In the age of digital, where screens have become the dominant feature of our lives The appeal of tangible printed materials hasn't faded away. In the case of educational materials or creative projects, or just adding the personal touch to your space, Deduction On Car Loan have become a valuable source. The following article is a dive deeper into "Deduction On Car Loan," exploring the different types of printables, where to get them, as well as how they can improve various aspects of your daily life.

Get Latest Deduction On Car Loan Below

Deduction On Car Loan

Deduction On Car Loan -

The general rule is that input tax on the supply or importation of motor vehicles is non deductible However leasing firms have been permitted by Statutory Instrument No 12 of 1998 to reclaim input tax on the purchases of motor vehicles meant for leasing

Tax benefits on Car Loans Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST rate of 28 currently Thus you are not eligible for any deductions on your Car Loan if you are buying for your personal use

Deduction On Car Loan cover a large assortment of printable materials online, at no cost. These resources come in many kinds, including worksheets coloring pages, templates and much more. The value of Deduction On Car Loan is their flexibility and accessibility.

More of Deduction On Car Loan

Section 80EE Of Income Tax Act Deduction On Home Loan

Section 80EE Of Income Tax Act Deduction On Home Loan

Car loan interest is deductible in certain situations where you use your vehicle for business purposes Owning a car that you use some or all of the time for your business can provide tax

You can take tax benefit deduction of up to Rs 1 5 lacs per annum on interest payment towards a car loan subject to following conditions The loan is taken to purchase an electric vehicle Applies to both 2 wheelers and 4 wheelers The loan is sanctioned between April 1 2019 and March 31 2023

Deduction On Car Loan have risen to immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

The ability to customize: You can tailor printing templates to your own specific requirements for invitations, whether that's creating them, organizing your schedule, or decorating your home.

-

Education Value The free educational worksheets provide for students of all ages, which makes them a valuable instrument for parents and teachers.

-

Affordability: instant access various designs and templates cuts down on time and efforts.

Where to Find more Deduction On Car Loan

Interest On Car Loan Calculator CALCULATORUK DFE

Interest On Car Loan Calculator CALCULATORUK DFE

Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction When you prepay interest you must allocate the interest over the tax years to which the interest applies

What is Section 80EEB Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to purchase an electric car However certain restrictions and conditions concerning the loan issuer and the electric vehicle must be followed in order to claim the 80EEB deduction

Now that we've ignited your curiosity about Deduction On Car Loan we'll explore the places you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of motives.

- Explore categories such as decoration for your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- The blogs are a vast selection of subjects, that includes DIY projects to party planning.

Maximizing Deduction On Car Loan

Here are some creative ways ensure you get the very most of Deduction On Car Loan:

1. Home Decor

- Print and frame stunning art, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Deduction On Car Loan are an abundance with useful and creative ideas catering to different needs and interest. Their availability and versatility make them a fantastic addition to each day life. Explore the plethora of Deduction On Car Loan right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes you can! You can download and print the resources for free.

-

Can I download free printing templates for commercial purposes?

- It's determined by the specific rules of usage. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables might have limitations in use. Be sure to read the terms and regulations provided by the designer.

-

How do I print Deduction On Car Loan?

- You can print them at home using any printer or head to the local print shop for more high-quality prints.

-

What program do I need in order to open printables free of charge?

- Many printables are offered with PDF formats, which can be opened with free software like Adobe Reader.

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

4 Quick Tips To Get A Lower Interest Rate On Car Loan

Check more sample of Deduction On Car Loan below

Deduction On Electrical Vehicle For Interest Paid On Loan

Deduction Helps Reaching Goals Pictured As A Race Car With A Phrase

How To Make Your Car A Tax Deduction YouTube

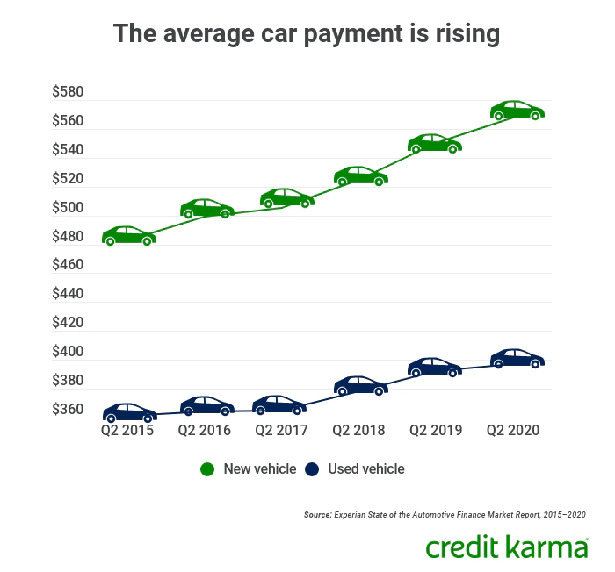

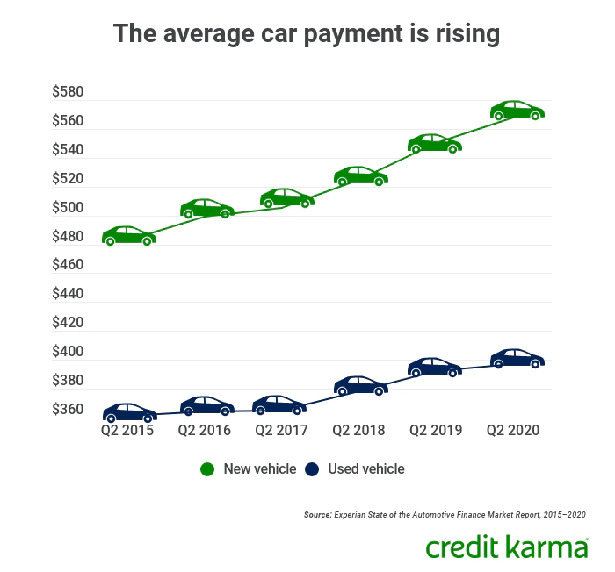

Calculating Payments On A Car Loan 100 Quality Save 70 Jlcatj gob mx

Salary Deduction Letter To Employee For Loan Download FREE

Instead They Can Claim Both The Student Loan Interest Deduction And

https://www.icicibank.com/blogs/car-loan/car-loan...

Tax benefits on Car Loans Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST rate of 28 currently Thus you are not eligible for any deductions on your Car Loan if you are buying for your personal use

https://www.keepertax.com/posts/can-i-write-off-my-car-payment

In reality car loan payments and lease payments are usually not fully tax deductible This article will explain exactly why using three different scenarios We ll explore how much of your monthly car payment you can write off with a financed personal vehicle a financed company car and a leased vehicle

Tax benefits on Car Loans Car is considered a luxury product in India and in fact attracts the highest Goods and Services Tax GST rate of 28 currently Thus you are not eligible for any deductions on your Car Loan if you are buying for your personal use

In reality car loan payments and lease payments are usually not fully tax deductible This article will explain exactly why using three different scenarios We ll explore how much of your monthly car payment you can write off with a financed personal vehicle a financed company car and a leased vehicle

Calculating Payments On A Car Loan 100 Quality Save 70 Jlcatj gob mx

Deduction Helps Reaching Goals Pictured As A Race Car With A Phrase

Salary Deduction Letter To Employee For Loan Download FREE

Instead They Can Claim Both The Student Loan Interest Deduction And

All About Section 80EEA For Deduction On Home Loan Interest

How Do I Take Over Payments On Car Loan Contract 2022

How Do I Take Over Payments On Car Loan Contract 2022

Calculate Apr On Car Loan Offers Discount Save 68 Jlcatj gob mx