Today, where screens rule our lives but the value of tangible, printed materials hasn't diminished. If it's to aid in education project ideas, artistic or simply adding the personal touch to your space, Does Hawaii Tax My Pension can be an excellent resource. Through this post, we'll dive through the vast world of "Does Hawaii Tax My Pension," exploring their purpose, where to get them, as well as what they can do to improve different aspects of your lives.

Get Latest Does Hawaii Tax My Pension Below

Does Hawaii Tax My Pension

Does Hawaii Tax My Pension -

Hawaii taxation of pension income is somewhat of a mixed bag Our income tax law has an exemption for compensation received in the form of a pension for past services that has been on our books since Act 169 of 1953

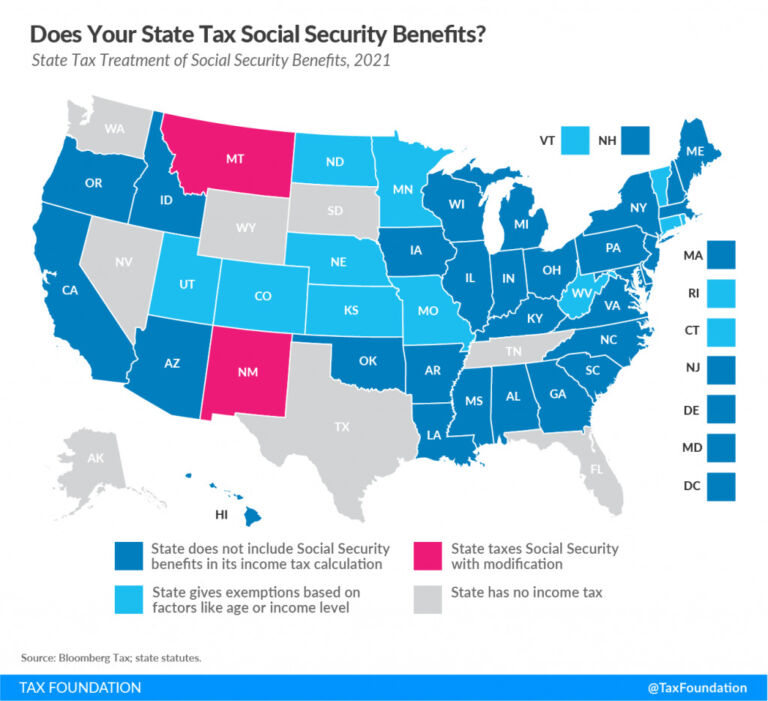

The good news is that public pension income is totally tax exempt in Hawaii The bad news is that all other forms of retirement income are taxed and are not eligible for any kind of deduction Hawaii entirely exempts some types of retirement income including Social Security retirement benefits and public pension income but fully taxes income

Does Hawaii Tax My Pension provide a diverse assortment of printable, downloadable materials that are accessible online for free cost. These materials come in a variety of forms, including worksheets, templates, coloring pages, and many more. The appealingness of Does Hawaii Tax My Pension is in their variety and accessibility.

More of Does Hawaii Tax My Pension

Hawaii Pension Exclusion 21andmain

Hawaii Pension Exclusion 21andmain

What taxes do retirees pay in Hawaii Hawaii exempts some retirement income but income tax rates are on the high end for retirement income that is taxable Hawaii also has an estate

2024 W 4P Pension Tax Withholding Form FAQ Refer to tax withholding tables for approximate federal income taxes to be withheld Mailing Address ERS 211 Mailing Address Change To ensure receipt of 1099 R tax statement annual pension statement Holomua newsletters and ERS correspondence

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Customization: The Customization feature lets you tailor the design to meet your needs for invitations, whether that's creating them to organize your schedule or even decorating your home.

-

Educational Benefits: The free educational worksheets can be used by students of all ages. This makes them an invaluable device for teachers and parents.

-

An easy way to access HTML0: The instant accessibility to numerous designs and templates saves time and effort.

Where to Find more Does Hawaii Tax My Pension

Does Hawaii Tax Pensions And Social Security

Does Hawaii Tax Pensions And Social Security

How Income Taxes Are Calculated First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401 k Next from AGI we subtract exemptions and deductions either itemized or standard to get your taxable income

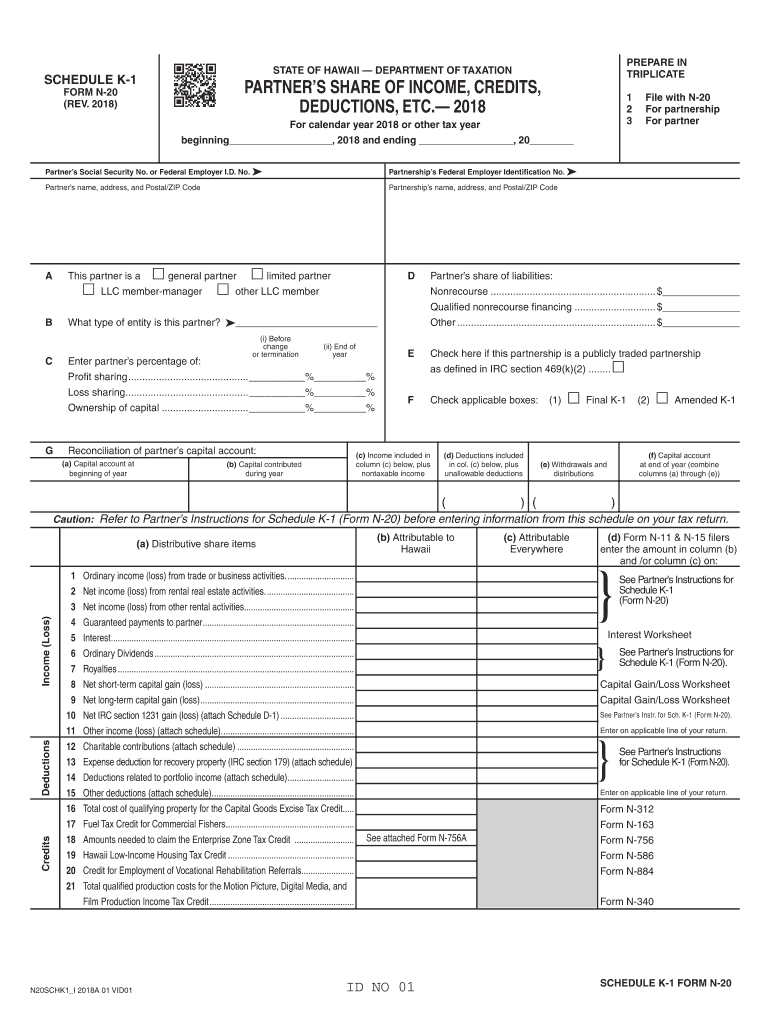

Q How is my retirement benefits classified for income tax reporting i e IRA pension or annuity A The ERS is a qualified defined benefit public pension plan covered under Section 401 a of the Internal Revenue Code All benefits paid by ERS and reported to you on Form 1099 R are pension benefits

We've now piqued your interest in printables for free we'll explore the places you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Does Hawaii Tax My Pension suitable for many applications.

- Explore categories like design, home decor, craft, and organization.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free with flashcards and other teaching tools.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- The blogs are a vast range of interests, everything from DIY projects to party planning.

Maximizing Does Hawaii Tax My Pension

Here are some new ways to make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home also in the classes.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Does Hawaii Tax My Pension are a treasure trove of practical and imaginative resources designed to meet a range of needs and interests. Their access and versatility makes them a great addition to every aspect of your life, both professional and personal. Explore the vast collection of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Does Hawaii Tax My Pension truly gratis?

- Yes you can! You can print and download these resources at no cost.

-

Are there any free printing templates for commercial purposes?

- It's dependent on the particular conditions of use. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables could have limitations on usage. Always read the terms and conditions set forth by the designer.

-

How can I print printables for free?

- You can print them at home with printing equipment or visit a local print shop to purchase premium prints.

-

What software do I need in order to open printables at no cost?

- The majority of PDF documents are provided in PDF format. These is open with no cost programs like Adobe Reader.

Hawaii General Excise Tax Id Number Roselee Seeley

200

Check more sample of Does Hawaii Tax My Pension below

All Hawaii News Grim Pension Fund News Sends State Government Seeking

How Much Could The UK Tax My Pension The Spectrum IFA Group

I m Moving To New Jersey Will The State Tax My Pension Nj

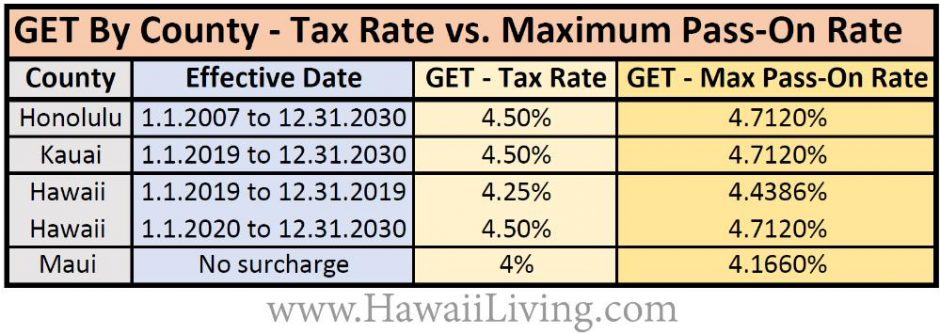

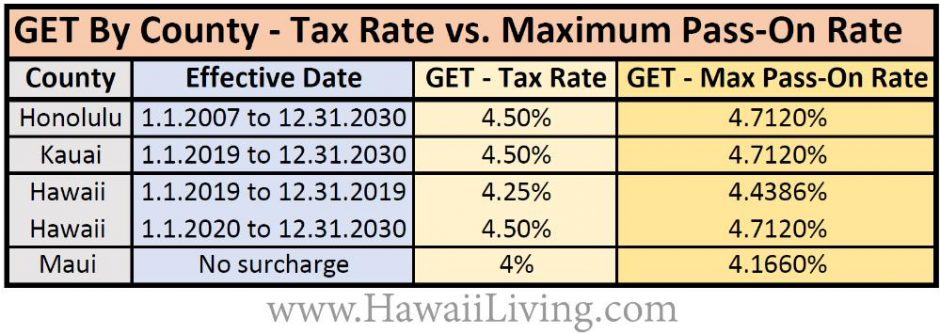

Hawaii s Revised GET Tax Rates By County New TAT Requirement 2019

All Hawaii News Policing The Police Rideshare Regulations Coming

Does Hawaii Tax Unemployment Benefits YUNEMPLO

https:// ttlc.intuit.com /community/retirement/...

The good news is that public pension income is totally tax exempt in Hawaii The bad news is that all other forms of retirement income are taxed and are not eligible for any kind of deduction Hawaii entirely exempts some types of retirement income including Social Security retirement benefits and public pension income but fully taxes income

https:// support.taxslayer.com /hc/en-us/articles/...

Hawaii does not tax qualifying distributions from Employer funded pension plan Federal civil service retirement Military pension State or county retirement system If you received distributions from a private employer pension plan and you made contributions to the pension plan your distribution is partially taxable

The good news is that public pension income is totally tax exempt in Hawaii The bad news is that all other forms of retirement income are taxed and are not eligible for any kind of deduction Hawaii entirely exempts some types of retirement income including Social Security retirement benefits and public pension income but fully taxes income

Hawaii does not tax qualifying distributions from Employer funded pension plan Federal civil service retirement Military pension State or county retirement system If you received distributions from a private employer pension plan and you made contributions to the pension plan your distribution is partially taxable

Hawaii s Revised GET Tax Rates By County New TAT Requirement 2019

How Much Could The UK Tax My Pension The Spectrum IFA Group

All Hawaii News Policing The Police Rideshare Regulations Coming

Does Hawaii Tax Unemployment Benefits YUNEMPLO

Hitax Hawaii Gov Forms N 20 Fill Out And Sign Printable PDF Template

Os Payroll Your Payslip Document Explained Unamed

Os Payroll Your Payslip Document Explained Unamed

Hawaii State Tax Tables 2023 US ICalculator