In a world with screens dominating our lives it's no wonder that the appeal of tangible printed objects hasn't waned. In the case of educational materials or creative projects, or simply adding an element of personalization to your space, Earned Income Tax Credit 2023 are now a useful resource. For this piece, we'll take a dive deeper into "Earned Income Tax Credit 2023," exploring what they are, where they are, and ways they can help you improve many aspects of your daily life.

Get Latest Earned Income Tax Credit 2023 Below

Earned Income Tax Credit 2023

Earned Income Tax Credit 2023 -

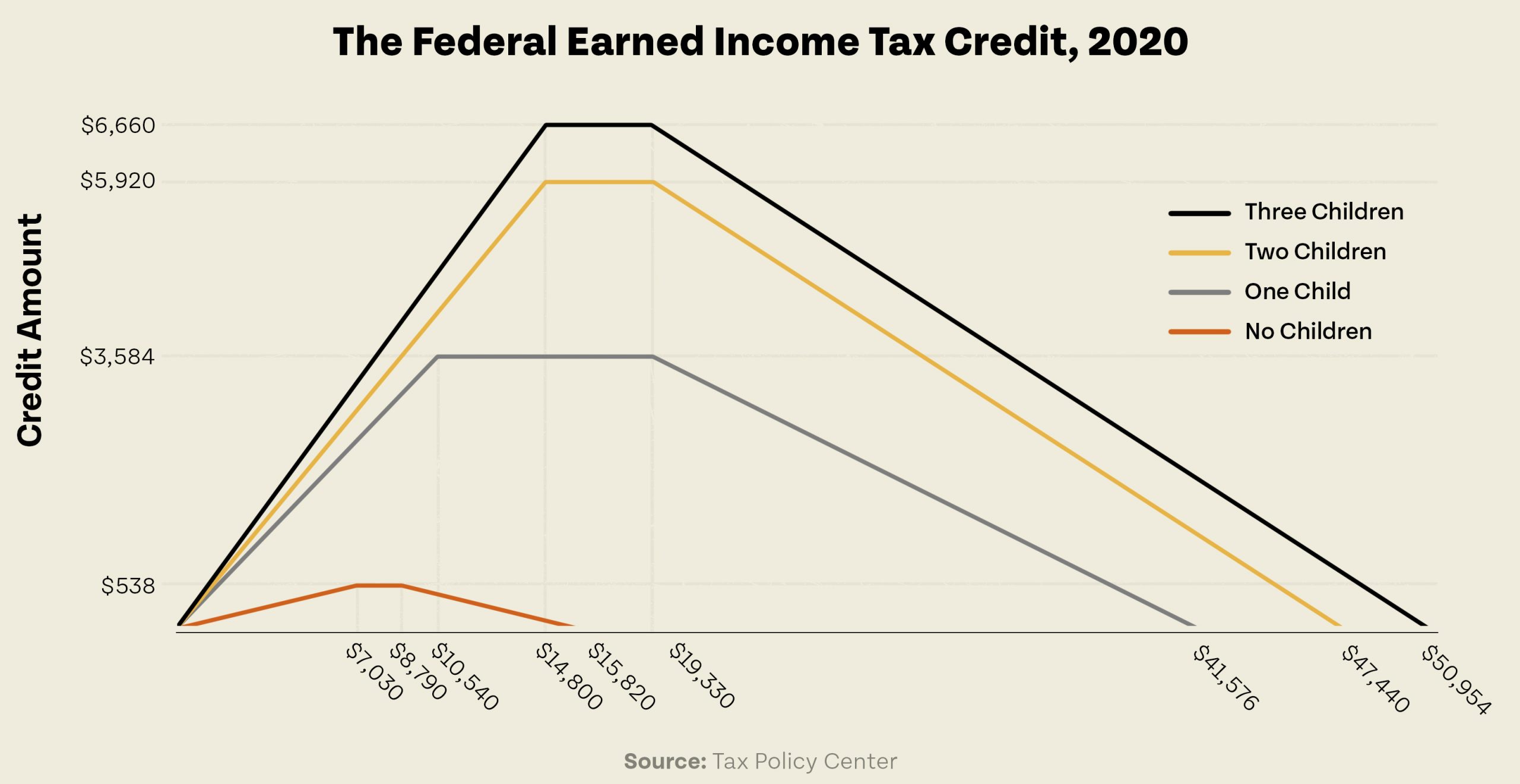

As of December 2023 more than 23 million workers and families received about 57 billion in EITC The average amount of EITC received nationwide in tax year 2022 was about 2 541 However there are still millions of people not taking advantage of

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund

Earned Income Tax Credit 2023 encompass a wide assortment of printable items that are available online at no cost. These printables come in different types, like worksheets, coloring pages, templates and many more. The appealingness of Earned Income Tax Credit 2023 is in their variety and accessibility.

More of Earned Income Tax Credit 2023

Earned Income Tax Credit Calculator 2022 2023 Internal Revenue Code

Earned Income Tax Credit Calculator 2022 2023 Internal Revenue Code

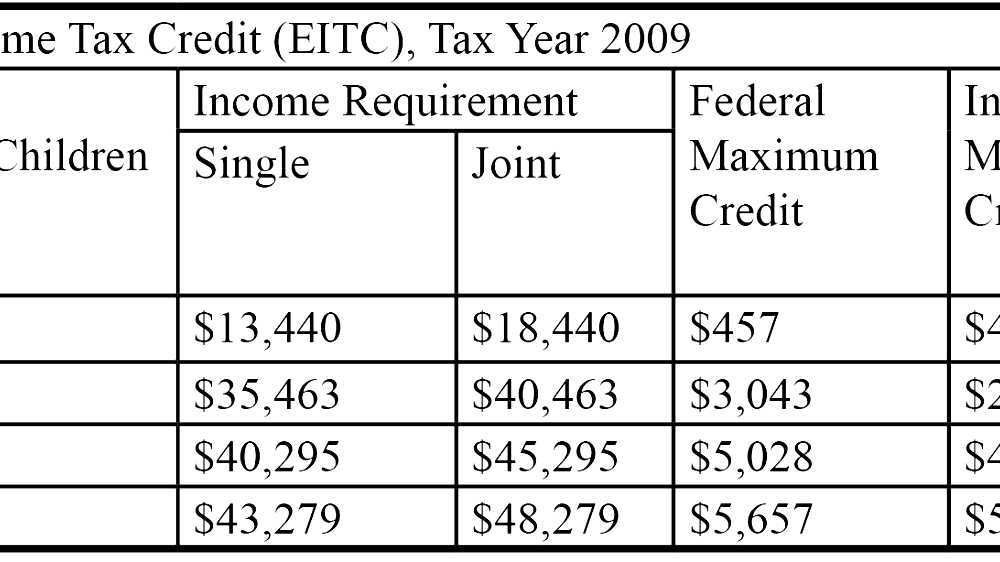

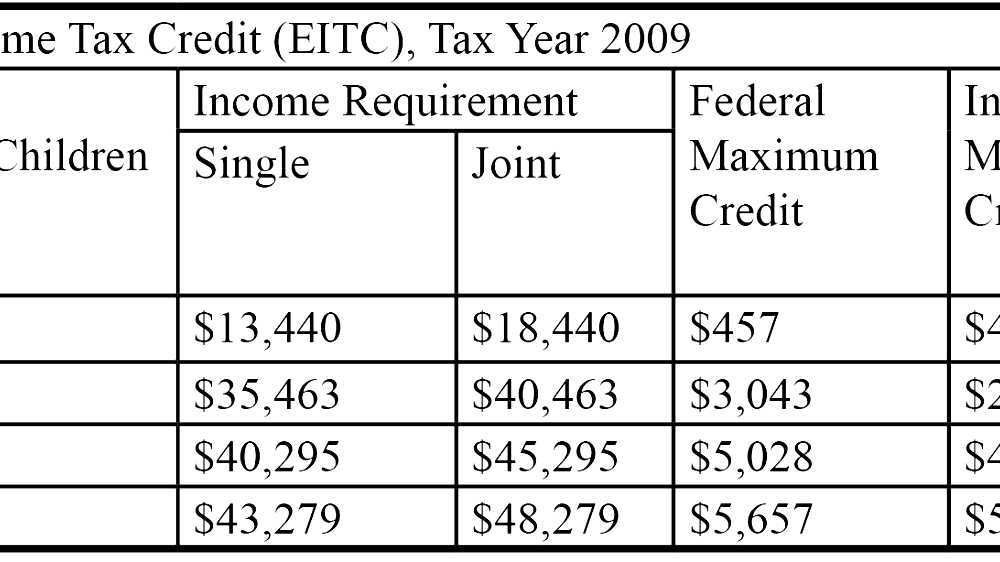

Tax Year 2023 Income Limits and Range of EITC Taxpayers claiming the EITC who file Married Filing Separately must meet the eligibility requirements under the special rule in the American Rescue Plan Act ARPA of 2021 Income Limits and Amount of EITC for additional tax years

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break Answer some questions to see if you qualify 1 General Info 2 Filing Status 3 AGI 4 Qualifying Children 5 Results General Information Answer a few quick questions about yourself to see if you qualify

The Earned Income Tax Credit 2023 have gained huge popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Flexible: It is possible to tailor printed materials to meet your requirements be it designing invitations making your schedule, or even decorating your house.

-

Educational Worth: These Earned Income Tax Credit 2023 are designed to appeal to students of all ages. This makes them a valuable tool for parents and teachers.

-

Accessibility: You have instant access a plethora of designs and templates helps save time and effort.

Where to Find more Earned Income Tax Credit 2023

Earned Income Tax Credit 2023 Federal Tax Credits

Earned Income Tax Credit 2023 Federal Tax Credits

Taxpayer claiming the EITC who file Married Filing Separately must meet the eligibility requirements under the special rule in the American Rescue Plan Act ARPA of 2021 See Who Qualifies for the EITC The income limits for earned income adjusted gross income and investment income are adjusted for cost of living each year

Eligibility for the EITC 1 Filing a Federal Income Tax Return 2

After we've peaked your interest in Earned Income Tax Credit 2023 We'll take a look around to see where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Earned Income Tax Credit 2023 to suit a variety of motives.

- Explore categories like interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching materials.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- These blogs cover a wide selection of subjects, including DIY projects to planning a party.

Maximizing Earned Income Tax Credit 2023

Here are some unique ways of making the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free to enhance your learning at home for the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

Earned Income Tax Credit 2023 are a treasure trove with useful and creative ideas that can meet the needs of a variety of people and interest. Their accessibility and versatility make them an essential part of every aspect of your life, both professional and personal. Explore the vast array of Earned Income Tax Credit 2023 today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Earned Income Tax Credit 2023 truly for free?

- Yes they are! You can print and download these tools for free.

-

Can I use the free printables for commercial uses?

- It is contingent on the specific usage guidelines. Always verify the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may have restrictions in use. Be sure to read the terms and regulations provided by the author.

-

How do I print Earned Income Tax Credit 2023?

- Print them at home using printing equipment or visit a local print shop to purchase premium prints.

-

What program do I require to view Earned Income Tax Credit 2023?

- The majority are printed in the PDF format, and can be opened using free programs like Adobe Reader.

Earned Income Tax Credit EITC Tax Refund Schedule For 2022 2023 Tax

Earned Income Tax Credit City Of Detroit

Check more sample of Earned Income Tax Credit 2023 below

What Is The Earned Income Tax Credit

Earned Income Tax Credit

The Earned Income Tax Credit EITC A Primer Tax Foundation

Earned Income Credit Refund Chart INVOMERT

Publication 596 Earned Income Credit EIC Appendix

Do I Qualify For The Earned Income Tax Credit

https://www.irs.gov/credits-deductions/individuals/earned-income...

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund

https://www.irs.gov/credits-deductions/individuals/earned-income...

Basic Qualifying Rules To qualify for the EITC you must Have worked and earned income under 63 398 Have investment income below 11 000 in the tax year 2023 Have a valid Social Security number by the due date of your 2023 return including extensions Be a U S citizen or a resident alien all year Not file Form 2555 Foreign

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund

Basic Qualifying Rules To qualify for the EITC you must Have worked and earned income under 63 398 Have investment income below 11 000 in the tax year 2023 Have a valid Social Security number by the due date of your 2023 return including extensions Be a U S citizen or a resident alien all year Not file Form 2555 Foreign

Earned Income Credit Refund Chart INVOMERT

Earned Income Tax Credit

Publication 596 Earned Income Credit EIC Appendix

Do I Qualify For The Earned Income Tax Credit

Why Tax Credits For Working Families Matter

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income

New For 2023 Tax Year Get New Year 2023 Update