In this age of technology, with screens dominating our lives yet the appeal of tangible printed materials hasn't faded away. In the case of educational materials and creative work, or simply to add an individual touch to the space, Does Toyota Camry Hybrid Qualify For Tax Credit are a great source. The following article is a take a dive deep into the realm of "Does Toyota Camry Hybrid Qualify For Tax Credit," exploring their purpose, where they can be found, and how they can enrich various aspects of your daily life.

Get Latest Does Toyota Camry Hybrid Qualify For Tax Credit Below

Does Toyota Camry Hybrid Qualify For Tax Credit

Does Toyota Camry Hybrid Qualify For Tax Credit -

During the first two quarters buyers will be eligible for a 3 750 tax credit and in the final two quarters they ll get a 1 875 credit As a reminder the federal tax credit is not a

That means if your budget or interest extends only to traditional parallel hybrids like the standard Toyota Prius or Honda CR V Hybrid you won t qualify for the rebate

Does Toyota Camry Hybrid Qualify For Tax Credit include a broad assortment of printable, downloadable materials online, at no cost. The resources are offered in a variety forms, including worksheets, templates, coloring pages and much more. The beauty of Does Toyota Camry Hybrid Qualify For Tax Credit lies in their versatility and accessibility.

More of Does Toyota Camry Hybrid Qualify For Tax Credit

The Sporting Camry The 2016 Toyota Camry XSE

The Sporting Camry The 2016 Toyota Camry XSE

You claim the credit using Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit and submit it with your individual tax return Beginning in 2024 buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit amount as a down payment or a reduction of the manufacturer s suggested retail price

No the Toyota Camry Hybrid is not eligible for a federal tax credit even with new legislation bringing changes to the tax incentives in the electric vehicle market Let s take a closer look at what these incentives and their legislation have looked like over the past decade or so

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Modifications: We can customize the design to meet your needs such as designing invitations planning your schedule or even decorating your home.

-

Education Value Printables for education that are free provide for students of all ages. This makes them an essential device for teachers and parents.

-

Affordability: Quick access to an array of designs and templates will save you time and effort.

Where to Find more Does Toyota Camry Hybrid Qualify For Tax Credit

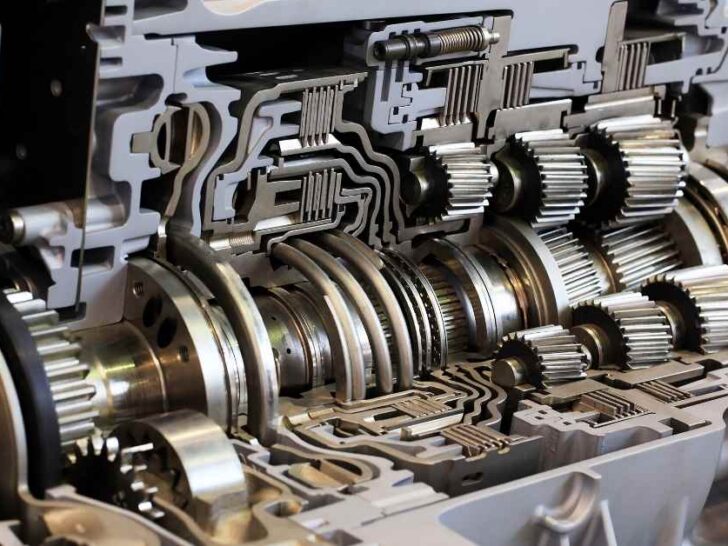

Does Toyota Camry Use CVT Transmission Explained

Does Toyota Camry Use CVT Transmission Explained

Yes hybrid and electric vehicles may not be a tax write off but may instead be eligible for a credit on your return You may be able to get a maximum of 7 500 towards your taxes on your tax return The hybrid tax credit will not increase your refund because it is

The five PHEVs that receive a 3750 credit are the BMW X5 xDrive 50e the Ford Escape PHEV the Jeep Grand Cherokee 4xe and Wrangler 4xe and the Lincoln Corsair Grand Touring Remember any plug

Now that we've piqued your curiosity about Does Toyota Camry Hybrid Qualify For Tax Credit and other printables, let's discover where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Does Toyota Camry Hybrid Qualify For Tax Credit designed for a variety purposes.

- Explore categories such as decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs are a vast array of topics, ranging ranging from DIY projects to planning a party.

Maximizing Does Toyota Camry Hybrid Qualify For Tax Credit

Here are some creative ways to make the most use of Does Toyota Camry Hybrid Qualify For Tax Credit:

1. Home Decor

- Print and frame stunning images, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home and in class.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Does Toyota Camry Hybrid Qualify For Tax Credit are an abundance filled with creative and practical information that can meet the needs of a variety of people and desires. Their access and versatility makes them a great addition to every aspect of your life, both professional and personal. Explore the world of Does Toyota Camry Hybrid Qualify For Tax Credit and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes they are! You can download and print these free resources for no cost.

-

Can I use free printing templates for commercial purposes?

- It's dependent on the particular terms of use. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables could be restricted in use. Be sure to review the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- Print them at home using a printer or visit a local print shop to purchase more high-quality prints.

-

What software must I use to open printables that are free?

- Most printables come in the PDF format, and can be opened using free software such as Adobe Reader.

Does Toyota Camry Have Rear Air Vents Toyota Ask

Despite Mixed Reviews Prius Prime Tops Plug in Sales In May

Check more sample of Does Toyota Camry Hybrid Qualify For Tax Credit below

These Electric Cars Qualify For The EV Tax Credits

The Toyota Prius A Car Qualified For The Electric Car Credit OsVehicle

Just 10 Electric Vehicles Qualify For Full 7 500 U S Tax Credit CPA

Are There Any Tax Rebates For Hybrid Cars In 2022 2023 Carrebate

Does The RAV4 Hybrid Qualify For A Federal Tax Credit 2023

Will Rav4 Prime Qualify For Tax Credit In Canada Matos

https://www. cars.com /articles/heres-which-hybrids...

That means if your budget or interest extends only to traditional parallel hybrids like the standard Toyota Prius or Honda CR V Hybrid you won t qualify for the rebate

https://www. irs.gov /credits-deductions/...

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before Internal Revenue Service

That means if your budget or interest extends only to traditional parallel hybrids like the standard Toyota Prius or Honda CR V Hybrid you won t qualify for the rebate

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before Internal Revenue Service

Are There Any Tax Rebates For Hybrid Cars In 2022 2023 Carrebate

The Toyota Prius A Car Qualified For The Electric Car Credit OsVehicle

Does The RAV4 Hybrid Qualify For A Federal Tax Credit 2023

Will Rav4 Prime Qualify For Tax Credit In Canada Matos

Confused As To Which Plug in Cars Still Qualify For Tax Credits

The Toyota Camry s Airbag Off Light Why It Comes On And What To Do

The Toyota Camry s Airbag Off Light Why It Comes On And What To Do

Will 2023 Honda Accord Hybrid Qualify For Tax Credit Drive Accord