In the age of digital, when screens dominate our lives and the appeal of physical printed materials hasn't faded away. No matter whether it's for educational uses for creative projects, just adding an individual touch to the space, Csp Tax Deduction are now an essential source. In this article, we'll dive deeper into "Csp Tax Deduction," exploring the different types of printables, where to locate them, and how they can enhance various aspects of your life.

Get Latest Csp Tax Deduction Below

Csp Tax Deduction

Csp Tax Deduction -

Individuals may be able to claim self education expense deductions for tuitionfees incurred when undertaking courses of study that are not subsidised by the Commonwealth that is are

You may be able to claim tax relief of either the actual amount you spent you will need to keep receipts or an agreed fixed amount To be able to claim tax relief ALL of the following must

Printables for free include a vast variety of printable, downloadable resources available online for download at no cost. They come in many types, such as worksheets templates, coloring pages, and much more. The benefit of Csp Tax Deduction is their flexibility and accessibility.

More of Csp Tax Deduction

North America Advanced Packaging Market 2021 2031 By Active Packaging

North America Advanced Packaging Market 2021 2031 By Active Packaging

What about self employed CSP tax If you re a self employed physiotherapy practitioner you have to pay the tax you owe yourself You do this via a tax return Here are

How much you and your employer will pay towards your pension The following contributions rates apply for members of the classic classic plus premium nuvos and alpha pension schemes

Csp Tax Deduction have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization There is the possibility of tailoring printables to your specific needs whether you're designing invitations planning your schedule or even decorating your house.

-

Educational Value Printing educational materials for no cost offer a wide range of educational content for learners of all ages, making them an invaluable source for educators and parents.

-

The convenience of You have instant access a plethora of designs and templates is time-saving and saves effort.

Where to Find more Csp Tax Deduction

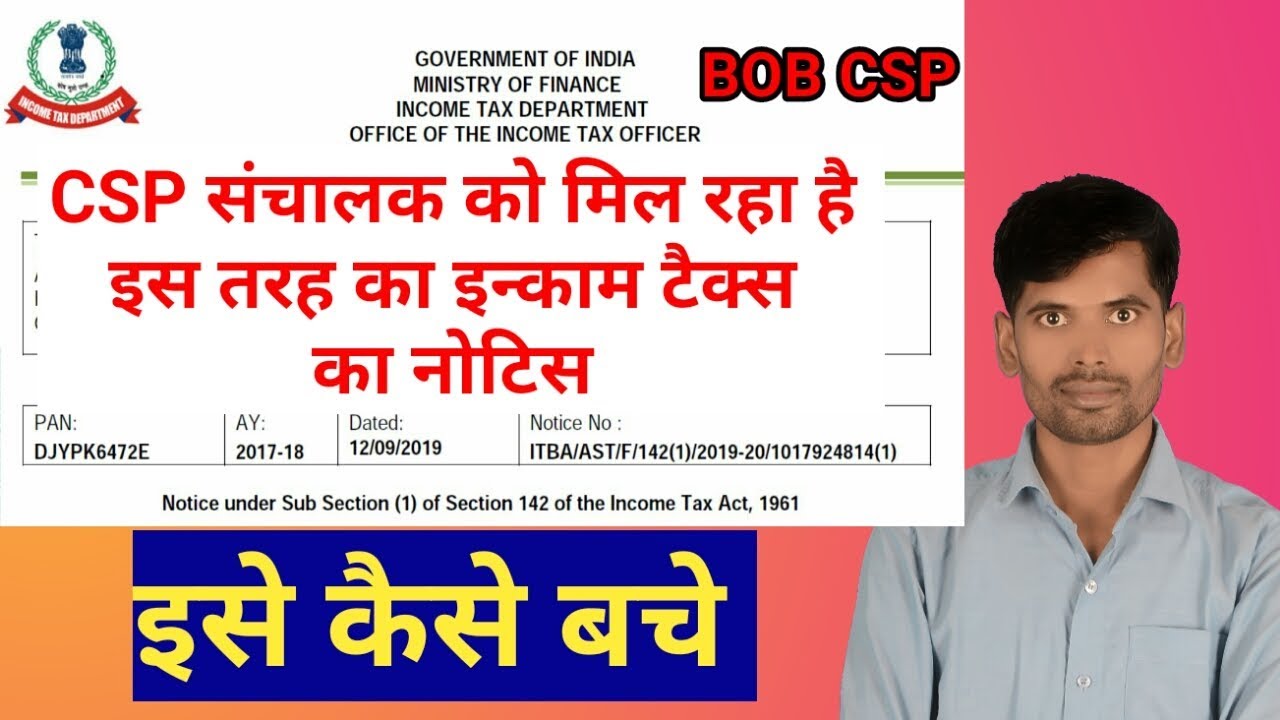

CSP Csp Income Tax

CSP Csp Income Tax

See the Civil Service Pensions website for current contribution rates Your employer takes your contributions from your pay before working out the tax so you will automatically receive full

Tax deduction If your course is related to your job you could claim it as a tax deduction The course has to meet the following criteria to be eligible for a self education deduction The course must maintain or improve the

Now that we've ignited your interest in Csp Tax Deduction, let's explore where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Csp Tax Deduction designed for a variety applications.

- Explore categories like interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- Ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs covered cover a wide array of topics, ranging ranging from DIY projects to party planning.

Maximizing Csp Tax Deduction

Here are some innovative ways create the maximum value of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets to enhance your learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Csp Tax Deduction are a treasure trove of innovative and useful resources catering to different needs and desires. Their availability and versatility make them a great addition to both professional and personal life. Explore the many options of Csp Tax Deduction right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes, they are! You can download and print these files for free.

-

Are there any free printouts for commercial usage?

- It's dependent on the particular usage guidelines. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables may be subject to restrictions on their use. Make sure to read the terms and condition of use as provided by the author.

-

How can I print Csp Tax Deduction?

- You can print them at home with the printer, or go to a print shop in your area for premium prints.

-

What software must I use to open printables that are free?

- Most printables come as PDF files, which can be opened using free software like Adobe Reader.

4 03 LightsOff Projects Natasha C Mobile CSP Portfolio

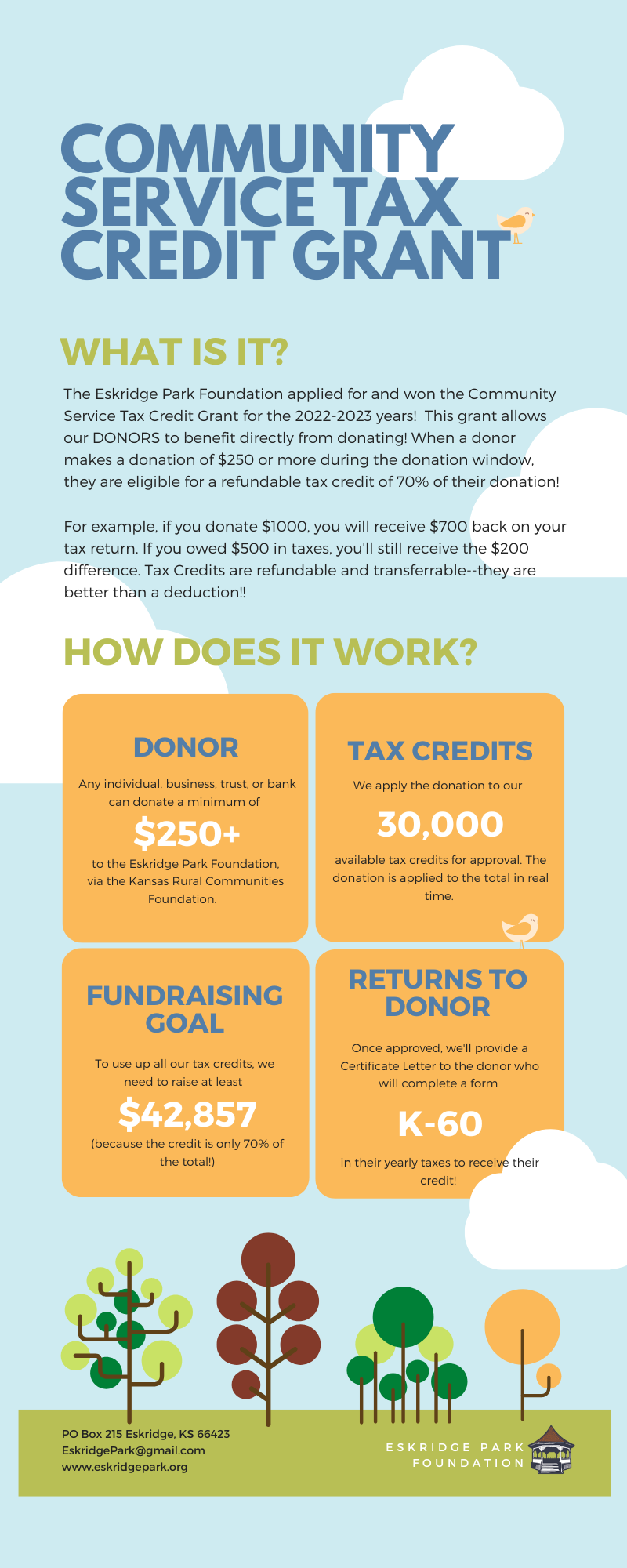

Community Service Tax Credit Grant 2022 23 Awarded To EPF Eskridge

Check more sample of Csp Tax Deduction below

Governor Laura Kelly Awards Tax Credits To Help Local Nonprofit

Eugene Community Safety Payroll Tax Rates Example More

What Is CSP Tax TaxScouts

CSP Tax Accounting Bedford NH Accountant Bedford CPA

Linda Lovett Office Manager Team Lead CSP Tax Pro H R Block LinkedIn

Krysamere Shockley Sales Consultant Furniture Row Companies LinkedIn

https://www.csp.org.uk › system › files › publication_files

You may be able to claim tax relief of either the actual amount you spent you will need to keep receipts or an agreed fixed amount To be able to claim tax relief ALL of the following must

https://www.vero.fi › en › individuals › deductions › what-can-I-deduct

The deduction reduces your net taxable earned income in both state and municipal taxation Deduction amounts in 2024 and 2023 The deduction is 20 of your

You may be able to claim tax relief of either the actual amount you spent you will need to keep receipts or an agreed fixed amount To be able to claim tax relief ALL of the following must

The deduction reduces your net taxable earned income in both state and municipal taxation Deduction amounts in 2024 and 2023 The deduction is 20 of your

CSP Tax Accounting Bedford NH Accountant Bedford CPA

Eugene Community Safety Payroll Tax Rates Example More

Linda Lovett Office Manager Team Lead CSP Tax Pro H R Block LinkedIn

Krysamere Shockley Sales Consultant Furniture Row Companies LinkedIn

CSP Tax And Accounting Petro CPA

NH Accountant NH Business Accountant CSP Tax Accounting

NH Accountant NH Business Accountant CSP Tax Accounting

Peacenlyn Wells CSP Tax Research Analyst H R Block LinkedIn