In this age of electronic devices, where screens dominate our lives but the value of tangible printed materials hasn't faded away. Whatever the reason, whether for education in creative or artistic projects, or simply to add an individual touch to the area, Does A Wood Burning Stove Qualify For Energy Tax Credit are now a useful resource. Through this post, we'll take a dive through the vast world of "Does A Wood Burning Stove Qualify For Energy Tax Credit," exploring the benefits of them, where they are, and how they can add value to various aspects of your life.

Get Latest Does A Wood Burning Stove Qualify For Energy Tax Credit Below

Does A Wood Burning Stove Qualify For Energy Tax Credit

Does A Wood Burning Stove Qualify For Energy Tax Credit -

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

A The tax credit was signed into law on December 21 2020 and stoves purchased and installed in 2021 and 2022 will qualify for the 26 tax credit In 2023 the tax credit

Does A Wood Burning Stove Qualify For Energy Tax Credit include a broad selection of printable and downloadable documents that can be downloaded online at no cost. These printables come in different styles, from worksheets to coloring pages, templates and much more. The appealingness of Does A Wood Burning Stove Qualify For Energy Tax Credit lies in their versatility and accessibility.

More of Does A Wood Burning Stove Qualify For Energy Tax Credit

See If You Qualify For Duke Energy s Wood Stove Changeout Program

See If You Qualify For Duke Energy s Wood Stove Changeout Program

In fact most wood stoves inserts and fireplaces on the Market do not qualify Why The legislation aimed at helping consumers get more efficient heaters

Congress removed biomass stoves from section 25 C which had provided a 300 tax credit up until Dec 31 to prevent a double benefit or double dipping under

The Does A Wood Burning Stove Qualify For Energy Tax Credit have gained huge popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

customization: This allows you to modify the templates to meet your individual needs whether it's making invitations or arranging your schedule or even decorating your house.

-

Educational Value Downloads of educational content for free offer a wide range of educational content for learners from all ages, making them a vital instrument for parents and teachers.

-

Easy to use: Access to various designs and templates cuts down on time and efforts.

Where to Find more Does A Wood Burning Stove Qualify For Energy Tax Credit

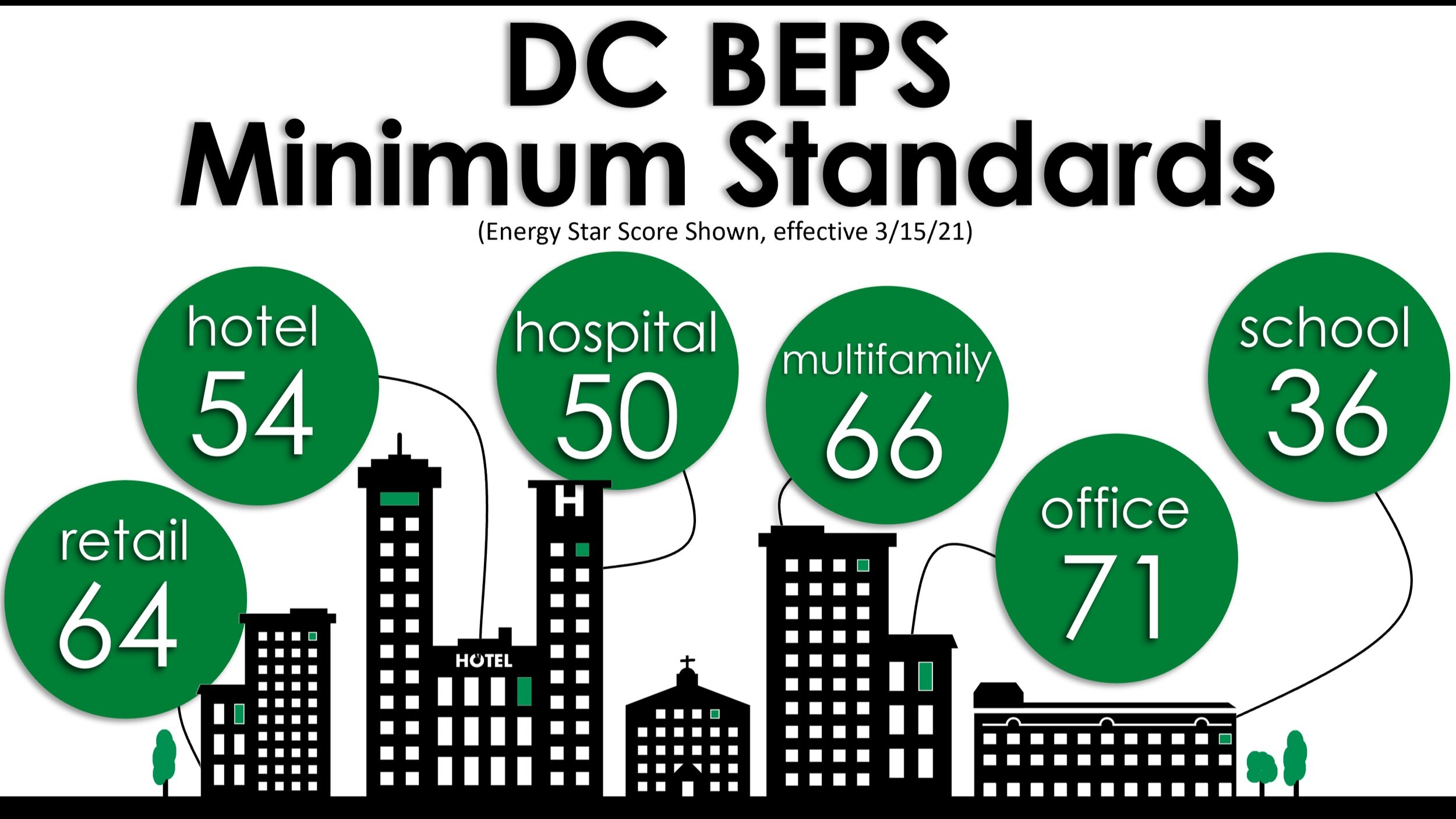

What Is DC BEPS Building Energy Performance Standard Era

What Is DC BEPS Building Energy Performance Standard Era

With the signing of the 2022 Inflation Reduction Act high efficiency wood stoves now qualify for a 30 tax credit under Section 25 C of the Internal Revenue Code This tax credit is

Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped

We've now piqued your curiosity about Does A Wood Burning Stove Qualify For Energy Tax Credit Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Does A Wood Burning Stove Qualify For Energy Tax Credit to suit a variety of needs.

- Explore categories such as decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free or flashcards as well as learning materials.

- Ideal for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs covered cover a wide selection of subjects, starting from DIY projects to planning a party.

Maximizing Does A Wood Burning Stove Qualify For Energy Tax Credit

Here are some fresh ways of making the most of Does A Wood Burning Stove Qualify For Energy Tax Credit:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free for teaching at-home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Does A Wood Burning Stove Qualify For Energy Tax Credit are an abundance of practical and imaginative resources which cater to a wide range of needs and interests. Their availability and versatility make them a great addition to your professional and personal life. Explore the vast array of Does A Wood Burning Stove Qualify For Energy Tax Credit now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes, they are! You can download and print these tools for free.

-

Can I use free printables to make commercial products?

- It is contingent on the specific usage guidelines. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with Does A Wood Burning Stove Qualify For Energy Tax Credit?

- Some printables could have limitations on usage. Always read the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home using your printer or visit a local print shop for premium prints.

-

What software do I need to open printables for free?

- The majority of PDF documents are provided with PDF formats, which can be opened with free software such as Adobe Reader.

You Could Qualify For A 300 Tax Credit The Biomass Stove Tax Credit

What Home Improvements Qualify For Tax Credit Energy Texas

Check more sample of Does A Wood Burning Stove Qualify For Energy Tax Credit below

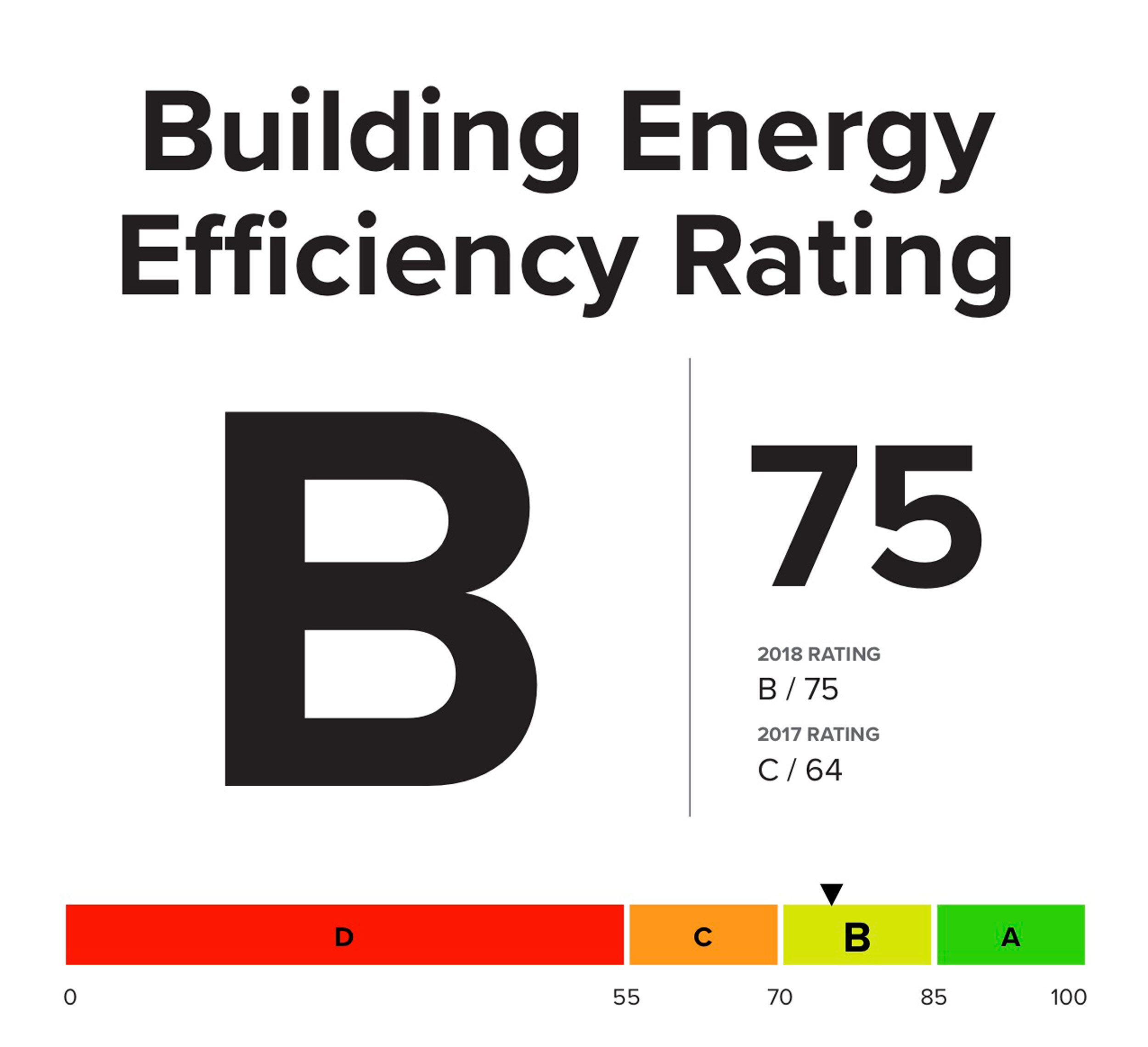

Understanding New York City s Building Energy Efficiency Rating System

Feens Financing Promotions And Sales

Federal Tax Credit Wood Stove 2022 Get What You Need For Free

Federal Tax Credit Wood Stove 2022 Get What You Need For Free

Energy Tax Credit Which Home Improvements Qualify SCL

Financing Energy Efficient Homes Department Of Energy

https://woodstove.com/tax-credit-initiatives

A The tax credit was signed into law on December 21 2020 and stoves purchased and installed in 2021 and 2022 will qualify for the 26 tax credit In 2023 the tax credit

https://ttlc.intuit.com/community/tax-credits...

How do I claim the credit for the installation of a qualified wood stove I am due a 26 credit but Turbotax is only calculating a typical home energy credit TurboTax

A The tax credit was signed into law on December 21 2020 and stoves purchased and installed in 2021 and 2022 will qualify for the 26 tax credit In 2023 the tax credit

How do I claim the credit for the installation of a qualified wood stove I am due a 26 credit but Turbotax is only calculating a typical home energy credit TurboTax

Federal Tax Credit Wood Stove 2022 Get What You Need For Free

Feens Financing Promotions And Sales

Energy Tax Credit Which Home Improvements Qualify SCL

Financing Energy Efficient Homes Department Of Energy

Rheem Heat Pump Reviews And Prices 2021 Trend Repository

How Does A Wood Stove Work HomeServe USA

How Does A Wood Stove Work HomeServe USA

What Roof Shingles Qualify For Energy Tax Credit A Guide To Saving And