In this digital age, in which screens are the norm yet the appeal of tangible printed materials hasn't faded away. Whatever the reason, whether for education for creative projects, simply adding an individual touch to the home, printables for free are now a useful source. The following article is a dive into the world "Education Loan Interest Exemption Limit," exploring what they are, where to find them, and how they can enrich various aspects of your lives.

Get Latest Education Loan Interest Exemption Limit Below

Education Loan Interest Exemption Limit

Education Loan Interest Exemption Limit -

Education loan option tax exemption limit under Section 80E The interest portion of an education loan option qualifies for deduction from your income akin to deductions under

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you

Printables for free cover a broad array of printable items that are available online at no cost. They come in many types, like worksheets, coloring pages, templates and more. One of the advantages of Education Loan Interest Exemption Limit is in their versatility and accessibility.

More of Education Loan Interest Exemption Limit

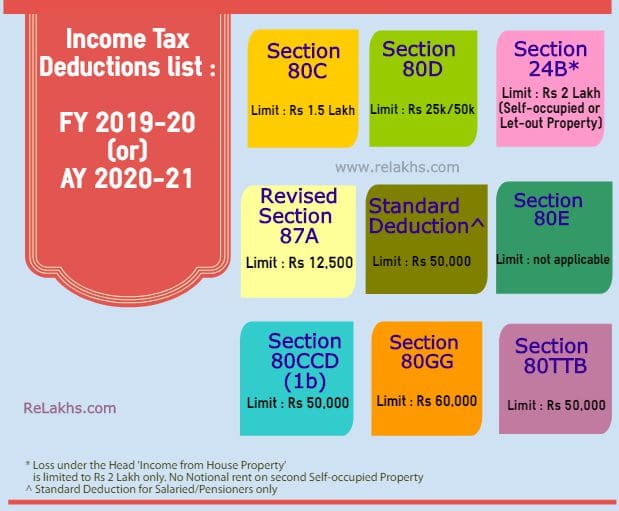

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

Home Loan Interest Tax Exemption Limit 2019 20 Home Sweet Home

What is the income limit for the student loan interest deduction in 2022 You cannot claim the student loan interest deduction if your modified adjusted gross income is above 85 000 170 000

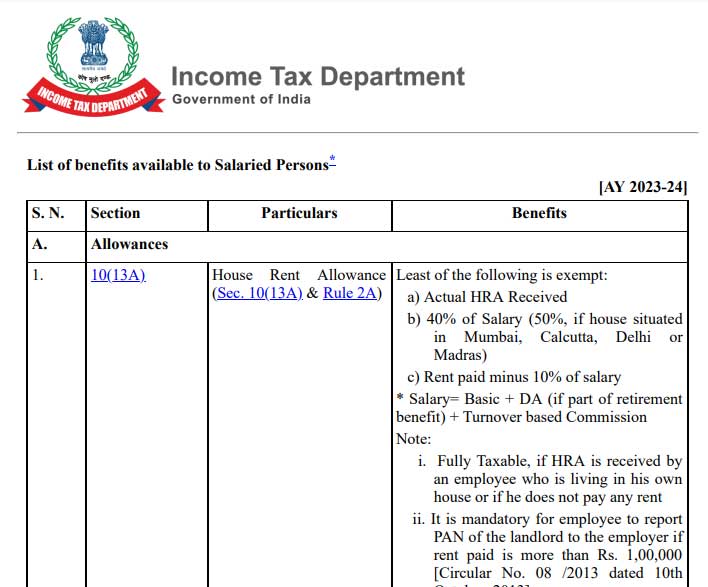

Interest on educational loan should have been paid on loan taken by him from any financial institution or any approved charitable institution for the purpose of pursuing his higher

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Modifications: There is the possibility of tailoring the templates to meet your individual needs in designing invitations making your schedule, or even decorating your house.

-

Educational value: Downloads of educational content for free offer a wide range of educational content for learners from all ages, making the perfect tool for parents and educators.

-

Easy to use: Access to an array of designs and templates helps save time and effort.

Where to Find more Education Loan Interest Exemption Limit

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Student Loan Interest Deduction for 2023 and 2024 Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what

The provisions of Section 80E of the Income Tax Act 1961 specifically cater to educational loans This section offers deductions that apply to the interest component of these loans Moreover

Since we've got your interest in Education Loan Interest Exemption Limit we'll explore the places they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Education Loan Interest Exemption Limit designed for a variety needs.

- Explore categories such as home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free including flashcards, learning tools.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- These blogs cover a broad range of topics, all the way from DIY projects to party planning.

Maximizing Education Loan Interest Exemption Limit

Here are some fresh ways of making the most use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Utilize free printable worksheets to build your knowledge at home and in class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Education Loan Interest Exemption Limit are an abundance of creative and practical resources which cater to a wide range of needs and interest. Their accessibility and flexibility make them a wonderful addition to any professional or personal life. Explore the vast world of Education Loan Interest Exemption Limit now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes, they are! You can download and print these resources at no cost.

-

Can I make use of free printouts for commercial usage?

- It is contingent on the specific usage guidelines. Be sure to read the rules of the creator before using printables for commercial projects.

-

Are there any copyright issues when you download Education Loan Interest Exemption Limit?

- Certain printables may be subject to restrictions on usage. Be sure to read the terms and regulations provided by the author.

-

How can I print printables for free?

- Print them at home using your printer or visit an area print shop for premium prints.

-

What software do I require to open printables at no cost?

- Most PDF-based printables are available in PDF format, which can be opened with free software, such as Adobe Reader.

Home Loan Interest Exemption Limit Home Sweet Home Modern Livingroom

National Interest Exemption Vs National Interest Waiver

Check more sample of Education Loan Interest Exemption Limit below

List Of Benefits Available To Salaried Persons For AY 2023 24

Lok Sabha Election Result Now That They Have Got The Votes They

Income Tax Exemption Limit May Get Doubled To Rs 2 Lacs

Build India February 2012

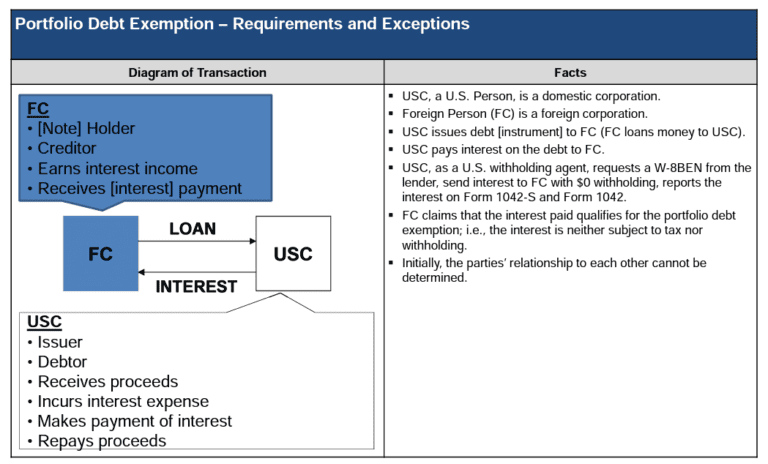

The New Section 163 j Interest Limits And The Portfolio Interest Exemption

Income Tax Exemption On Interest Of Education Loan YouTube

https://www.irs.gov/taxtopics/tc456

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you

https://www.etmoney.com/learn/income …

Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is available for a

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you

Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is available for a

Build India February 2012

Lok Sabha Election Result Now That They Have Got The Votes They

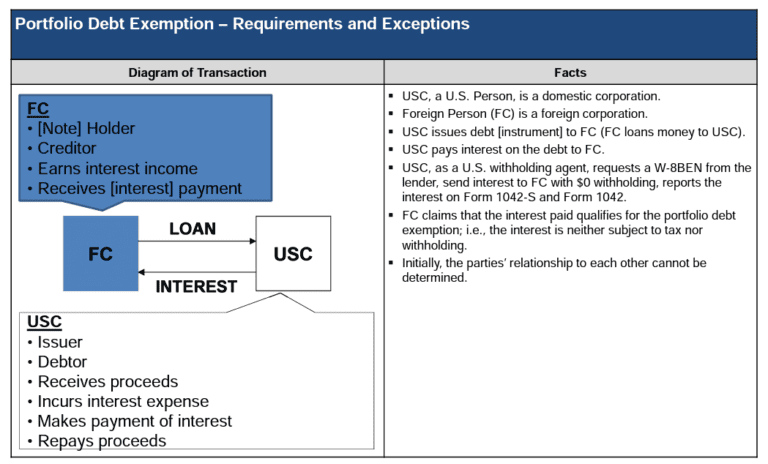

The New Section 163 j Interest Limits And The Portfolio Interest Exemption

Income Tax Exemption On Interest Of Education Loan YouTube

Auxilo Education Loan Without Collateral Interest Rate And Process

Portfolio Interest Exemption US HTJ Tax

Portfolio Interest Exemption US HTJ Tax

Portfolio Interest Exemption US HTJ Tax