In this age of electronic devices, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons and creative work, or simply to add the personal touch to your area, Education Loan Principal Repayment Tax Benefit are now a useful resource. For this piece, we'll take a dive in the world of "Education Loan Principal Repayment Tax Benefit," exploring their purpose, where they are available, and how they can enrich various aspects of your lives.

Get Latest Education Loan Principal Repayment Tax Benefit Below

Education Loan Principal Repayment Tax Benefit

Education Loan Principal Repayment Tax Benefit -

A maximum deduction of up to Rs 40 000 can be availed under Section 80E While availing deduction under section 80E the taxpayer must obtain a certificate from

No Tax benefit is allowed for the principal repayment Period of deduction The deduction for interest on loan starts from the

Printables for free include a vast assortment of printable, downloadable materials online, at no cost. They come in many types, like worksheets, templates, coloring pages and much more. The appeal of printables for free is in their variety and accessibility.

More of Education Loan Principal Repayment Tax Benefit

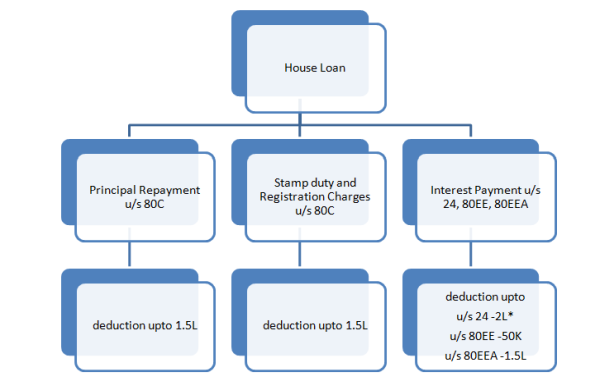

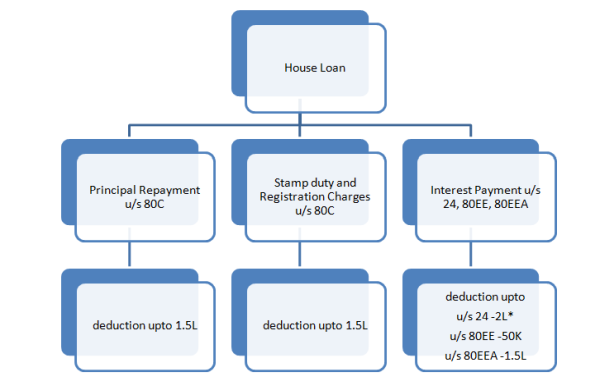

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

You won t get tax benefit on the repayment of the principal amount For example if the total EMI of your education loan is Rs 12 000 and Rs 8 000 is the principal component and Rs 4 000 is

Navneet Dubey An education loan makes available the finances and gives you flexibility to take up higher education and pay for it systematically over a longer

Education Loan Principal Repayment Tax Benefit have gained immense popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Flexible: This allows you to modify designs to suit your personal needs whether it's making invitations and schedules, or even decorating your home.

-

Educational Value: Downloads of educational content for free offer a wide range of educational content for learners of all ages, making these printables a powerful source for educators and parents.

-

Affordability: Instant access to many designs and templates can save you time and energy.

Where to Find more Education Loan Principal Repayment Tax Benefit

Tax Paid Back For Bonus Repayment Dimov Tax CPA Services

Tax Paid Back For Bonus Repayment Dimov Tax CPA Services

You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year The deduction is gradually reduced and eventually eliminated by

Employer provided educational assistance benefits include payments made after March 27 2020 and before January 1 2026 for principal or interest on any qualified education loan you incurred for your education

We've now piqued your interest in printables for free we'll explore the places you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of uses.

- Explore categories like home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- This is a great resource for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- The blogs are a vast range of topics, starting from DIY projects to party planning.

Maximizing Education Loan Principal Repayment Tax Benefit

Here are some new ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Utilize free printable worksheets for reinforcement of learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Education Loan Principal Repayment Tax Benefit are an abundance of useful and creative resources catering to different needs and needs and. Their availability and versatility make they a beneficial addition to both professional and personal life. Explore the wide world of Education Loan Principal Repayment Tax Benefit right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes they are! You can print and download these materials for free.

-

Can I utilize free printables in commercial projects?

- It's based on the rules of usage. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright problems with Education Loan Principal Repayment Tax Benefit?

- Certain printables might have limitations concerning their use. Be sure to read the terms and conditions provided by the creator.

-

How can I print printables for free?

- Print them at home with the printer, or go to the local print shops for high-quality prints.

-

What program do I need to run Education Loan Principal Repayment Tax Benefit?

- The majority of PDF documents are provided in PDF format. They can be opened using free software like Adobe Reader.

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

TTT CERB Repayment The Mad Accountant

Check more sample of Education Loan Principal Repayment Tax Benefit below

MoneyGram Announces 15 Million Voluntary Term Loan Principal Repayment

Is My Business Loan Repayment Tax Deductible IIFL Finance

Loan Interest Vs Principal Repayment Calculator

How To Choose Between The New And Old Income Tax Regimes Chandan

What Are The Tax Benefits On Top Up Loan HomeFirst

Income Tax Savings On Home Loan

https://cleartax.in/s/section-80e-deduction-interest-education-loan

No Tax benefit is allowed for the principal repayment Period of deduction The deduction for interest on loan starts from the

https://www.tankhapay.com/blog/section-80e

The deduction applies only to the total interest paid and no tax benefit is provided for the principal repayment Period of Deduction for Education Loan under

No Tax benefit is allowed for the principal repayment Period of deduction The deduction for interest on loan starts from the

The deduction applies only to the total interest paid and no tax benefit is provided for the principal repayment Period of Deduction for Education Loan under

How To Choose Between The New And Old Income Tax Regimes Chandan

Is My Business Loan Repayment Tax Deductible IIFL Finance

What Are The Tax Benefits On Top Up Loan HomeFirst

Income Tax Savings On Home Loan

How To Optimise Your Tax Saving Using Your Home Loan Using Your Home

Budget 2023 MYRE Capital s Aryaman Vir Wants Separate Section For Home

Budget 2023 MYRE Capital s Aryaman Vir Wants Separate Section For Home

Can You Claim Tax Benefit On Both HRA And Home Loan Repayment USA