In this age of electronic devices, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. In the case of educational materials, creative projects, or simply adding the personal touch to your home, printables for free have become an invaluable source. We'll dive in the world of "Defined Benefit Tax Offset," exploring what they are, how to locate them, and how they can improve various aspects of your daily life.

Get Latest Defined Benefit Tax Offset Below

Defined Benefit Tax Offset

Defined Benefit Tax Offset -

You may be entitled to a tax offset on your untaxed element and we can help you work this out by accessing the ATO s defined benefit income cap calculation tool You re not

To work out if you can claim a tax offset on your untaxed element use the Defined benefit income cap tool You can t claim a tax offset for the taxed element of any super

Defined Benefit Tax Offset offer a wide collection of printable documents that can be downloaded online at no cost. They come in many forms, like worksheets templates, coloring pages, and more. The value of Defined Benefit Tax Offset lies in their versatility and accessibility.

More of Defined Benefit Tax Offset

Tax Offset V Tax Deduction What s The Difference Sherlock Wealth

Tax Offset V Tax Deduction What s The Difference Sherlock Wealth

I am receiving a defined benefit pension income stream and according to the CSC the 10 tax offset is being applied to my pension fortnightly I was 61 years old when i

To calculate how much of the Australian super income stream tax offset 15 of the taxed element 10 of the untaxed element You should use our Defined benefit income

Defined Benefit Tax Offset have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization They can make the design to meet your needs in designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Value: The free educational worksheets provide for students of all ages, which makes them an essential source for educators and parents.

-

The convenience of instant access various designs and templates can save you time and energy.

Where to Find more Defined Benefit Tax Offset

Business gov au On Twitter Don t Miss Out Companies Are Often

Business gov au On Twitter Don t Miss Out Companies Are Often

Based on the numbers you ve provided you can claim the 8 384 tax offset in your 2021 tax return You can also amend your 2020 tax return and claim whatever offset the tool

What is a tax offset A tax offset is a reduction in your tax liability Often a tax offset is described as a percentage for example an offset of 10 to a pension It is different from a tax

Now that we've piqued your interest in Defined Benefit Tax Offset we'll explore the places you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Defined Benefit Tax Offset suitable for many reasons.

- Explore categories like the home, decor, management, and craft.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- The blogs are a vast selection of subjects, everything from DIY projects to party planning.

Maximizing Defined Benefit Tax Offset

Here are some innovative ways in order to maximize the use of Defined Benefit Tax Offset:

1. Home Decor

- Print and frame beautiful images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home also in the classes.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Defined Benefit Tax Offset are an abundance of practical and imaginative resources designed to meet a range of needs and preferences. Their access and versatility makes them a wonderful addition to both professional and personal life. Explore the wide world of Defined Benefit Tax Offset to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes, they are! You can download and print these resources at no cost.

-

Can I make use of free printables for commercial purposes?

- It is contingent on the specific rules of usage. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables might have limitations on their use. Always read the terms and conditions provided by the creator.

-

How can I print printables for free?

- You can print them at home with the printer, or go to the local print shops for superior prints.

-

What software do I need to run printables free of charge?

- The majority are printed in PDF format. These is open with no cost software like Adobe Reader.

Judge Favors States In ARPA Tax Offset Case The Journal Record

Maximize Small Business Income Tax Offset In 2021 Australia

Check more sample of Defined Benefit Tax Offset below

Lower Your Tax Bill Through A Defined Benefit Plan

Zone Tax Offset Guide Australia Who How One Click Life

How LISTO Works Low Income Superannuation Tax Offset

How To Get The 30 Digital Games Tax Offset For Game Developers

Who Is Entitled To The Low And Middle Income Tax Offset One Click Life

Small Business Income Tax Offset Vs Tax Deductions Visory

https://www.ato.gov.au › individuals-and-families › ...

To work out if you can claim a tax offset on your untaxed element use the Defined benefit income cap tool You can t claim a tax offset for the taxed element of any super

https://www.csc.gov.au › Defined-benefit-members › ...

A tax offset reduces the tax you pay on your taxable income e g an offset of 10 to a benefit It is different from a tax deduction which reduces your assessable income When you turn 60

To work out if you can claim a tax offset on your untaxed element use the Defined benefit income cap tool You can t claim a tax offset for the taxed element of any super

A tax offset reduces the tax you pay on your taxable income e g an offset of 10 to a benefit It is different from a tax deduction which reduces your assessable income When you turn 60

How To Get The 30 Digital Games Tax Offset For Game Developers

Zone Tax Offset Guide Australia Who How One Click Life

Who Is Entitled To The Low And Middle Income Tax Offset One Click Life

Small Business Income Tax Offset Vs Tax Deductions Visory

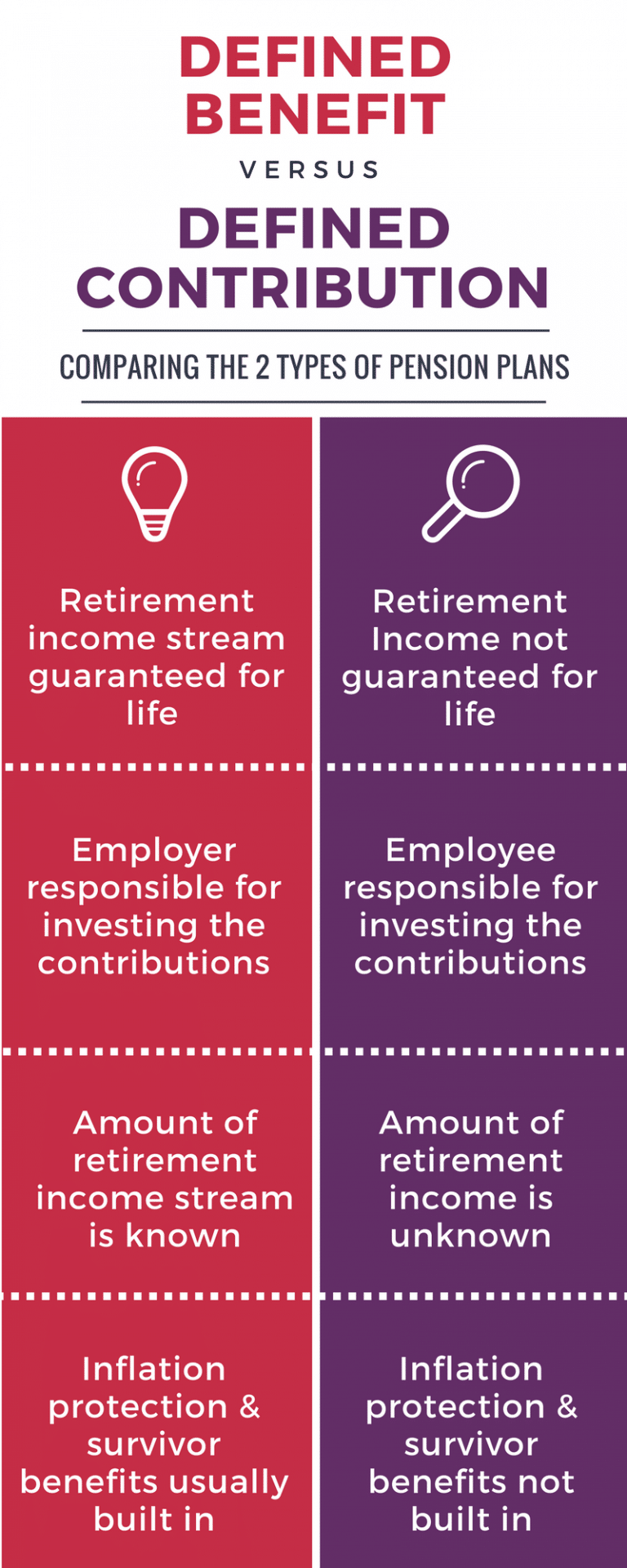

Infographic Defined Benefit Vs Defined Contribution Pension Plan

What Does The Low Income Super Tax Offset Program Offer

What Does The Low Income Super Tax Offset Program Offer

Benefits Of Retirement Saving Pension Group Inc