In this age of electronic devices, where screens have become the dominant feature of our lives The appeal of tangible, printed materials hasn't diminished. Whatever the reason, whether for education as well as creative projects or just adding an individual touch to the home, printables for free are now a vital resource. This article will dive to the depths of "Define Tax Deduction At Source," exploring what they are, where to find them, and how they can improve various aspects of your daily life.

Get Latest Define Tax Deduction At Source Below

Define Tax Deduction At Source

Define Tax Deduction At Source -

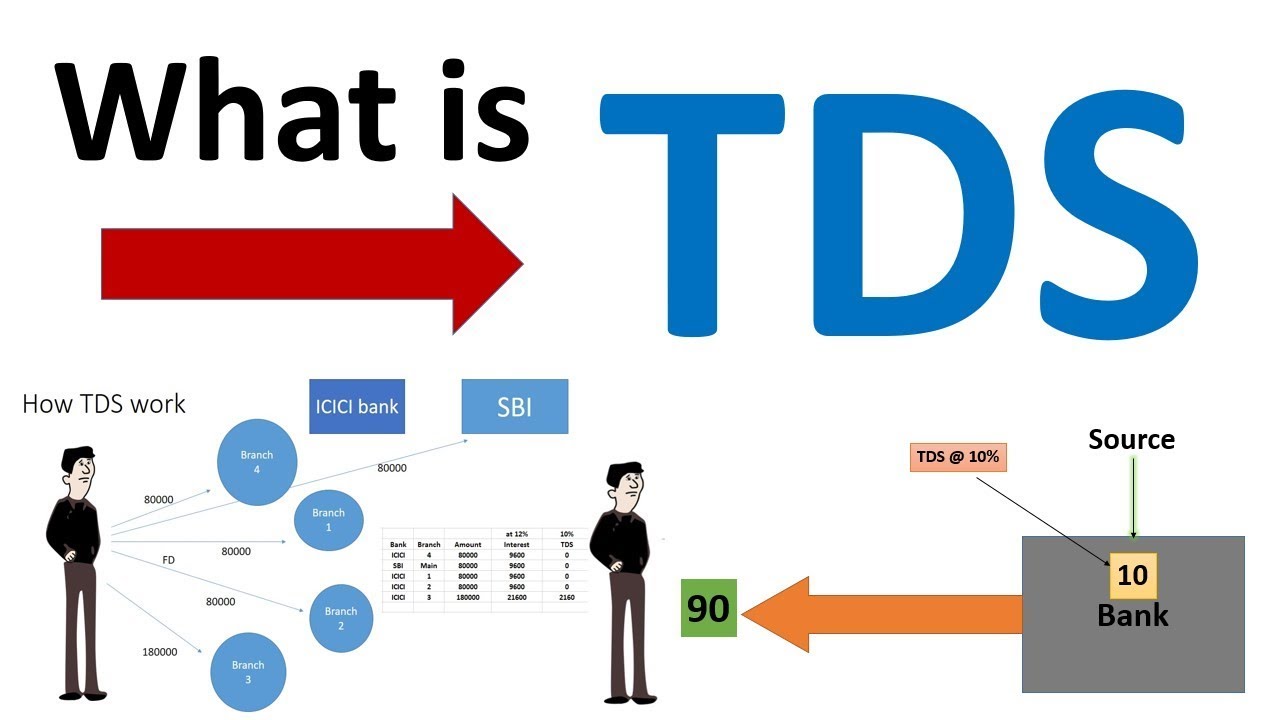

For quick and efficient collection of taxes the Income tax Law has incorporated a system of deduction of tax at the point of generation of income This system is called as Tax Deducted at Source commonly known as TDS Under this system tax is deducted at the origin of the income

TDS or Tax Deducted at Source is income tax deducted from payments made by a person at the time of such payments such as rent commission professional fees salary interest etc Usually the person receiving income is liable to pay income tax

Printables for free cover a broad collection of printable materials that are accessible online for free cost. They are available in a variety of types, like worksheets, templates, coloring pages, and much more. The beauty of Define Tax Deduction At Source is in their versatility and accessibility.

More of Define Tax Deduction At Source

Tax Deduction At Source TDS In India The Ultimate Guide

Tax Deduction At Source TDS In India The Ultimate Guide

TAX DEDUCTED AT SOURCE TDS is a system introduced by Income Tax Department where person responsible for making specified payments such as salary commission professional fees interest rent etc is liable to deduct a certain percentage of tax before making payment in full to the receiver of the payment

What is Tax Deducted at Source TDS Tax Deducted at Source is a type of advance tax that the Government of India levies on a periodic basis The overall deducted TDS is claimed as a tax refund after a taxpayer files the Income Tax Return

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization: It is possible to tailor printables to your specific needs be it designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Value Printables for education that are free provide for students from all ages, making them a useful tool for parents and teachers.

-

Simple: Instant access to a plethora of designs and templates reduces time and effort.

Where to Find more Define Tax Deduction At Source

What Is TDS How Tax Deduction At Source Works

What Is TDS How Tax Deduction At Source Works

If you earn income from certain sources such as salary interest rent or professional fees a portion of that income is taken or deducted by the payer or deductor and submitted directly to the government as tax on your behalf the deductee

Under the scheme of tax deduction at source TDS persons responsible for making payment of income covered by the scheme are responsible to deduct tax at source and deposit the same to the Government s treasury within the stipulated time

Since we've got your interest in printables for free Let's take a look at where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection in Define Tax Deduction At Source for different reasons.

- Explore categories like decorating your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free including flashcards, learning tools.

- Perfect for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs covered cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Define Tax Deduction At Source

Here are some inventive ways in order to maximize the use use of Define Tax Deduction At Source:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to enhance your learning at home also in the classes.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Define Tax Deduction At Source are an abundance of useful and creative resources which cater to a wide range of needs and desires. Their accessibility and versatility make them a wonderful addition to your professional and personal life. Explore the many options of Define Tax Deduction At Source today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes you can! You can print and download these documents for free.

-

Do I have the right to use free printables for commercial uses?

- It's determined by the specific usage guidelines. Always consult the author's guidelines before using their printables for commercial projects.

-

Do you have any copyright violations with Define Tax Deduction At Source?

- Some printables may have restrictions on usage. You should read the conditions and terms of use provided by the creator.

-

How do I print printables for free?

- You can print them at home using the printer, or go to a print shop in your area for high-quality prints.

-

What software do I require to open printables that are free?

- The majority of printed documents are in PDF format. They can be opened using free programs like Adobe Reader.

Your Ultimate Guide To TDS Tax Deduction At Source Samco

What Is TDS Tax Deduction At Source How To Calculate TDS Tax

Check more sample of Define Tax Deduction At Source below

Tax Deduction At Source TDS YouTube

TDS On GST Tax Deduction At Source On GST MyBillBook

What Is Tax Deduction At Source TDS Meaning Definition And Various

Demystifying Tax Deduction At Source TDS Interest On Securities

Tax Deduction At Source From Commission 2022 23 Chartered Journal

What Is TDS 2020 TDS Tax Deduction At Source Basic

https://saral.pro/blogs/tax-deducted-at-source

TDS or Tax Deducted at Source is income tax deducted from payments made by a person at the time of such payments such as rent commission professional fees salary interest etc Usually the person receiving income is liable to pay income tax

https://en.wikipedia.org/wiki/Tax_withholding

Tax withholding also known as tax retention pay as you earn tax or tax deduction at source is income tax paid to the government by the payer of the income rather than by the recipient of the income

TDS or Tax Deducted at Source is income tax deducted from payments made by a person at the time of such payments such as rent commission professional fees salary interest etc Usually the person receiving income is liable to pay income tax

Tax withholding also known as tax retention pay as you earn tax or tax deduction at source is income tax paid to the government by the payer of the income rather than by the recipient of the income

Demystifying Tax Deduction At Source TDS Interest On Securities

TDS On GST Tax Deduction At Source On GST MyBillBook

Tax Deduction At Source From Commission 2022 23 Chartered Journal

What Is TDS 2020 TDS Tax Deduction At Source Basic

What Is The Full Form Of TDS Meaning Example Of TDS

Applicability Of Tax Deduction At Source Under Section 195 On Payment

Applicability Of Tax Deduction At Source Under Section 195 On Payment

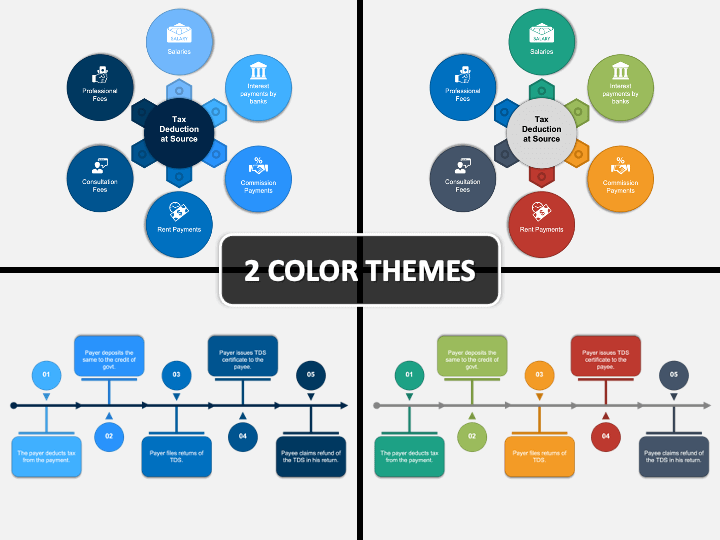

Tax Deduction At Source PowerPoint Template PPT Slides