In this day and age with screens dominating our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. Whatever the reason, whether for education for creative projects, just adding the personal touch to your home, printables for free are now an essential resource. The following article is a dive into the sphere of "Cpf Tax Relief 2023," exploring their purpose, where they are available, and how they can add value to various aspects of your lives.

Get Latest Cpf Tax Relief 2023 Below

Cpf Tax Relief 2023

Cpf Tax Relief 2023 -

View the CPF related announcements during Budget Highlights 2024 Seniors with retirement savings below the Basic Retirement Sum for 2023 of 99 400 will receive a one time bonus in their Special Account or Retirement Account depending on age The bonus will be paid in December 2024 Tax relief for cash top ups that

He makes cash top ups of 5 000 to his own CPF Special Account and 10 000 to his mother s CPF Retirement Account in 2023 to enjoy tax relief for Year of Assessment 2024 For Year of Assessment 2024 Mr Tan may claim a total CPF Cash Top up Relief of 13 000 5 000 8 000

Printables for free cover a broad range of printable, free material that is available online at no cost. The resources are offered in a variety types, like worksheets, coloring pages, templates and more. One of the advantages of Cpf Tax Relief 2023 is their versatility and accessibility.

More of Cpf Tax Relief 2023

Are The NEW CPF Rules Good For You 5 Ways On You Can Benefit With Tax

Are The NEW CPF Rules Good For You 5 Ways On You Can Benefit With Tax

CPF Contribution Changes from 1 September 2023 and 1 January 2024 1 Increase in CPF Ordinary Wage ceiling for 1 September 2023 and 1 January 2024 a The CPF Ordinary Wage OW ceiling limits the amount of OW that attract CPF contributions in a calendar month for all employees

At least S 60 000 but less than S 99 400 2023 s Basic Retirement Sum S 1 000 The income threshold to qualify for tax relief for cash top ups made to CPF accounts of spouse siblings will be increased from S 4 000 to S 8 000 in Year of Assessment 2025 for top ups made from 1 January 2024 9 Enhancements to Silver

Cpf Tax Relief 2023 have gained a lot of popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Individualization It is possible to tailor printed materials to meet your requirements whether it's making invitations planning your schedule or decorating your home.

-

Educational value: Free educational printables offer a wide range of educational content for learners of all ages. This makes them a valuable aid for parents as well as educators.

-

Easy to use: Access to a plethora of designs and templates is time-saving and saves effort.

Where to Find more Cpf Tax Relief 2023

Significant Changes To CPF MediSave Cash Top Ups And Tax Relief

Significant Changes To CPF MediSave Cash Top Ups And Tax Relief

Tax reliefs Maximum amount CPF top up your SA S 8 000 capped at current FRS S 198 800 for 2023 CPF top up your loved ones SA RA S 8 000 capped at current FRS S 198 800 for 2023 CPF top up your Medisave Capped at current BHS S 68 500 in 2023 SRS account S 15 300 Singaporeans or S 35 700 foreigners

The maximum SRS contribution you can make each year is 15 300 for Singapore Citizens PR and 35 700 for foreigners In summary the SRS has the following features Contributions to SRS are eligible for tax relief You can invest using the funds in SRS Investment returns are tax free before withdrawal

After we've peaked your interest in Cpf Tax Relief 2023 Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and Cpf Tax Relief 2023 for a variety goals.

- Explore categories such as decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets or flashcards as well as learning materials.

- Perfect for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs are a vast selection of subjects, from DIY projects to party planning.

Maximizing Cpf Tax Relief 2023

Here are some innovative ways to make the most of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use free printable worksheets to build your knowledge at home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Cpf Tax Relief 2023 are a treasure trove of practical and innovative resources that meet a variety of needs and interest. Their access and versatility makes they a beneficial addition to both professional and personal life. Explore the plethora of Cpf Tax Relief 2023 right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes, they are! You can print and download these items for free.

-

Do I have the right to use free templates for commercial use?

- It's based on specific terms of use. Always review the terms of use for the creator before using their printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may have restrictions on usage. Check these terms and conditions as set out by the author.

-

How do I print printables for free?

- You can print them at home with the printer, or go to a print shop in your area for higher quality prints.

-

What program do I need in order to open printables at no cost?

- The majority of PDF documents are provided in PDF format. They can be opened using free software, such as Adobe Reader.

Company Tax Relief 2023 Malaysia Printable Forms Free Online

Company Tax Relief 2023 Malaysia Printable Forms Free Online

Check more sample of Cpf Tax Relief 2023 below

What Is The Maximum Amount Of Tax Relief We Can Get From Our CPF

Income Tax In Singapore Calculating Your CPF Relief 2020 Wiki sg

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of

HUGE CPF Changes For Tax Relief DO THIS NOW YouTube

Tax Relief For 2023

CPF Top Up Guide Should You Top Up Your CPF For Tax Relief Money

https://www.iras.gov.sg/taxes/individual-income...

He makes cash top ups of 5 000 to his own CPF Special Account and 10 000 to his mother s CPF Retirement Account in 2023 to enjoy tax relief for Year of Assessment 2024 For Year of Assessment 2024 Mr Tan may claim a total CPF Cash Top up Relief of 13 000 5 000 8 000

https://www.iras.gov.sg/taxes/individual-income...

For YA 2023 your tax relief for your MediSave and voluntary CPF contributions will be capped at the lowest of 37 of your net trade income assessed or CPF relief cap of 37 740 or Actual amount contributed by you in the year 2022

He makes cash top ups of 5 000 to his own CPF Special Account and 10 000 to his mother s CPF Retirement Account in 2023 to enjoy tax relief for Year of Assessment 2024 For Year of Assessment 2024 Mr Tan may claim a total CPF Cash Top up Relief of 13 000 5 000 8 000

For YA 2023 your tax relief for your MediSave and voluntary CPF contributions will be capped at the lowest of 37 of your net trade income assessed or CPF relief cap of 37 740 or Actual amount contributed by you in the year 2022

HUGE CPF Changes For Tax Relief DO THIS NOW YouTube

Income Tax In Singapore Calculating Your CPF Relief 2020 Wiki sg

Tax Relief For 2023

CPF Top Up Guide Should You Top Up Your CPF For Tax Relief Money

CPF Cash Top up Relief Are You Ready

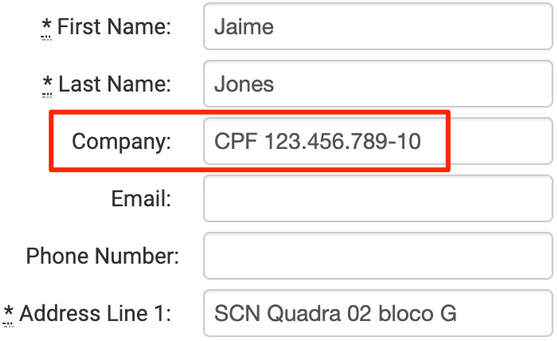

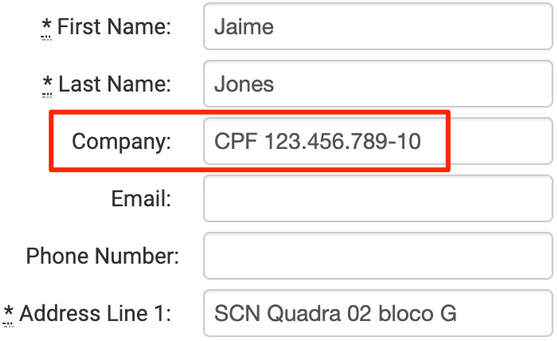

Brazil Shipments Require CPF Tax ID As Of January 1 2020 Overview

Brazil Shipments Require CPF Tax ID As Of January 1 2020 Overview

Tax Relief Reduce Your Income Tax Through CPF SRS Top ups