In this digital age, in which screens are the norm however, the attraction of tangible printed products hasn't decreased. No matter whether it's for educational uses such as creative projects or just adding an individual touch to the area, Covered California Tax Credit Calculator can be an excellent source. In this article, we'll take a dive deeper into "Covered California Tax Credit Calculator," exploring the different types of printables, where to get them, as well as the ways that they can benefit different aspects of your lives.

Get Latest Covered California Tax Credit Calculator Below

Covered California Tax Credit Calculator

Covered California Tax Credit Calculator -

What is your filing status Help with filing status How old were you on December 31 2023 How many qualifying children do you have Help with qualifying children How much did you earn from your California job s or self employment in 2023 Whole dollars no commas Enter losses with a dash Example 12400 or 6000 00

When you calculate your income you ll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes You can start by using your adjusted gross income AGI from your most recent federal income tax return located on line 11 on the Form 1040

Printables for free cover a broad collection of printable documents that can be downloaded online at no cost. They are available in a variety of forms, including worksheets, coloring pages, templates and many more. The beauty of Covered California Tax Credit Calculator is their versatility and accessibility.

More of Covered California Tax Credit Calculator

Covered California Messed Up My Tax Form What Should I Do updated

Covered California Messed Up My Tax Form What Should I Do updated

The amount the government pays initially is dependent on your estimate of what your annual income is expected to be during the year that you apply for health insurance If at tax time the next year it turns out that you made less money than predicted then you will get a

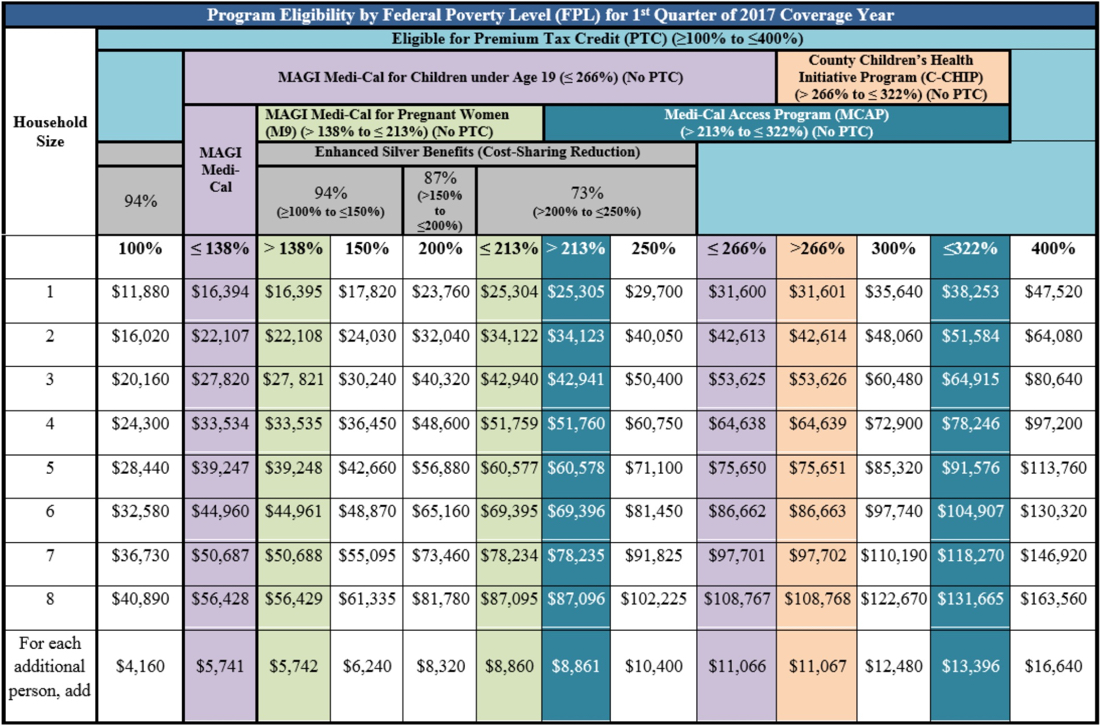

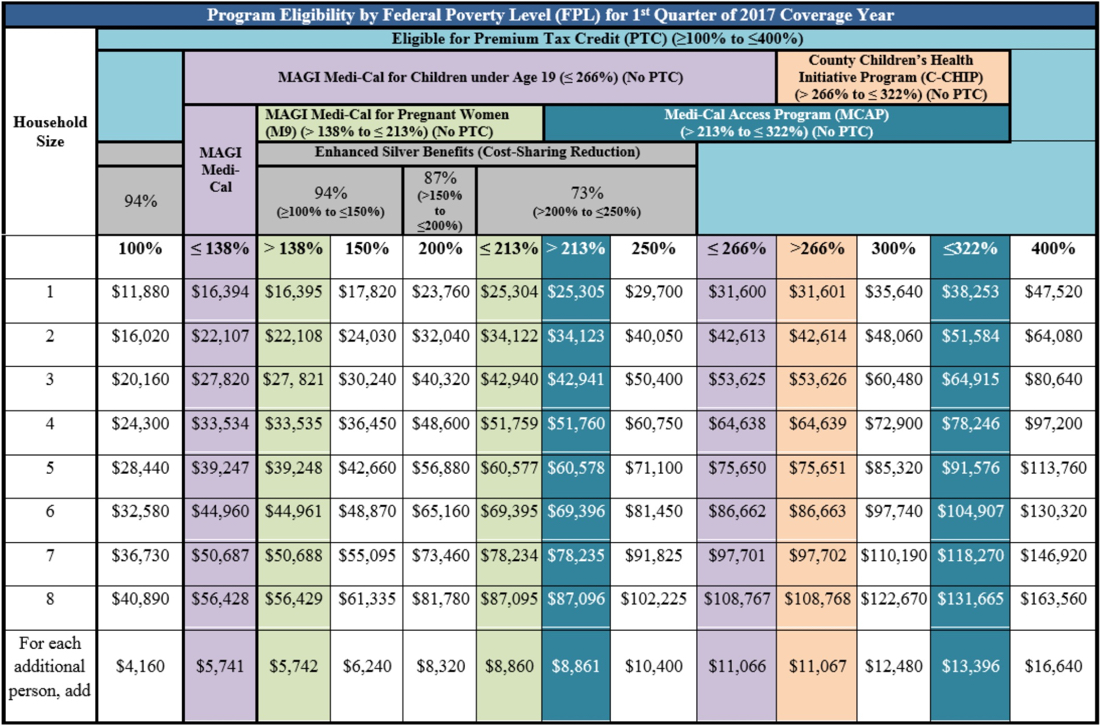

What is the Advanced Premium Tax Credit APTC The Advanced Premium Tax Credit is provided to those who qualify to help pay for health coverage Your APTC is calculated based on your estimated annual household income household size and where you live

The Covered California Tax Credit Calculator have gained huge popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Flexible: You can tailor printing templates to your own specific requirements be it designing invitations to organize your schedule or even decorating your house.

-

Educational value: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages. This makes the perfect tool for teachers and parents.

-

It's easy: You have instant access many designs and templates can save you time and energy.

Where to Find more Covered California Tax Credit Calculator

What Is The Medi Cal Income Limit For 2022 INVOMERT

What Is The Medi Cal Income Limit For 2022 INVOMERT

View Larger Image Understanding how the Advanced Premium Tax Credit APTC is calculated can be crucial to getting affordable healthcare coverage The APTC is a tax credit that can help reduce the cost of monthly premiums for health insurance plans purchased through Covered California

Estimated tax credit from the government Your estimated monthly silver plan premium Call our agent today 855 653 3626 Notes This calculator shows expected spending for families and individuals eligible to purchase coverage through Covered California under the Affordable Care Act

Since we've got your interest in Covered California Tax Credit Calculator we'll explore the places you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Covered California Tax Credit Calculator to suit a variety of motives.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free, flashcards, and learning materials.

- The perfect resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs are a vast variety of topics, all the way from DIY projects to planning a party.

Maximizing Covered California Tax Credit Calculator

Here are some fresh ways of making the most of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities for teaching at-home, or even in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Covered California Tax Credit Calculator are an abundance of useful and creative resources catering to different needs and desires. Their availability and versatility make them a fantastic addition to both professional and personal lives. Explore the vast collection of Covered California Tax Credit Calculator and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes, they are! You can download and print these documents for free.

-

Does it allow me to use free printables for commercial uses?

- It's determined by the specific conditions of use. Make sure you read the guidelines for the creator before using any printables on commercial projects.

-

Do you have any copyright rights issues with Covered California Tax Credit Calculator?

- Certain printables could be restricted on use. You should read the terms and conditions offered by the designer.

-

How do I print Covered California Tax Credit Calculator?

- You can print them at home with either a printer at home or in an area print shop for better quality prints.

-

What software do I need to run printables free of charge?

- The majority of printed documents are with PDF formats, which can be opened with free software like Adobe Reader.

2022 Georgia State Income Tax Brackets Latest News Update

Common Tax Credit Mistakes People Make With Covered Ca

Check more sample of Covered California Tax Credit Calculator below

Ertc Calculation Worksheet

Ready To Use Employee Retention Credit Calculator 2021 MSOfficeGeek

Tax Credit Calculator Sunnybrook Foundation

Covered Ca 2023 Income Limits 2023

2022 Child Tax Credit Refundable Amount Latest News Update

Fill Free Fillable Covered California PDF Forms

https://www.coveredca.com/support/financial-help/estimate-income

When you calculate your income you ll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes You can start by using your adjusted gross income AGI from your most recent federal income tax return located on line 11 on the Form 1040

https://www.coveredca.com/marketing-blog/health...

Use the Small Business Tax Credit Calculator to estimate if your business is eligible Currently only small businesses that buy health insurance through Covered California are able to receive this federal tax credit Avoid Tax Penalties If you don t have health insurance you may face a penalty come tax time For tax year 2023 this penalty

When you calculate your income you ll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes You can start by using your adjusted gross income AGI from your most recent federal income tax return located on line 11 on the Form 1040

Use the Small Business Tax Credit Calculator to estimate if your business is eligible Currently only small businesses that buy health insurance through Covered California are able to receive this federal tax credit Avoid Tax Penalties If you don t have health insurance you may face a penalty come tax time For tax year 2023 this penalty

Covered Ca 2023 Income Limits 2023

Ready To Use Employee Retention Credit Calculator 2021 MSOfficeGeek

2022 Child Tax Credit Refundable Amount Latest News Update

Fill Free Fillable Covered California PDF Forms

Health Insurance Subsidy Chart All About The Covered California

Over 65 Covered California Subsidy Calculator Medicare Eligible

Over 65 Covered California Subsidy Calculator Medicare Eligible

HARK ALS