In this day and age when screens dominate our lives but the value of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply adding a personal touch to your home, printables for free have become a valuable source. Here, we'll take a dive deep into the realm of "Dependent Tax Credit Amount," exploring what they are, where to locate them, and ways they can help you improve many aspects of your daily life.

Get Latest Dependent Tax Credit Amount Below

Dependent Tax Credit Amount

Dependent Tax Credit Amount -

Everything you need to know about the 2024 child tax credit CTC including eligibility income limits and how to claim up to 2 000 per child on your federal tax return

What is the child tax credit for 2024 For 2024 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married

Dependent Tax Credit Amount offer a wide assortment of printable material that is available online at no cost. These resources come in various styles, from worksheets to coloring pages, templates and much more. One of the advantages of Dependent Tax Credit Amount is their flexibility and accessibility.

More of Dependent Tax Credit Amount

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

What qualifies someone as a dependent The Child Tax Credit is up to 2 000 The Credit for Other Dependents is worth up to 500 The IRS defines a dependent as a qualifying child under age 19 or under 24 if a full

The threshold amount for the tax year as of January 2023 via the latest revision of IRS Publication 501 puts the threshold at 4 400 or more Pass the IRS s support test which requires the taxpayer to have provided more than 50 of

The Dependent Tax Credit Amount have gained huge popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Modifications: It is possible to tailor designs to suit your personal needs when it comes to designing invitations as well as organizing your calendar, or even decorating your house.

-

Education Value These Dependent Tax Credit Amount offer a wide range of educational content for learners of all ages, making them an essential device for teachers and parents.

-

Easy to use: instant access many designs and templates helps save time and effort.

Where to Find more Dependent Tax Credit Amount

2022 Child Tax Credit Refundable Amount Latest News Update

2022 Child Tax Credit Refundable Amount Latest News Update

How much is the child and dependent care credit The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000

The maximum amount taxpayers can claim for the child tax credit is 2 000 for each qualifying child The amount claimed on Form 1040 depends on the taxpayer s filing status modified

We hope we've stimulated your interest in printables for free, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Dependent Tax Credit Amount for various purposes.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free with flashcards and other teaching tools.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their creative designs or templates for download.

- The blogs are a vast selection of subjects, that includes DIY projects to party planning.

Maximizing Dependent Tax Credit Amount

Here are some fresh ways that you can make use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Utilize free printable worksheets to reinforce learning at home and in class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Dependent Tax Credit Amount are a treasure trove of practical and imaginative resources which cater to a wide range of needs and pursuits. Their accessibility and flexibility make them a great addition to any professional or personal life. Explore the vast world of Dependent Tax Credit Amount today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Dependent Tax Credit Amount truly available for download?

- Yes they are! You can print and download the resources for free.

-

Does it allow me to use free printables for commercial use?

- It's determined by the specific conditions of use. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with Dependent Tax Credit Amount?

- Some printables could have limitations in their usage. You should read the terms and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home with either a printer or go to the local print shop for higher quality prints.

-

What software must I use to open printables for free?

- The majority of printed documents are in PDF format, which can be opened using free software such as Adobe Reader.

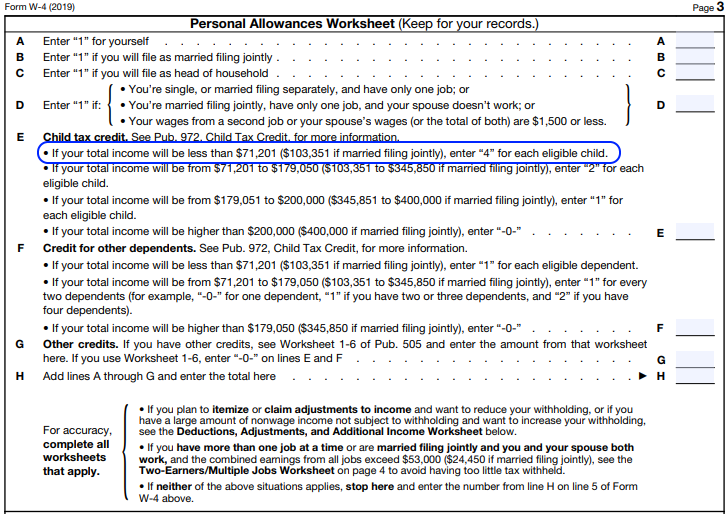

W 4 Changes Allowances Vs Credits Datatech

531 Stretch Your College Student s Spending Money With The Dependent

Check more sample of Dependent Tax Credit Amount below

Child care and dependent tax credit Paragon

Child Tax Credit 2022 Brackets Latest News Update

Dependent Tax Credit Claim Eligibility And Exceptions FastnEasyTax

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Individual Newsletter October 2022 Ciampi Tax Financial Services LLC

The Child And Dependent Care Tax Credit

https://www.nerdwallet.com/article/tax…

What is the child tax credit for 2024 For 2024 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married

https://www.kiplinger.com/taxes/new-family-tax-credits-for-next-year

For the 2025 tax year the IRS announced that the refundable portion of the CTC is 1 700 That s the amount you can claim for tax returns you generally file in 2026 For the

What is the child tax credit for 2024 For 2024 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married

For the 2025 tax year the IRS announced that the refundable portion of the CTC is 1 700 That s the amount you can claim for tax returns you generally file in 2026 For the

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Child Tax Credit 2022 Brackets Latest News Update

Individual Newsletter October 2022 Ciampi Tax Financial Services LLC

The Child And Dependent Care Tax Credit

2018 Child Dependent Tax Credit Chad Harrison CPA

How To Change The Tax Credit Amount Applied To Your Health Plan YouTube

How To Change The Tax Credit Amount Applied To Your Health Plan YouTube

2012 2013 Child Tax Credit Amount YouTube