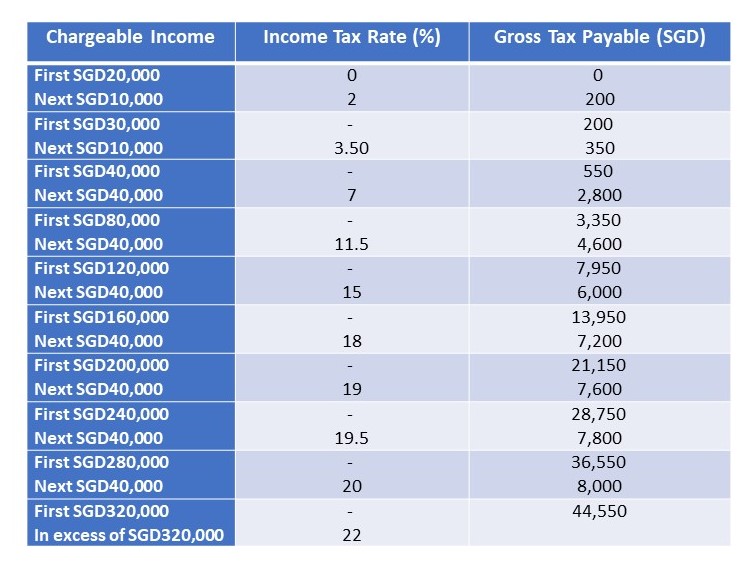

Singapore corporate tax rate is at 17 on chargeable income This article will explain who must pay corporate tax how to pay corporate tax and the penalties for evading taxes

Income derived by companies in Singapore is taxed at a flat rate of 17 The start up tax exemption scheme encourages entrepreneurship by providing newly incorporated companies some exemption on their taxable profits in their first three years of operation

Now that we've piqued your curiosity about Corporate Income Tax Return Singapore We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection with Corporate Income Tax Return Singapore for all needs.

- Explore categories such as interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets, flashcards, and learning materials.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- These blogs cover a wide array of topics, ranging from DIY projects to planning a party.

Maximizing Corporate Income Tax Return Singapore

Here are some ideas of making the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Corporate Income Tax Return Singapore are a treasure trove of useful and creative resources catering to different needs and interest. Their accessibility and versatility make they a beneficial addition to the professional and personal lives of both. Explore the many options of Corporate Income Tax Return Singapore to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes they are! You can print and download these tools for free.

-

Can I make use of free templates for commercial use?

- It's based on the usage guidelines. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues with Corporate Income Tax Return Singapore?

- Some printables could have limitations on their use. Make sure to read the terms and condition of use as provided by the author.

-

How do I print printables for free?

- You can print them at home using the printer, or go to the local print shop for more high-quality prints.

-

What program do I need to run printables for free?

- Many printables are offered with PDF formats, which can be opened using free programs like Adobe Reader.

Borang C Company Felicity Black

Notice On Deadline For Reporting 2021 Corporate Income Tax Return Confida

Check more sample of Corporate Income Tax Return Singapore below

Singapore Company s Annual Filing Requirements ACRA IRAS

Singapore Corporate Tax Rate Exemptions Filing Requirements

IRAS Understanding My Tax Assessment

Corporate Income Tax Return Form 2 Free Templates In PDF Word Excel

Corporate Income Tax Filing For Singapore Companies Rikvin Pte Ltd

Corporate Income Tax In Singapore

https://www.iras.gov.sg/taxes/corporate-income-tax...

The status of your company s Corporate Income Tax Return and tax assessment can be found at mytax iras gov sg or through the Corporate Income Tax Integrated Phone Service Learn how to check your Form C S Form C S Lite Form C submission and assessment status

https://www.iras.gov.sg/taxes/corporate-income-tax/...

A basic guide to learn about Corporate Income Tax in Singapore e g tax rates Year of Assessment filing obligations and tips for new companies

The status of your company s Corporate Income Tax Return and tax assessment can be found at mytax iras gov sg or through the Corporate Income Tax Integrated Phone Service Learn how to check your Form C S Form C S Lite Form C submission and assessment status

A basic guide to learn about Corporate Income Tax in Singapore e g tax rates Year of Assessment filing obligations and tips for new companies

Corporate Income Tax Return Form 2 Free Templates In PDF Word Excel

Singapore Corporate Tax Rate Exemptions Filing Requirements

Corporate Income Tax Filing For Singapore Companies Rikvin Pte Ltd

Corporate Income Tax In Singapore

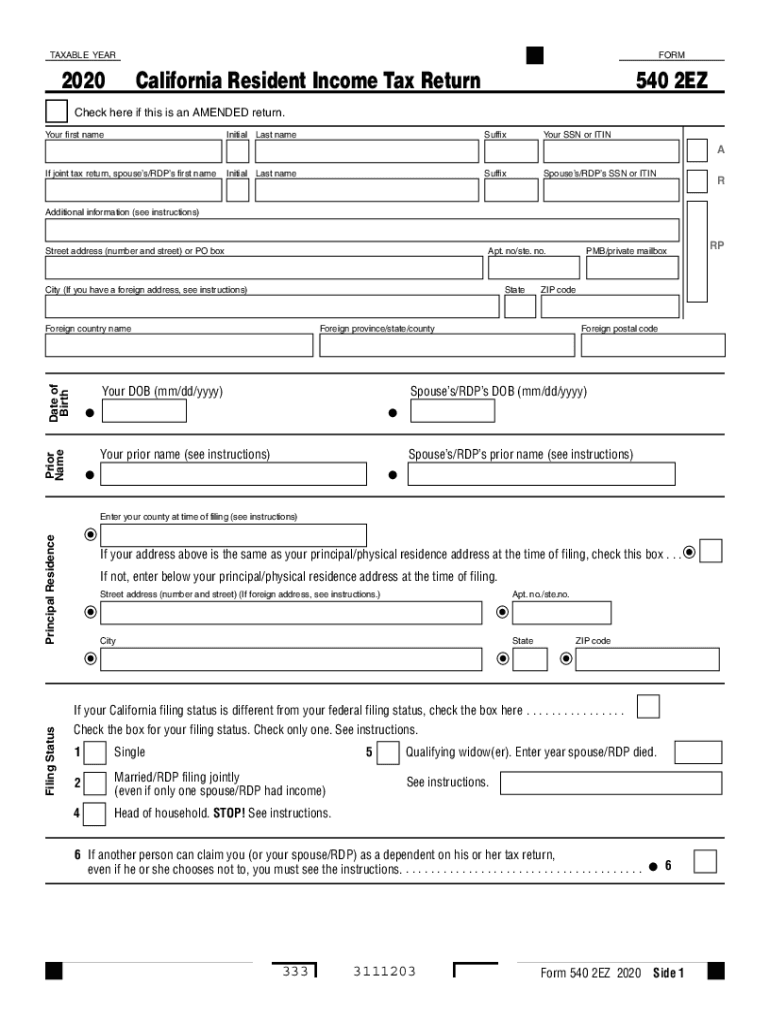

2014 Printable 540 2Ez Form Fill Out And Sign Printable PDF Template

How To Pay Iras Tax With Credit Card TAX

How To Pay Iras Tax With Credit Card TAX

This 31 Facts About Iras Singapore Tax Rate Assist In Preparation