In this age of technology, where screens have become the dominant feature of our lives yet the appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses and creative work, or just adding the personal touch to your area, Does Massachusetts Allow Bonus Depreciation are now a vital source. Through this post, we'll take a dive into the world of "Does Massachusetts Allow Bonus Depreciation," exploring what they are, how you can find them, and how they can enhance various aspects of your life.

Get Latest Does Massachusetts Allow Bonus Depreciation Below

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/15591797/GettyImages-492972836.0.1447953106.jpg)

Does Massachusetts Allow Bonus Depreciation

Does Massachusetts Allow Bonus Depreciation -

Return Filing Requirements For Massachusetts purposes for taxable years ending after September 10 2001 depreciation is to be claimed on all assets regardless of when they are placed in service using the method used for federal income tax purposes prior to the enactment of Code s 168 k

A Massachusetts taxpayer that claims bonus depreciation under IRC 168 k for federal purposes must calculate a separate depreciation schedule for purposes of claiming depreciation on the Massachusetts corporate excise return or the Massachusetts personal income tax return

Printables for free include a vast collection of printable items that are available online at no cost. These resources come in various forms, like worksheets templates, coloring pages, and much more. The great thing about Does Massachusetts Allow Bonus Depreciation lies in their versatility and accessibility.

More of Does Massachusetts Allow Bonus Depreciation

What Is Bonus Depreciation And How Does It Work In 2023

What Is Bonus Depreciation And How Does It Work In 2023

Use our lookup tool below to quickly find which states follow federal bonus depreciation rules and which states don t allow bonus depreciation Download the full list of state charts to easily compare how each state plus Washington D C and New York City conforms to the federal treatment of bonus depreciation

In the context of bonus depreciation a state s conformity status determines whether or not a business can claim bonus depreciation on their state tax returns This can vary widely with some states fully conforming to federal laws while others choose to partially conform or not conform at all

Does Massachusetts Allow Bonus Depreciation have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

customization We can customize printables to fit your particular needs whether you're designing invitations planning your schedule or decorating your home.

-

Educational Use: Educational printables that can be downloaded for free cater to learners of all ages, making the perfect tool for parents and teachers.

-

Convenience: Quick access to numerous designs and templates can save you time and energy.

Where to Find more Does Massachusetts Allow Bonus Depreciation

Manage Your Tax Bill Focus CPA

Manage Your Tax Bill Focus CPA

However Massachusetts is decoupled from the bonus depreciation rules in Code 168 k Consequently the Massachusetts depreciation deduction for QIP must be calculated under Code 168 without regard to 168 k

Bonus depreciation is a special first year 100 deduction for eligible property in its first year of use in addition to any section 179 deduction Of the 47 states that have no corporate income tax 8 states and the District of Columbia allow businesses to take bonus depreciation to reduce their state income taxes

Now that we've ignited your interest in printables for free we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Does Massachusetts Allow Bonus Depreciation to suit a variety of purposes.

- Explore categories like interior decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs are a vast variety of topics, everything from DIY projects to planning a party.

Maximizing Does Massachusetts Allow Bonus Depreciation

Here are some creative ways to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use printable worksheets from the internet to aid in learning at your home or in the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Does Massachusetts Allow Bonus Depreciation are a treasure trove of useful and creative resources that cater to various needs and preferences. Their availability and versatility make they a beneficial addition to any professional or personal life. Explore the plethora of Does Massachusetts Allow Bonus Depreciation and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really completely free?

- Yes you can! You can print and download these resources at no cost.

-

Can I use free printing templates for commercial purposes?

- It is contingent on the specific terms of use. Always verify the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues with Does Massachusetts Allow Bonus Depreciation?

- Certain printables may be subject to restrictions regarding their use. Make sure to read the terms and conditions set forth by the author.

-

How do I print Does Massachusetts Allow Bonus Depreciation?

- Print them at home using the printer, or go to a local print shop to purchase premium prints.

-

What program do I need to open printables that are free?

- The majority of PDF documents are provided in PDF format. These can be opened using free software like Adobe Reader.

Mercedes G Wagon Tax Write Off 2022 2023

Tax Planning For Your Business Focus CPA

Check more sample of Does Massachusetts Allow Bonus Depreciation below

PDF Accelerated Depreciation And State Revenues

Manage Your Tax Bill Small Business Tax Planning Focus CPA

Bonus Depreciation Definition Example How Does It Work

Massachusetts Will Allow 100 Capacity At Stadiums In Time For Football

/cdn.vox-cdn.com/uploads/chorus_image/image/69197853/1177744974.jpg.0.jpg)

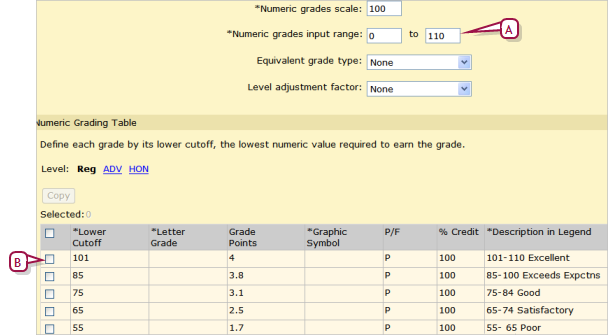

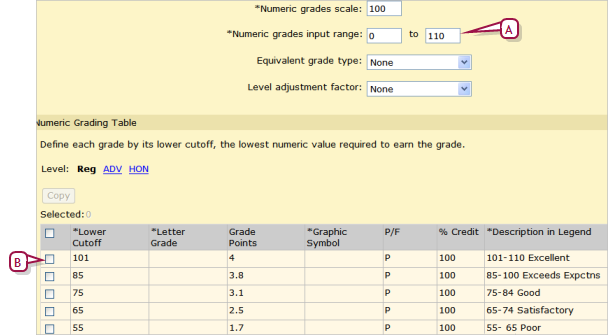

Setting Up A Grading Table To Allow Bonus Points

25 Kent Brooklyn Hirschen Singer Epstein LLP

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/15591797/GettyImages-492972836.0.1447953106.jpg?w=186)

https://www.mass.gov/technical-information-release...

A Massachusetts taxpayer that claims bonus depreciation under IRC 168 k for federal purposes must calculate a separate depreciation schedule for purposes of claiming depreciation on the Massachusetts corporate excise return or the Massachusetts personal income tax return

https://www.mass.gov/regulations/830-CMR-6331n1...

On its 2009 Massachusetts tax return X must calculate the federal depreciation deduction for the property as if it did not elect to utilize the federal bonus depreciation allowance as Massachusetts does not allow bonus depreciation

A Massachusetts taxpayer that claims bonus depreciation under IRC 168 k for federal purposes must calculate a separate depreciation schedule for purposes of claiming depreciation on the Massachusetts corporate excise return or the Massachusetts personal income tax return

On its 2009 Massachusetts tax return X must calculate the federal depreciation deduction for the property as if it did not elect to utilize the federal bonus depreciation allowance as Massachusetts does not allow bonus depreciation

/cdn.vox-cdn.com/uploads/chorus_image/image/69197853/1177744974.jpg.0.jpg)

Massachusetts Will Allow 100 Capacity At Stadiums In Time For Football

Manage Your Tax Bill Small Business Tax Planning Focus CPA

Setting Up A Grading Table To Allow Bonus Points

25 Kent Brooklyn Hirschen Singer Epstein LLP

The White House Budget Highlights The Need To Extend Pro Growth TCJA

Solved Instructions Based On The Following Information Prepare The

Solved Instructions Based On The Following Information Prepare The

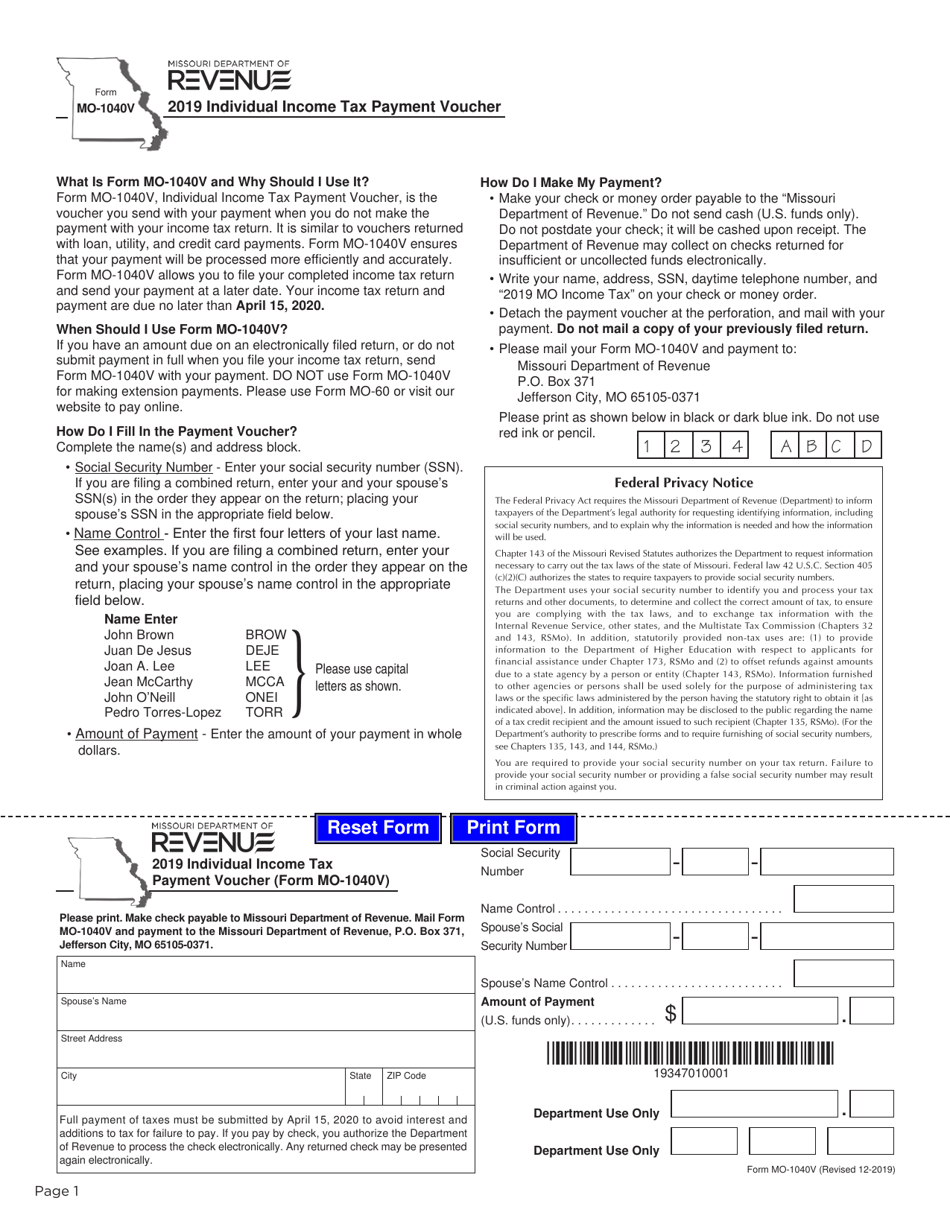

Missouri Form 4682 Fillable Printable Forms Free Online