In this age of technology, when screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. Whatever the reason, whether for education project ideas, artistic or simply to add an extra personal touch to your area, Diff Between Tax Deduction Vs Tax Rebate In India are a great resource. Here, we'll take a dive to the depths of "Diff Between Tax Deduction Vs Tax Rebate In India," exploring their purpose, where they are, and the ways that they can benefit different aspects of your lives.

Get Latest Diff Between Tax Deduction Vs Tax Rebate In India Below

Diff Between Tax Deduction Vs Tax Rebate In India

Diff Between Tax Deduction Vs Tax Rebate In India -

Web 19 oct 2022 nbsp 0183 32 When you compute your tax liability these exemptions will be deducted from your gross salary One such example is the House Rent Allowance HRA which is

Web 1 f 233 vr 2023 nbsp 0183 32 Tax Deduction vs Exemption vs Tax Rebate What s the Difference Are you worried about the intricacies of taxation in India How much tax deduction can you get in the current financial year Do

Diff Between Tax Deduction Vs Tax Rebate In India encompass a wide collection of printable materials online, at no cost. They come in many types, like worksheets, templates, coloring pages, and much more. The benefit of Diff Between Tax Deduction Vs Tax Rebate In India is in their variety and accessibility.

More of Diff Between Tax Deduction Vs Tax Rebate In India

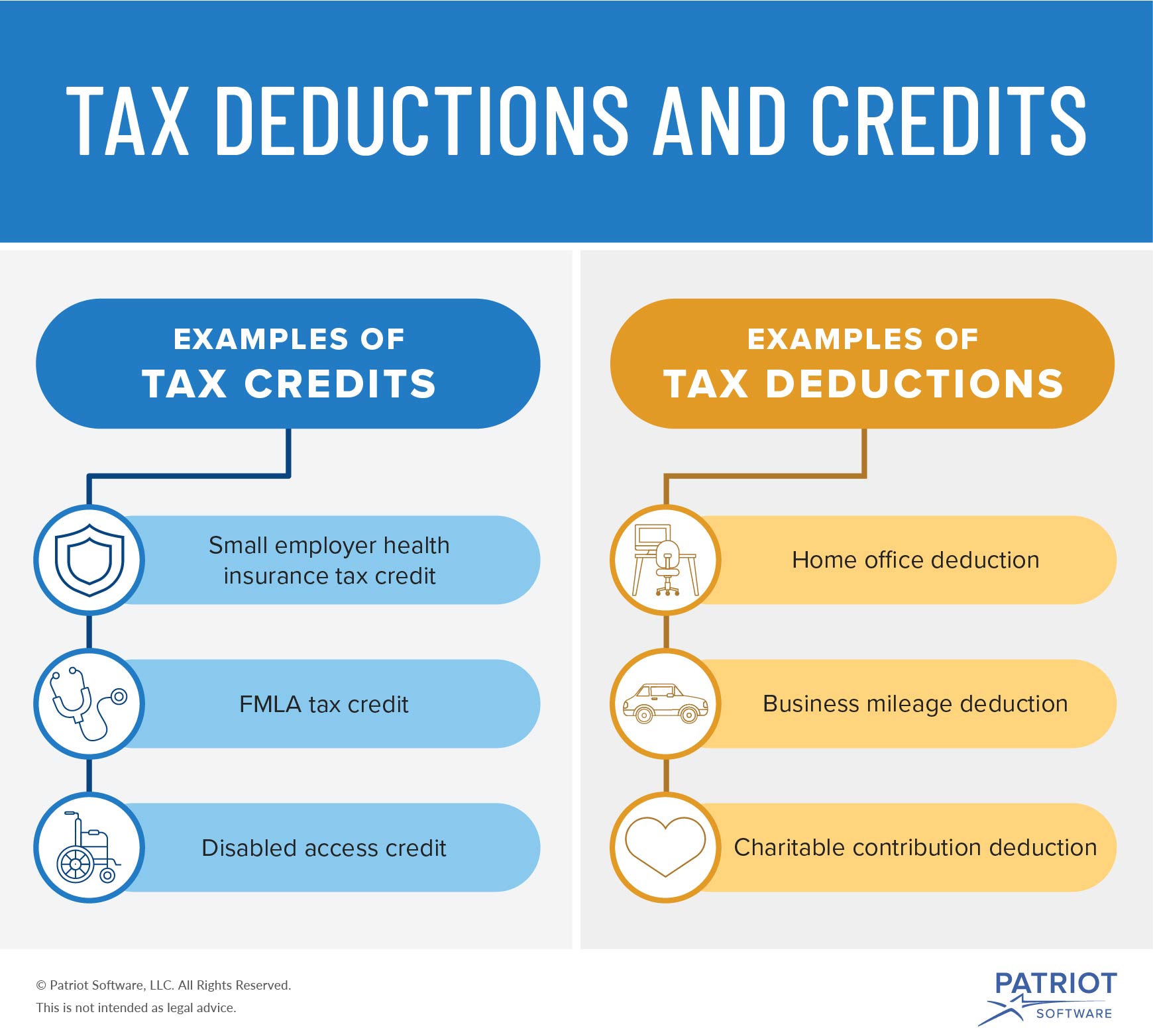

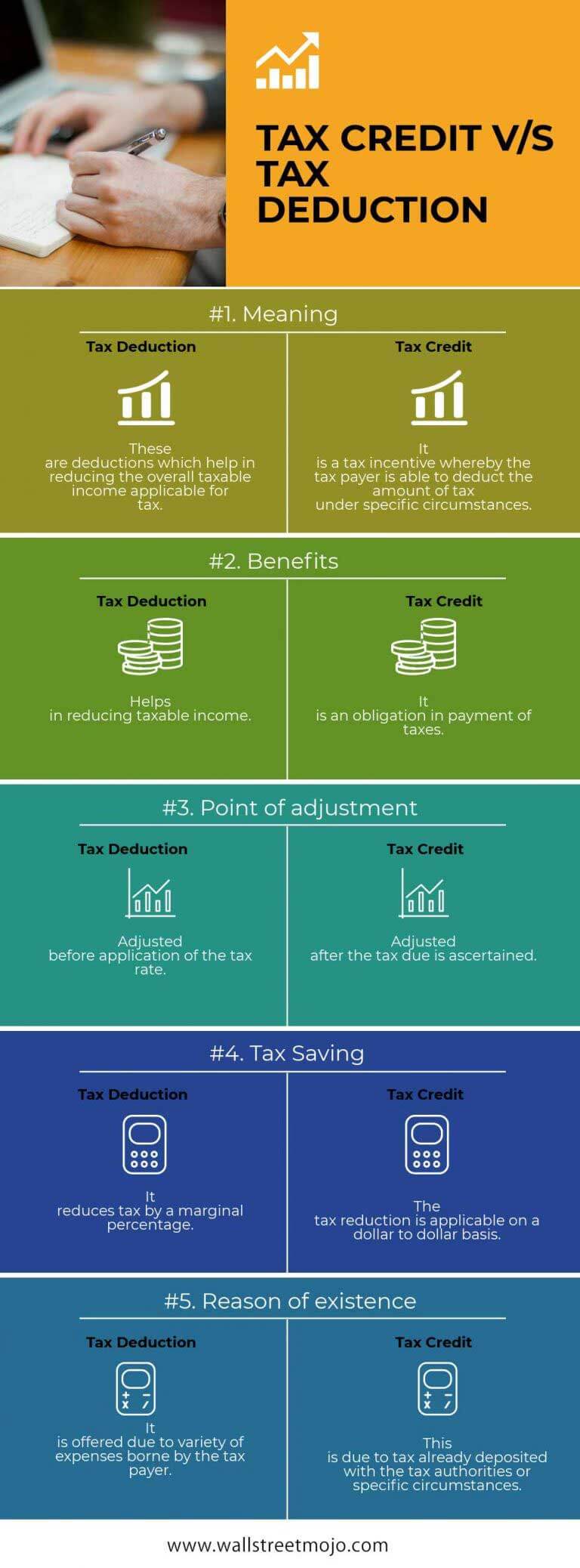

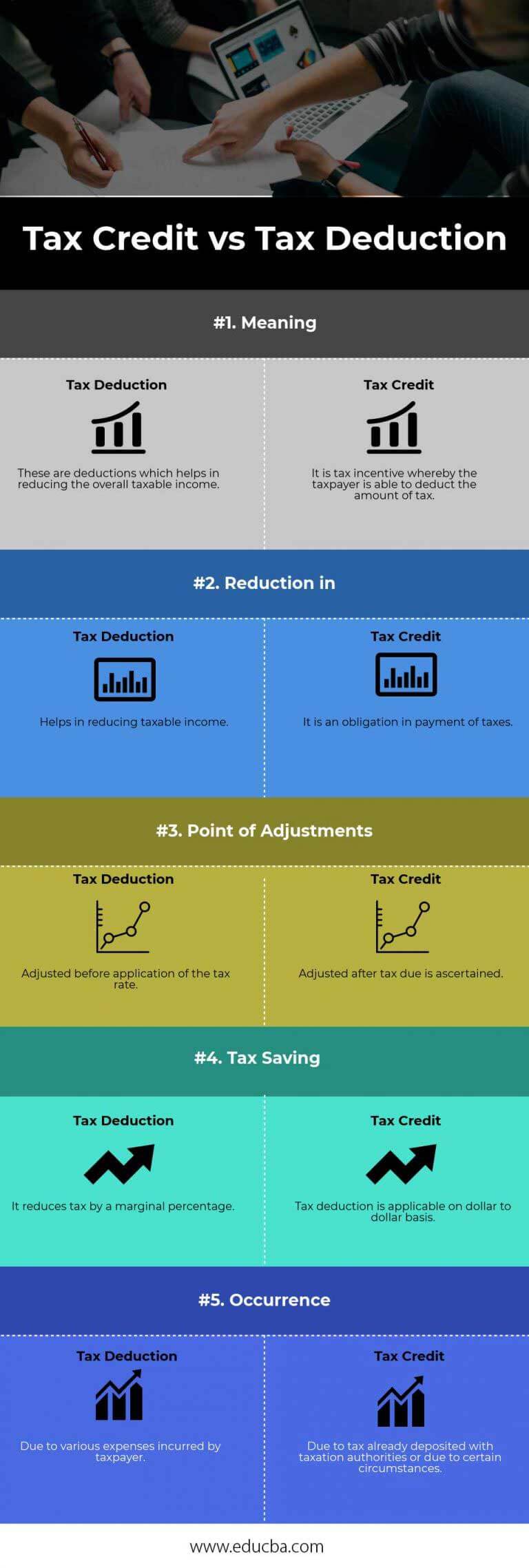

Business Tax Credit Vs Tax Deduction What s The Difference

Business Tax Credit Vs Tax Deduction What s The Difference

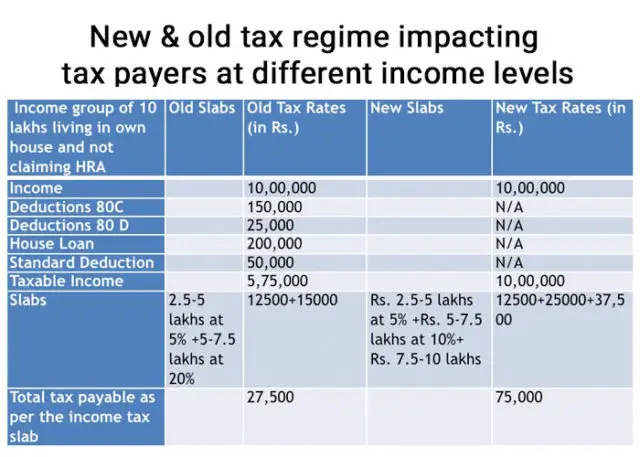

Web Unlike income tax exemption and tax deduction a tax rebate is not deducted from the income Tax rebate is claimed from the total amount of tax payable For example the resident individual with a taxable income

Web 24 janv 2019 nbsp 0183 32 Tax rebates After exemptions and deduction what remains is the total income on which you pay the tax Once you calculate the tax a rebate offers relief in the amount of income tax you need to pay

Diff Between Tax Deduction Vs Tax Rebate In India have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Individualization They can make designs to suit your personal needs for invitations, whether that's creating them or arranging your schedule or even decorating your house.

-

Education Value Education-related printables at no charge provide for students of all ages. This makes them an invaluable device for teachers and parents.

-

Simple: You have instant access a variety of designs and templates can save you time and energy.

Where to Find more Diff Between Tax Deduction Vs Tax Rebate In India

Tax Deduction Vs Exemption Vs Tax Rebate What s The Difference

Tax Deduction Vs Exemption Vs Tax Rebate What s The Difference

Web 27 mai 2023 nbsp 0183 32 The tax deduction is made from a taxpayer s gross income which reduces the taxable income whereas rebates are claimed from the tax you have paid Rebates have no objective other

Web Difference between tax exemption tax deduction and tax rebate SHARE POPULAR TAGS SIP ELSS Mutual Funds retirement Term Insurance Motor Insurance Health

Now that we've piqued your interest in printables for free, let's explore where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection and Diff Between Tax Deduction Vs Tax Rebate In India for a variety purposes.

- Explore categories such as furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free with flashcards and other teaching materials.

- Ideal for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- These blogs cover a broad variety of topics, all the way from DIY projects to party planning.

Maximizing Diff Between Tax Deduction Vs Tax Rebate In India

Here are some fresh ways for you to get the best use of Diff Between Tax Deduction Vs Tax Rebate In India:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet to build your knowledge at home as well as in the class.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Diff Between Tax Deduction Vs Tax Rebate In India are an abundance with useful and creative ideas that can meet the needs of a variety of people and preferences. Their availability and versatility make them a fantastic addition to your professional and personal life. Explore the endless world of Diff Between Tax Deduction Vs Tax Rebate In India today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes you can! You can download and print these materials for free.

-

Can I make use of free printables in commercial projects?

- It's based on the terms of use. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables could have limitations on usage. You should read the terms of service and conditions provided by the author.

-

How do I print printables for free?

- Print them at home with a printer or visit an area print shop for better quality prints.

-

What program will I need to access printables that are free?

- The majority are printed in the format PDF. This can be opened with free software, such as Adobe Reader.

What Are Direct Taxes And Indirect Taxes In India Tax2win

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

Check more sample of Diff Between Tax Deduction Vs Tax Rebate In India below

Difference Between Tax Credit And Tax Deduction Main Differences

What Is The Difference Between A Tax Credit And Tax Deduction

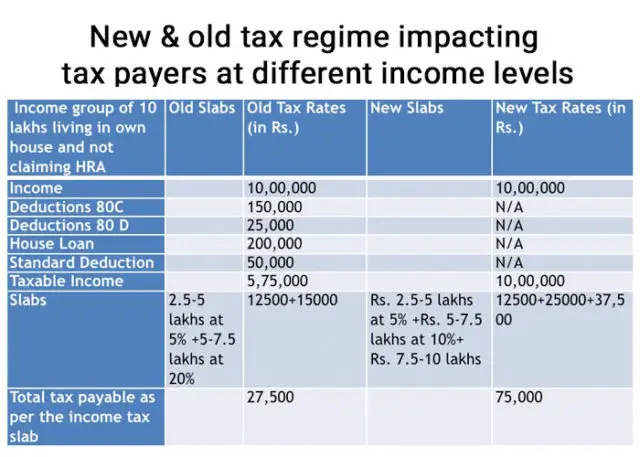

How To Choose Between The New And Old Income Tax Regimes

Major Exemptions Deductions Availed By Taxpayers In India

Comparison Between The New Tax Regime Vs Old Tax Regime In India And

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

https://www.tomorrowmakers.com/tax-plannin…

Web 1 f 233 vr 2023 nbsp 0183 32 Tax Deduction vs Exemption vs Tax Rebate What s the Difference Are you worried about the intricacies of taxation in India How much tax deduction can you get in the current financial year Do

https://www.etmoney.com/blog/difference-bet…

Web Standard deduction of Rs 50 000 is available to all taxpayers from their gross income thereby reducing the gross income by a flat Rs 50 000 For instance if a taxpayer has a gross annual salary of Rs 8 lakh the

Web 1 f 233 vr 2023 nbsp 0183 32 Tax Deduction vs Exemption vs Tax Rebate What s the Difference Are you worried about the intricacies of taxation in India How much tax deduction can you get in the current financial year Do

Web Standard deduction of Rs 50 000 is available to all taxpayers from their gross income thereby reducing the gross income by a flat Rs 50 000 For instance if a taxpayer has a gross annual salary of Rs 8 lakh the

Major Exemptions Deductions Availed By Taxpayers In India

What Is The Difference Between A Tax Credit And Tax Deduction

Comparison Between The New Tax Regime Vs Old Tax Regime In India And

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Credits Vs Tax Deductions Top 5 Differences You Must Know

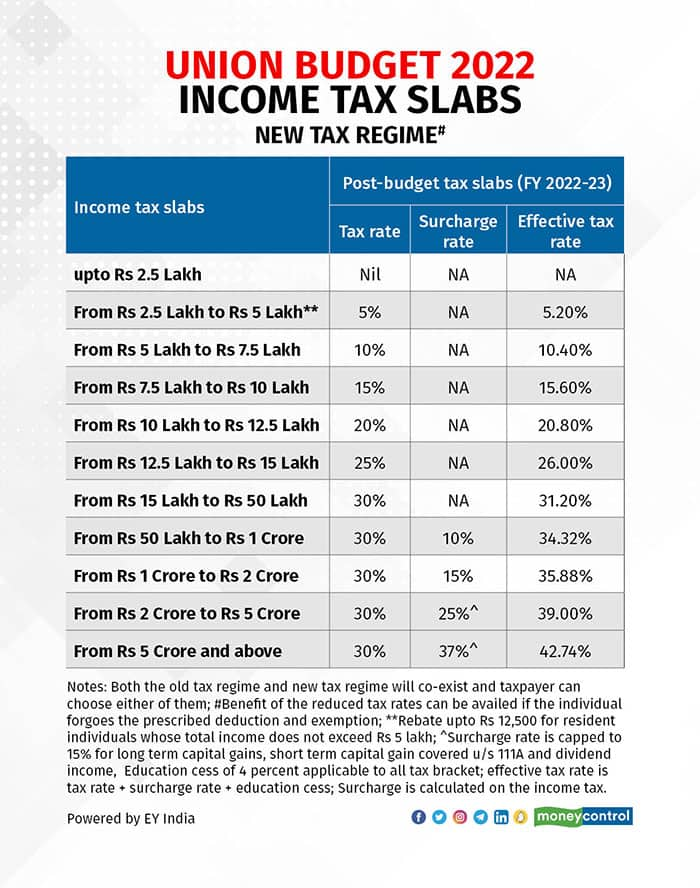

Old Or New Tax Regime Which Is Beneficial For You Post The Union

Old Or New Tax Regime Which Is Beneficial For You Post The Union

Tax Credit Vs Tax Deduction Top 5 Best Differences And Comparisons