In this age of technology, with screens dominating our lives The appeal of tangible printed material hasn't diminished. No matter whether it's for educational uses and creative work, or simply to add an extra personal touch to your space, Education Tax Deduction Form are now a vital resource. The following article is a take a dive into the world of "Education Tax Deduction Form," exploring the different types of printables, where they are available, and how they can enhance various aspects of your lives.

Get Latest Education Tax Deduction Form Below

Education Tax Deduction Form

Education Tax Deduction Form -

Updated Jan 25 2023 Edited by Chris Hutchison Many or all of the products featured here are from our partners who compensate us This influences which products we write about and where and how the

You can deduct the following training expenses attendance fees charges for course materials travel expenses expenses for staying overnight at the study location

Education Tax Deduction Form include a broad variety of printable, downloadable materials online, at no cost. These resources come in many kinds, including worksheets templates, coloring pages, and many more. The value of Education Tax Deduction Form is in their variety and accessibility.

More of Education Tax Deduction Form

Pin On Business Template

Pin On Business Template

News Tax Benefits for Education Information Center You can use the IRS s Interactive Tax Assistant tool to help determine if you re eligible for educational credits or

Tuition paying students at eligible colleges or other post secondary institutions should receive a copy of Internal Revenue Service Form 1098 T from their

Education Tax Deduction Form have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

customization Your HTML0 customization options allow you to customize printables to fit your particular needs such as designing invitations, organizing your schedule, or even decorating your home.

-

Educational Value The free educational worksheets cater to learners of all ages, which makes them a vital tool for parents and teachers.

-

Simple: Access to a variety of designs and templates, which saves time as well as effort.

Where to Find more Education Tax Deduction Form

Refundable Nonrefundable Education Tax Credits Finance Zacks

Refundable Nonrefundable Education Tax Credits Finance Zacks

Parents and students with an Adjusted Gross Income under 90 000 if filing as single or under 185 000 if married filing jointly can deduct up to 2 500 of interest

Jesus Morales Grace EA Updated January 2 2024 Are you spending money to advance your skills or keep up with your field Good news That could be a

Now that we've ignited your interest in printables for free, let's explore where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Education Tax Deduction Form to suit a variety of motives.

- Explore categories such as furniture, education, craft, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing including flashcards, learning tools.

- The perfect resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- These blogs cover a broad array of topics, ranging starting from DIY projects to party planning.

Maximizing Education Tax Deduction Form

Here are some creative ways in order to maximize the use use of Education Tax Deduction Form:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet to reinforce learning at home for the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Education Tax Deduction Form are an abundance of practical and imaginative resources that cater to various needs and pursuits. Their availability and versatility make them an essential part of the professional and personal lives of both. Explore the world of Education Tax Deduction Form today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Education Tax Deduction Form really available for download?

- Yes they are! You can print and download these resources at no cost.

-

Can I download free printing templates for commercial purposes?

- It's dependent on the particular terms of use. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables could have limitations in their usage. Make sure you read the terms and condition of use as provided by the creator.

-

How do I print Education Tax Deduction Form?

- Print them at home using an printer, or go to an area print shop for better quality prints.

-

What software do I require to open Education Tax Deduction Form?

- The majority of printables are in the format PDF. This can be opened with free programs like Adobe Reader.

Education Tax Credits And Deductions Guide Nj

Printable Tax Deduction Form For Donations Printable Forms Free Online

Check more sample of Education Tax Deduction Form below

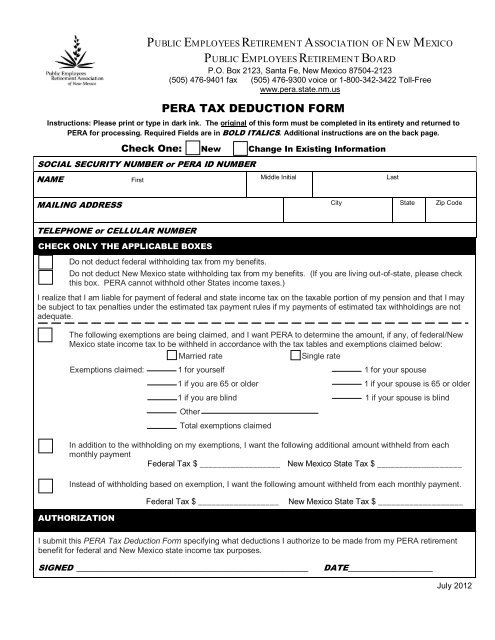

PERA TAX DEDUCTION FORM Public Employees Retirement

Tax Deduction Shellark

Printable Itemized Deductions Worksheet

New IRS Rule Tax Deduction For Special Education Tuition Elder Law

Tax Deduction Form For Clothing Donation Prosecution2012

Above the Line Education Tax Deduction Reinstated Coastal Tax Advisors

https://www.vero.fi/en/individuals/tax-cards-and...

You can deduct the following training expenses attendance fees charges for course materials travel expenses expenses for staying overnight at the study location

https://www.kela.fi/benefit-forms/OT20e.pdf

This claim form concerns persons who have completed a higher education degree and have a student loan if the first higher education studies started before 1 August 2014

You can deduct the following training expenses attendance fees charges for course materials travel expenses expenses for staying overnight at the study location

This claim form concerns persons who have completed a higher education degree and have a student loan if the first higher education studies started before 1 August 2014

New IRS Rule Tax Deduction For Special Education Tuition Elder Law

Tax Deduction Shellark

Tax Deduction Form For Clothing Donation Prosecution2012

Above the Line Education Tax Deduction Reinstated Coastal Tax Advisors

5 Commonly Overlooked Education Tax Credits And Deductions Chime

Education Tax Deduction And Tax Credit PriorTax Blog

Education Tax Deduction And Tax Credit PriorTax Blog

How To Claim Your Self Education Tax Deduction