In a world with screens dominating our lives yet the appeal of tangible printed material hasn't diminished. For educational purposes and creative work, or just adding a personal touch to your home, printables for free have become a valuable source. In this article, we'll dive to the depths of "Deduction Of Interest On Housing Loan For Let Out Property," exploring what they are, how they can be found, and how they can enrich various aspects of your lives.

Get Latest Deduction Of Interest On Housing Loan For Let Out Property Below

Deduction Of Interest On Housing Loan For Let Out Property

Deduction Of Interest On Housing Loan For Let Out Property -

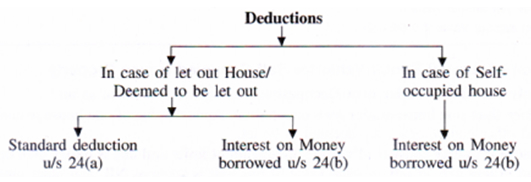

Section 24 provides for deduction for interest on a home loan of up to Rs 2 00 000 in a financial year The assessee can claim a deduction up to Rs 2 lakh while computing his her total taxable income under the head of house property The loan must be taken to acquire construct repair renew or reconstruct the property

If you have taken a home loan to build purchase a house for your own use then the interest paid is eligible for deduction Generally in the case of a self occupied house the annual value is NIL Therefore any municipal taxes paid will not be allowed standard deduction will also be NIL

Printables for free cover a broad collection of printable content that can be downloaded from the internet at no cost. These resources come in many designs, including worksheets templates, coloring pages and much more. The great thing about Deduction Of Interest On Housing Loan For Let Out Property lies in their versatility and accessibility.

More of Deduction Of Interest On Housing Loan For Let Out Property

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

For let out property there is no upper limit for claiming tax exemption on interest which means that you can claim deduction on the entire interest paid on your home loan In case the construction exceeds the stipulated time i e 5 years you can claim deductions on interest of home loan only up to Rs 30 000 for the financial year

The most relevant provision for individuals with housing loans on let out properties is Section 24 of the Income Tax Act 1961 Unlike self occupied properties where the interest deduction is capped at 2 00 000 per annum the interest on the housing loan for let out properties can be fully deducted from the rental income without any upper

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

The ability to customize: We can customize the design to meet your needs whether it's making invitations to organize your schedule or decorating your home.

-

Education Value The free educational worksheets cater to learners of all ages. This makes these printables a powerful resource for educators and parents.

-

Accessibility: Quick access to various designs and templates will save you time and effort.

Where to Find more Deduction Of Interest On Housing Loan For Let Out Property

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

Deductions under House Property Standard Deduction Interest on Home Loan Pre Construction Interest How to determine Income from House Property FAQ Income from House Property

Income from Deemed Let out Annual Letable Value Municipal Taxes Paid During the Year Calculate Less Unrealized Rent Less Deductions from Net Annual Value Total interest for Pre Construction Period Interest on Housing Loan Calculate Understanding Income from House Property

If we've already piqued your interest in printables for free Let's see where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection and Deduction Of Interest On Housing Loan For Let Out Property for a variety goals.

- Explore categories such as the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free as well as flashcards and other learning materials.

- Ideal for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a wide array of topics, ranging that range from DIY projects to planning a party.

Maximizing Deduction Of Interest On Housing Loan For Let Out Property

Here are some fresh ways of making the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Deduction Of Interest On Housing Loan For Let Out Property are a treasure trove filled with creative and practical information that can meet the needs of a variety of people and needs and. Their access and versatility makes they a beneficial addition to both professional and personal life. Explore the many options of Deduction Of Interest On Housing Loan For Let Out Property now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes, they are! You can download and print these files for free.

-

Are there any free templates for commercial use?

- It depends on the specific rules of usage. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables could have limitations regarding their use. Be sure to check these terms and conditions as set out by the author.

-

How can I print printables for free?

- You can print them at home with either a printer at home or in a local print shop to purchase better quality prints.

-

What program do I require to open printables free of charge?

- The majority are printed in the format PDF. This is open with no cost software such as Adobe Reader.

The Deduction Of Interest On Mortgages Is More Delicate With The New

Additional Deduction Of Interest On Housing Loan Blog

Check more sample of Deduction Of Interest On Housing Loan For Let Out Property below

DEDUCTION OF INTEREST ON HOUSING LOAN FOR A Y 2021 22

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

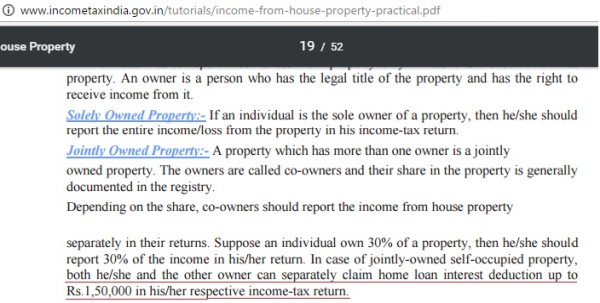

Deduction Of Interest On Housing Loan In Case Of Co ownership

Section 80EE And 80EEA Interest On Housing Loan Deduction

How To Calculate Interest On Housing Loan For Income Tax Haiper

https://tax2win.in/guide/interest-deduction-on-rented-house-property

If you have taken a home loan to build purchase a house for your own use then the interest paid is eligible for deduction Generally in the case of a self occupied house the annual value is NIL Therefore any municipal taxes paid will not be allowed standard deduction will also be NIL

https://www.kotak.com/en/stories-in-focus/loans/...

Homeowners can claim a deduction on the interest on housing loan for let out property under Section 24 of the Income Tax Act If the owner or their family resides in the house property the interest deduction on let out property can go up to Rs 2 lakhs Tax benefits under Section 80EEA

If you have taken a home loan to build purchase a house for your own use then the interest paid is eligible for deduction Generally in the case of a self occupied house the annual value is NIL Therefore any municipal taxes paid will not be allowed standard deduction will also be NIL

Homeowners can claim a deduction on the interest on housing loan for let out property under Section 24 of the Income Tax Act If the owner or their family resides in the house property the interest deduction on let out property can go up to Rs 2 lakhs Tax benefits under Section 80EEA

Deduction Of Interest On Housing Loan In Case Of Co ownership

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

Section 80EE And 80EEA Interest On Housing Loan Deduction

How To Calculate Interest On Housing Loan For Income Tax Haiper

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Understanding Housing Loan Interest Deductions For Salaried Individuals

Understanding Housing Loan Interest Deductions For Salaried Individuals

Deduction Of Interest On Home Loan Income Tax Forum