In this age of technology, in which screens are the norm yet the appeal of tangible printed materials hasn't faded away. Whether it's for educational purposes in creative or artistic projects, or simply adding personal touches to your area, Corporate Tax Deduction Singapore are a great source. In this article, we'll take a dive into the sphere of "Corporate Tax Deduction Singapore," exploring their purpose, where to get them, as well as the ways that they can benefit different aspects of your daily life.

Get Latest Corporate Tax Deduction Singapore Below

Corporate Tax Deduction Singapore

Corporate Tax Deduction Singapore -

2024 guide to Singapore s corporate tax rates taxable income calculation tax residency rules tax incentive schemes and filing deadlines

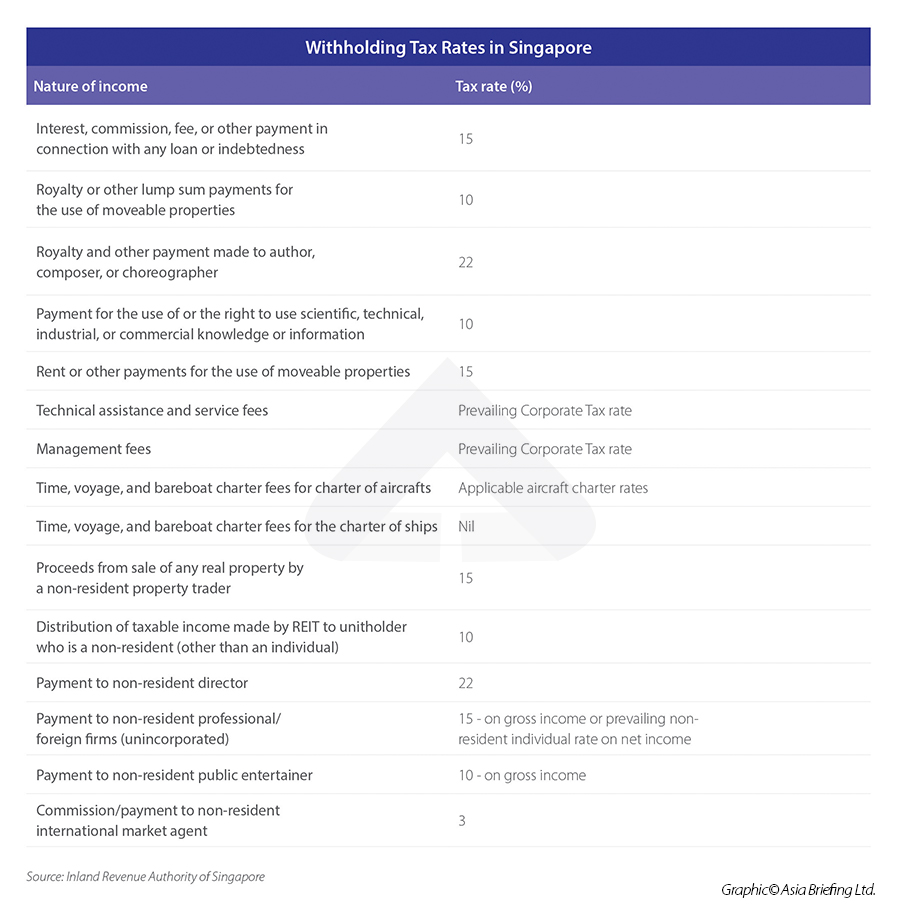

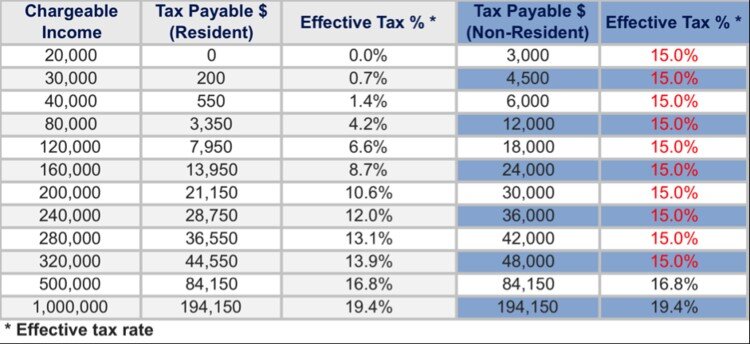

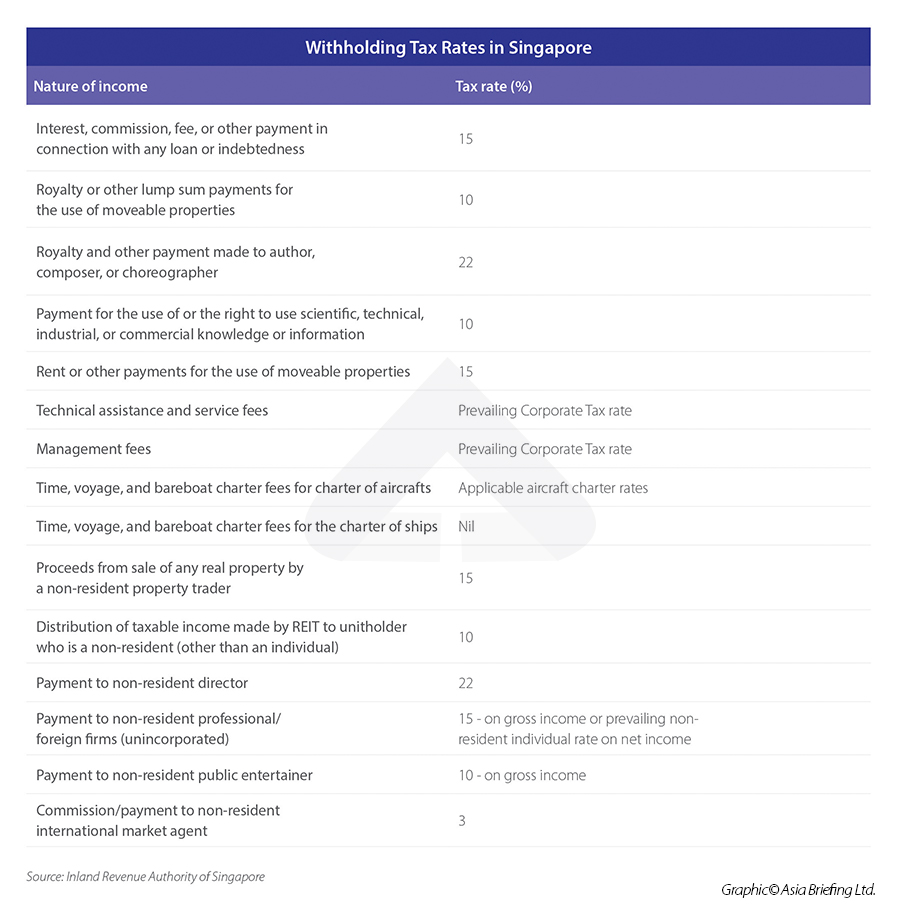

Tax on corporate income is imposed at a flat rate of 17 A partial tax exemption and a three year start up tax exemption for qualifying start up companies are

Printables for free cover a broad collection of printable items that are available online at no cost. These printables come in different styles, from worksheets to templates, coloring pages and much more. One of the advantages of Corporate Tax Deduction Singapore lies in their versatility and accessibility.

More of Corporate Tax Deduction Singapore

Complete Guide Tax Deductions Tax Breaks In 2022 Singapore

Complete Guide Tax Deductions Tax Breaks In 2022 Singapore

Corporate Income Tax Rate The tax rate is 17 Companies are entitled to a 40 corporate income tax CIT rebate capped at SGD 15 000 for Year of Assessment YA

The Comptroller is satisfied that the tax exemption would be beneficial to the Singapore tax resident corporation The Minister for Finance also retains the discretion to grant tax

Printables for free have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Customization: There is the possibility of tailoring the templates to meet your individual needs in designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Impact: Downloads of educational content for free provide for students of all ages. This makes the perfect tool for parents and educators.

-

It's easy: Quick access to an array of designs and templates reduces time and effort.

Where to Find more Corporate Tax Deduction Singapore

5 Industry Specific Tax Deductions To Claim On Your Corporate Tax Return

5 Industry Specific Tax Deductions To Claim On Your Corporate Tax Return

Depending on their level of economic commitments to Singapore international headquarters can apply for various tax incentives including concessionary

In this article we will help you identify which of your business expenses are deductible according to Singapore tax laws

Since we've got your curiosity about Corporate Tax Deduction Singapore and other printables, let's discover where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety in Corporate Tax Deduction Singapore for different goals.

- Explore categories like decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- Ideal for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs are a vast selection of subjects, that range from DIY projects to party planning.

Maximizing Corporate Tax Deduction Singapore

Here are some innovative ways of making the most use of Corporate Tax Deduction Singapore:

1. Home Decor

- Print and frame gorgeous art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Corporate Tax Deduction Singapore are a treasure trove of fun and practical tools that meet a variety of needs and preferences. Their access and versatility makes them a valuable addition to every aspect of your life, both professional and personal. Explore the vast collection of Corporate Tax Deduction Singapore now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes, they are! You can print and download the resources for free.

-

Does it allow me to use free templates for commercial use?

- It's contingent upon the specific rules of usage. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may contain restrictions regarding usage. Check the terms and regulations provided by the designer.

-

How do I print printables for free?

- Print them at home using the printer, or go to a print shop in your area for top quality prints.

-

What software will I need to access printables for free?

- The majority of PDF documents are provided in PDF format. These can be opened with free programs like Adobe Reader.

Personal Income Tax 2017 Julianagwf

Income Tax 2022 Malaysia Rate Latest News Update

Check more sample of Corporate Tax Deduction Singapore below

Personal Income Tax In Singapore For Foreigners

Corporate Tax Reforms New Interest Deduction Rules In Belgium Nexia

What Are Corporate Tax Exemptions In Singapore

Cukai Makmur Is One off Corporate Tax

2022 Tax Brackets Irs Calculator

Donation Tax Calculator Giving NUS Yong Loo Lin School Of Medicine

https://taxsummaries.pwc.com/singapore/corporate/...

Tax on corporate income is imposed at a flat rate of 17 A partial tax exemption and a three year start up tax exemption for qualifying start up companies are

https://www.mof.gov.sg/policies/taxes/corporate-income-tax

Income derived by companies in Singapore is taxed at a flat rate of 17 The start up tax exemption scheme provides newly incorporated companies some exemption on their

Tax on corporate income is imposed at a flat rate of 17 A partial tax exemption and a three year start up tax exemption for qualifying start up companies are

Income derived by companies in Singapore is taxed at a flat rate of 17 The start up tax exemption scheme provides newly incorporated companies some exemption on their

Cukai Makmur Is One off Corporate Tax

Corporate Tax Reforms New Interest Deduction Rules In Belgium Nexia

2022 Tax Brackets Irs Calculator

Donation Tax Calculator Giving NUS Yong Loo Lin School Of Medicine

Deduction Singapore Crime Detective Drama Trailer BAFM 1115 YouTube

A Singaporean s Guide How To Claim Income Tax Deduction For Work

A Singaporean s Guide How To Claim Income Tax Deduction For Work

You ve Heard It Before Charitable Donations Can Help Your Business