In the age of digital, where screens dominate our lives however, the attraction of tangible printed material hasn't diminished. Whatever the reason, whether for education or creative projects, or simply adding an element of personalization to your home, printables for free are now an essential resource. For this piece, we'll dive into the world "Does A Wood Stove Qualify For Energy Tax Credit," exploring what they are, where to find them, and how they can enhance various aspects of your daily life.

Get Latest Does A Wood Stove Qualify For Energy Tax Credit Below

Does A Wood Stove Qualify For Energy Tax Credit

Does A Wood Stove Qualify For Energy Tax Credit -

Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped at 2 000 annually based on the full cost purchase and installation of the unit

A The tax credit was signed into law on December 21 2020 and stoves purchased and installed in 2021 and 2022 will qualify for the 26 tax credit In 2023 the tax credit reduces to 22 The sales receipt must indicate that the purchase was made between January 1 2021 and December 31 2022

Does A Wood Stove Qualify For Energy Tax Credit cover a large assortment of printable material that is available online at no cost. These resources come in many styles, from worksheets to templates, coloring pages and more. The appeal of printables for free is in their variety and accessibility.

More of Does A Wood Stove Qualify For Energy Tax Credit

You Could Qualify For A 300 Tax Credit The Biomass Stove Tax Credit

You Could Qualify For A 300 Tax Credit The Biomass Stove Tax Credit

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

customization: You can tailor printing templates to your own specific requirements whether you're designing invitations planning your schedule or even decorating your home.

-

Educational Value Downloads of educational content for free provide for students of all ages, making these printables a powerful resource for educators and parents.

-

Easy to use: Quick access to a plethora of designs and templates helps save time and effort.

Where to Find more Does A Wood Stove Qualify For Energy Tax Credit

See If You Qualify For Duke Energy s Wood Stove Changeout Program

See If You Qualify For Duke Energy s Wood Stove Changeout Program

Do all pellet and wood fireplaces qualify for the federal tax credit The answer is no In fact most wood stoves inserts and fireplaces on the Market do not qualify Why The legislation aimed at helping consumers get more efficient heaters

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022

We've now piqued your interest in printables for free Let's see where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and Does A Wood Stove Qualify For Energy Tax Credit for a variety reasons.

- Explore categories such as interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- Ideal for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- The blogs are a vast spectrum of interests, starting from DIY projects to planning a party.

Maximizing Does A Wood Stove Qualify For Energy Tax Credit

Here are some creative ways ensure you get the very most use of Does A Wood Stove Qualify For Energy Tax Credit:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets to build your knowledge at home for the classroom.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Does A Wood Stove Qualify For Energy Tax Credit are an abundance of fun and practical tools for a variety of needs and desires. Their availability and versatility make them an invaluable addition to your professional and personal life. Explore the vast collection that is Does A Wood Stove Qualify For Energy Tax Credit today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes they are! You can print and download these items for free.

-

Can I use free templates for commercial use?

- It's contingent upon the specific terms of use. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables could have limitations on their use. Make sure to read the terms and conditions set forth by the author.

-

How can I print printables for free?

- You can print them at home using either a printer at home or in a print shop in your area for high-quality prints.

-

What program do I need to open printables for free?

- The majority of printed documents are in PDF format. These can be opened with free programs like Adobe Reader.

How Hot Does A Wood Stove Get Johnny Counterfit

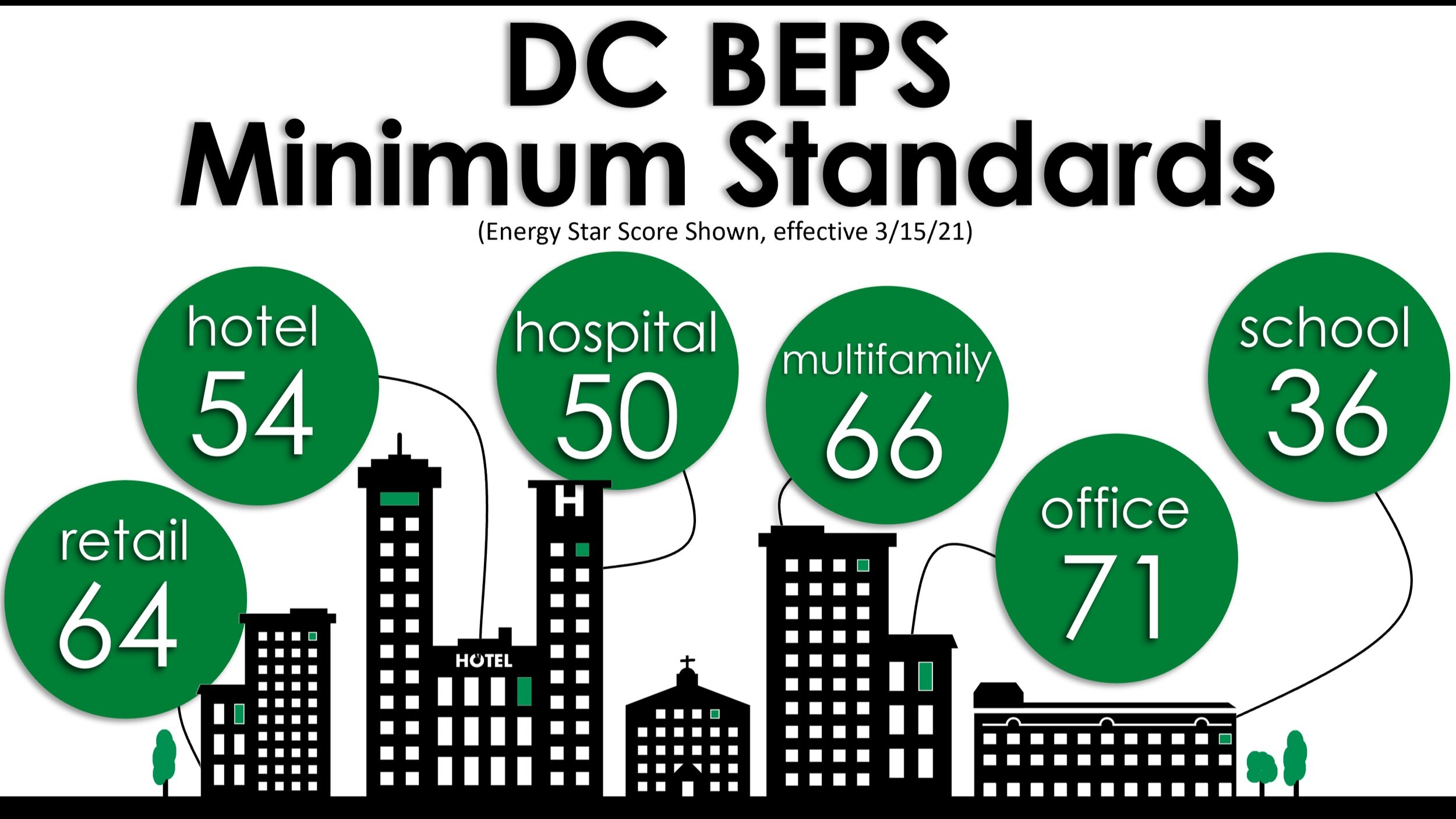

What Is DC BEPS Building Energy Performance Standard Era

Check more sample of Does A Wood Stove Qualify For Energy Tax Credit below

Does A Wood Stove Need Fire Brick Woodsy Acres

What Home Improvements Qualify For Tax Credit Energy Texas

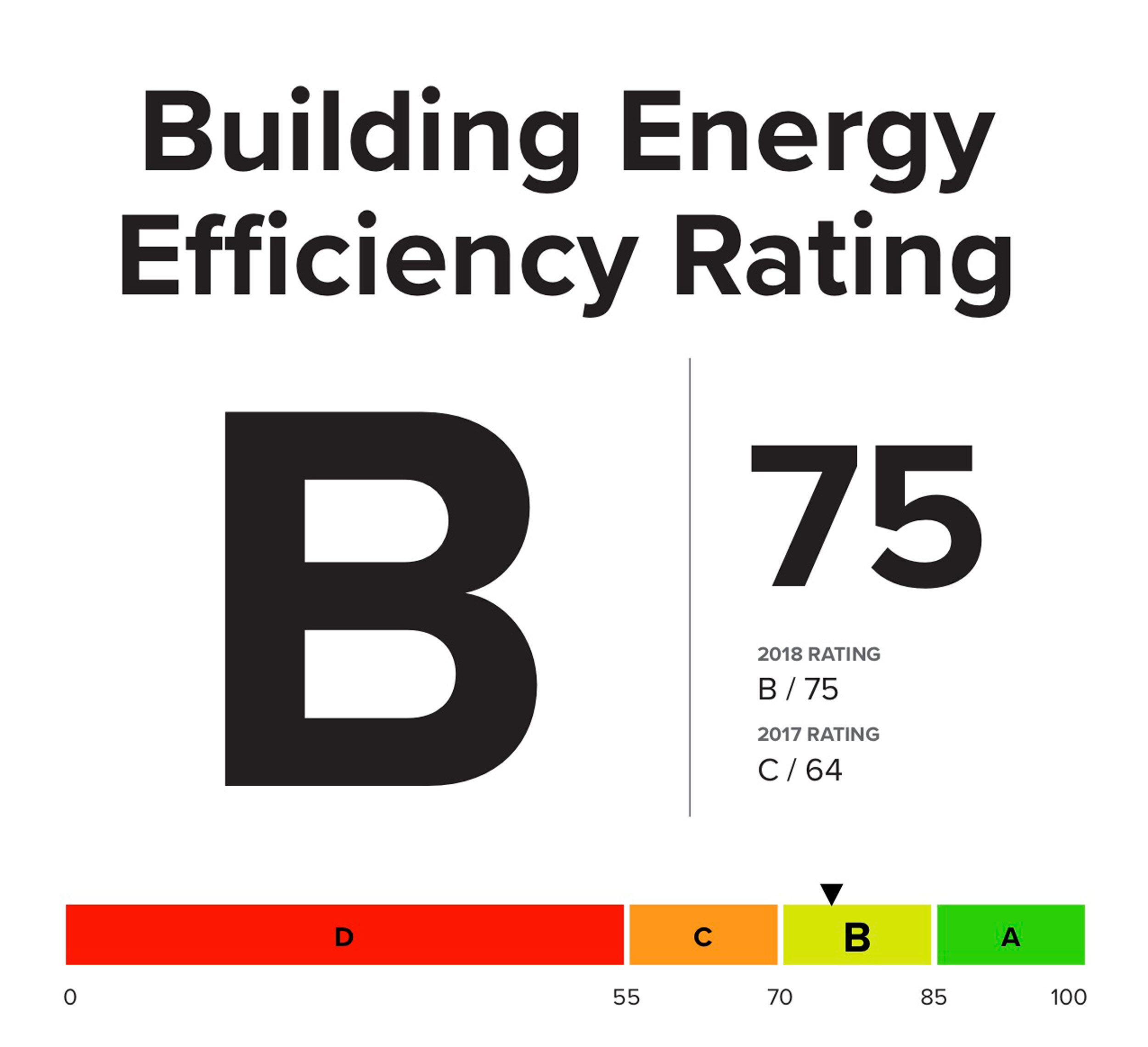

Understanding New York City s Building Energy Efficiency Rating System

Feens Financing Promotions And Sales

Does A Wood Stove Save Money

Federal Tax Credit Wood Stove 2022 Get What You Need For Free

https://woodstove.com/tax-credit-initiatives

A The tax credit was signed into law on December 21 2020 and stoves purchased and installed in 2021 and 2022 will qualify for the 26 tax credit In 2023 the tax credit reduces to 22 The sales receipt must indicate that the purchase was made between January 1 2021 and December 31 2022

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022

A The tax credit was signed into law on December 21 2020 and stoves purchased and installed in 2021 and 2022 will qualify for the 26 tax credit In 2023 the tax credit reduces to 22 The sales receipt must indicate that the purchase was made between January 1 2021 and December 31 2022

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022

Feens Financing Promotions And Sales

What Home Improvements Qualify For Tax Credit Energy Texas

Does A Wood Stove Save Money

Federal Tax Credit Wood Stove 2022 Get What You Need For Free

Energy Tax Credit Which Home Improvements Qualify SCL

Financing Energy Efficient Homes Department Of Energy

Financing Energy Efficient Homes Department Of Energy

Rheem Heat Pump Reviews And Prices 2021 Trend Repository