In the digital age, where screens have become the dominant feature of our lives yet the appeal of tangible, printed materials hasn't diminished. For educational purposes for creative projects, simply to add the personal touch to your space, Earned Income Tax Credit Eligible have proven to be a valuable resource. For this piece, we'll take a dive through the vast world of "Earned Income Tax Credit Eligible," exploring what they are, how to find them and how they can enrich various aspects of your daily life.

Get Latest Earned Income Tax Credit Eligible Below

Earned Income Tax Credit Eligible

Earned Income Tax Credit Eligible -

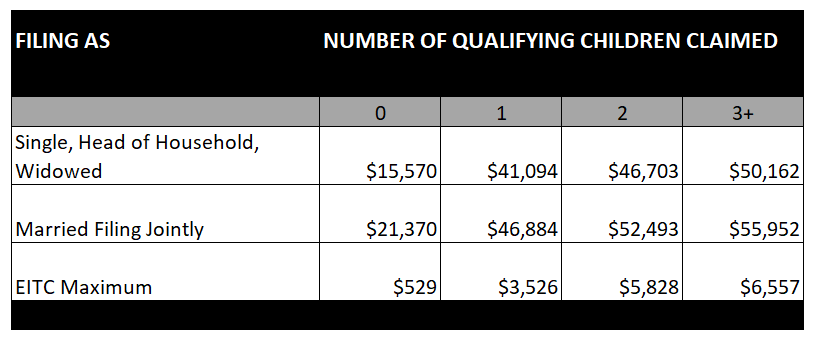

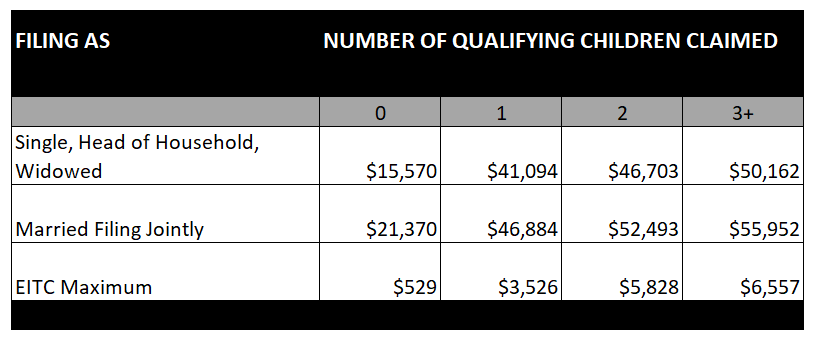

Find out if you are eligible for the EITC based on your income and number of qualifying children See the income limits and range of EITC for tax year 2023 and previous

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe

Earned Income Tax Credit Eligible offer a wide array of printable documents that can be downloaded online at no cost. These printables come in different types, such as worksheets templates, coloring pages and more. One of the advantages of Earned Income Tax Credit Eligible is in their variety and accessibility.

More of Earned Income Tax Credit Eligible

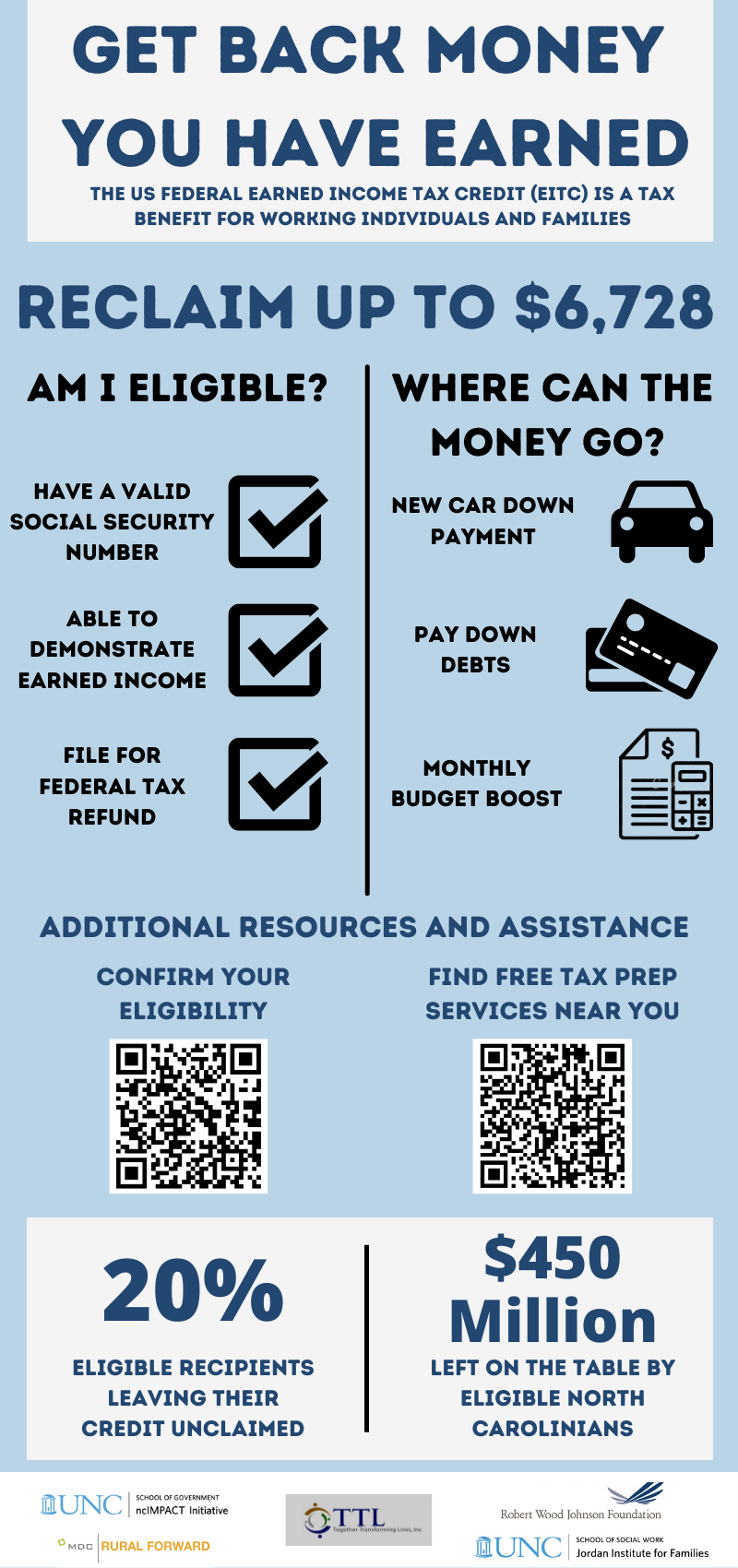

EITC Earned Income Tax Credit NcIMPACT Initiative

EITC Earned Income Tax Credit NcIMPACT Initiative

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break Answer some questions to see if you qualify 1 General Info 2 Filing Status 3

The earned income tax credit EITC sometimes shortened to earned income credit is a tax break for low and moderate income workers To qualify you have to have worked in the year for

Earned Income Tax Credit Eligible have gained a lot of popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Modifications: The Customization feature lets you tailor print-ready templates to your specific requirements, whether it's designing invitations to organize your schedule or decorating your home.

-

Educational Value: These Earned Income Tax Credit Eligible provide for students of all ages, which makes them a vital tool for teachers and parents.

-

Simple: Quick access to the vast array of design and templates is time-saving and saves effort.

Where to Find more Earned Income Tax Credit Eligible

Do I Qualify For The Earned Income Tax Credit

Do I Qualify For The Earned Income Tax Credit

Learn who qualifies for the earned income tax credit what s different on your 2022 tax return and how this tax break can work for you

If you earned less than 66 819 if Married Filing Jointly or 59 899 if filing as Single Qualifying Surviving Spouse or Head of Household in tax year 2024 you may qualify for the Earned Income Credit EIC These

Since we've got your curiosity about Earned Income Tax Credit Eligible and other printables, let's discover where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Earned Income Tax Credit Eligible designed for a variety motives.

- Explore categories like interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free including flashcards, learning materials.

- Ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- The blogs are a vast spectrum of interests, that includes DIY projects to party planning.

Maximizing Earned Income Tax Credit Eligible

Here are some unique ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Print out free worksheets and activities to enhance learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Earned Income Tax Credit Eligible are a treasure trove with useful and creative ideas that can meet the needs of a variety of people and preferences. Their access and versatility makes them a valuable addition to both professional and personal lives. Explore the many options that is Earned Income Tax Credit Eligible today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes you can! You can download and print these materials for free.

-

Do I have the right to use free printouts for commercial usage?

- It's dependent on the particular usage guidelines. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables might have limitations regarding their use. Check these terms and conditions as set out by the designer.

-

How can I print Earned Income Tax Credit Eligible?

- You can print them at home with either a printer at home or in a local print shop for more high-quality prints.

-

What program do I require to view Earned Income Tax Credit Eligible?

- Many printables are offered in the PDF format, and can be opened using free programs like Adobe Reader.

Earned Income Tax Credit 2023 Federal Tax Credits

Earned Income Tax Credit What It Is And Other Important Details

Check more sample of Earned Income Tax Credit Eligible below

Earned Income Tax Credit Calculator 2022 2023 Internal Revenue Code

This Is Earned Income Tax Credit Awareness Day

Am I Eligible For The Earned Income Tax Credit EITC YouTube

20 Of Eligible Filers Miss Out On The Earned Income Tax Credit

Are You Eligible For Earned Income Tax Credit Line

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income Free

https://www.irs.gov › credits-deductions › individuals...

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe

https://www.investopedia.com › terms …

The earned income tax credit EITC is a tax break available to low and moderate income wage earners It is a refundable tax credit that reduces the amount of taxes owed on a dollar for dollar

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe

The earned income tax credit EITC is a tax break available to low and moderate income wage earners It is a refundable tax credit that reduces the amount of taxes owed on a dollar for dollar

20 Of Eligible Filers Miss Out On The Earned Income Tax Credit

This Is Earned Income Tax Credit Awareness Day

Are You Eligible For Earned Income Tax Credit Line

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income Free

Who Is Eligible For EIC Credit Leia Aqui What Is The Income Level For

NYS Can Help Low income Working Families With Children By Increasing

NYS Can Help Low income Working Families With Children By Increasing

Earned Income Tax Credit City Of Detroit