In this digital age, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. No matter whether it's for educational uses and creative work, or just adding personal touches to your area, Deduction For Ppf Under 80c have become a valuable source. Here, we'll take a dive deep into the realm of "Deduction For Ppf Under 80c," exploring what they are, where you can find them, and ways they can help you improve many aspects of your daily life.

Get Latest Deduction For Ppf Under 80c Below

Deduction For Ppf Under 80c

Deduction For Ppf Under 80c -

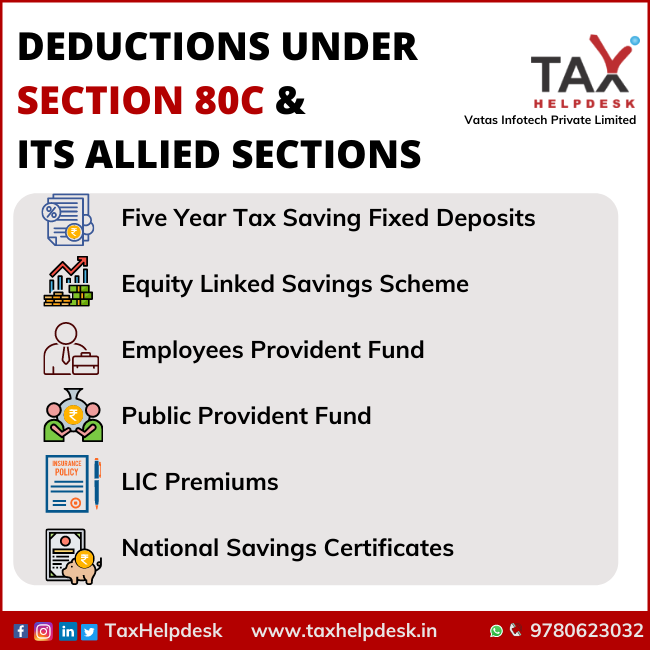

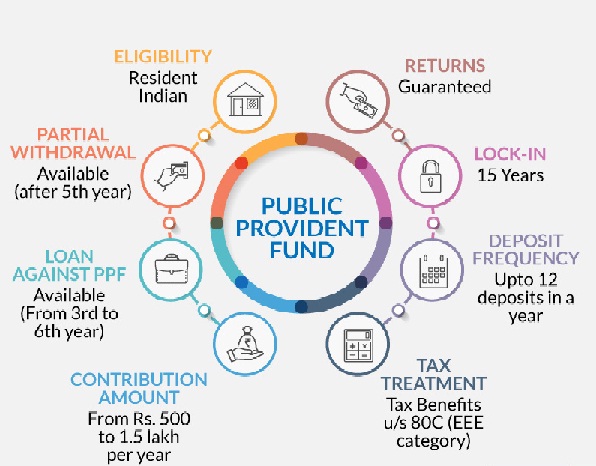

Any investment in the Public Provident Fund PPF is allowed as a deduction under this section PPF deposits fall under the EEE Exempt Exempt Exempt tax category Of which all three things including

Section 80C is the most popular income tax deduction for tax saving 80C deduction limit for the current FY 2023 24 AY 2024 25 is

Deduction For Ppf Under 80c provide a diverse array of printable documents that can be downloaded online at no cost. They are available in a variety of designs, including worksheets templates, coloring pages and many more. One of the advantages of Deduction For Ppf Under 80c is their versatility and accessibility.

More of Deduction For Ppf Under 80c

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Section 80C Tax Public Provident Fund PPF and Employee Provident Fund EPF are investments with long term retirement benefits Both investments are entitled to deduction under Section 80C

It also helps individuals to save tax as they can claim deductions up to Rs 1 5 lakh under Section 80C Apart from this interest earned and maturity proceeds are also tax free

Deduction For Ppf Under 80c have gained a lot of appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

The ability to customize: It is possible to tailor print-ready templates to your specific requirements such as designing invitations as well as organizing your calendar, or even decorating your home.

-

Education Value Educational printables that can be downloaded for free cater to learners of all ages, making them a valuable tool for parents and teachers.

-

The convenience of Instant access to an array of designs and templates will save you time and effort.

Where to Find more Deduction For Ppf Under 80c

Section 80C Deduction Under Section 80C In India Paisabazaar

Section 80C Deduction Under Section 80C In India Paisabazaar

PPF contributions made every year are eligible for tax deductions under Section 80C of the Income Tax Act 1961 The deductions can be claimed by anyone for the same limit The

You can claim a deduction under Section 80C if you invest in specified investment avenues or if you incur specific expenses in a financial year The maximum deduction which you

After we've peaked your curiosity about Deduction For Ppf Under 80c Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with Deduction For Ppf Under 80c for all needs.

- Explore categories such as furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free as well as flashcards and other learning tools.

- Ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- These blogs cover a wide array of topics, ranging from DIY projects to planning a party.

Maximizing Deduction For Ppf Under 80c

Here are some unique ways how you could make the most use of Deduction For Ppf Under 80c:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets to aid in learning at your home (or in the learning environment).

3. Event Planning

- Design invitations and banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Deduction For Ppf Under 80c are a treasure trove of practical and imaginative resources that can meet the needs of a variety of people and preferences. Their availability and versatility make they a beneficial addition to both personal and professional life. Explore the vast world that is Deduction For Ppf Under 80c today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes they are! You can download and print these files for free.

-

Can I utilize free printables for commercial use?

- It's based on the terms of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright problems with Deduction For Ppf Under 80c?

- Some printables may contain restrictions in use. Always read the terms of service and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home with a printer or visit an in-store print shop to get higher quality prints.

-

What program do I require to open Deduction For Ppf Under 80c?

- The majority of printed documents are with PDF formats, which is open with no cost programs like Adobe Reader.

Deduction Under Section 80C Its Allied Sections

Public Provident Fund PPF 5 Popular Investment Avenues For Tax

Check more sample of Deduction For Ppf Under 80c below

Public Provident Fund PPF PPF Account Types Benefits

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80C Deduction For Tax Saving Investments Learn By Quicko

Smart Things To Know Deduction Under Section 80C For Tuition Fee

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

https://tax2win.in/guide/income-tax-ded…

Section 80C is the most popular income tax deduction for tax saving 80C deduction limit for the current FY 2023 24 AY 2024 25 is

https://groww.in/p/tax/section-80c

Any contribution towards the Public Provident Fund PPF can be filed for tax deduction under Section 80C Public Provident Funds come with a maximum deposit limit of

Section 80C is the most popular income tax deduction for tax saving 80C deduction limit for the current FY 2023 24 AY 2024 25 is

Any contribution towards the Public Provident Fund PPF can be filed for tax deduction under Section 80C Public Provident Funds come with a maximum deposit limit of

Smart Things To Know Deduction Under Section 80C For Tuition Fee

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Income Tax Deduction PPF U s 80C With Auto Fills Income Tax Form 16

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

Income Tax Deduction Under Section 80C To 80U FY 2022 23