In the age of digital, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. In the case of educational materials as well as creative projects or just adding a personal touch to your space, Difference Between Tax Relief And Tax Rebate Singapore are a great resource. In this article, we'll dive into the sphere of "Difference Between Tax Relief And Tax Rebate Singapore," exploring their purpose, where to find them and how they can be used to enhance different aspects of your daily life.

Get Latest Difference Between Tax Relief And Tax Rebate Singapore Below

Difference Between Tax Relief And Tax Rebate Singapore

Difference Between Tax Relief And Tax Rebate Singapore -

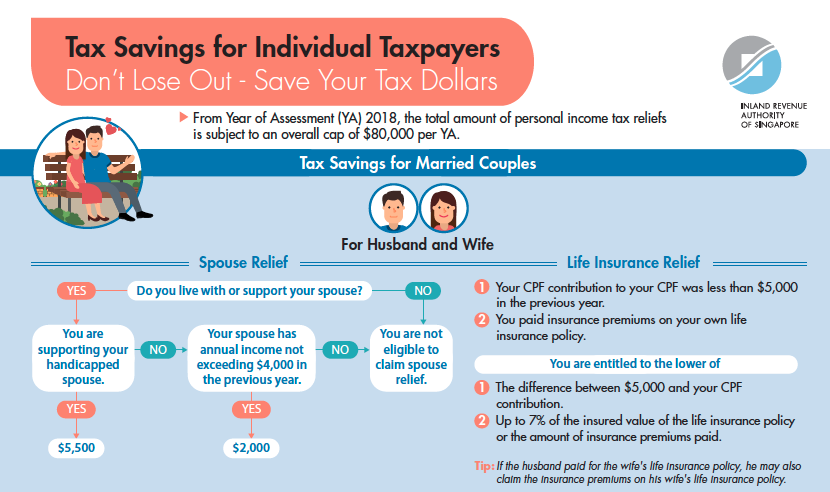

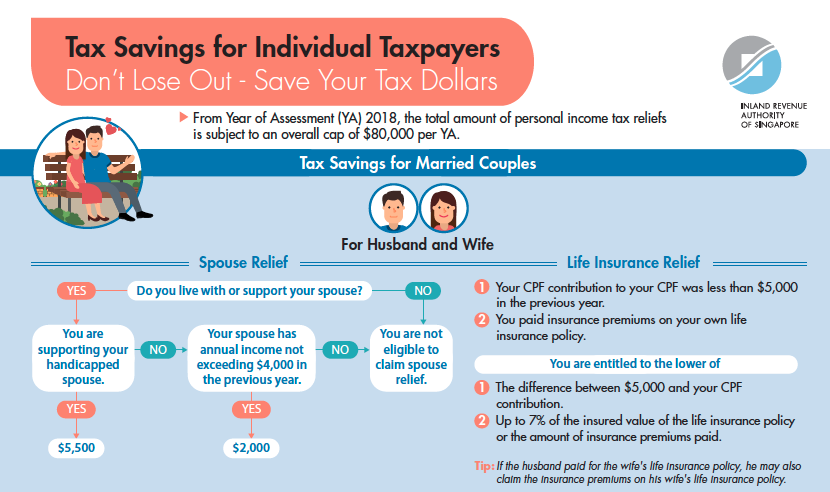

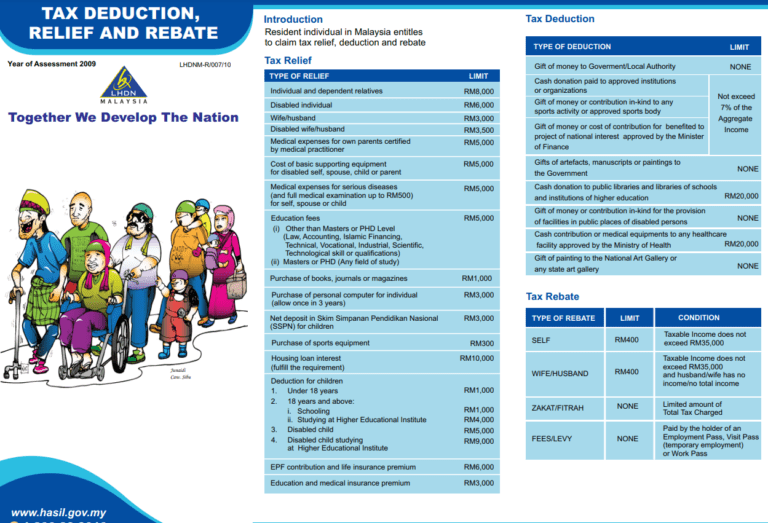

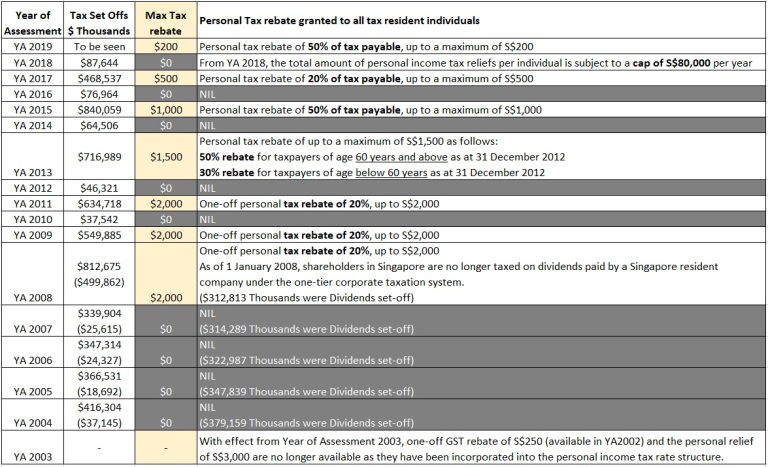

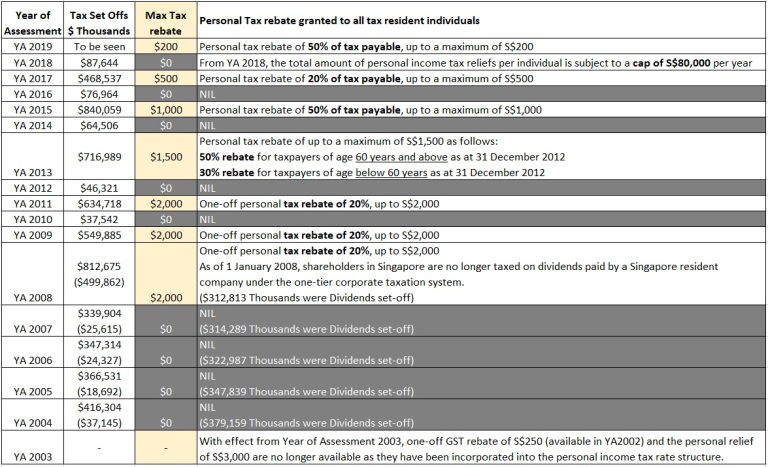

Web 15 lignes nbsp 0183 32 3 mai 2023 nbsp 0183 32 Resident individuals are entitled to certain personal reliefs and deductions and are subject to graduated tax rates ranging from 0 to 22 24 from

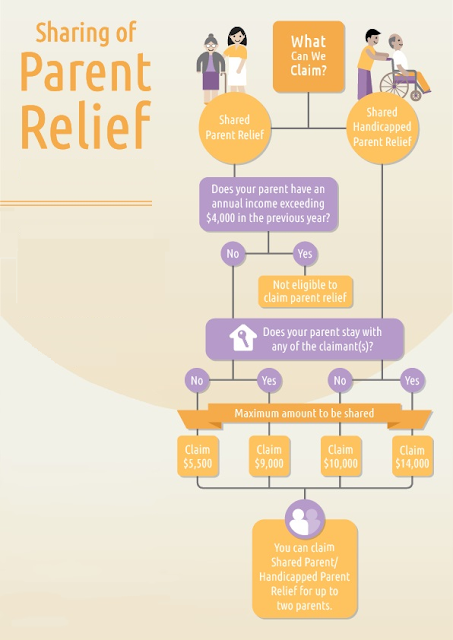

Web Tax Reliefs and Rebate Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second

Difference Between Tax Relief And Tax Rebate Singapore cover a large variety of printable, downloadable materials available online at no cost. The resources are offered in a variety forms, including worksheets, templates, coloring pages, and more. The beauty of Difference Between Tax Relief And Tax Rebate Singapore is their flexibility and accessibility.

More of Difference Between Tax Relief And Tax Rebate Singapore

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Web 1 Regional Headquarters Award 2 International Headquarters Award PWCS Tier 1 co funding ratios Mergers and Acquisitions Allowance Capital allowances Deduction on

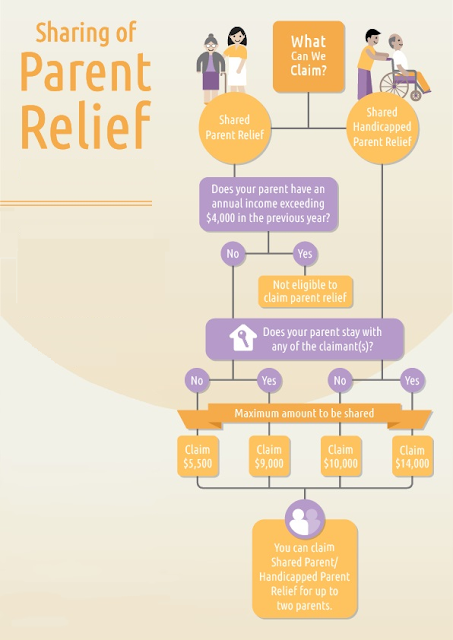

Web Tax reliefs and rebates in Singapore are used to encourage filial piety family formation and even the advancement of certain skills through these reliefs given in support of the

The Difference Between Tax Relief And Tax Rebate Singapore have gained huge popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

customization There is the possibility of tailoring print-ready templates to your specific requirements whether you're designing invitations or arranging your schedule or even decorating your house.

-

Educational Value Educational printables that can be downloaded for free provide for students of all ages. This makes them a vital source for educators and parents.

-

Affordability: Instant access to various designs and templates helps save time and effort.

Where to Find more Difference Between Tax Relief And Tax Rebate Singapore

A Guide To Taxes And Tax Relief R singaporefi

A Guide To Taxes And Tax Relief R singaporefi

Web 24 janv 2020 nbsp 0183 32 For the second child 20 of earned income is eligible for tax relief For the third and subsequent children 25 of earned income is eligible for tax relief The percentage of tax rebate can also be added

Web Articles CPF amp SRS Understanding the latest Singapore income tax reliefs 2022 Updated 3 Nov 2022 published 4 Dec 2020 While Singapore has one of the lowest

After we've peaked your curiosity about Difference Between Tax Relief And Tax Rebate Singapore we'll explore the places you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection in Difference Between Tax Relief And Tax Rebate Singapore for different needs.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- These blogs cover a broad variety of topics, ranging from DIY projects to planning a party.

Maximizing Difference Between Tax Relief And Tax Rebate Singapore

Here are some inventive ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets for free to aid in learning at your home for the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars with to-do lists, planners, and meal planners.

Conclusion

Difference Between Tax Relief And Tax Rebate Singapore are an abundance with useful and creative ideas that satisfy a wide range of requirements and needs and. Their availability and versatility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast array of Difference Between Tax Relief And Tax Rebate Singapore today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes, they are! You can print and download these files for free.

-

Does it allow me to use free printables for commercial use?

- It's all dependent on the rules of usage. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright problems with Difference Between Tax Relief And Tax Rebate Singapore?

- Some printables may have restrictions regarding usage. Always read the terms and conditions offered by the creator.

-

How do I print Difference Between Tax Relief And Tax Rebate Singapore?

- Print them at home using the printer, or go to a print shop in your area for more high-quality prints.

-

What software do I require to view printables at no cost?

- Most PDF-based printables are available in PDF format, which can be opened using free software, such as Adobe Reader.

Freelancer Guide All You Need To Know About Your Income Taxes

Index Of wp content uploads 2022 03

Check more sample of Difference Between Tax Relief And Tax Rebate Singapore below

All Income Earned In Singapore Is Subject To Tax However Singapore

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022

How To Reduce Your Income Tax In Singapore make Use Of These Tax

How To Reduce Your Income Tax In Singapore make Use Of These Tax

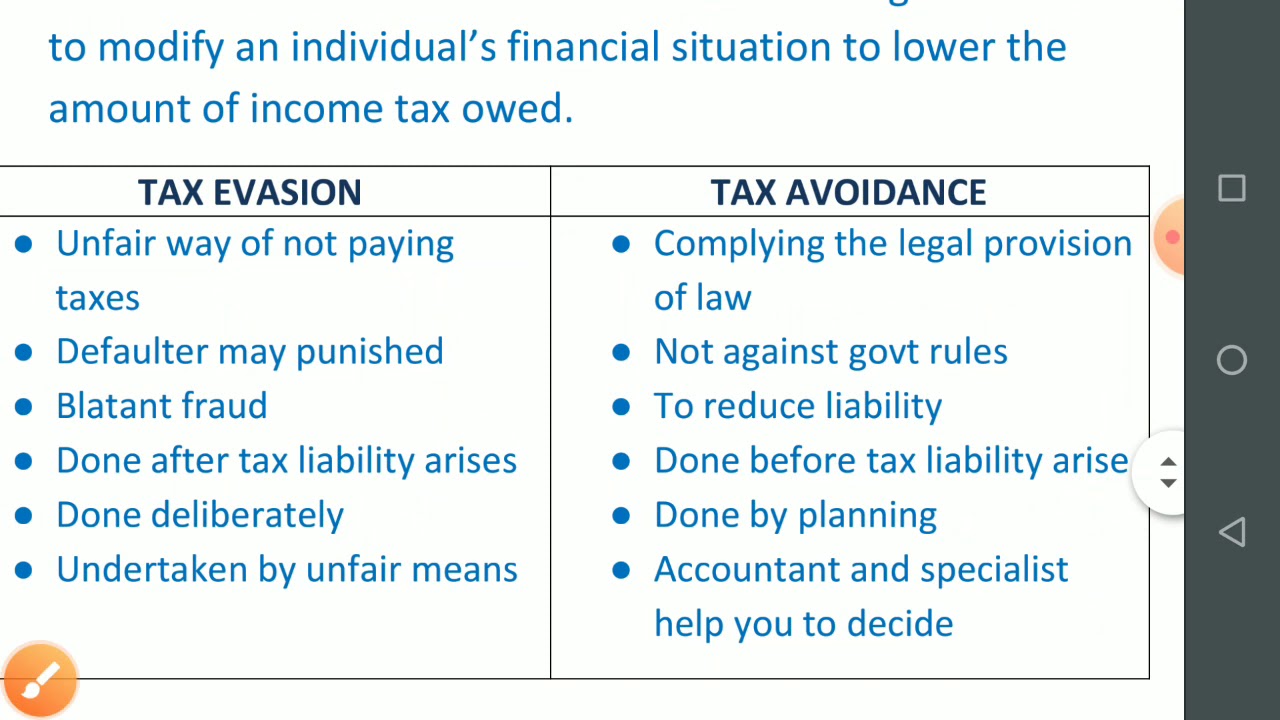

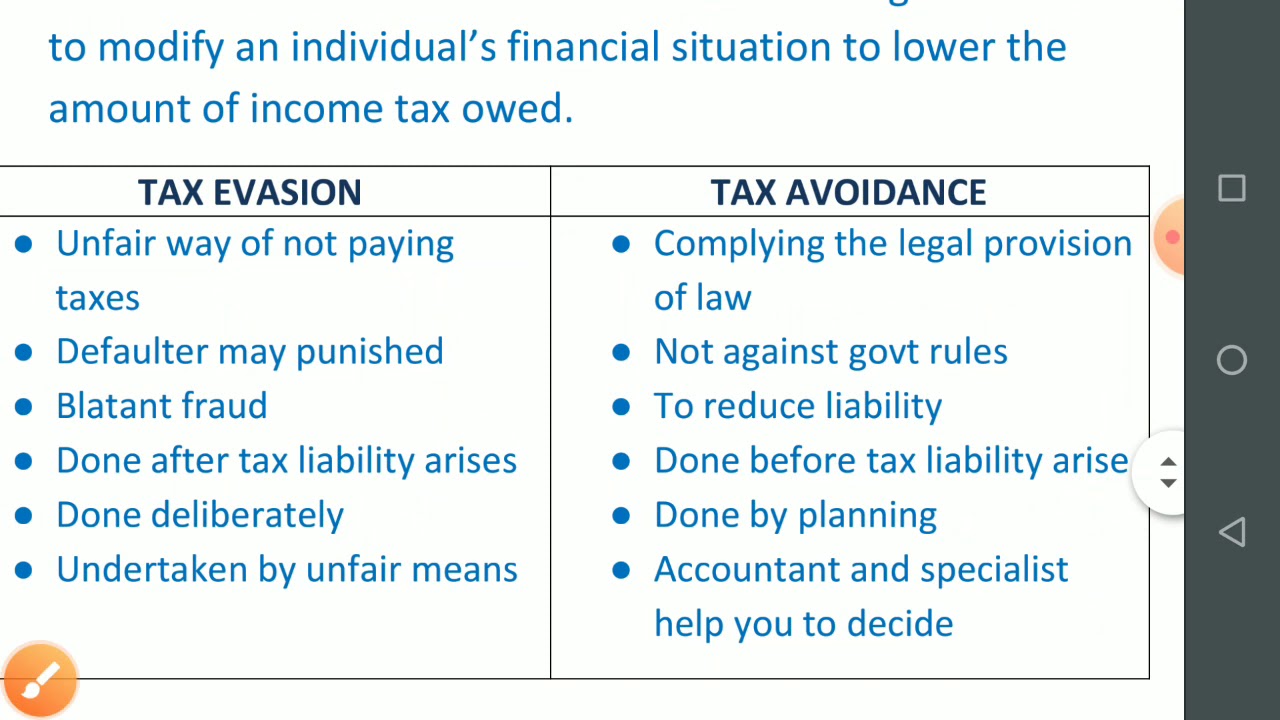

Tax Evasion And Tax Avoidance YouTube

https://www.madeforfamilies.gov.sg/.../tax-relief-and-rebates

Web Tax Reliefs and Rebate Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second

https://www.iras.gov.sg/.../tax-reliefs/parenthood-tax-rebate-(ptr)

Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR

Web Tax Reliefs and Rebate Parenthood Tax Rebate If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second

Web Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR

How To Reduce Your Income Tax In Singapore make Use Of These Tax

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

How To Reduce Your Income Tax In Singapore make Use Of These Tax

Tax Evasion And Tax Avoidance YouTube

Difference Between Rebate And Relief Act Printable Rebate Form

Why I Stress That Working Singaporeans Should Maximise Their Tax

Why I Stress That Working Singaporeans Should Maximise Their Tax

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022