In this day and age when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed products hasn't decreased. If it's to aid in education and creative work, or just adding personal touches to your space, Discount Received Accounting Entry have proven to be a valuable source. In this article, we'll take a dive deeper into "Discount Received Accounting Entry," exploring what they are, where to get them, as well as how they can enhance various aspects of your life.

Get Latest Discount Received Accounting Entry Below

Discount Received Accounting Entry

Discount Received Accounting Entry -

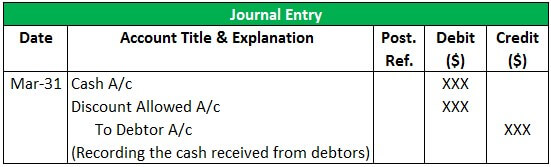

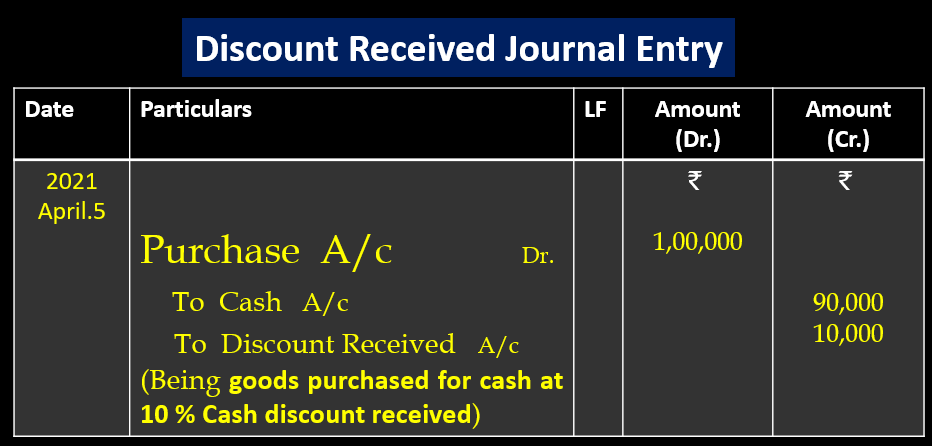

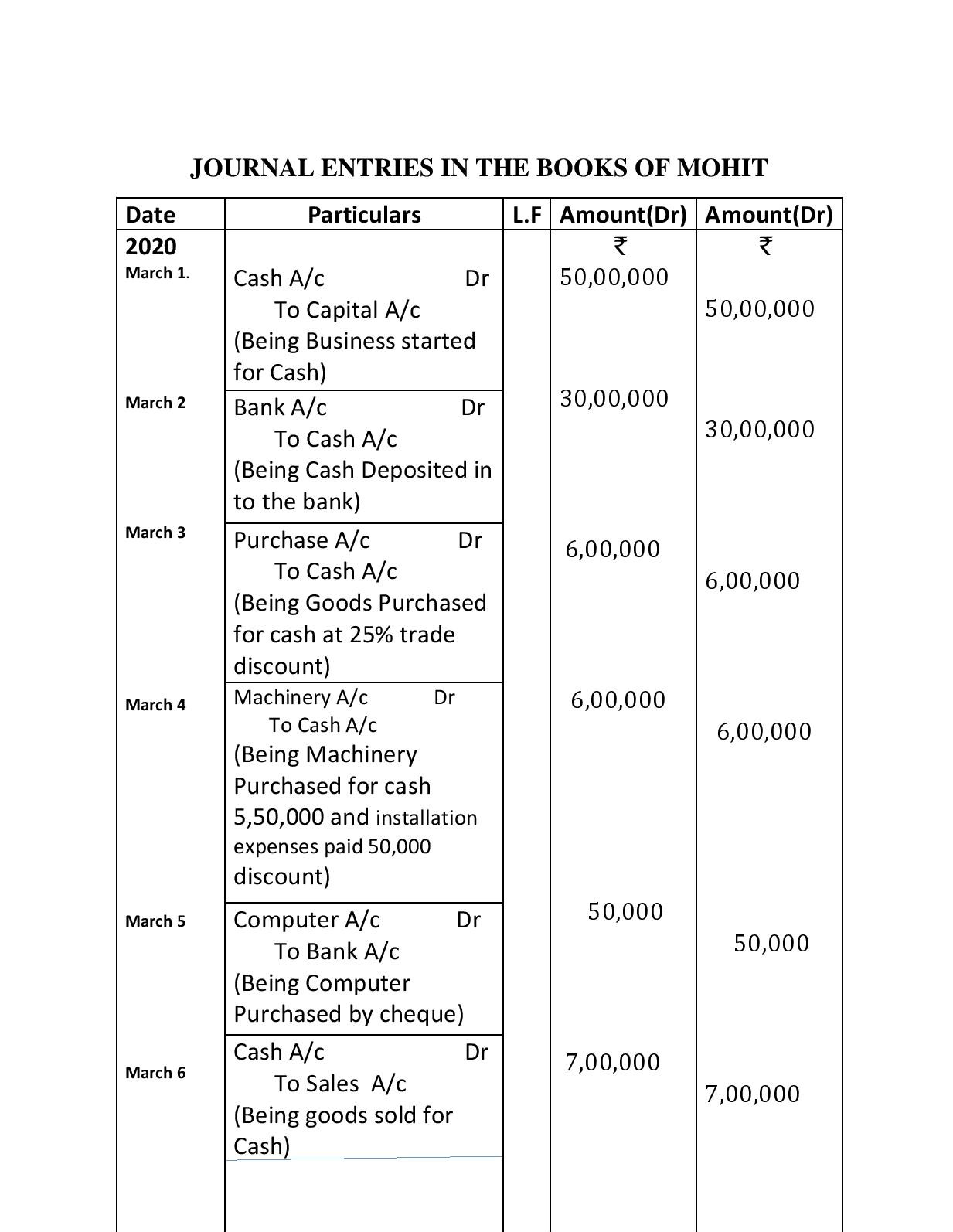

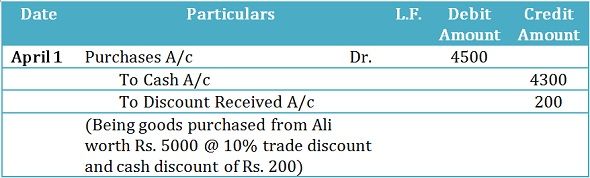

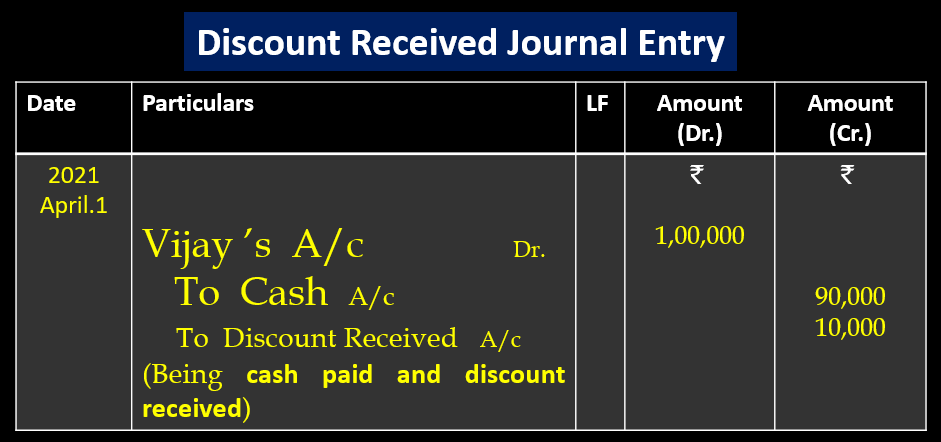

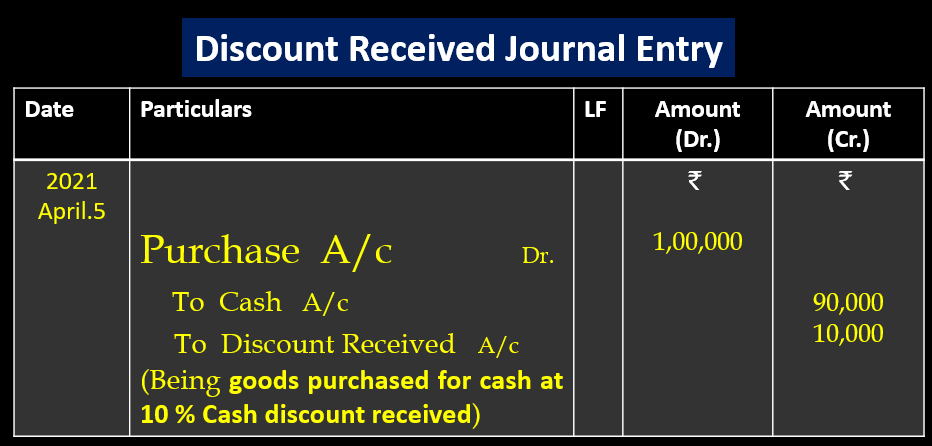

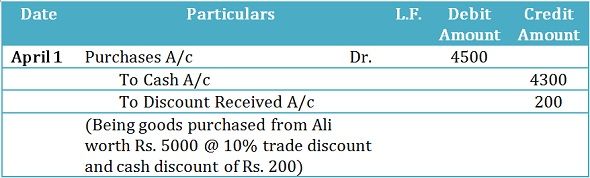

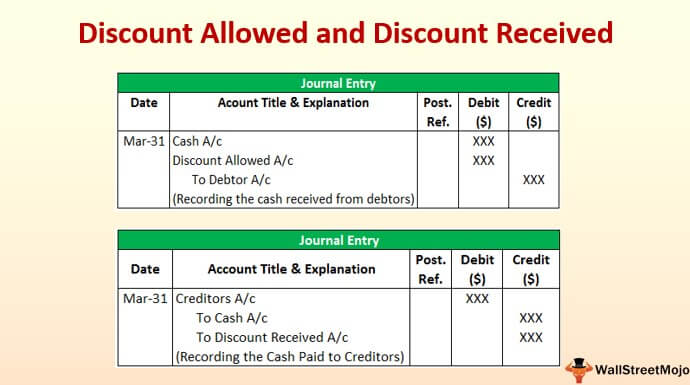

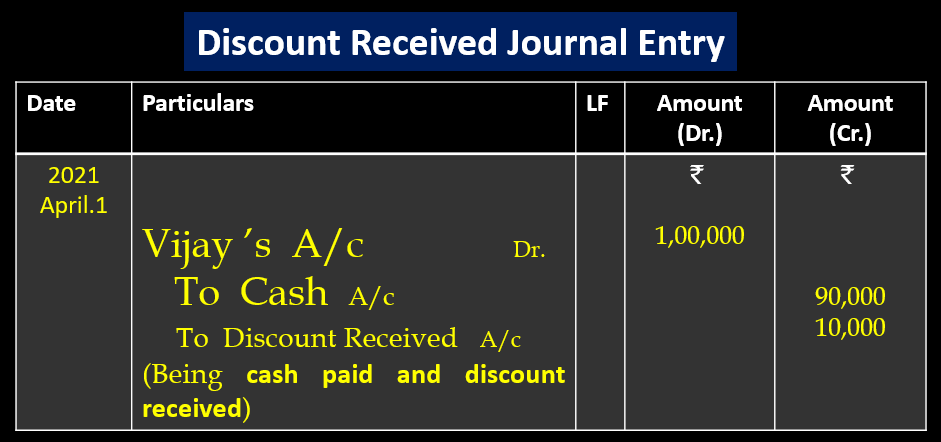

Overview Some suppliers may provide a discount when the company makes an early payment e g within 10 days of credit purchase Likewise when the company receives the discount by paying the suppliers during the discount period it needs to make a proper journal entry for the discount received

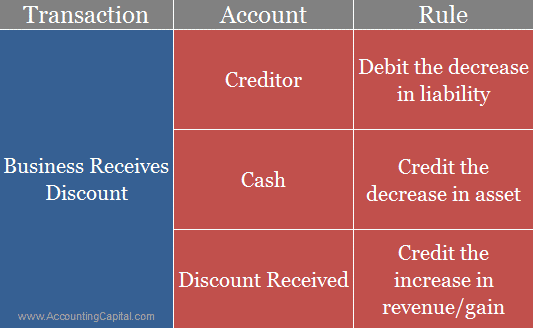

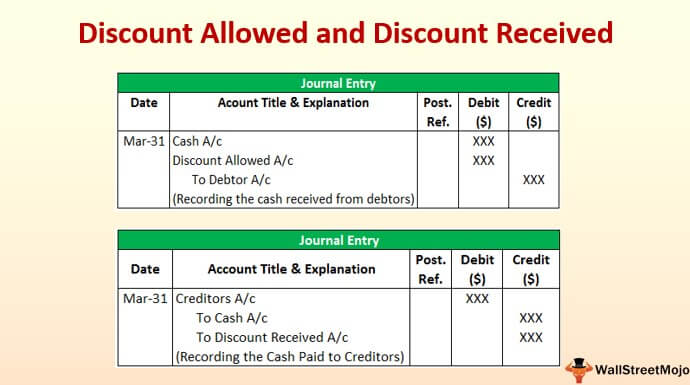

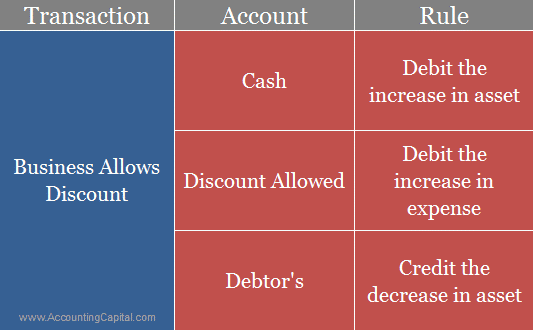

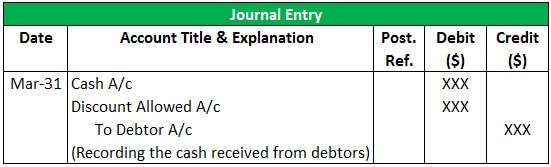

Discounts received and discounts allowed are on different sides of the same coin In any transaction involving a discount one party allows a discount and another receives the discount For the buyer the discount received is an income of the buyer and the discount allowed is the seller s expense

Discount Received Accounting Entry encompass a wide assortment of printable materials that are accessible online for free cost. The resources are offered in a variety types, like worksheets, templates, coloring pages, and much more. One of the advantages of Discount Received Accounting Entry is in their versatility and accessibility.

More of Discount Received Accounting Entry

Discount Received Journal Entry

Discount Received Journal Entry

Discounts may be classified into two types Trade Discounts offered at the time of purchase for example when goods are purchased in bulk or to retain loyal customers Cash Discount offered to customers as an incentive for timely payment of their liabilities in respect of credit purchases

Accounting for discounts Prompt payment discounts also known as settlement or cash discounts are offered to credit customers to encourage prompt payment of their account

The Discount Received Accounting Entry have gained huge popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization This allows you to modify printed materials to meet your requirements, whether it's designing invitations, organizing your schedule, or even decorating your home.

-

Educational Use: Printing educational materials for no cost cater to learners from all ages, making these printables a powerful tool for parents and teachers.

-

Simple: immediate access the vast array of design and templates cuts down on time and efforts.

Where to Find more Discount Received Accounting Entry

What Is The Journal Entry For Discount Received Accounting Capital

What Is The Journal Entry For Discount Received Accounting Capital

Basically the cash discount received journal entry is a credit entry because it represents a reduction in expenses The exceptions to this rule are the accounts Sales Returns Sales Allowances and Sales Discounts these accounts have debit balances because they are reductions to sales

The journal entry for the receipt of a discount will involve a debit to Accounts Payable and a credit to Cash This is because a discount received is a reduction of the amount owed by the purchaser and is recorded as a

We've now piqued your interest in Discount Received Accounting Entry Let's look into where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Discount Received Accounting Entry designed for a variety reasons.

- Explore categories like interior decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets along with flashcards, as well as other learning tools.

- It is ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- These blogs cover a broad spectrum of interests, from DIY projects to planning a party.

Maximizing Discount Received Accounting Entry

Here are some ideas how you could make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to aid in learning at your home, or even in the classroom.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings and birthdays.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Discount Received Accounting Entry are a treasure trove of innovative and useful resources that cater to various needs and interest. Their accessibility and flexibility make them an essential part of your professional and personal life. Explore the vast world of Discount Received Accounting Entry now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Discount Received Accounting Entry truly free?

- Yes, they are! You can print and download these tools for free.

-

Can I utilize free printouts for commercial usage?

- It depends on the specific conditions of use. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may contain restrictions concerning their use. Make sure you read the terms and conditions provided by the creator.

-

How can I print Discount Received Accounting Entry?

- You can print them at home using a printer or visit the local print shop for higher quality prints.

-

What software must I use to open printables at no cost?

- The majority of printed documents are as PDF files, which can be opened with free software, such as Adobe Reader.

Discount Received Journal Entry

Journal Entry Of Discount Received And Discount Allowed In Accounting

Check more sample of Discount Received Accounting Entry below

Outstanding 30 Journal Entries With Ledger Trial Balance And Final

Discount Allowed And Discount Received Journal Entries With Examples

Discount Received Journal Entry KaydenceminJoyce

Difference Between Trade Discount And Cash Discount with Example

Discount Received Journal Entry Bhardwaj Accounting Academy

Discount Allowed Double Entry

https://www.wallstreetmojo.com/discount-allowed...

Discounts received and discounts allowed are on different sides of the same coin In any transaction involving a discount one party allows a discount and another receives the discount For the buyer the discount received is an income of the buyer and the discount allowed is the seller s expense

https://accounting-simplified.com/financial/...

Discount Received Income Statement Crediting discount received has the effect of reducing gross purchases by the amount of cash discount received Consequently payables are debited to reduce their balance to the amount that is expected to be paid to them i e net of cash discount

Discounts received and discounts allowed are on different sides of the same coin In any transaction involving a discount one party allows a discount and another receives the discount For the buyer the discount received is an income of the buyer and the discount allowed is the seller s expense

Discount Received Income Statement Crediting discount received has the effect of reducing gross purchases by the amount of cash discount received Consequently payables are debited to reduce their balance to the amount that is expected to be paid to them i e net of cash discount

Difference Between Trade Discount And Cash Discount with Example

Discount Allowed And Discount Received Journal Entries With Examples

Discount Received Journal Entry Bhardwaj Accounting Academy

Discount Allowed Double Entry

Discount Allowed Discount Received Accounting Basics YouTube

Journal Entry For Discount Allowed And Received GeeksforGeeks

Journal Entry For Discount Allowed And Received GeeksforGeeks

Purchases With Discount gross Principlesofaccounting