In the age of digital, where screens rule our lives however, the attraction of tangible printed material hasn't diminished. Whether it's for educational purposes in creative or artistic projects, or simply adding a personal touch to your space, Corporate Tax Exemption In India have become an invaluable resource. With this guide, you'll dive into the world of "Corporate Tax Exemption In India," exploring the different types of printables, where they are, and how they can add value to various aspects of your lives.

Get Latest Corporate Tax Exemption In India Below

Corporate Tax Exemption In India

Corporate Tax Exemption In India -

1 100 per cent exemption from Central excise duty or CENVAT for 10 years from date of commercial production 2 100 per cent exemption from Corporate Income Tax CIT for

Companies in India are subject to corporate tax a direct tax levied on companies based on their net profit or income of a company which is the excess income after

Corporate Tax Exemption In India include a broad assortment of printable documents that can be downloaded online at no cost. These materials come in a variety of types, like worksheets, templates, coloring pages and many more. The attraction of printables that are free is their flexibility and accessibility.

More of Corporate Tax Exemption In India

Tax On Rental Income India Deduction Exemption Calculation More

Tax On Rental Income India Deduction Exemption Calculation More

1 Corporate Income Tax 1 1 General Information Corporate Income Tax Income tax Tax Rate The basic tax rate for an Indian company is 30 which with applicable surcharge and

Ministry of Finance 20 SEP 2019 11 59AM by PIB Delhi Corporate tax rates slashed to 22 for domestic companies and 15 for new domestic manufacturing companies and other fiscal

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Individualization The Customization feature lets you tailor the templates to meet your individual needs such as designing invitations to organize your schedule or decorating your home.

-

Educational Benefits: Printables for education that are free offer a wide range of educational content for learners of all ages, which makes them a valuable aid for parents as well as educators.

-

Convenience: Instant access to many designs and templates reduces time and effort.

Where to Find more Corporate Tax Exemption In India

Corporate Tax Exemption For Companies And Startup India In Budget 2020

Corporate Tax Exemption For Companies And Startup India In Budget 2020

Foreign corporations are liable for corporate taxes in India only on the income earned within the country However domestic corporations are taxed on their overall income CIT rate

1 Tax Treaties and Residence 2 Transaction Taxes 3 Cross border Payments 4 Tax on Business Operations General 5 Capital Gains 6 Local Branch or Subsidiary 7

After we've peaked your interest in printables for free, let's explore where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection with Corporate Tax Exemption In India for all reasons.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free or flashcards as well as learning materials.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs covered cover a wide range of interests, including DIY projects to planning a party.

Maximizing Corporate Tax Exemption In India

Here are some creative ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print out free worksheets and activities to enhance learning at home, or even in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners for to-do list, lists of chores, and meal planners.

Conclusion

Corporate Tax Exemption In India are an abundance of creative and practical resources catering to different needs and interest. Their accessibility and flexibility make them a valuable addition to your professional and personal life. Explore the many options that is Corporate Tax Exemption In India today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes, they are! You can download and print these materials for free.

-

Can I use the free printables in commercial projects?

- It depends on the specific conditions of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables could be restricted regarding their use. Be sure to check the terms and conditions offered by the creator.

-

How can I print printables for free?

- You can print them at home using the printer, or go to a local print shop to purchase the highest quality prints.

-

What software do I require to open printables free of charge?

- Most printables come in PDF format, which can be opened with free software like Adobe Reader.

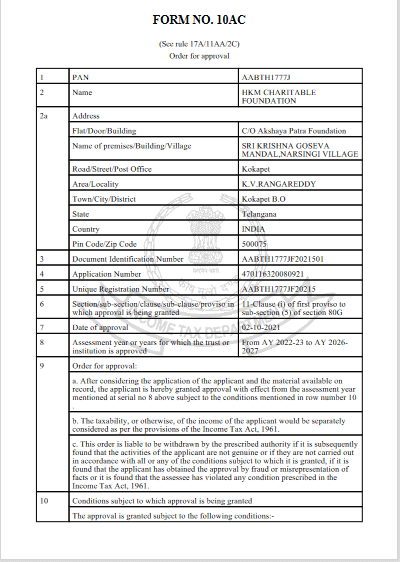

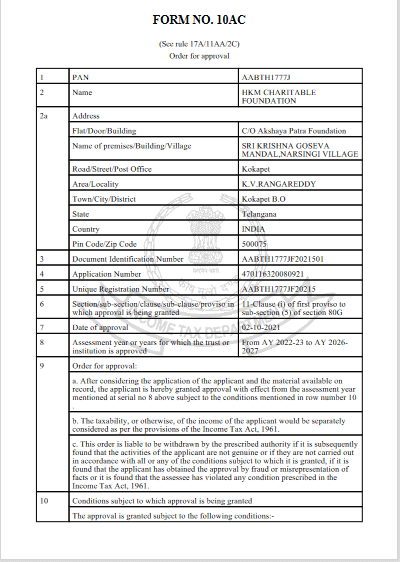

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

Check more sample of Corporate Tax Exemption In India below

Request Letter Format For Tax Exemption From Sales Sample

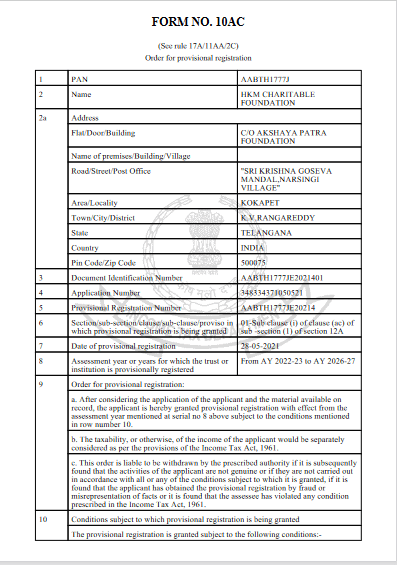

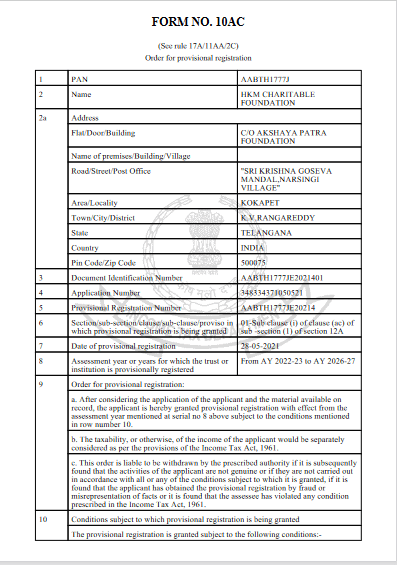

Tax Exemption Trust Deed Of AkshayaChaitaniya NGO In India

Know The Exemption Of Tax On

Tax Exemption Trust Deed Of AkshayaChaitaniya NGO In India

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Tax Exemption Certificate Egniol

https://www.businessgo.hsbc.com/en/article/...

Companies in India are subject to corporate tax a direct tax levied on companies based on their net profit or income of a company which is the excess income after

https://groww.in/p/tax/corporate-tax

Additionally companies availing benefits of Section 115BAA are exempted from paying Minimum Alternate Tax MAT under Section 115JB of the Act Corporate Tax Rate in India An

Companies in India are subject to corporate tax a direct tax levied on companies based on their net profit or income of a company which is the excess income after

Additionally companies availing benefits of Section 115BAA are exempted from paying Minimum Alternate Tax MAT under Section 115JB of the Act Corporate Tax Rate in India An

Tax Exemption Trust Deed Of AkshayaChaitaniya NGO In India

Tax Exemption Trust Deed Of AkshayaChaitaniya NGO In India

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Tax Exemption Certificate Egniol

Sales Tax Exemption Certificate Wisconsin

Prove Tax Residency To Avail Of Tax Exemption In India Welcomenri

Prove Tax Residency To Avail Of Tax Exemption In India Welcomenri

Social Benefits Of Tax Exemption In India