In this age of electronic devices, in which screens are the norm The appeal of tangible printed objects isn't diminished. In the case of educational materials project ideas, artistic or just adding an element of personalization to your home, printables for free are now a vital source. For this piece, we'll dive into the world "Disability Tax Refund Form," exploring what they are, where they are, and ways they can help you improve many aspects of your life.

Get Latest Disability Tax Refund Form Below

Disability Tax Refund Form

Disability Tax Refund Form -

You won t qualify for the credit You receive only 300 in SSDI per month but you have 18 000 in an annual taxable disability pension You won t qualify for the credit If you do qualify for the credit for the disabled the amount ranges from 3 750 to 7 500 depending on your filing status and income

If you were eligible for the DTC in past years but did not claim the disability amount you may be able to claim it going back up to 10 years If you did not check the box on the DTC application form asking the CRA to adjust your previous returns you may either A credit from past years may result in a refund on your tax return

Printables for free cover a broad selection of printable and downloadable documents that can be downloaded online at no cost. These materials come in a variety of kinds, including worksheets coloring pages, templates and more. The great thing about Disability Tax Refund Form lies in their versatility and accessibility.

More of Disability Tax Refund Form

Disability Tax Credit Application Form T2201 Guide

Disability Tax Credit Application Form T2201 Guide

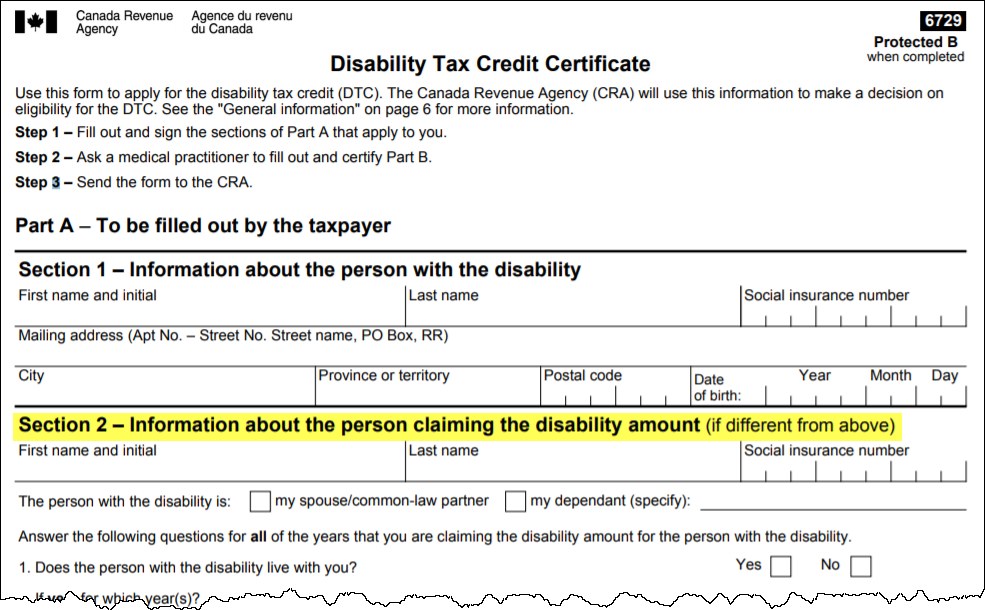

There are 2 ways to submit a completed Form T2201 Disability Tax Credit Certificate and any related documents to the CRA Online If you have a PDF or scanned version of the form the person with the impairment may sign into My Account and select Submit documents Sign in to My Account Register By mail

The Disability Tax Credit Resource Guide Updated March 2024 The Most Comprehensive and Up to Date 2024 Disability Tax Credit Guide We Cover the Most Recent Info on the Application Process Eligibility Criteria T2201 Form and How To Claim The Credit FREE ASSESSMENT

Printables for free have gained immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Individualization Your HTML0 customization options allow you to customize printables to fit your particular needs, whether it's designing invitations, organizing your schedule, or even decorating your home.

-

Education Value Education-related printables at no charge are designed to appeal to students of all ages, making the perfect resource for educators and parents.

-

Easy to use: Quick access to a variety of designs and templates will save you time and effort.

Where to Find more Disability Tax Refund Form

Cancer Cavus Foot Disability Tax Credit Get Tax Refund Today

Cancer Cavus Foot Disability Tax Credit Get Tax Refund Today

If you have any further questions or concerns regarding the DTC e g filling out the T2201 form our virtual branch team is available to assist you Monday to Friday from 7 30 a m to 6 30 p m EST 1400 522 University Avenue Toronto Ontario M5G 2R5 Donation Hotline 1 800 BANTING 226 8464 diabetes ca

For tax year 2021 The amount of qualifying expenses increases from 3 000 to 8 000 for one qualifying person and from 6 000 to 16 000 for two or more qualifying individuals The beginning of the reduction of the credit is increased from 15 000 to 125 000 of adjusted gross income AGI

Now that we've piqued your interest in Disability Tax Refund Form, let's explore where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection and Disability Tax Refund Form for a variety purposes.

- Explore categories such as design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- These blogs cover a broad array of topics, ranging that range from DIY projects to party planning.

Maximizing Disability Tax Refund Form

Here are some ideas for you to get the best use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print free worksheets for teaching at-home also in the classes.

3. Event Planning

- Design invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Disability Tax Refund Form are an abundance of creative and practical resources catering to different needs and desires. Their accessibility and flexibility make them a great addition to both personal and professional life. Explore the plethora of Disability Tax Refund Form now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I use free printables for commercial use?

- It's all dependent on the terms of use. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Are there any copyright issues with Disability Tax Refund Form?

- Certain printables could be restricted regarding their use. Check the conditions and terms of use provided by the author.

-

How can I print Disability Tax Refund Form?

- Print them at home with the printer, or go to a local print shop for superior prints.

-

What program do I need to open printables for free?

- The majority of printed documents are as PDF files, which can be opened with free software such as Adobe Reader.

Missouri Gas Tax Refund Form Veche info 16

Does The CRA Have A Disability Tax Credit Certificate form T2201 On

Check more sample of Disability Tax Refund Form below

Juvenile Arthritis Disability Tax Credit Get A Tax Refund Today

Stroke Disability Tax Credit Get A Tax Refund Today

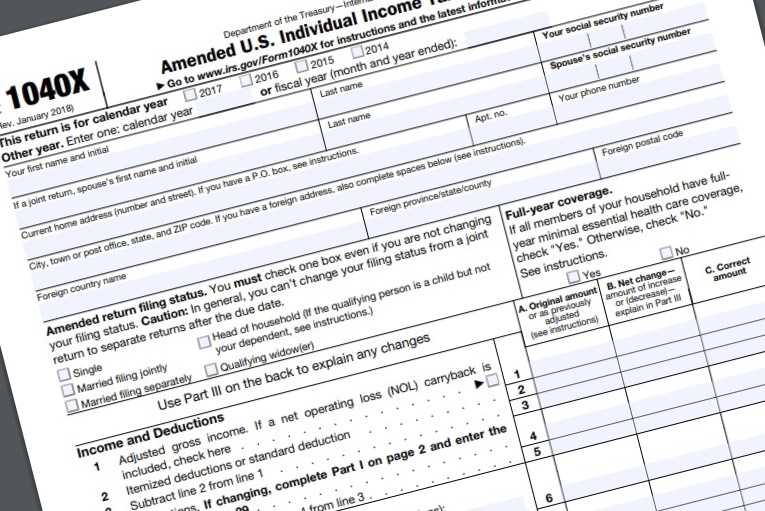

1040X

How To Check Your IRS Refund Status LoveToKnow

IRS Announcement Nearly 1 5 Billion Currently Available In Unclaimed

Paralysation Disability Tax Credit Get A Tax Refund Today

https://www. canada.ca /.../disability-tax-credit/claiming-dtc.html

If you were eligible for the DTC in past years but did not claim the disability amount you may be able to claim it going back up to 10 years If you did not check the box on the DTC application form asking the CRA to adjust your previous returns you may either A credit from past years may result in a refund on your tax return

https://www. canada.ca /.../forms/t2201.html

Individuals with a severe and prolonged impairment in physical or mental functions can use this form to apply for the disability tax credit Ways to get the form Download and fill out with Acrobat Reader

If you were eligible for the DTC in past years but did not claim the disability amount you may be able to claim it going back up to 10 years If you did not check the box on the DTC application form asking the CRA to adjust your previous returns you may either A credit from past years may result in a refund on your tax return

Individuals with a severe and prolonged impairment in physical or mental functions can use this form to apply for the disability tax credit Ways to get the form Download and fill out with Acrobat Reader

How To Check Your IRS Refund Status LoveToKnow

Stroke Disability Tax Credit Get A Tax Refund Today

IRS Announcement Nearly 1 5 Billion Currently Available In Unclaimed

Paralysation Disability Tax Credit Get A Tax Refund Today

Veterans Urged To Claim Refund For Tax Overpayments On Disability Severance

Ileostomy Disability Tax Credit Get Tax Refund Today

Ileostomy Disability Tax Credit Get Tax Refund Today

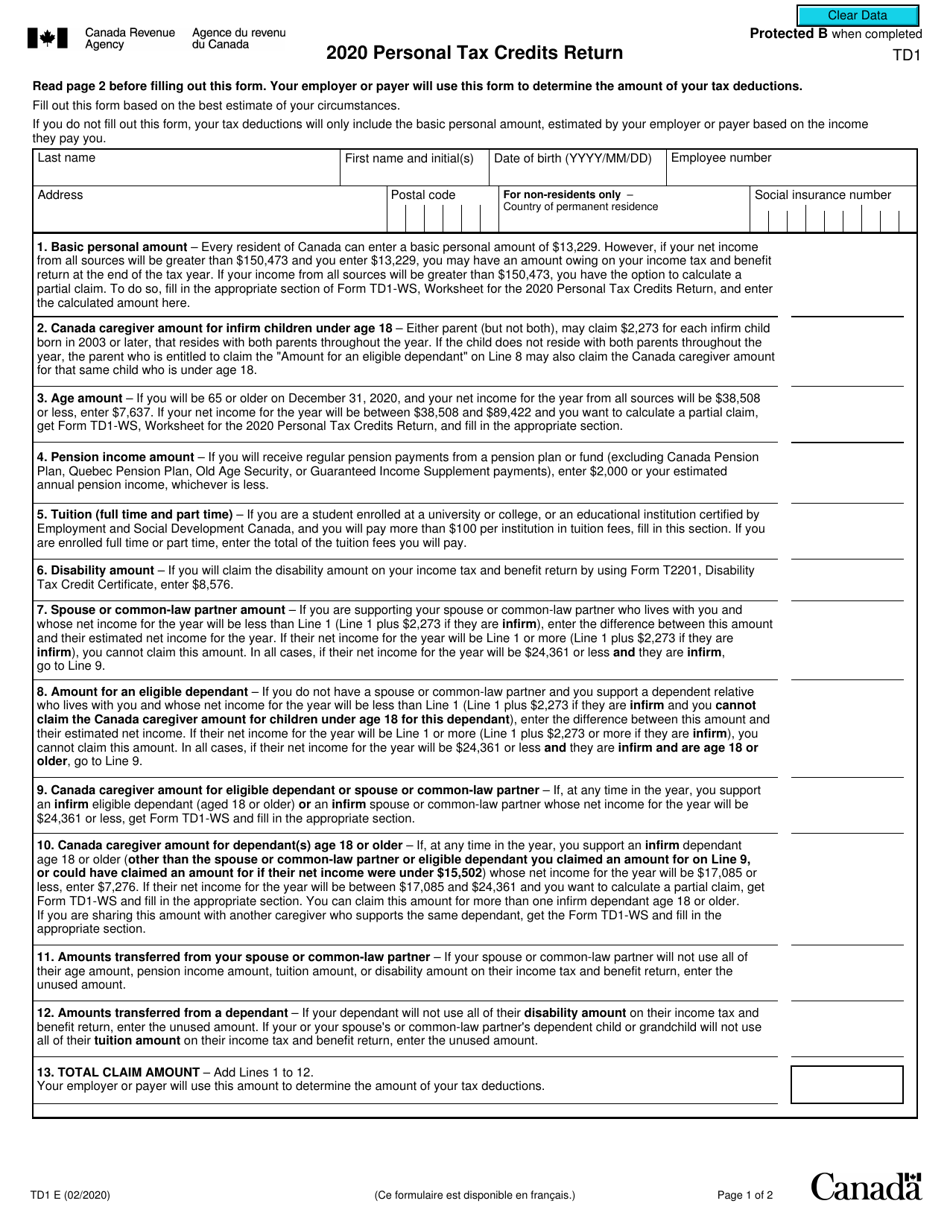

Form TD1 2020 Fill Out Sign Online And Download Fillable PDF