In this day and age where screens have become the dominant feature of our lives, the charm of tangible printed materials isn't diminishing. If it's to aid in education for creative projects, simply to add personal touches to your space, Deduction From House Rent Income are a great resource. With this guide, you'll dive in the world of "Deduction From House Rent Income," exploring what they are, how they are available, and the ways that they can benefit different aspects of your lives.

Get Latest Deduction From House Rent Income Below

Deduction From House Rent Income

Deduction From House Rent Income -

Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income In general you can deduct expenses of renting property from your rental income

Rental income from residential and other property You must report the rental income you receive and the expenses of renting The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to 30 000 and it rises to 34 for amounts

Printables for free include a vast assortment of printable materials online, at no cost. These resources come in various styles, from worksheets to templates, coloring pages, and more. The appealingness of Deduction From House Rent Income lies in their versatility and accessibility.

More of Deduction From House Rent Income

Section 24 Deduction Income From House Property

Section 24 Deduction Income From House Property

You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of renting out the property

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest property tax operating expenses depreciation and repairs

The Deduction From House Rent Income have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Personalization This allows you to modify designs to suit your personal needs be it designing invitations and schedules, or decorating your home.

-

Educational Impact: Education-related printables at no charge are designed to appeal to students of all ages. This makes them an invaluable tool for parents and educators.

-

Accessibility: Quick access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Deduction From House Rent Income

3 Mistakes Salaried Do While Claiming HRA As A Tax Deduction Faceless

3 Mistakes Salaried Do While Claiming HRA As A Tax Deduction Faceless

If your tenant pays any of your expenses such as a utility or repair bill and deducts the amount from the regular rent payment the amount paid is treated as taxable income to you However you can deduct an equal amount if the underlying expenses qualify as deductible rental expenses see below

Tax deductions for rental property Owning a rental property can generate some extra income but it can also generate some great tax deductions Here are five big ones that tax pros say should

If we've already piqued your curiosity about Deduction From House Rent Income Let's take a look at where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Deduction From House Rent Income to suit a variety of needs.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free as well as flashcards and other learning materials.

- The perfect resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs covered cover a wide range of interests, that includes DIY projects to planning a party.

Maximizing Deduction From House Rent Income

Here are some innovative ways to make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Deduction From House Rent Income are an abundance of practical and imaginative resources catering to different needs and desires. Their availability and versatility make they a beneficial addition to the professional and personal lives of both. Explore the vast array of Deduction From House Rent Income today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Deduction From House Rent Income truly gratis?

- Yes, they are! You can print and download these items for free.

-

Does it allow me to use free printables for commercial purposes?

- It's all dependent on the usage guidelines. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may come with restrictions on usage. Be sure to read the conditions and terms of use provided by the author.

-

How do I print Deduction From House Rent Income?

- You can print them at home with printing equipment or visit the local print shops for better quality prints.

-

What program will I need to access printables for free?

- Many printables are offered as PDF files, which can be opened using free software like Adobe Reader.

Income Tax On Rent Income From House Property Deduction From Rental

House Rent Deduction Raised From Rs 24 000 To Rs 60 000 Hindustan Times

Check more sample of Deduction From House Rent Income below

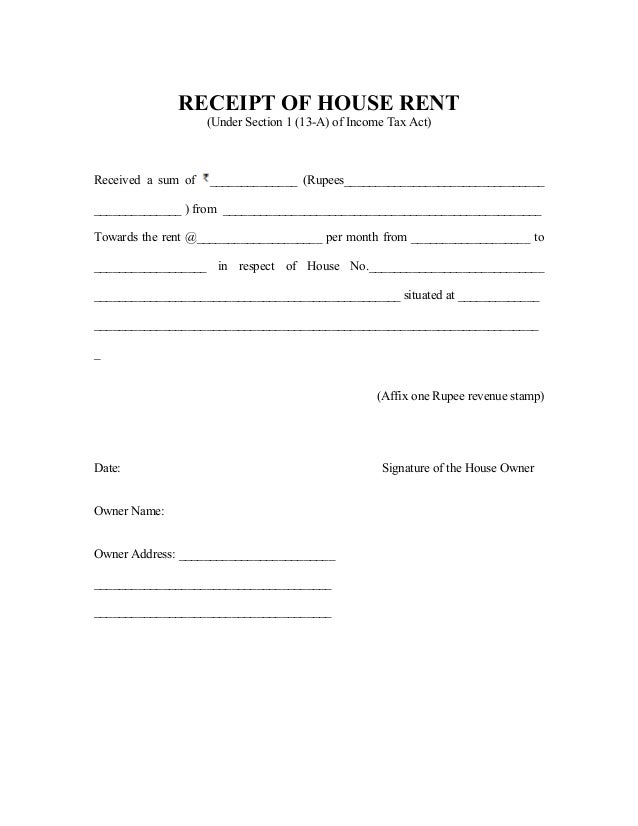

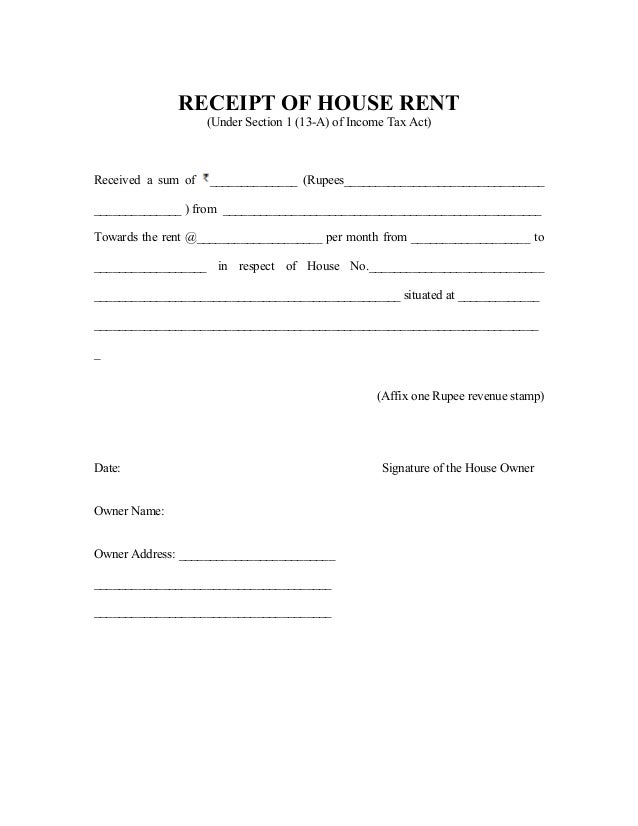

Material Requirement Form House Rent Deduction In Income Tax Section

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

House Rent Deduction In Income Tax TOP CHARTERED ACCOUNTANT IN

Abc

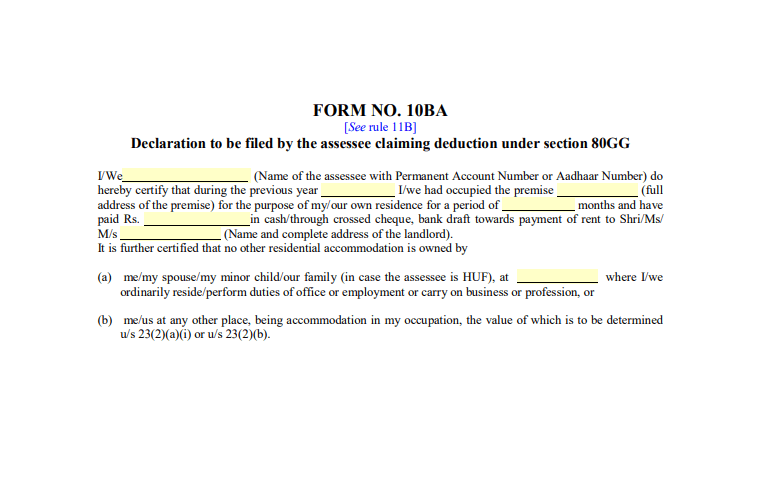

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

Income Tax

https://www.vero.fi/en/individuals/property/rental_income

Rental income from residential and other property You must report the rental income you receive and the expenses of renting The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to 30 000 and it rises to 34 for amounts

https://cleartax.in/s/deductions-under-section24...

Individuals owning a residential property that generates rental income or is self occupied are eligible to claim deductions under Section 24 Types of deductions Standard deduction A flat 30 deduction is allowed on the gross annual value of the let out property regardless of any actual expenses incurred

Rental income from residential and other property You must report the rental income you receive and the expenses of renting The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to 30 000 and it rises to 34 for amounts

Individuals owning a residential property that generates rental income or is self occupied are eligible to claim deductions under Section 24 Types of deductions Standard deduction A flat 30 deduction is allowed on the gross annual value of the let out property regardless of any actual expenses incurred

Abc

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Section 80GG Deduction On Rent Paid Yadnya Investment Academy

Income Tax

Deduction In Respect Of Rent Paid Sec 80GG Eligibility Calculation

No Deduction Of Actual Expenditure Incurred On House Property Besides

No Deduction Of Actual Expenditure Incurred On House Property Besides

Income From Rented House Interest Deduction Tax Exemption Rebate