In this age of technology, where screens have become the dominant feature of our lives, the charm of tangible printed objects hasn't waned. For educational purposes or creative projects, or just adding an individual touch to the space, Education Loan Interest Benefit In Income Tax have proven to be a valuable resource. This article will dive into the sphere of "Education Loan Interest Benefit In Income Tax," exploring their purpose, where to find them and how they can be used to enhance different aspects of your lives.

Get Latest Education Loan Interest Benefit In Income Tax Below

Education Loan Interest Benefit In Income Tax

Education Loan Interest Benefit In Income Tax -

Student loan interest deduction For 2023 the amount of your student loan interest deduction is gradually reduced phased out if your MAGI is between 75 000 and 90 000 155 000 and 185 000 if you file a joint return You can t claim the deduction if your MAGI is 90 000 or more 185 000 or more if you file a joint return See chapter 4

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education loans Learn eligibility criteria benefits and how to

Education Loan Interest Benefit In Income Tax encompass a wide array of printable material that is available online at no cost. They come in many styles, from worksheets to templates, coloring pages, and more. The beauty of Education Loan Interest Benefit In Income Tax is in their variety and accessibility.

More of Education Loan Interest Benefit In Income Tax

Automatic Student Loan Interest Benefit For Veterans Military

Automatic Student Loan Interest Benefit For Veterans Military

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year

The provisions of Section 80E of the Income Tax Act 1961 specifically cater to educational loans This section offers deductions that apply to the interest component of these loans Moreover these deductions can only be claimed by individuals once repayment for a

The Education Loan Interest Benefit In Income Tax have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Modifications: We can customize designs to suit your personal needs whether it's making invitations planning your schedule or even decorating your home.

-

Educational Value: Printing educational materials for no cost can be used by students from all ages, making them an invaluable resource for educators and parents.

-

The convenience of Instant access to a plethora of designs and templates will save you time and effort.

Where to Find more Education Loan Interest Benefit In Income Tax

Home Loan Interest Benefit In Income Tax 2023 24 Maximum Amount 2 Lakh

Home Loan Interest Benefit In Income Tax 2023 24 Maximum Amount 2 Lakh

If you ve been paying interest on an educational loan in the tax year 2024 2025 you can benefit from tax deductions under Section 80E of the Income Tax Act In India higher education costs have increased significantly in recent years making it

Section 80E of the Income Tax Act allows a tax deduction on the interest paid on education loans for higher studies Section 80E deduction helps to reduce the financial burden of education loans by lowering the taxable income of the borrower

We've now piqued your interest in printables for free and other printables, let's discover where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Education Loan Interest Benefit In Income Tax to suit a variety of motives.

- Explore categories like design, home decor, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free including flashcards, learning tools.

- Great for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs covered cover a wide range of topics, including DIY projects to planning a party.

Maximizing Education Loan Interest Benefit In Income Tax

Here are some fresh ways to make the most of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use free printable worksheets for teaching at-home, or even in the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Education Loan Interest Benefit In Income Tax are a treasure trove with useful and creative ideas that can meet the needs of a variety of people and interest. Their availability and versatility make them a fantastic addition to any professional or personal life. Explore the many options of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes, they are! You can print and download these documents for free.

-

Can I use free printing templates for commercial purposes?

- It's all dependent on the terms of use. Always consult the author's guidelines before using printables for commercial projects.

-

Are there any copyright problems with Education Loan Interest Benefit In Income Tax?

- Some printables could have limitations concerning their use. Be sure to review the terms and conditions offered by the creator.

-

How do I print printables for free?

- Print them at home with the printer, or go to a local print shop for premium prints.

-

What software do I need to open printables at no cost?

- Many printables are offered as PDF files, which can be opened using free software, such as Adobe Reader.

TAX BENEFITS ON ELECTRIC VEHICLES INDIA

Exim Bank Extends 400m Loan To Maldives Banking Finance News

Check more sample of Education Loan Interest Benefit In Income Tax below

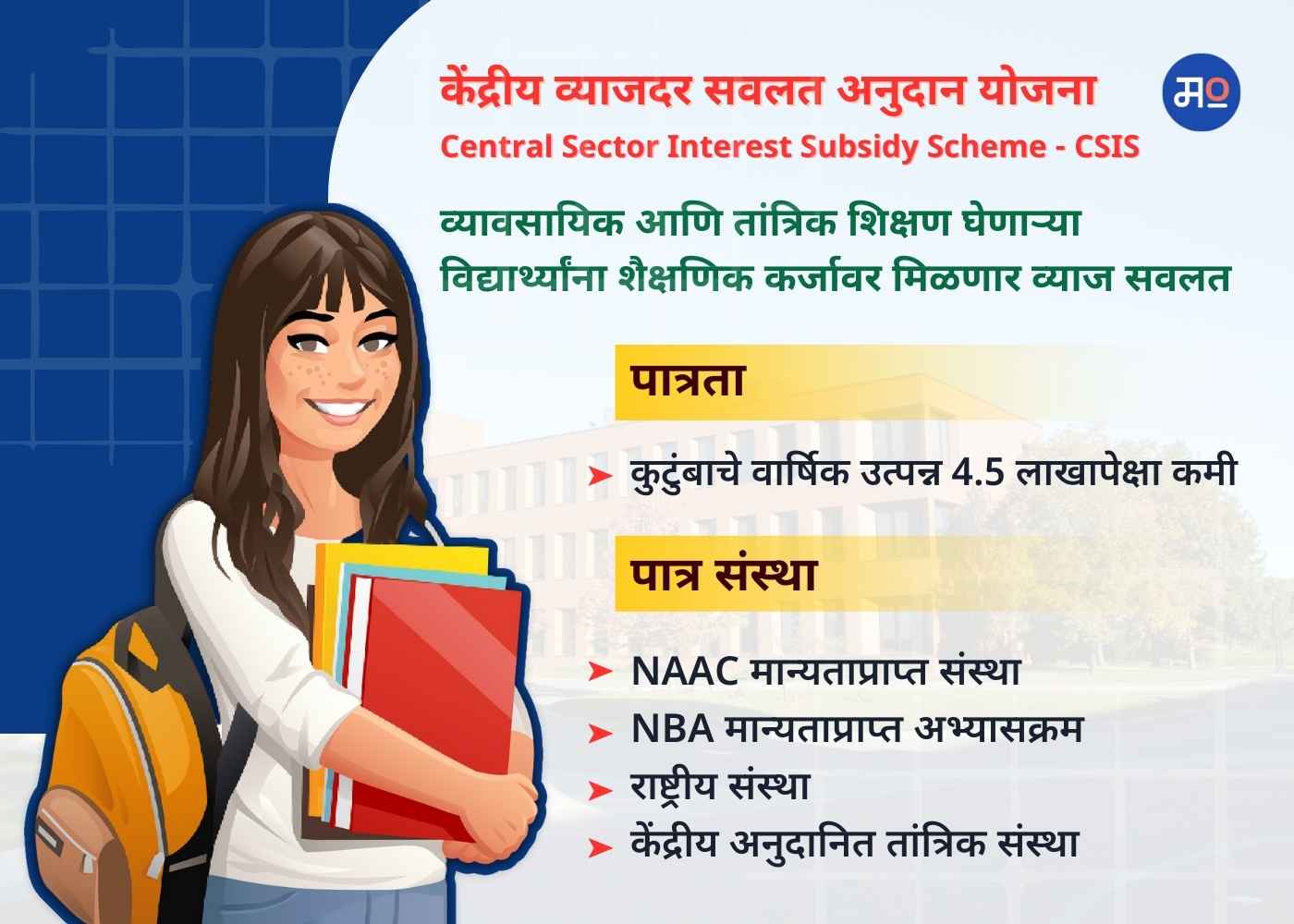

Interest Subsidy Education Loan

Home Loan Interest Home Loan Interest Benefit For Income Tax In 2016 17

Housing SOC Letter Enough To Claim Loan Interest Benefit ITAT

SC Laundering More Heinous Than Murder Banking Finance News

Home Loan Interest Benefit Can Only Be Taken Once Now Mint

Banks Get RBI Nod To Use Any Other ARR In Place Of LIBOR Banking

https://tax2win.in/guide/sec-80e-deduction...

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education loans Learn eligibility criteria benefits and how to

https://cleartax.in/s/section-80e-deduction-interest-education-loan

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available only in old tax regime

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education loans Learn eligibility criteria benefits and how to

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available only in old tax regime

SC Laundering More Heinous Than Murder Banking Finance News

Home Loan Interest Home Loan Interest Benefit For Income Tax In 2016 17

Home Loan Interest Benefit Can Only Be Taken Once Now Mint

Banks Get RBI Nod To Use Any Other ARR In Place Of LIBOR Banking

Education Loan Interest Rate Tax Benefits And Loan Subsidy

Home Loan Interest Benefit Can Only Be Taken Once Now Mint

Home Loan Interest Benefit Can Only Be Taken Once Now Mint

Income Tax Benefits On Housing Loan In India