In a world where screens have become the dominant feature of our lives but the value of tangible printed materials isn't diminishing. For educational purposes project ideas, artistic or simply to add an individual touch to your area, Earned Income Tax Credit are now an essential resource. For this piece, we'll dive into the sphere of "Earned Income Tax Credit," exploring what they are, how they are, and the ways that they can benefit different aspects of your lives.

Get Latest Earned Income Tax Credit Below

Earned Income Tax Credit

Earned Income Tax Credit -

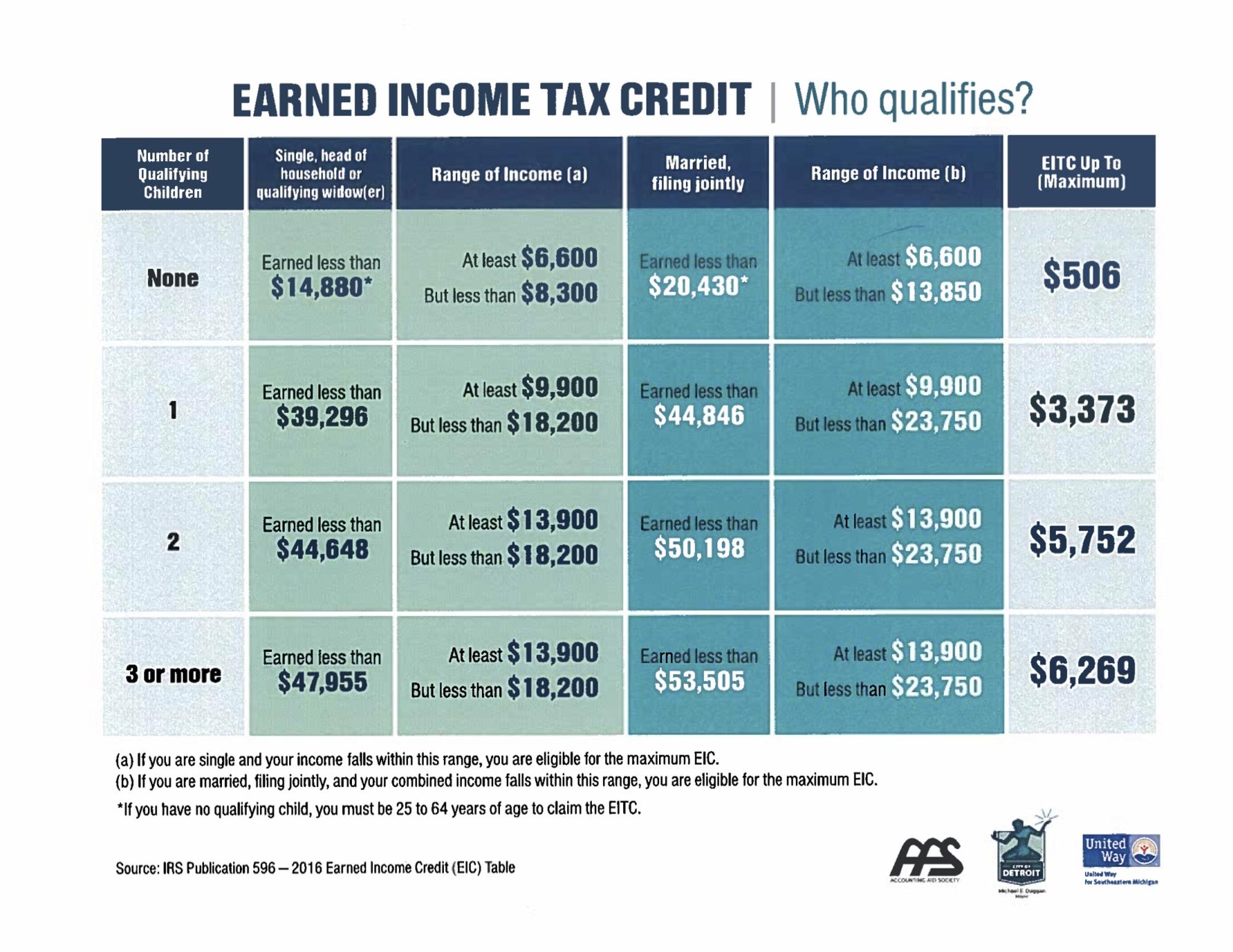

Earned Income Tax Credit EITC Assistant The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break Answer some questions to see if you qualify

Find if you qualify for the Earned Income Tax Credit EITC with or without qualifying children or relatives on your tax return Low to moderate income workers with qualifying children may be eligible to claim the Earned Income Tax Credit EITC if certain qualifying rules apply to them

Earned Income Tax Credit offer a wide assortment of printable resources available online for download at no cost. These materials come in a variety of types, such as worksheets coloring pages, templates and many more. The benefit of Earned Income Tax Credit lies in their versatility and accessibility.

More of Earned Income Tax Credit

Mayor Urges Detroit Residents To Seek Tax Refunds WDET

Mayor Urges Detroit Residents To Seek Tax Refunds WDET

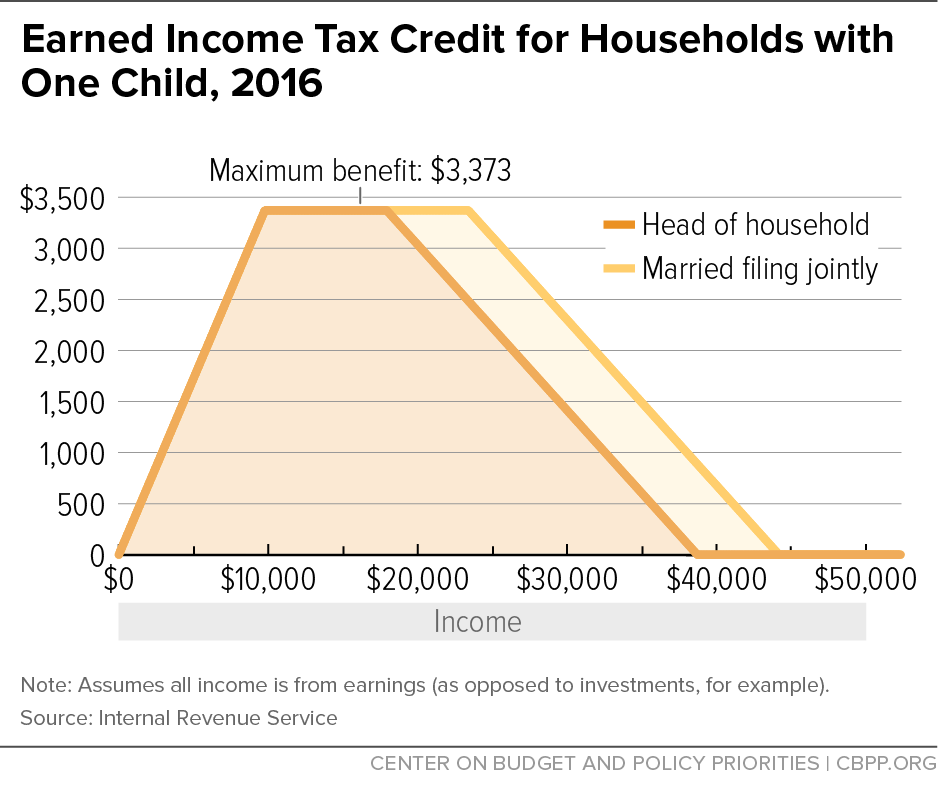

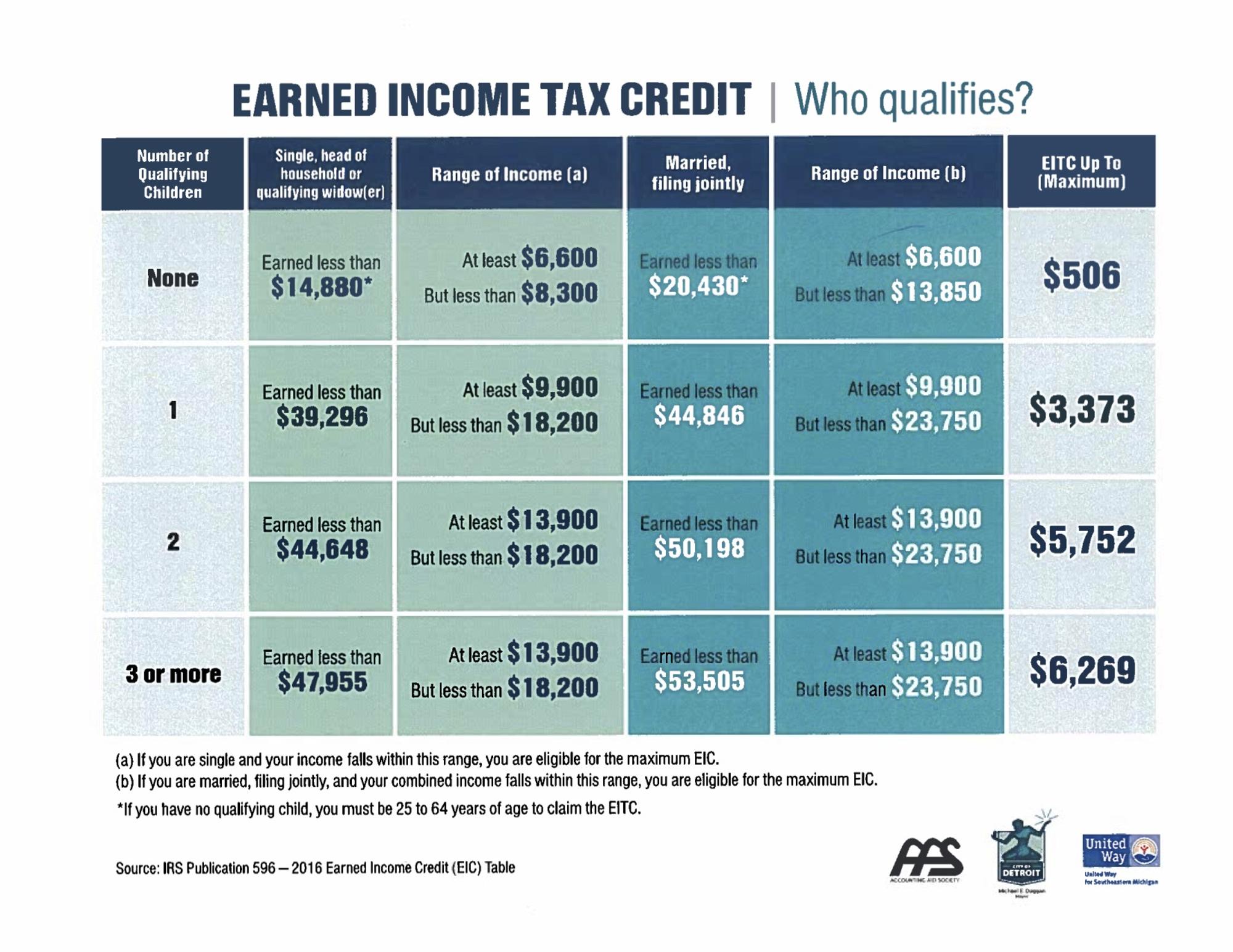

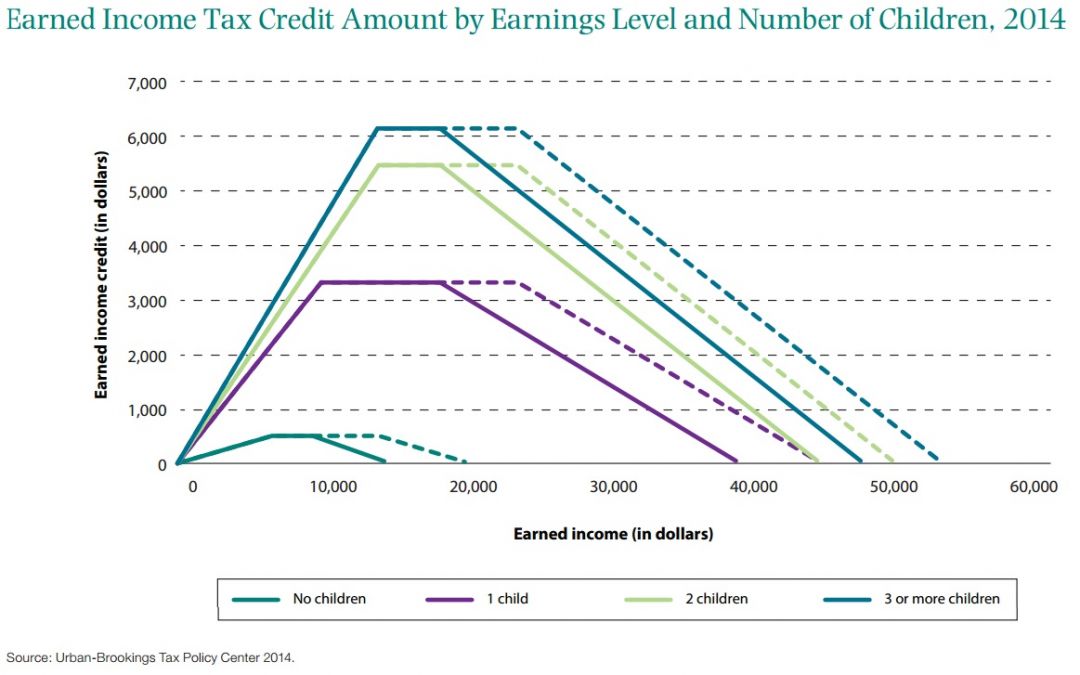

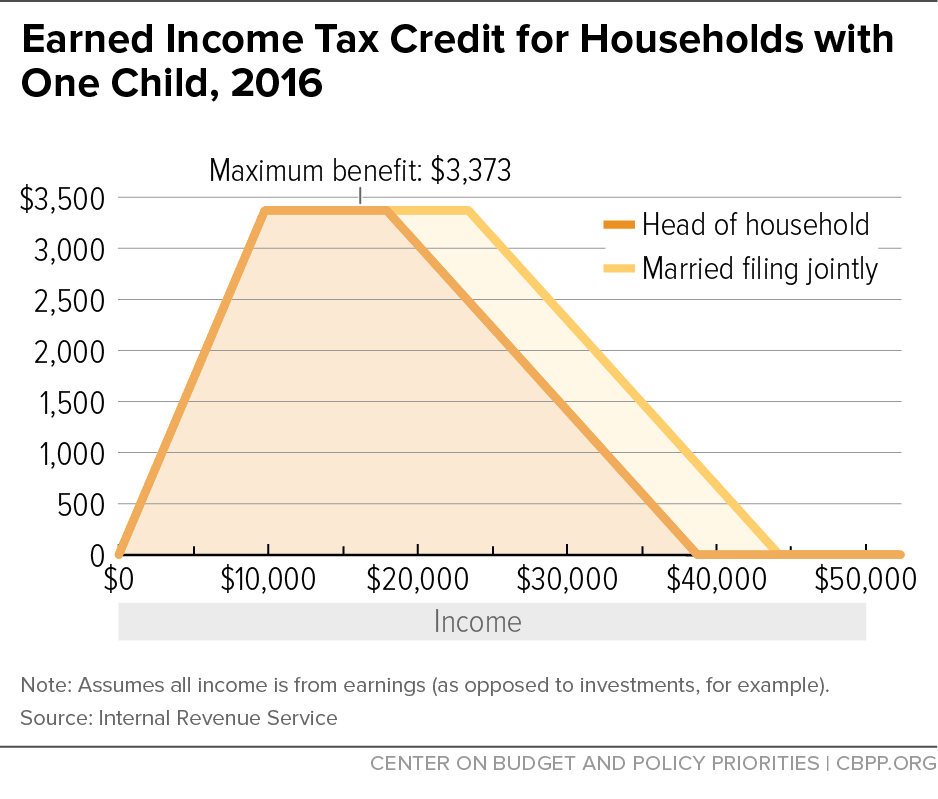

As of December 2023 more than 23 million workers and families received about 57 billion in EITC The average amount of EITC received nationwide in tax year 2022 was about 2 541 However there are still millions of people

Generally be a U S citizen or resident alien for the entire year Taxpayer claiming the EITC who file Married Filing Separately must meet the eligibility requirements under the special rule in the American Rescue Plan

The Earned Income Tax Credit have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: They can make printables to your specific needs such as designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Use: The free educational worksheets cater to learners of all ages, which makes them a valuable tool for parents and teachers.

-

Simple: You have instant access a variety of designs and templates is time-saving and saves effort.

Where to Find more Earned Income Tax Credit

NYS Can Help Low income Working Families With Children By Increasing

NYS Can Help Low income Working Families With Children By Increasing

The EIC is a tax credit for certain people who work and have earned income under 63 398 A tax credit usually means more money in your pocket It reduces the amount of tax you owe The EIC may also give you a refund

The earned income tax credit EITC is a refundable tax credit that helps certain U S taxpayers with low earnings by reducing the amount of tax owed on a dollar for dollar basis Taxpayers

After we've peaked your interest in Earned Income Tax Credit Let's see where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of uses.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing, flashcards, and learning materials.

- This is a great resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- These blogs cover a wide spectrum of interests, from DIY projects to planning a party.

Maximizing Earned Income Tax Credit

Here are some new ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use free printable worksheets to aid in learning at your home and in class.

3. Event Planning

- Invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Earned Income Tax Credit are an abundance of innovative and useful resources that satisfy a wide range of requirements and interests. Their access and versatility makes they a beneficial addition to your professional and personal life. Explore the world of Earned Income Tax Credit and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes they are! You can print and download these materials for free.

-

Do I have the right to use free printouts for commercial usage?

- It's based on the rules of usage. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Some printables may come with restrictions on usage. Be sure to review the terms and condition of use as provided by the creator.

-

How do I print Earned Income Tax Credit?

- Print them at home using printing equipment or visit any local print store for better quality prints.

-

What program must I use to open printables for free?

- The majority of PDF documents are provided in PDF format. They is open with no cost software, such as Adobe Reader.

What Is The Earned Income Tax Credit

Earned Income Credit Table 2017 Age Brokeasshome

Check more sample of Earned Income Tax Credit below

Earned Income Tax Credit Amount By Earnings Level And Number Of

How The Earned Income Tax Credit Could Get You More Money

Do I Qualify For The Earned Income Tax Credit

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income

Earned Income Credit Refund Chart INVOMERT

The New California Earned Income Tax Credit

https://www.irs.gov/credits-deductions/individuals/...

Find if you qualify for the Earned Income Tax Credit EITC with or without qualifying children or relatives on your tax return Low to moderate income workers with qualifying children may be eligible to claim the Earned Income Tax Credit EITC if certain qualifying rules apply to them

https://www.irs.gov/credits-deductions/individuals...

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current previous and upcoming tax years Use the EITC tables to look up maximum credit amounts by tax year

Find if you qualify for the Earned Income Tax Credit EITC with or without qualifying children or relatives on your tax return Low to moderate income workers with qualifying children may be eligible to claim the Earned Income Tax Credit EITC if certain qualifying rules apply to them

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current previous and upcoming tax years Use the EITC tables to look up maximum credit amounts by tax year

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income

How The Earned Income Tax Credit Could Get You More Money

Earned Income Credit Refund Chart INVOMERT

The New California Earned Income Tax Credit

Earned Income Tax Credit EITC What It Is And Who Qualifies Quakerpedia

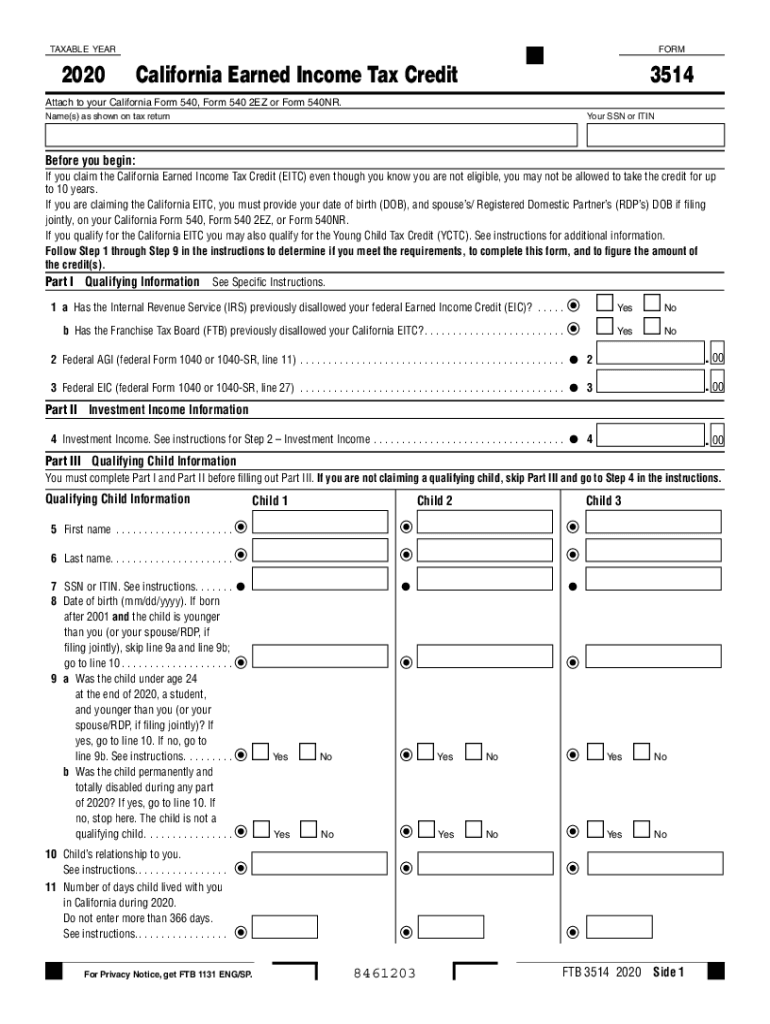

2020 Form 3514 California Earned Income Tax Credit 2020 Form 3514

2020 Form 3514 California Earned Income Tax Credit 2020 Form 3514

Earned Income Tax Credit What You Need To Know