In this day and age when screens dominate our lives and the appeal of physical printed material hasn't diminished. In the case of educational materials in creative or artistic projects, or simply adding the personal touch to your area, Deduction On Car Loan Interest are a great source. For this piece, we'll take a dive into the sphere of "Deduction On Car Loan Interest," exploring their purpose, where to get them, as well as how they can improve various aspects of your daily life.

Get Latest Deduction On Car Loan Interest Below

Deduction On Car Loan Interest

Deduction On Car Loan Interest -

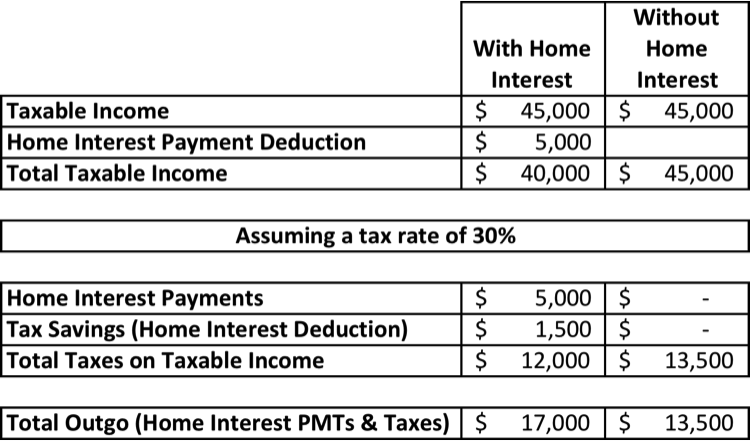

You can deduct the interest paid on an auto loan as a business expense using one of two methods the expense method or the standard mileage deduction when you file your taxes But writing off car loan interest as a business expense isn t as easy as just deciding you want to start itemizing your tax return when you file

If you pay 1 000 in interest on your car loan annually this means you can only claim a 500 deduction On the other hand if the car is used entirely for business purposes the full amount

Deduction On Car Loan Interest cover a large range of printable, free material that is available online at no cost. These resources come in many types, such as worksheets templates, coloring pages, and much more. The appealingness of Deduction On Car Loan Interest is their flexibility and accessibility.

More of Deduction On Car Loan Interest

Interest On Car Loan Calculator CALCULATORUK DFE

Interest On Car Loan Calculator CALCULATORUK DFE

Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction When you prepay interest you must allocate the interest over the tax years to which the interest applies

You cannot deduct a personal car loan or it s interest While typically deducting car loan interest is not allowed there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense

The Deduction On Car Loan Interest have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Individualization The Customization feature lets you tailor designs to suit your personal needs, whether it's designing invitations, organizing your schedule, or even decorating your house.

-

Educational Benefits: Free educational printables offer a wide range of educational content for learners of all ages, making them a valuable device for teachers and parents.

-

Simple: Quick access to an array of designs and templates can save you time and energy.

Where to Find more Deduction On Car Loan Interest

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

Car loan interest deduction can be a valuable way to save money on your taxes if you meet the eligibility requirements However there are limits to how much you can deduct and you should weigh the pros and cons of itemizing your

Car loan interest is only tax deductible if you re a business owner or self employed Unfortunately employees can t claim this deduction even if they use their car for work purposes Let s break down how the car loan interest tax deduction works and who qualifies

Since we've got your interest in printables for free We'll take a look around to see where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection in Deduction On Car Loan Interest for different uses.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- This is a great resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- These blogs cover a broad range of interests, ranging from DIY projects to planning a party.

Maximizing Deduction On Car Loan Interest

Here are some new ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Deduction On Car Loan Interest are an abundance of practical and innovative resources that can meet the needs of a variety of people and interest. Their accessibility and flexibility make they a beneficial addition to the professional and personal lives of both. Explore the plethora of Deduction On Car Loan Interest to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes, they are! You can download and print the resources for free.

-

Can I make use of free printables in commercial projects?

- It's based on the rules of usage. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright issues in Deduction On Car Loan Interest?

- Some printables may have restrictions on their use. You should read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- Print them at home with the printer, or go to an in-store print shop to get superior prints.

-

What program do I need in order to open printables for free?

- The majority are printed with PDF formats, which is open with no cost programs like Adobe Reader.

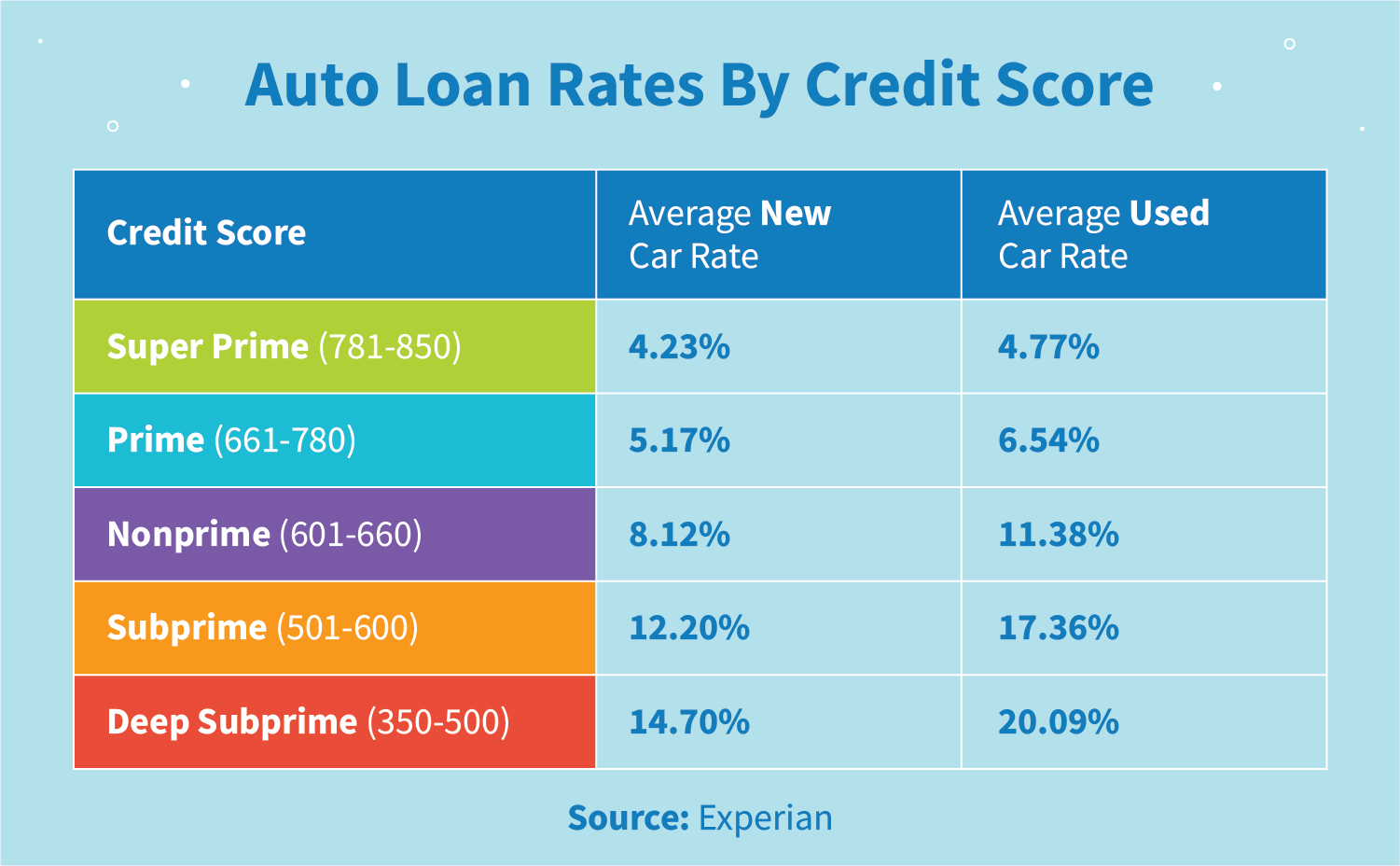

4 Quick Tips To Get A Lower Interest Rate On Car Loan

What Credit Union Has The Best Auto Loan Rates UnderstandLoans

Check more sample of Deduction On Car Loan Interest below

2021 Student Loan Interest Deduction

Deduction On Electrical Vehicle For Interest Paid On Loan

Instead They Can Claim Both The Student Loan Interest Deduction And

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

All About Section 80EEA For Deduction On Home Loan Interest

Best Used Auto Loan Rates Loan Auto Rates Current Car Loans Lowest Used

https://finance.yahoo.com › news

If you pay 1 000 in interest on your car loan annually this means you can only claim a 500 deduction On the other hand if the car is used entirely for business purposes the full amount

https://www.hrblock.com › tax-center › filing › ...

Typically deducting car loan interest is not allowed But there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense

If you pay 1 000 in interest on your car loan annually this means you can only claim a 500 deduction On the other hand if the car is used entirely for business purposes the full amount

Typically deducting car loan interest is not allowed But there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

Deduction On Electrical Vehicle For Interest Paid On Loan

All About Section 80EEA For Deduction On Home Loan Interest

Best Used Auto Loan Rates Loan Auto Rates Current Car Loans Lowest Used

SBI Car Loan Interest Rate 2021 Today Calculator Toyota State Bank Of

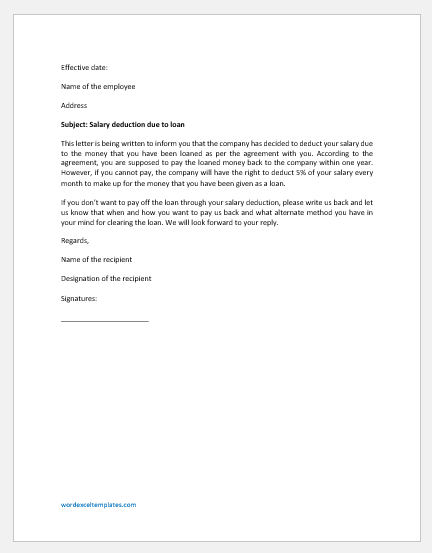

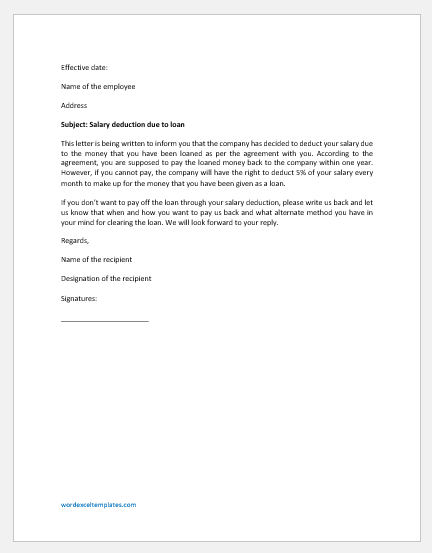

Salary Deduction Letter To Employee For Loan Download FREE

Salary Deduction Letter To Employee For Loan Download FREE

Calculate Apr On Car Loan Offers Discount Save 68 Jlcatj gob mx