In a world where screens rule our lives, the charm of tangible printed materials isn't diminishing. If it's to aid in education and creative work, or just adding an individual touch to your area, Eis Capital Gains Tax Relief Example can be an excellent resource. We'll take a dive deeper into "Eis Capital Gains Tax Relief Example," exploring their purpose, where to find them, and how they can be used to enhance different aspects of your daily life.

Get Latest Eis Capital Gains Tax Relief Example Below

Eis Capital Gains Tax Relief Example

Eis Capital Gains Tax Relief Example -

Loss Relief If an EIS investment results in a loss the loss can be offset against the investor s income or capital gains in the current or future tax years For a higher rate taxpayer this can result in a tax relief of up to 45 of the net loss

EIS capital gains tax relief also known as CGT exemption or disposal relief is a tax incentive available under the Enterprise Investment Scheme EIS It enables investors to sell EIS shares free of the 10 20 rate of capital gains tax typically due on the sale of assets

Eis Capital Gains Tax Relief Example encompass a wide range of printable, free content that can be downloaded from the internet at no cost. These resources come in various formats, such as worksheets, templates, coloring pages and much more. The appealingness of Eis Capital Gains Tax Relief Example is their versatility and accessibility.

More of Eis Capital Gains Tax Relief Example

EIS And SEIS Capital Gains Tax Relief More Valuable Now Than Ever

EIS And SEIS Capital Gains Tax Relief More Valuable Now Than Ever

While most investments are taxed on capital gain the EIS offers capital gains tax disposal relief to incentivise EIS investments So long as you hold your EIS investment for a minimum of 3 years you don t have to pay capital gains tax on profits from that sale

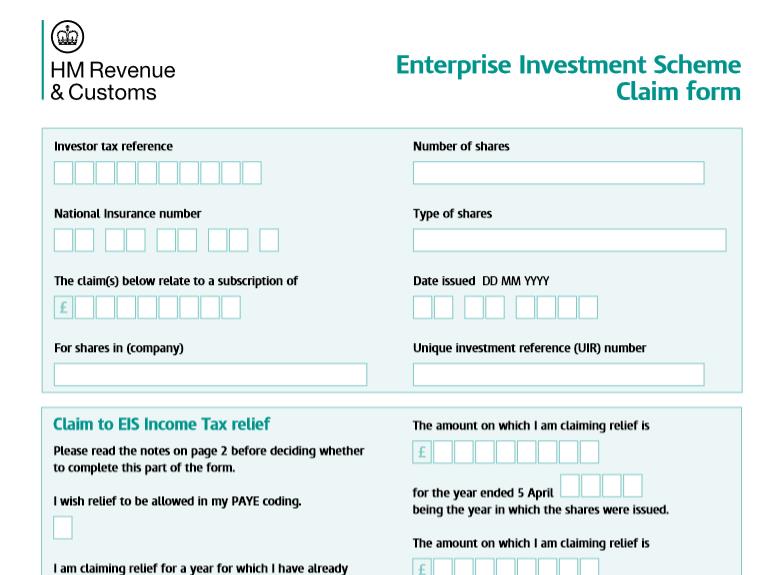

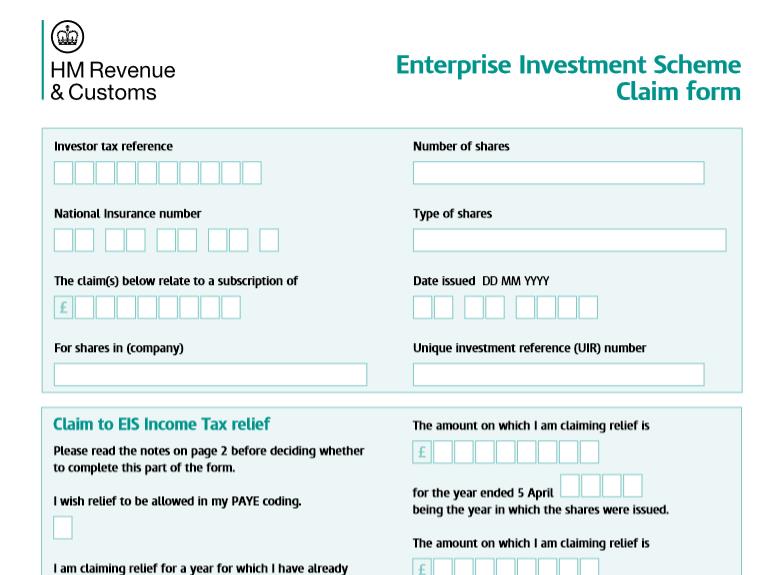

Discover how the Enterprise Investment Scheme EIS offers UK investors significant tax relief including 30 income tax reduction capital gains deferral and loss relief

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

The ability to customize: This allows you to modify designs to suit your personal needs whether you're designing invitations, organizing your schedule, or even decorating your home.

-

Educational Value: These Eis Capital Gains Tax Relief Example provide for students of all ages, making them a great resource for educators and parents.

-

Accessibility: Access to various designs and templates can save you time and energy.

Where to Find more Eis Capital Gains Tax Relief Example

EIS Deferral Relief Capital Gains Tax Savings For Residential

EIS Deferral Relief Capital Gains Tax Savings For Residential

Here we explore the vast and varied tax reliefs accessible to investors under the Enterprise Investment Scheme relating to capital gains tax

Investors with capital gains made up to three years before or one year after an EIS investment is made can claim deferral relief against those gains at up to 24 for gains on residential property and up to 20 on other gains except carried interest taxed at 28

In the event that we've stirred your curiosity about Eis Capital Gains Tax Relief Example Let's look into where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection and Eis Capital Gains Tax Relief Example for a variety needs.

- Explore categories such as design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Great for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a broad selection of subjects, that includes DIY projects to planning a party.

Maximizing Eis Capital Gains Tax Relief Example

Here are some fresh ways create the maximum value use of Eis Capital Gains Tax Relief Example:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use these printable worksheets free of charge for teaching at-home also in the classes.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Eis Capital Gains Tax Relief Example are an abundance of practical and innovative resources that can meet the needs of a variety of people and passions. Their availability and versatility make they a beneficial addition to both personal and professional life. Explore the vast world that is Eis Capital Gains Tax Relief Example today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes, they are! You can download and print the resources for free.

-

Do I have the right to use free printables to make commercial products?

- It's based on specific conditions of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns when using Eis Capital Gains Tax Relief Example?

- Some printables could have limitations concerning their use. Always read these terms and conditions as set out by the designer.

-

How can I print printables for free?

- Print them at home using any printer or head to a local print shop to purchase high-quality prints.

-

What program do I require to view printables at no cost?

- The majority of PDF documents are provided in the PDF format, and can be opened with free software such as Adobe Reader.

Home Page EIS Investment

EIS Capital Gains Tax Relief An Overview For Investors GCV

Check more sample of Eis Capital Gains Tax Relief Example below

EIS TAX RELIEFS CAPITAL GAINS TAX DEFERRAL RELIEF FOCUS

Retirement Relief Capital Gains Tax Relief In Ireland 2 000 Clients

When Can I Claim EIS Tax Relief Capital Gains Tax CGT Deferral

Thousands Of Shopkeepers Stand To Lose 15 000 From Chancellor s Plan

EIS Get The Most Before Tax Year End Bure Valley

Here s How To Claim EIS Tax Reliefs This Tax Year

https://www.growthcapitalventures.co.uk/insights/...

EIS capital gains tax relief also known as CGT exemption or disposal relief is a tax incentive available under the Enterprise Investment Scheme EIS It enables investors to sell EIS shares free of the 10 20 rate of capital gains tax typically due on the sale of assets

https://octopusinvestments.com/.../eis-tax-reliefs

Investors can claim up to 30 income tax relief on EIS investments which gives an incentive for some of the risk normally associated with funding small companies The maximum investment that investors can claim relief on in a single tax year is 1 million which amounts to 300 000 of income tax relief

EIS capital gains tax relief also known as CGT exemption or disposal relief is a tax incentive available under the Enterprise Investment Scheme EIS It enables investors to sell EIS shares free of the 10 20 rate of capital gains tax typically due on the sale of assets

Investors can claim up to 30 income tax relief on EIS investments which gives an incentive for some of the risk normally associated with funding small companies The maximum investment that investors can claim relief on in a single tax year is 1 million which amounts to 300 000 of income tax relief

Thousands Of Shopkeepers Stand To Lose 15 000 From Chancellor s Plan

Retirement Relief Capital Gains Tax Relief In Ireland 2 000 Clients

EIS Get The Most Before Tax Year End Bure Valley

Here s How To Claim EIS Tax Reliefs This Tax Year

EIS Shares And Capital Gains Tax Deferral Relief

EIS Capital Gains Tax Relief An Overview For Investors GCV

EIS Capital Gains Tax Relief An Overview For Investors GCV

SEIS EIS Relief For Non Doms Via Business Investment Relief KBC