In the digital age, with screens dominating our lives however, the attraction of tangible printed materials isn't diminishing. Whether it's for educational purposes in creative or artistic projects, or simply to add some personal flair to your space, Cra Gst Rebate Eligibility are now an essential resource. Here, we'll dive deeper into "Cra Gst Rebate Eligibility," exploring what they are, how to locate them, and how they can enrich various aspects of your daily life.

Get Latest Cra Gst Rebate Eligibility Below

Cra Gst Rebate Eligibility

Cra Gst Rebate Eligibility -

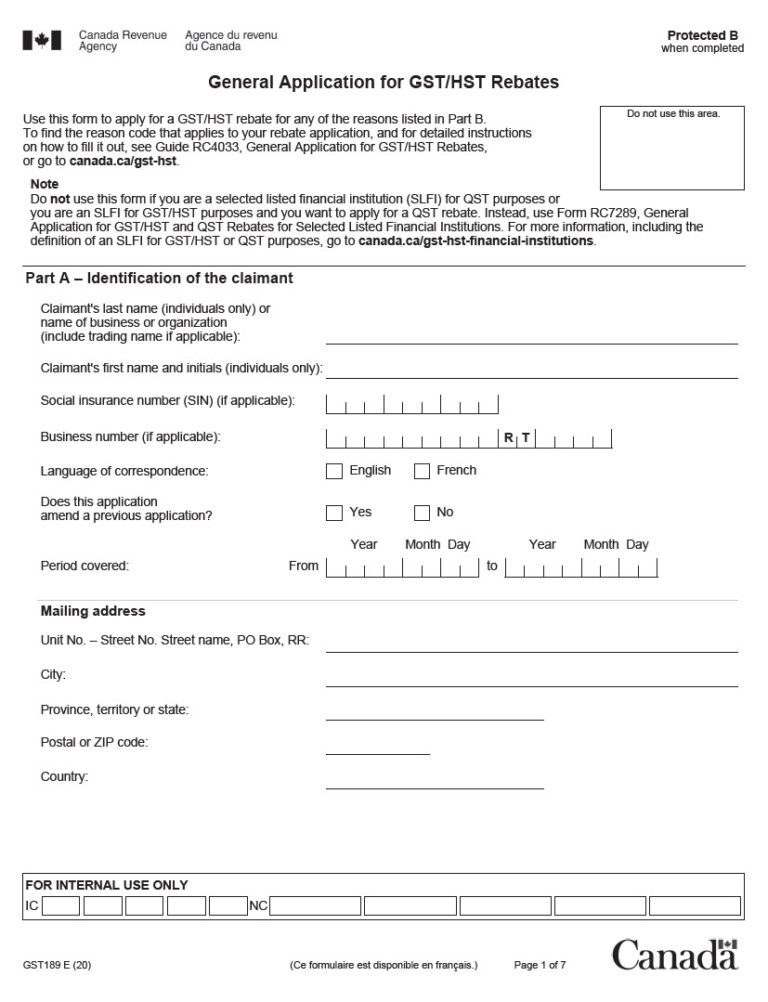

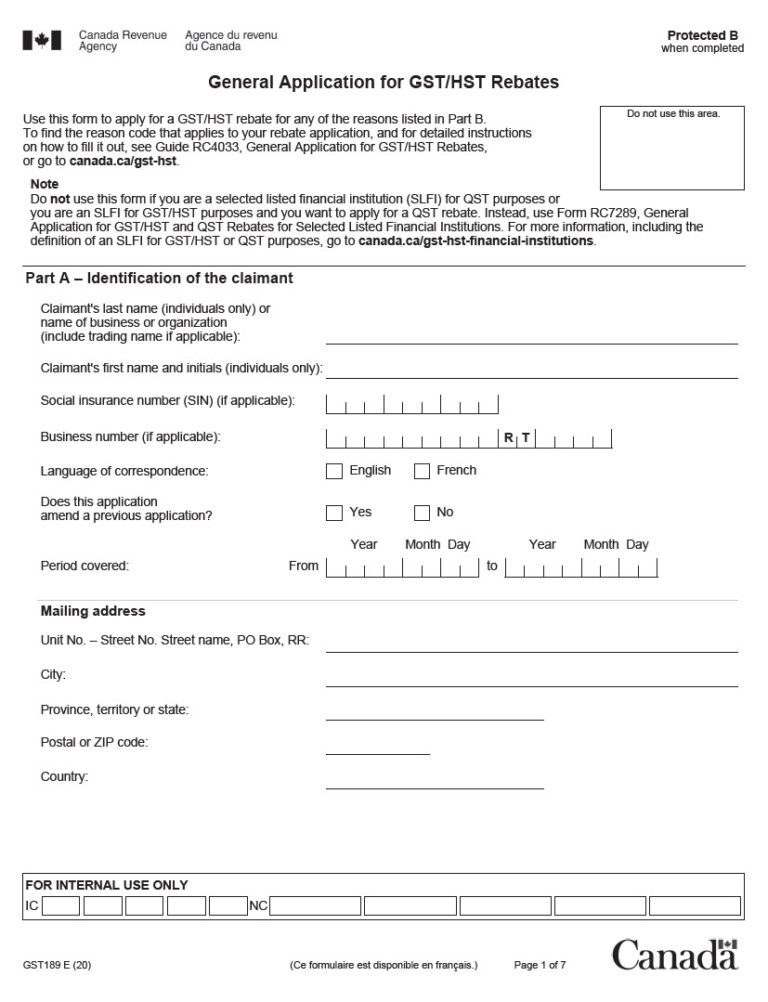

The GST HST New Residential Rental Property NRRP rebate is a tax saving tool for real estate investors in Canada who purchase or construct new residential rental

If you are an individual who purchased a new or substantially renovated mobile home including a modular home or a new or substantially renovated floating home for use as your or your

The Cra Gst Rebate Eligibility are a huge collection of printable content that can be downloaded from the internet at no cost. These printables come in different kinds, including worksheets templates, coloring pages and much more. One of the advantages of Cra Gst Rebate Eligibility is in their versatility and accessibility.

More of Cra Gst Rebate Eligibility

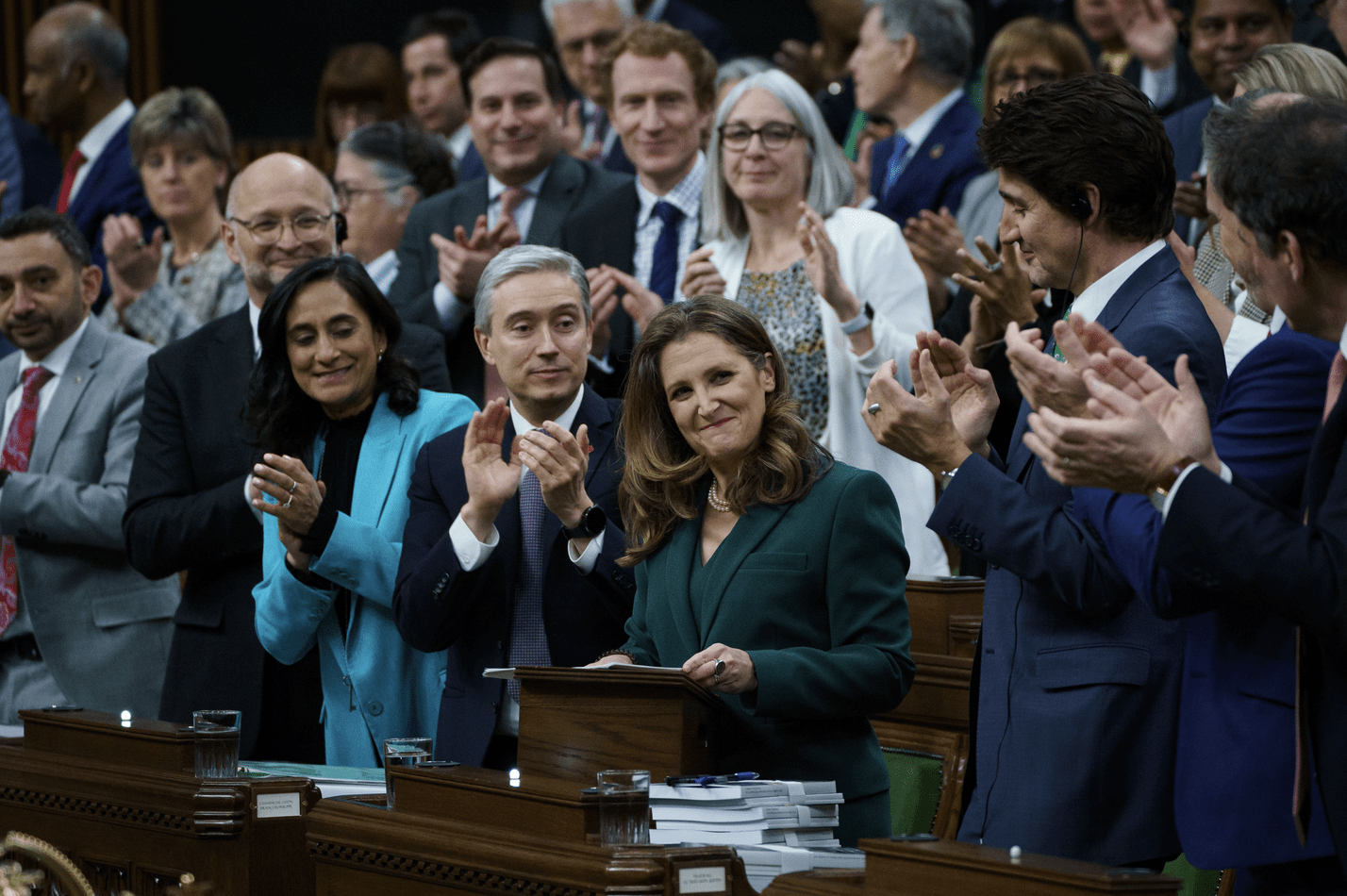

Feds Temporary Boost To GST Rebate Will Help During High Inflation

Feds Temporary Boost To GST Rebate Will Help During High Inflation

Who s eligible to receive the rebate The rebate is available to those are already eligible for GST HST credits a non taxable amount paid out four times a year to low or modest income

Rebates worth up to 628 started making their way to eligible Canadians along with the July 5 GST HST credit payment Guidelines around rebate amounts and income limits have also been released

Cra Gst Rebate Eligibility have garnered immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Flexible: It is possible to tailor print-ready templates to your specific requirements be it designing invitations planning your schedule or even decorating your house.

-

Educational Worth: Printing educational materials for no cost are designed to appeal to students of all ages, making them a great instrument for parents and teachers.

-

Accessibility: The instant accessibility to a variety of designs and templates cuts down on time and efforts.

Where to Find more Cra Gst Rebate Eligibility

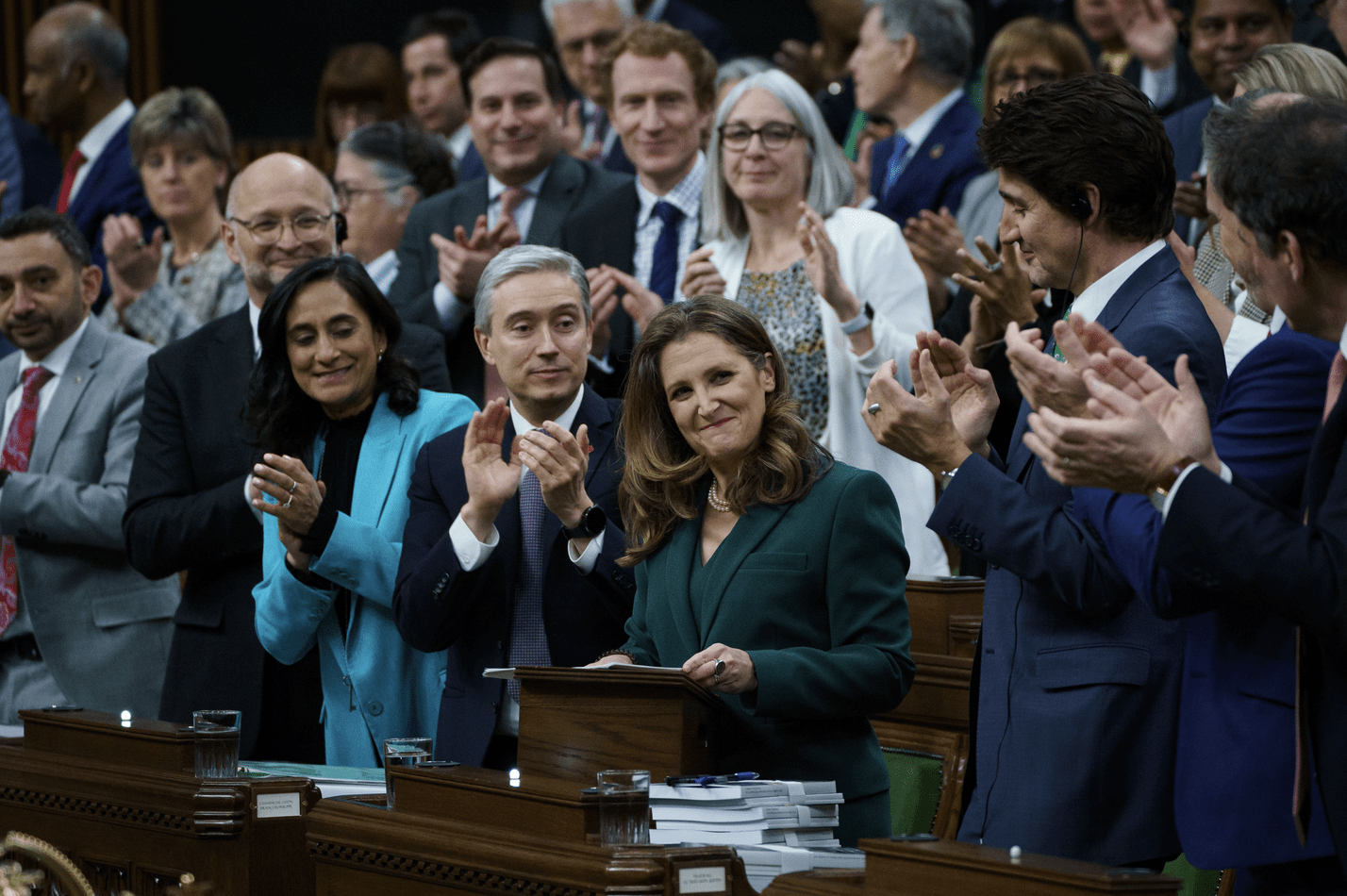

Temporary Boost To GST Rebate Appropriate Amid High Inflation

Temporary Boost To GST Rebate Appropriate Amid High Inflation

Who is eligible to get the payment If you are already entitled to receive the GST credit in October of this year you will automatically qualify for the one time GST payment top up The tax credit

The CRA will automatically determine your eligibility for the GST HST credit and if you are eligible your first payment will be issued in the quarterly payment after your 19th birthday

We hope we've stimulated your curiosity about Cra Gst Rebate Eligibility, let's explore where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection in Cra Gst Rebate Eligibility for different objectives.

- Explore categories such as decorating your home, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a broad variety of topics, ranging from DIY projects to party planning.

Maximizing Cra Gst Rebate Eligibility

Here are some ways to make the most use of Cra Gst Rebate Eligibility:

1. Home Decor

- Print and frame stunning art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home also in the classes.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Cra Gst Rebate Eligibility are a treasure trove of practical and imaginative resources catering to different needs and hobbies. Their accessibility and flexibility make them a wonderful addition to any professional or personal life. Explore the plethora of Cra Gst Rebate Eligibility now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes you can! You can download and print the resources for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It's dependent on the particular terms of use. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright violations with Cra Gst Rebate Eligibility?

- Some printables may contain restrictions regarding their use. Check the terms and regulations provided by the creator.

-

How do I print printables for free?

- You can print them at home with an printer, or go to an in-store print shop to get the highest quality prints.

-

What software do I require to view printables that are free?

- Most printables come in PDF format, which can be opened with free software such as Adobe Reader.

New Condo HST Rebates Sproule Associates

AY 2022 2023 GST Vouchers Everything You Need To Know

Check more sample of Cra Gst Rebate Eligibility below

CRA GST HST Text Based Scam In Canada Be Careful YouTube

MPs Unanimously Vote To Temporarily Double GST Rebate For Lower income

GST HST New Housing Rebate And New Residential Rental Property Rebate

Budget 2023 An Ironic GST Rebate And A Happy NDP Policy Magazine

CPA Canada Commodity Tax Committee Response To CRA Bulletin About GST

GST Refund Form Rfd 01 Printable Rebate Form

https://www.canada.ca/.../new-housing-rebate.html

If you are an individual who purchased a new or substantially renovated mobile home including a modular home or a new or substantially renovated floating home for use as your or your

https://www.springfinancial.ca/blog/boost-your...

To qualify for the GST HST credit you must be a Canadian resident for income tax purposes in the month prior and at the start of the month in which the CRA makes a payment You also

If you are an individual who purchased a new or substantially renovated mobile home including a modular home or a new or substantially renovated floating home for use as your or your

To qualify for the GST HST credit you must be a Canadian resident for income tax purposes in the month prior and at the start of the month in which the CRA makes a payment You also

Budget 2023 An Ironic GST Rebate And A Happy NDP Policy Magazine

MPs Unanimously Vote To Temporarily Double GST Rebate For Lower income

CPA Canada Commodity Tax Committee Response To CRA Bulletin About GST

GST Refund Form Rfd 01 Printable Rebate Form

New Home HST GST Rebate By Nadene Milnes Issuu

New Grocery Rebate To Help Canadians Combat Rising Food Costs August

New Grocery Rebate To Help Canadians Combat Rising Food Costs August

Customers To Fully Understand GST Rebate Method On Prepaid Top ups