In this age of technology, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. In the case of educational materials project ideas, artistic or simply adding an element of personalization to your area, Cpf Tax Relief Cap are now an essential source. For this piece, we'll dive through the vast world of "Cpf Tax Relief Cap," exploring what they are, where to get them, as well as how they can enrich various aspects of your lives.

Get Latest Cpf Tax Relief Cap Below

Cpf Tax Relief Cap

Cpf Tax Relief Cap -

1 Before 1 January 2022 the tax relief eligibility conditions for cash top ups differed between both scheme in terms of i tax beneficiary giver for Retirement Sum Topping Up RSTU recipient for Voluntary Contribution to MediSave Account VCMA and ii tax relief cap for top ups to self loved ones capped at 7k 7k for RSTU tax relief

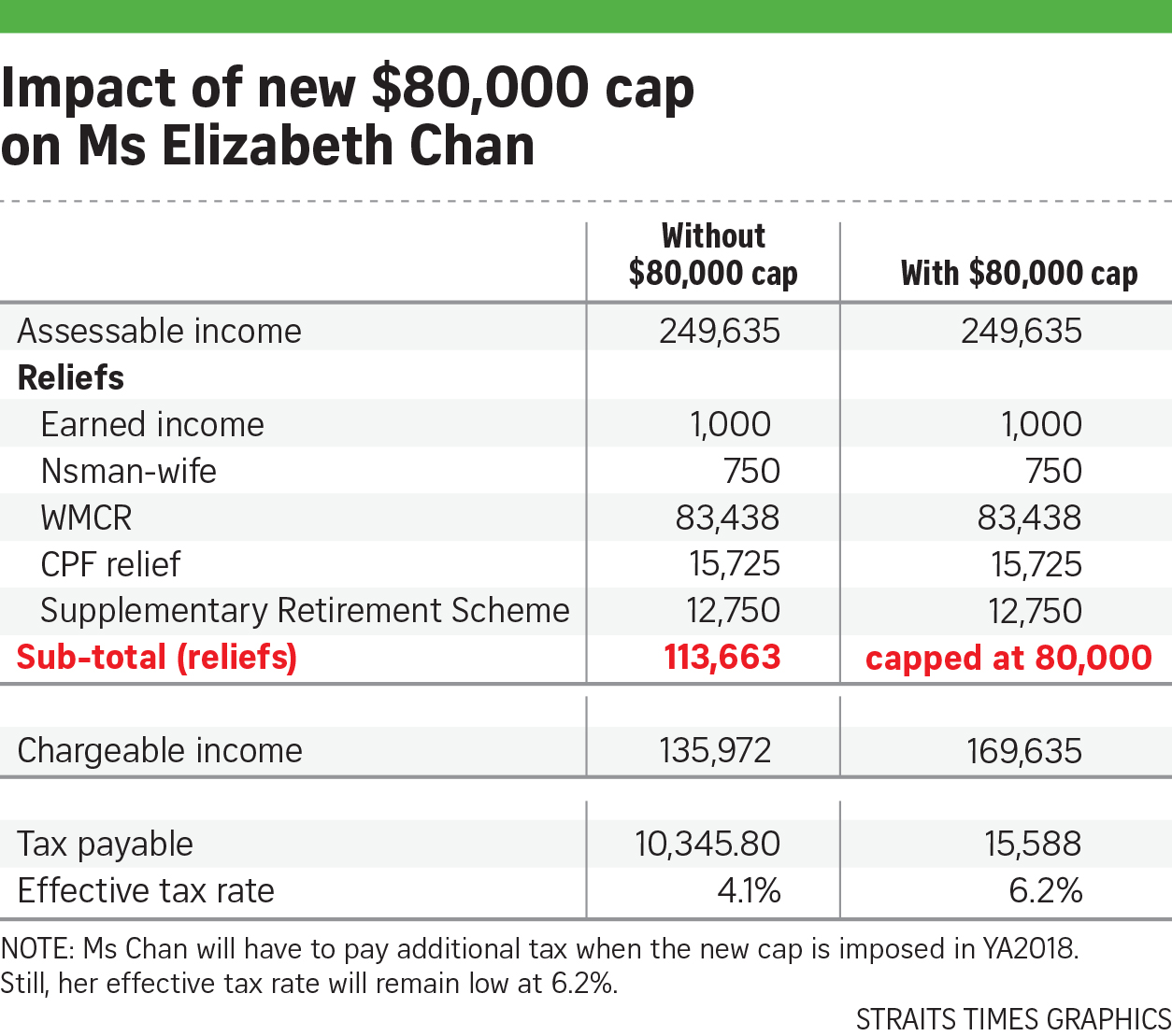

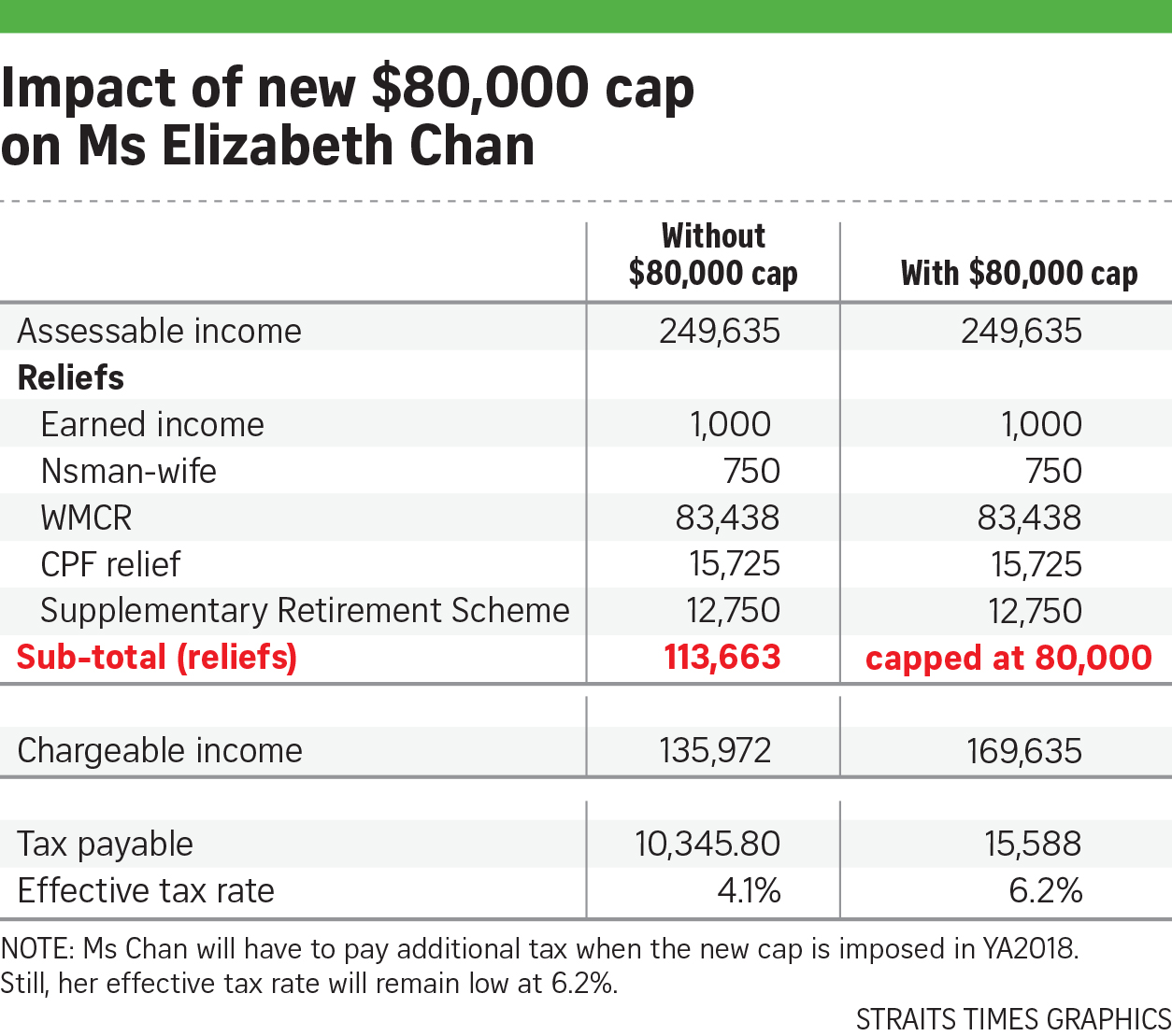

There is a personal income tax relief cap of 80 000 which applies to all tax reliefs including tax relief on cash top ups made to your CPF accounts The tax relief cap will be shared for cash top ups to Special Account SA Retirement Account RA and or cash top ups to MediSave Account MA

Printables for free include a vast array of printable materials online, at no cost. These printables come in different designs, including worksheets templates, coloring pages, and many more. The appealingness of Cpf Tax Relief Cap lies in their versatility as well as accessibility.

More of Cpf Tax Relief Cap

What Is The Maximum Amount Of Tax Relief We Can Get From Our CPF

What Is The Maximum Amount Of Tax Relief We Can Get From Our CPF

For self employed the tax relief applies to mandatory MediSave contributions as well as voluntary CPF contributions The cap on CPF Relief is capped at the lower of 37 of net trade income assessed CPF relief cap of 37 740 or the actual amount contributed

CPF relief cap of 37 740 or Actual amount contributed by you in the year 2022 No CPF relief will be allowed in respect of your compulsory MediSave or voluntary CPF contributions made in 2022 if you have no assessable net trade income for the Year of Assessment 2023 CPF contributions by a self employed person who is also an employee

The Cpf Tax Relief Cap have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Individualization There is the possibility of tailoring print-ready templates to your specific requirements whether it's making invitations as well as organizing your calendar, or decorating your home.

-

Educational Use: Free educational printables provide for students of all ages, making them a great device for teachers and parents.

-

Convenience: You have instant access numerous designs and templates can save you time and energy.

Where to Find more Cpf Tax Relief Cap

HUGE CPF Changes For Tax Relief DO THIS NOW YouTube

HUGE CPF Changes For Tax Relief DO THIS NOW YouTube

4 Enhanced tax relief cap for voluntary cash top ups As of 1 Jan 2022 the annual tax relief cap has been increased to 8 000 from 7 000 previously for cash top ups to your own CPF Account and an additional 8 000 from 7 000 previously for cash top ups for to loved ones accounts

The cap for the total amount of annual tax relief has been raised to 8 000 up from 7 000 previously Members that top up their own CPF accounts can obtain an annual tax relief of 8 000 for self top ups and also another 8 000 tax relief for top ups for their loved ones

Now that we've ignited your curiosity about Cpf Tax Relief Cap and other printables, let's discover where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection and Cpf Tax Relief Cap for a variety applications.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- These blogs cover a broad variety of topics, including DIY projects to party planning.

Maximizing Cpf Tax Relief Cap

Here are some creative ways that you can make use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home and in class.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Cpf Tax Relief Cap are an abundance of useful and creative resources that cater to various needs and hobbies. Their availability and versatility make them a fantastic addition to your professional and personal life. Explore the wide world that is Cpf Tax Relief Cap today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Cpf Tax Relief Cap truly cost-free?

- Yes you can! You can print and download these files for free.

-

Can I make use of free printables in commercial projects?

- It's based on specific terms of use. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright violations with Cpf Tax Relief Cap?

- Certain printables might have limitations on usage. Make sure to read the terms and regulations provided by the creator.

-

How can I print Cpf Tax Relief Cap?

- Print them at home using either a printer at home or in the local print shops for top quality prints.

-

What software is required to open printables at no cost?

- A majority of printed materials are in PDF format, which is open with no cost software like Adobe Reader.

CPF Top Up Guide Should You Top Up Your CPF For Tax Relief Money

Income Tax In Singapore Calculating Your CPF Relief 2020 Wiki sg

Check more sample of Cpf Tax Relief Cap below

CPF Cash Top up Relief Are You Ready

Tax Relief Reduce Your Income Tax Through CPF SRS Top ups

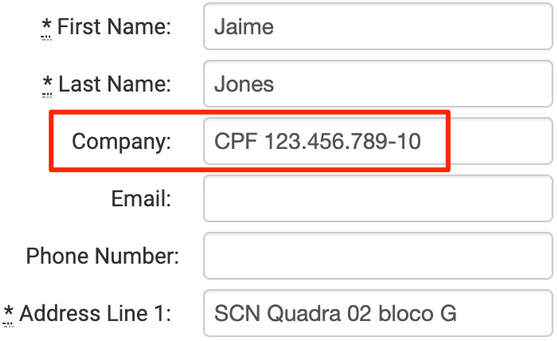

Brazil Shipments Require CPF Tax ID As Of January 1 2020 Overview

VFX Industry Argues For Change To 80 Tax Relief Cap Televisual

Retro Brass Flower Carved LeatherCraft Western Cowboy Belt Buckle Fit

Ultimate Guide To Singapore CPF For US Taxpayers And US Expats

https://www.cpf.gov.sg/member/faq/growing-your...

There is a personal income tax relief cap of 80 000 which applies to all tax reliefs including tax relief on cash top ups made to your CPF accounts The tax relief cap will be shared for cash top ups to Special Account SA Retirement Account RA and or cash top ups to MediSave Account MA

https://www.iras.gov.sg/taxes/individual-income...

Yes Both you and your sibling will be eligible for the tax relief if the member receiving the top up meets the qualifying criteria The maximum cap for CPF Cash Top up Relief to family members for Year of Assessment 2023 and subsequent Years of Assessment is 8 000 for each individual taxpayer

There is a personal income tax relief cap of 80 000 which applies to all tax reliefs including tax relief on cash top ups made to your CPF accounts The tax relief cap will be shared for cash top ups to Special Account SA Retirement Account RA and or cash top ups to MediSave Account MA

Yes Both you and your sibling will be eligible for the tax relief if the member receiving the top up meets the qualifying criteria The maximum cap for CPF Cash Top up Relief to family members for Year of Assessment 2023 and subsequent Years of Assessment is 8 000 for each individual taxpayer

VFX Industry Argues For Change To 80 Tax Relief Cap Televisual

Tax Relief Reduce Your Income Tax Through CPF SRS Top ups

Retro Brass Flower Carved LeatherCraft Western Cowboy Belt Buckle Fit

Ultimate Guide To Singapore CPF For US Taxpayers And US Expats

CPF Top Up Guide Should You Top Up Your CPF For Tax Relief Money

Hot Under The Collar About 80k Tax Relief Cap Business News AsiaOne

Hot Under The Collar About 80k Tax Relief Cap Business News AsiaOne

PLASTIC ENCLOSURE FRONT REAR PANEL TYPE PF Series FREE SAMPLE