In this day and age with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. Whether it's for educational purposes project ideas, artistic or just adding an individual touch to your home, printables for free have become a valuable resource. In this article, we'll dive deep into the realm of "Corporate Tax Deductions In India," exploring the benefits of them, where to find them, and how they can be used to enhance different aspects of your life.

Get Latest Corporate Tax Deductions In India Below

Corporate Tax Deductions In India

Corporate Tax Deductions In India -

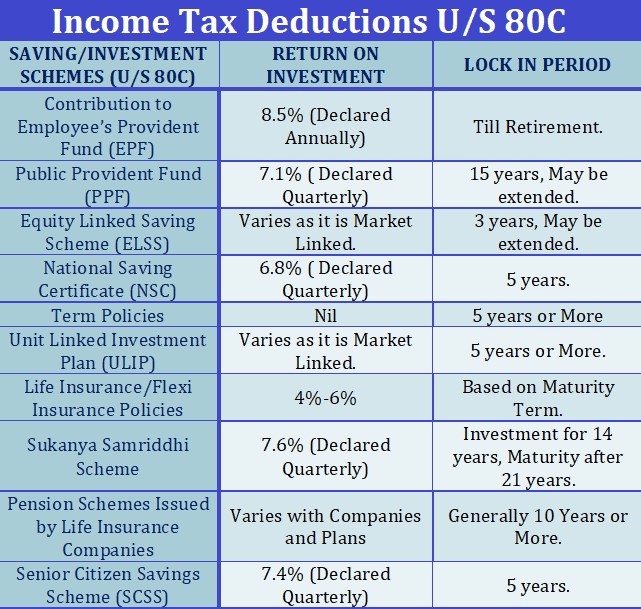

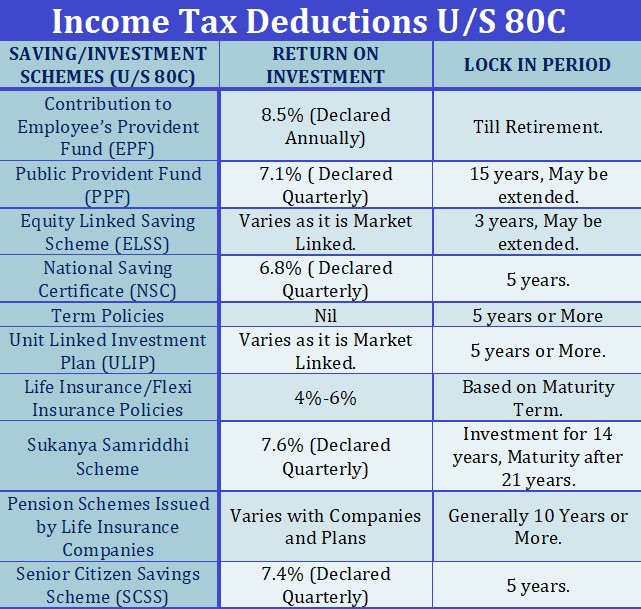

Corporate tax in India is calculated after taking into account deductions such as depreciation administrative expenses cost of goods sold and salary expenses Both domestic and foreign corporations in India must pay corporate tax which is based on the corporate income tax rate and their annual turnover

The corporate income tax CIT rate applicable to an Indian company and a foreign company for the tax year 2022 23 is as follows Surcharge of 10 is payable only where total taxable income exceeds INR 10 million Effective tax rates include surcharge and health and education cess of 4

Corporate Tax Deductions In India cover a large assortment of printable, downloadable documents that can be downloaded online at no cost. These resources come in many types, like worksheets, templates, coloring pages and more. One of the advantages of Corporate Tax Deductions In India is in their versatility and accessibility.

More of Corporate Tax Deductions In India

A Detailed Guide To Income Tax Deductions In India Fibe Formerly

A Detailed Guide To Income Tax Deductions In India Fibe Formerly

Discover the latest corporate tax in India with updated rates for domestic companies surcharges rebates and learn how to calculate taxable income

Corporate tax in India is levied by the Income Tax Department on both foreign and domestic companies With the enactment of the Income Tax Act 1961 the Indian Government makes it compulsory for domestic companies to make corporate tax payments depending on their overall income

Corporate Tax Deductions In India have risen to immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Modifications: There is the possibility of tailoring printables to your specific needs whether it's making invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Use: These Corporate Tax Deductions In India can be used by students of all ages. This makes them an essential tool for parents and teachers.

-

Accessibility: Access to a myriad of designs as well as templates reduces time and effort.

Where to Find more Corporate Tax Deductions In India

Types Of Deductions Allowed To Salaried Individual In India KDK Softwares

Types Of Deductions Allowed To Salaried Individual In India KDK Softwares

What is corporate tax in India According to the Income Tax Act 1961 the Government of India levies taxes on domestic and foreign corporates While domestic companies are taxed on their universal income foreign corporates are taxed on income accrued in India only

This article provides an in depth analysis of the key features of the new corporate tax regime including reduced rates changes in Minimum Alternate Tax MAT and industry specific responses The government announced a reduction in the corporate tax rate to promote economic growth and attract investment The key features of the

In the event that we've stirred your curiosity about Corporate Tax Deductions In India Let's take a look at where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Corporate Tax Deductions In India suitable for many needs.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs covered cover a wide selection of subjects, ranging from DIY projects to party planning.

Maximizing Corporate Tax Deductions In India

Here are some inventive ways of making the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print free worksheets to enhance learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Corporate Tax Deductions In India are a treasure trove of practical and innovative resources that satisfy a wide range of requirements and interests. Their accessibility and versatility make they a beneficial addition to each day life. Explore the many options that is Corporate Tax Deductions In India today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Corporate Tax Deductions In India really are they free?

- Yes they are! You can print and download these tools for free.

-

Can I utilize free printables for commercial use?

- It's based on specific conditions of use. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues with Corporate Tax Deductions In India?

- Some printables may come with restrictions concerning their use. Make sure you read the terms and regulations provided by the author.

-

How can I print Corporate Tax Deductions In India?

- You can print them at home with an printer, or go to a print shop in your area for the highest quality prints.

-

What software must I use to open printables free of charge?

- A majority of printed materials are with PDF formats, which can be opened with free software, such as Adobe Reader.

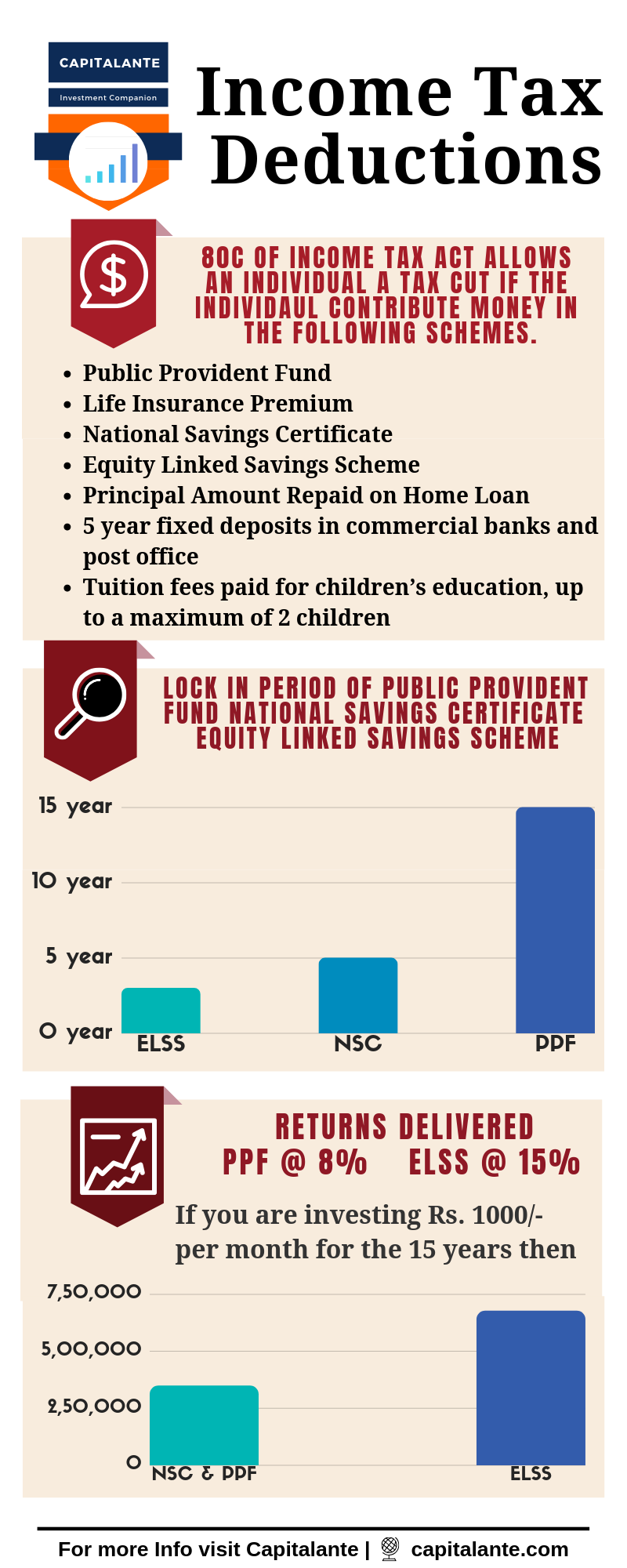

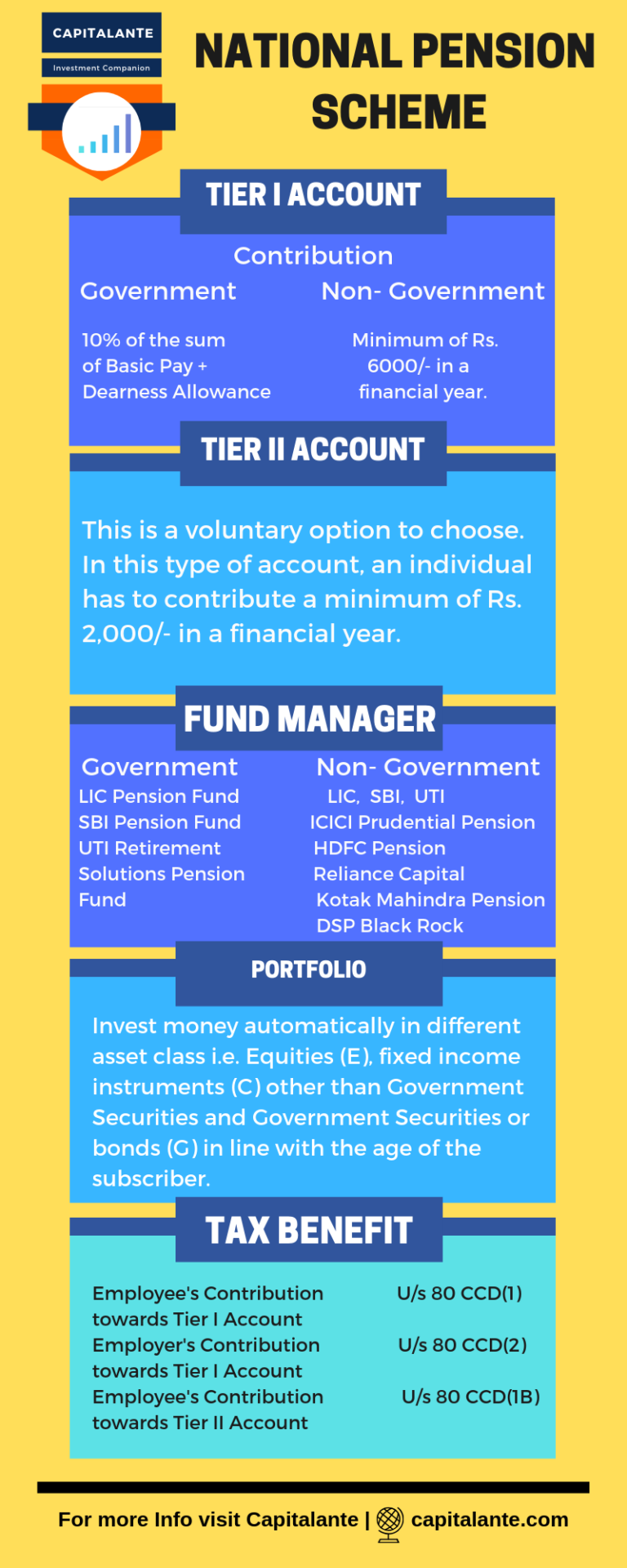

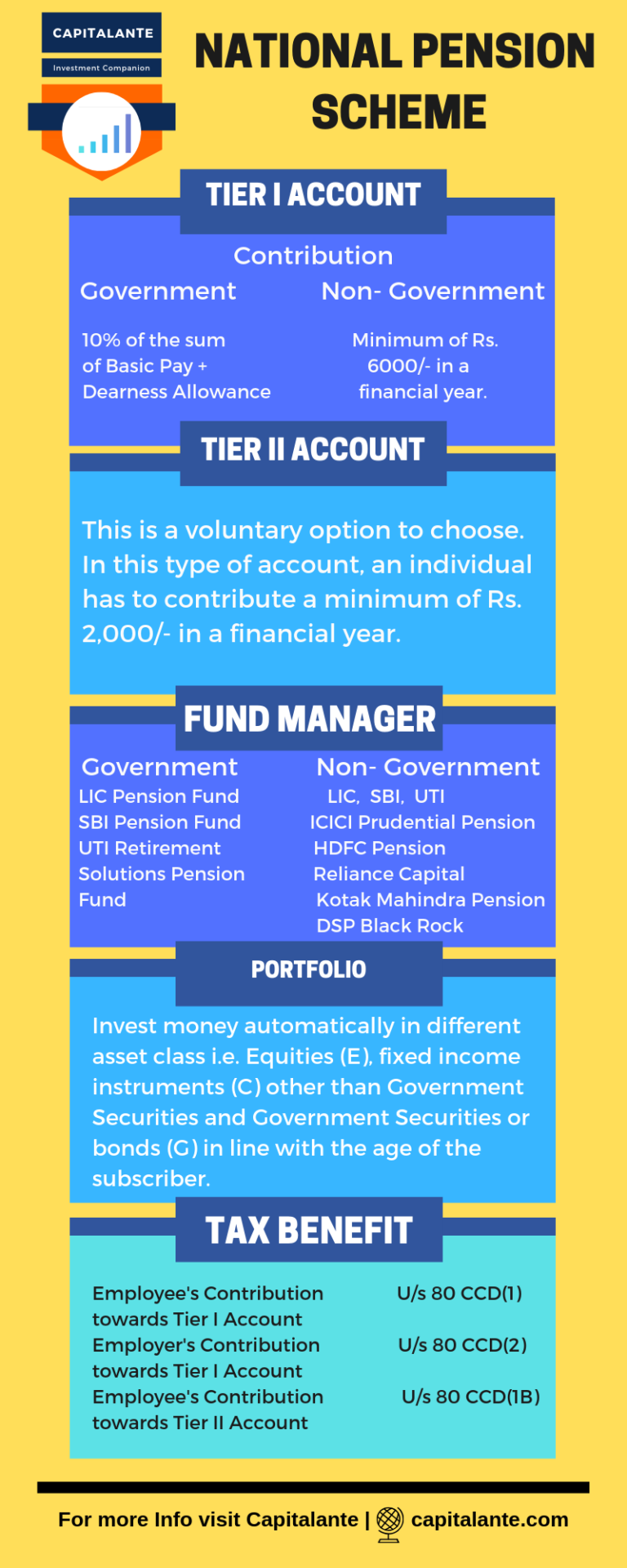

Income Tax Deductions In India Capitalante

Income Tax Deductions In India Capitalante

Check more sample of Corporate Tax Deductions In India below

How To Maximise Tax Deductions In India The Thrift Affair

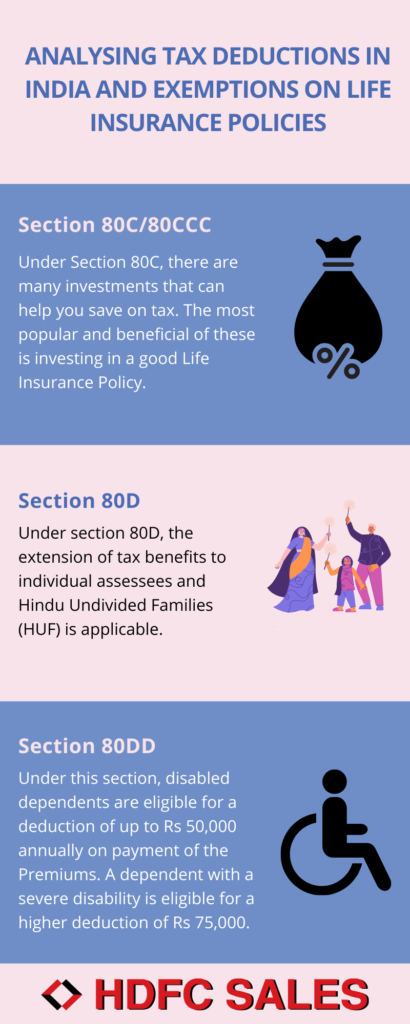

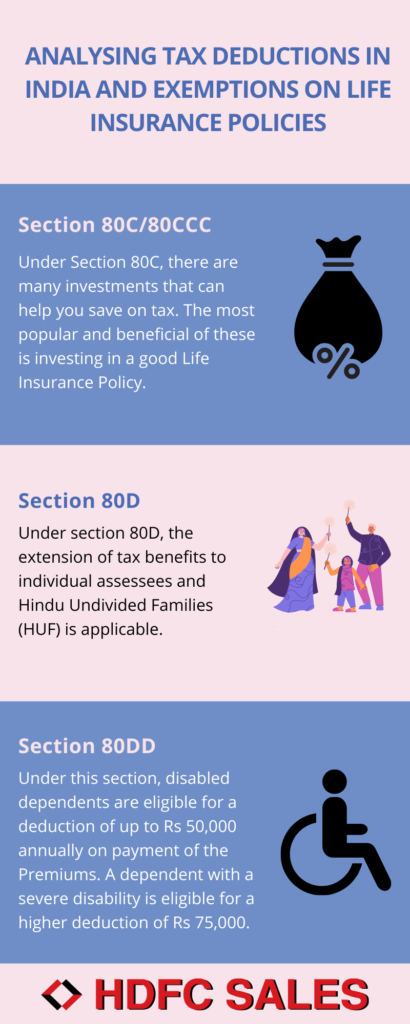

Analysing Tax Deductions In India And Exemptions On Life Insurance

Standard Deduction 2020 Self Employed Standard Deduction 2021

Budget 2018 Tax Highlights On Income Tax Deductions In India Fail Or

Income Tax Deductions In India Capitalante

Individual Income Tax Rates And Deductions In India India Briefing News

https://taxsummaries.pwc.com/india/corporate/taxes...

The corporate income tax CIT rate applicable to an Indian company and a foreign company for the tax year 2022 23 is as follows Surcharge of 10 is payable only where total taxable income exceeds INR 10 million Effective tax rates include surcharge and health and education cess of 4

https://cleartax.in/s/corporate-tax

Direct taxes include Personal Income Tax and Corporate Tax which are paid at different rates Foreign companies will see a reduction in corporate tax rate to 35 Domestic and foreign companies have different tax rates based on turnover

The corporate income tax CIT rate applicable to an Indian company and a foreign company for the tax year 2022 23 is as follows Surcharge of 10 is payable only where total taxable income exceeds INR 10 million Effective tax rates include surcharge and health and education cess of 4

Direct taxes include Personal Income Tax and Corporate Tax which are paid at different rates Foreign companies will see a reduction in corporate tax rate to 35 Domestic and foreign companies have different tax rates based on turnover

Budget 2018 Tax Highlights On Income Tax Deductions In India Fail Or

Analysing Tax Deductions In India And Exemptions On Life Insurance

Income Tax Deductions In India Capitalante

Individual Income Tax Rates And Deductions In India India Briefing News

Top 25 Types Of Taxes In India With Infographic Capitalante

Income Tax Deductions Exemptions Under Sections 80C Forbes Advisor

Income Tax Deductions Exemptions Under Sections 80C Forbes Advisor

Machinery Loan