In the digital age, where screens rule our lives yet the appeal of tangible, printed materials hasn't diminished. In the case of educational materials in creative or artistic projects, or simply adding an individual touch to the area, Difference Between Tax Allowance And Tax Credit have proven to be a valuable source. With this guide, you'll dive deeper into "Difference Between Tax Allowance And Tax Credit," exploring the benefits of them, where they are, and what they can do to improve different aspects of your daily life.

Get Latest Difference Between Tax Allowance And Tax Credit Below

Difference Between Tax Allowance And Tax Credit

Difference Between Tax Allowance And Tax Credit -

Tax credits are subtracted directly from a person s tax liability they therefore reduce taxes dollar for dollar Credits have the same value for everyone who can claim their full value Most tax credits are nonrefundable that is they

Because a deduction lowers your taxable income it lowers the amount of tax you owe but by decreasing your taxable income not by directly lowering your tax The benefit of a tax deduction depends on your tax rate Here are some commonly overlooked tax deductions Tax credit vs deduction An example

Printables for free cover a broad range of printable, free materials that are accessible online for free cost. They are available in a variety of forms, including worksheets, coloring pages, templates and more. The benefit of Difference Between Tax Allowance And Tax Credit lies in their versatility as well as accessibility.

More of Difference Between Tax Allowance And Tax Credit

The Difference Between A Tax Credit And A Tax Deduction

The Difference Between A Tax Credit And A Tax Deduction

Tax Deductions Credits Deductions and credits are two ways of saving money on your taxes Learn the important difference between these two ways of reducing your tax bill and how you

Both tax credits and tax deductions can reduce your tax bill but in different ways Tax credits directly reduce the amount of tax you owe the IRS Tax deductions reduce your taxable income so you re taxed on less

Difference Between Tax Allowance And Tax Credit have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

customization Your HTML0 customization options allow you to customize print-ready templates to your specific requirements whether it's making invitations as well as organizing your calendar, or even decorating your home.

-

Educational Use: Free educational printables cater to learners of all ages, making them a vital tool for parents and educators.

-

Convenience: Fast access many designs and templates saves time and effort.

Where to Find more Difference Between Tax Allowance And Tax Credit

Person Using Calculator To Compare Difference Between Tax Deduction And

Person Using Calculator To Compare Difference Between Tax Deduction And

Tax credits reduce the amount of taxes you owe but instead of doing so by reducing your taxable income tax credits reduce your actual tax liability acting as

The big difference between tax deductions vs tax credits is that deductions chip away at the income you ll pay taxes on which then reduces your taxes while credits directly reduce the amount of taxes you owe

Now that we've piqued your interest in printables for free and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection and Difference Between Tax Allowance And Tax Credit for a variety motives.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Perfect for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a wide range of topics, that range from DIY projects to planning a party.

Maximizing Difference Between Tax Allowance And Tax Credit

Here are some fresh ways of making the most use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets to enhance your learning at home for the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Difference Between Tax Allowance And Tax Credit are a treasure trove of innovative and useful resources that meet a variety of needs and needs and. Their access and versatility makes them a wonderful addition to both professional and personal lives. Explore the many options of Difference Between Tax Allowance And Tax Credit today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can download and print these resources at no cost.

-

Can I download free templates for commercial use?

- It's dependent on the particular usage guidelines. Always review the terms of use for the creator before using printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables could be restricted on their use. Always read the terms and conditions set forth by the designer.

-

How can I print Difference Between Tax Allowance And Tax Credit?

- You can print them at home using either a printer or go to the local print shop for top quality prints.

-

What software do I need to open printables free of charge?

- The majority are printed in PDF format. They is open with no cost software such as Adobe Reader.

Pin On Blogging

Difference Between Tax Capital Allowance And Accounting Depreciation

Check more sample of Difference Between Tax Allowance And Tax Credit below

What Is Your Marginal Tax Rate And Does It Matter Ritchie Phillips LLP

Croydon Sutton And Surrey Greens February 2014

.jpg)

Tax Allowance And Tax Exemptions How To Make Full Use Fairstone

Tax Deduction Vs Tax Credit What s The Difference With Table

Tax Allowance And Tax Exemptions How To Make Full Use Fairstone

The Difference Between Tax Credit And Tax Deduction Line

https://www.hrblock.com/tax-center/filing/credits/...

Because a deduction lowers your taxable income it lowers the amount of tax you owe but by decreasing your taxable income not by directly lowering your tax The benefit of a tax deduction depends on your tax rate Here are some commonly overlooked tax deductions Tax credit vs deduction An example

https://smartasset.com/taxes/tax-credits-vs...

Bottom Line Tax credits and tax deductions both decrease the total that you ll pay in taxes but they do so in different ways A tax credit is a dollar for dollar reduction of the money you owe while a tax deduction will decrease your taxable income leading to a slightly lower tax bill

Because a deduction lowers your taxable income it lowers the amount of tax you owe but by decreasing your taxable income not by directly lowering your tax The benefit of a tax deduction depends on your tax rate Here are some commonly overlooked tax deductions Tax credit vs deduction An example

Bottom Line Tax credits and tax deductions both decrease the total that you ll pay in taxes but they do so in different ways A tax credit is a dollar for dollar reduction of the money you owe while a tax deduction will decrease your taxable income leading to a slightly lower tax bill

Tax Deduction Vs Tax Credit What s The Difference With Table

.jpg)

Croydon Sutton And Surrey Greens February 2014

Tax Allowance And Tax Exemptions How To Make Full Use Fairstone

The Difference Between Tax Credit And Tax Deduction Line

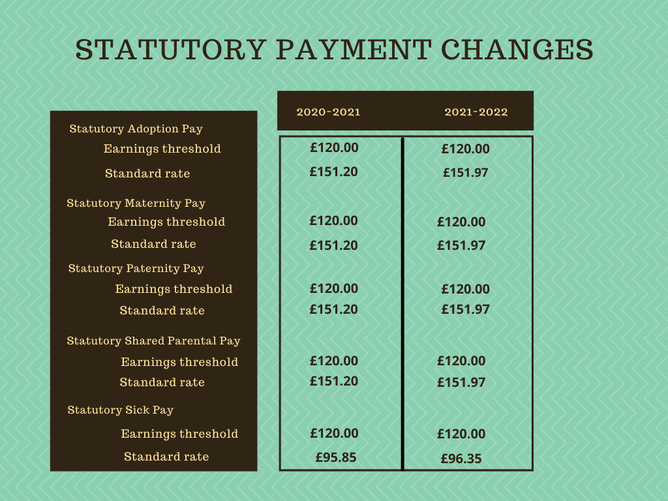

Cashtrak HMRC Statutory Payment Increases Self Assessment Tax Return

2023 Federal Pay 2023

2023 Federal Pay 2023

China Tax Update Challenges Ahead Advice On Hand