In this digital age, where screens rule our lives however, the attraction of tangible printed products hasn't decreased. In the case of educational materials for creative projects, just adding an individual touch to the home, printables for free have become an invaluable resource. We'll dive in the world of "Deduction Under Income Tax Act 1961," exploring what they are, where they are, and how they can improve various aspects of your lives.

What Are Deduction Under Income Tax Act 1961?

Deduction Under Income Tax Act 1961 include a broad range of downloadable, printable materials available online at no cost. These printables come in different types, like worksheets, templates, coloring pages and more. The benefit of Deduction Under Income Tax Act 1961 is their flexibility and accessibility.

Deduction Under Income Tax Act 1961

Deduction Under Income Tax Act 1961

Deduction Under Income Tax Act 1961 -

[desc-5]

[desc-1]

Income Tax Act 1961 Income Tax Laws Deductions In India Under Income

Income Tax Act 1961 Income Tax Laws Deductions In India Under Income

[desc-4]

[desc-6]

ITAT Rules On Deduction Under IT Act Legal 60

ITAT Rules On Deduction Under IT Act Legal 60

[desc-9]

[desc-7]

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

Deduction Under Chapter 6A Of Income Tax Act Loan Deduction Under

Clubbing Of Income Under Income Tax Act 1961 With FAQs

Housing Loan And Interest Paid Thereon For Construction Of Rented House

Information On Section 80G Of Income Tax Act Ebizfiling

Claim Of Deduction U s 54F Of Income Tax Act Rejected Due To Late

Claim Of Deduction U s 54F Of Income Tax Act Rejected Due To Late

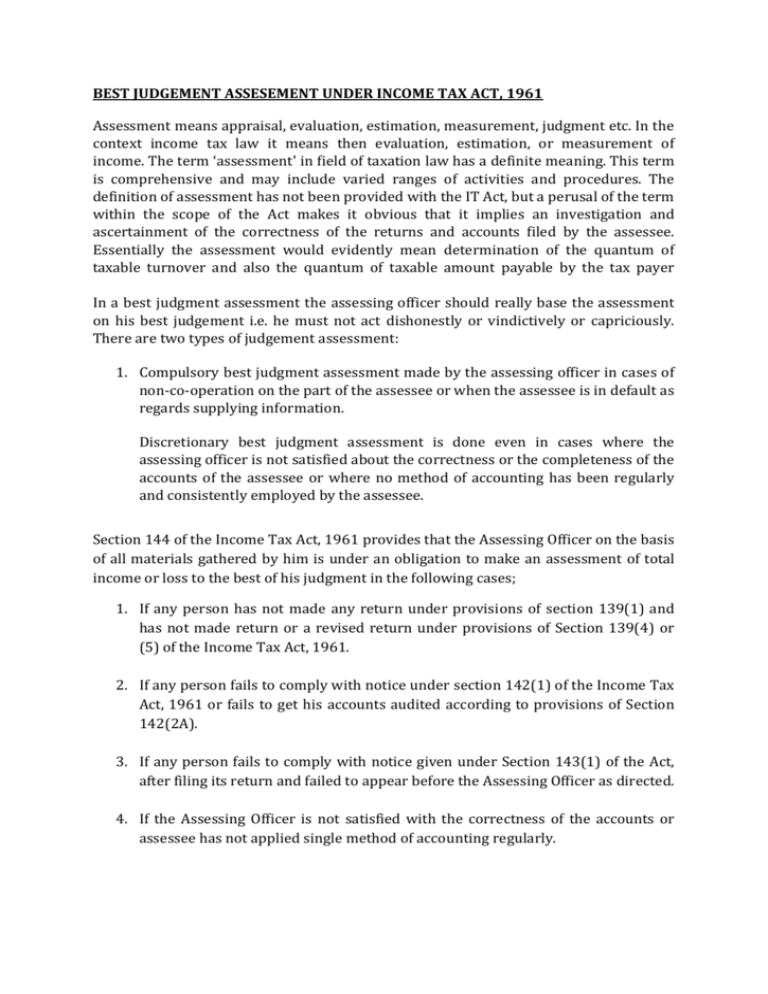

Best Judgement Assesement Under Income Tax Act 1961