In this digital age, in which screens are the norm yet the appeal of tangible printed materials hasn't faded away. Be it for educational use for creative projects, just adding the personal touch to your space, Eis Income Tax Relief Carry Back Time Limit are now an essential source. This article will take a dive in the world of "Eis Income Tax Relief Carry Back Time Limit," exploring their purpose, where to find them, and ways they can help you improve many aspects of your life.

Get Latest Eis Income Tax Relief Carry Back Time Limit Below

Eis Income Tax Relief Carry Back Time Limit

Eis Income Tax Relief Carry Back Time Limit -

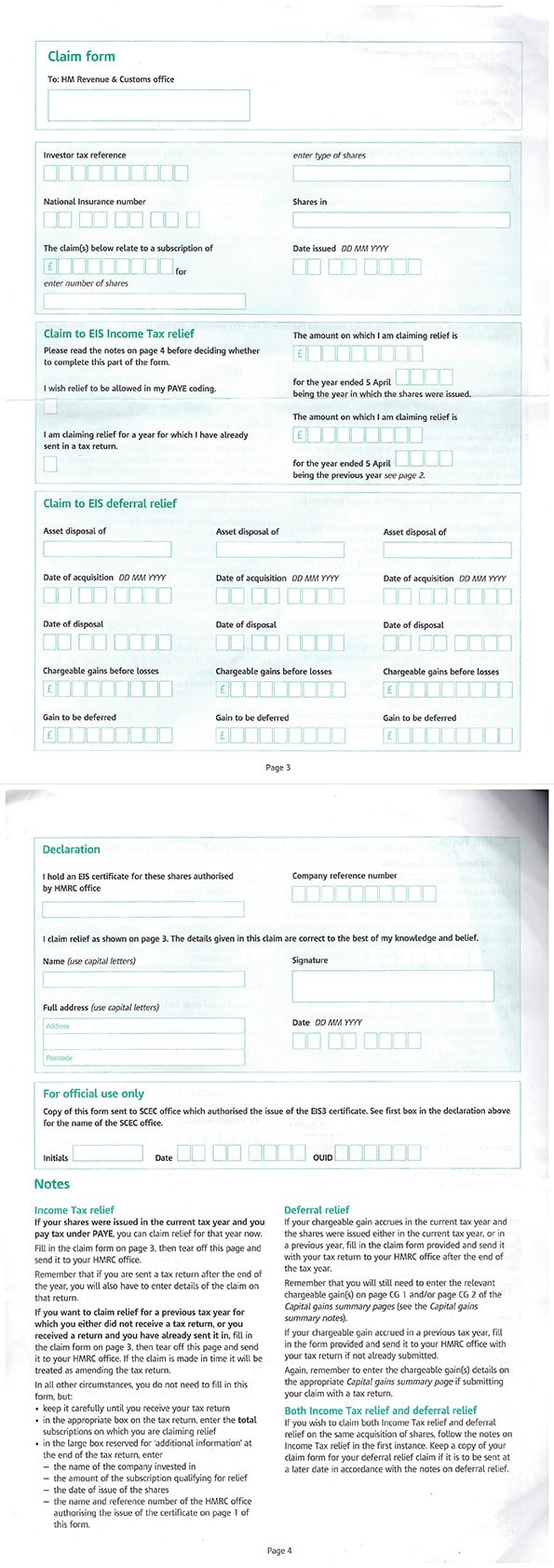

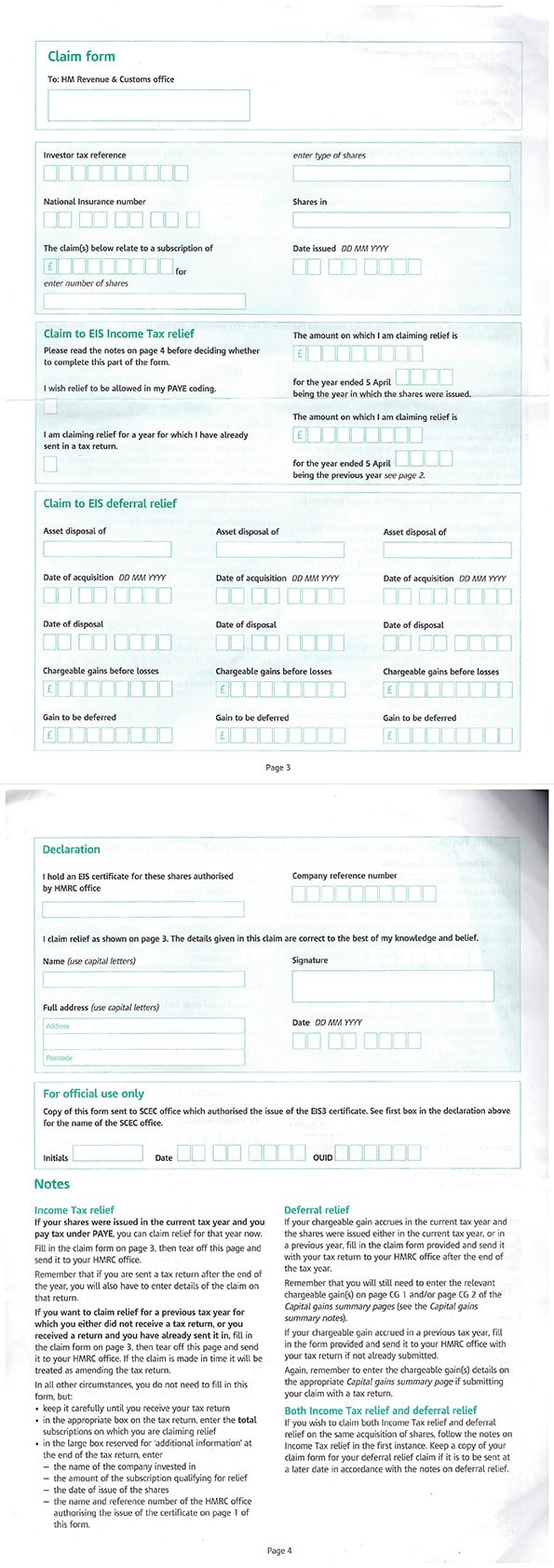

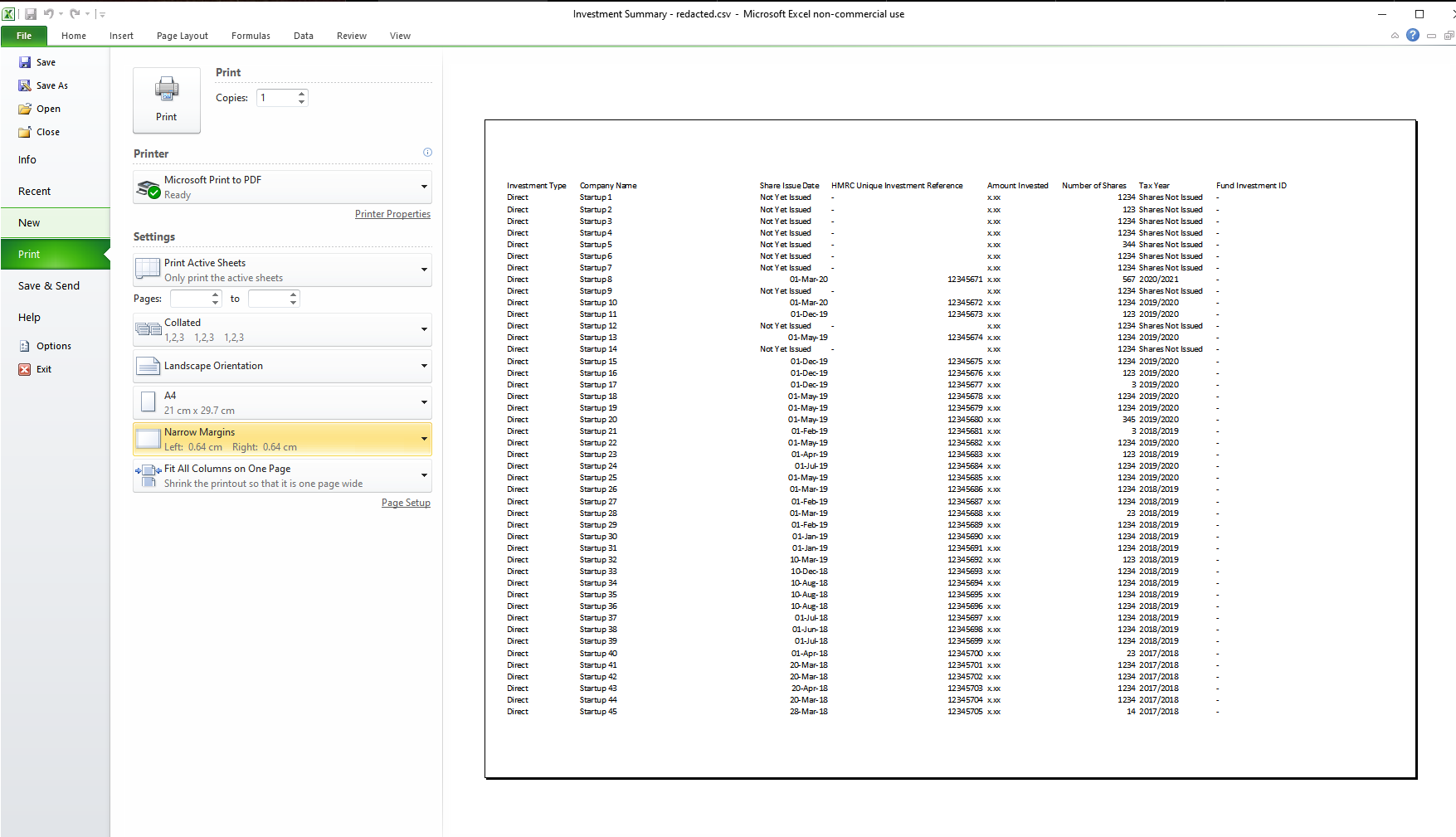

That is correct you can carry back EIS relief 1 year to the extent that the EIS limit was not exceeded in that previous year Note though you cannot claim until the company provides you the EIS 3 certificate or EIS 5 if its from an investment fund and said certificates will only be issued after 4 months of trading

A qualifying investment is made in the first 6 months of 2005 06 tax year and it is desired to elect for 50 of it to be treated as if paid in 2004 05

The Eis Income Tax Relief Carry Back Time Limit are a huge assortment of printable, downloadable materials online, at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages, and more. The great thing about Eis Income Tax Relief Carry Back Time Limit is their flexibility and accessibility.

More of Eis Income Tax Relief Carry Back Time Limit

Income Tax Relief Maximum Income Tax Relief On Eis

Income Tax Relief Maximum Income Tax Relief On Eis

It is the EIS1 time limit that is the 28 months you mention Yes it has no effect on class 4 because it directy reduces income tax rather than taxable income You can only carry back income tax relief if the subscription is before 6th October in any tax year So subscription on 2 4 04 can only be used in 03 04

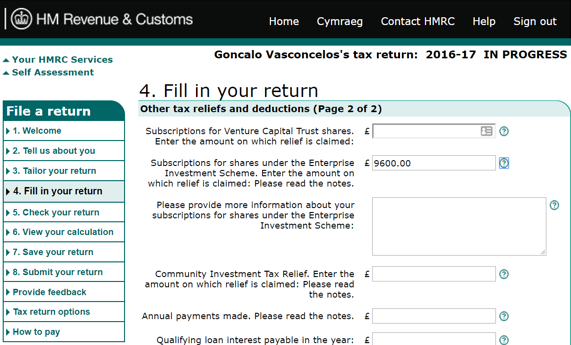

It has become apparent that client s original EIS3 income tax claim to carry back 2016 17 share subscriptions to 2015 16 was flawed in its quantum She now needs to amend the original carry back claim to carry back more of the 2016 17 subscription to 2015 16 2016 17 is of course now out of time for normal tax return amendment

Eis Income Tax Relief Carry Back Time Limit have garnered immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

customization: Your HTML0 customization options allow you to customize printables to your specific needs such as designing invitations, organizing your schedule, or even decorating your home.

-

Educational Impact: Printing educational materials for no cost offer a wide range of educational content for learners of all ages, making them a useful device for teachers and parents.

-

Easy to use: immediate access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Eis Income Tax Relief Carry Back Time Limit

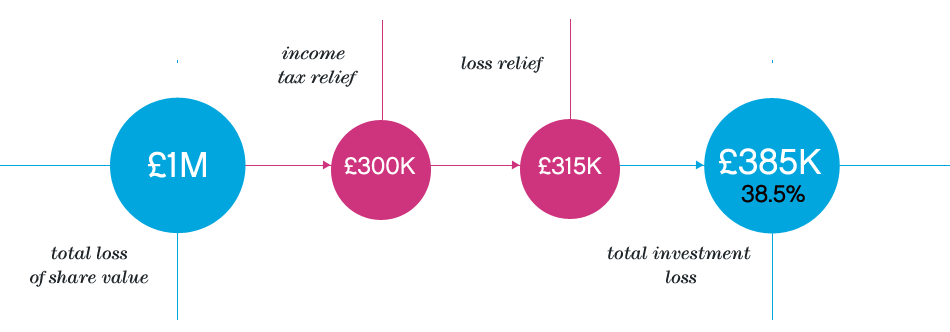

EIS SEIS Loss Relief Explained Kuber Ventures EIS SEIS BPR

EIS SEIS Loss Relief Explained Kuber Ventures EIS SEIS BPR

But I think for admin reasons you can only claim the latter reliefs if you make an income tax relief claim for the tax year you buy the shares What I m not clear on is how that works if there is no income tax to be relieved that year I have found reference to carrying back to the previous tax year which also doesn t help me

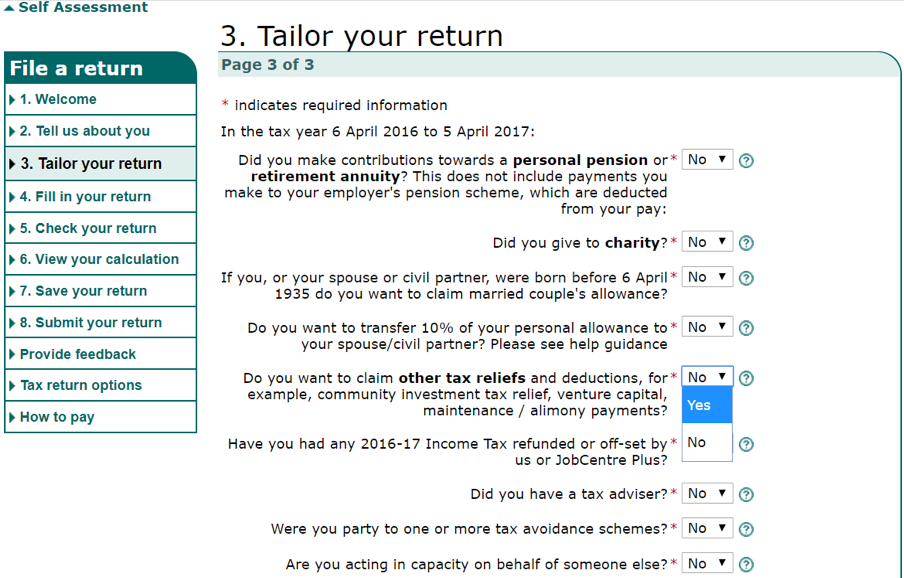

Client has an Income Tax liability for 2022 23 Made no EIS investments in 2022 23 but has made substantial EIS investment in 2023 24 EIS Relief cannot be carried forward as far as I know but it can be carried back one year My question is can I claim EIS relief on the client s 2022 23 Return on the investments made in 2023 24 or do I need to

Now that we've ignited your interest in printables for free Let's look into where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Eis Income Tax Relief Carry Back Time Limit for all uses.

- Explore categories like furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free including flashcards, learning tools.

- Ideal for teachers, parents as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- These blogs cover a broad selection of subjects, including DIY projects to planning a party.

Maximizing Eis Income Tax Relief Carry Back Time Limit

Here are some inventive ways for you to get the best of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Eis Income Tax Relief Carry Back Time Limit are an abundance of useful and creative resources that meet a variety of needs and passions. Their access and versatility makes them an essential part of your professional and personal life. Explore the vast collection of Eis Income Tax Relief Carry Back Time Limit and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Eis Income Tax Relief Carry Back Time Limit truly are they free?

- Yes you can! You can print and download these documents for free.

-

Can I use free printables for commercial purposes?

- It's all dependent on the usage guidelines. Always review the terms of use for the creator before using any printables on commercial projects.

-

Do you have any copyright problems with Eis Income Tax Relief Carry Back Time Limit?

- Some printables could have limitations in use. Be sure to check the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- You can print them at home using printing equipment or visit a local print shop to purchase better quality prints.

-

What software do I require to open Eis Income Tax Relief Carry Back Time Limit?

- Most PDF-based printables are available in PDF format. These can be opened using free programs like Adobe Reader.

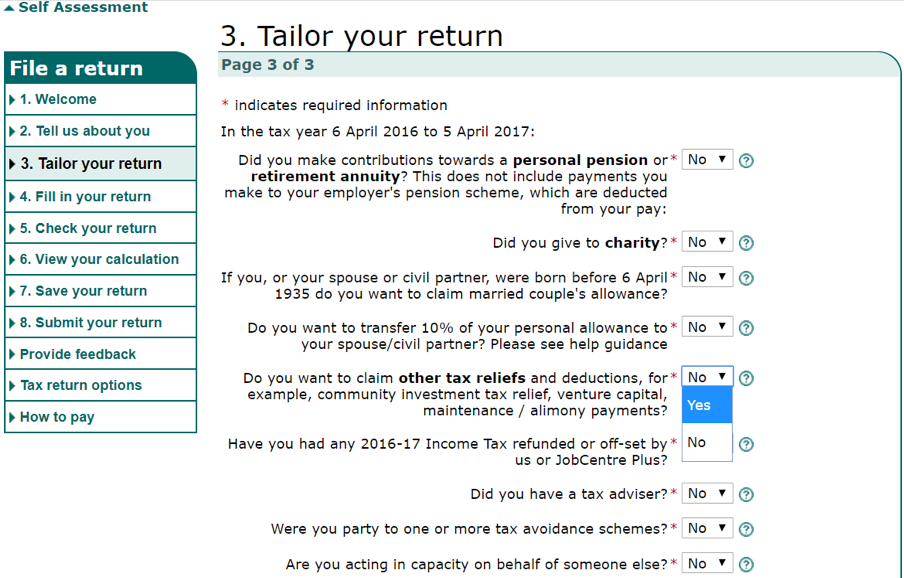

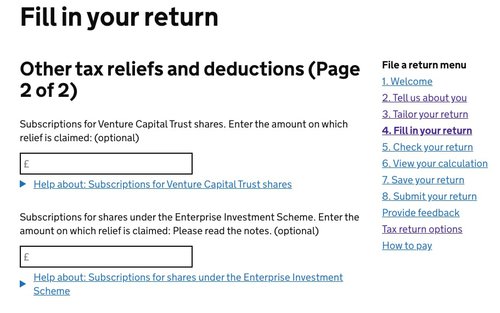

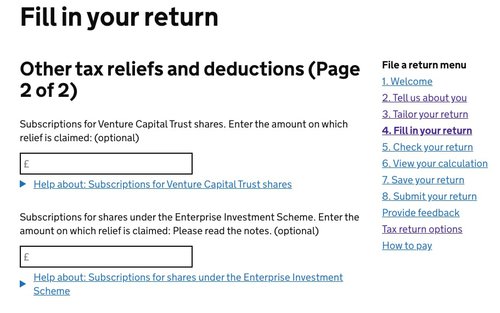

How To Claim EIS Income Tax Relief During HMRC Self assessment

EIS SEIS Loss Relief Explained Kuber Ventures EIS SEIS BPR

Check more sample of Eis Income Tax Relief Carry Back Time Limit below

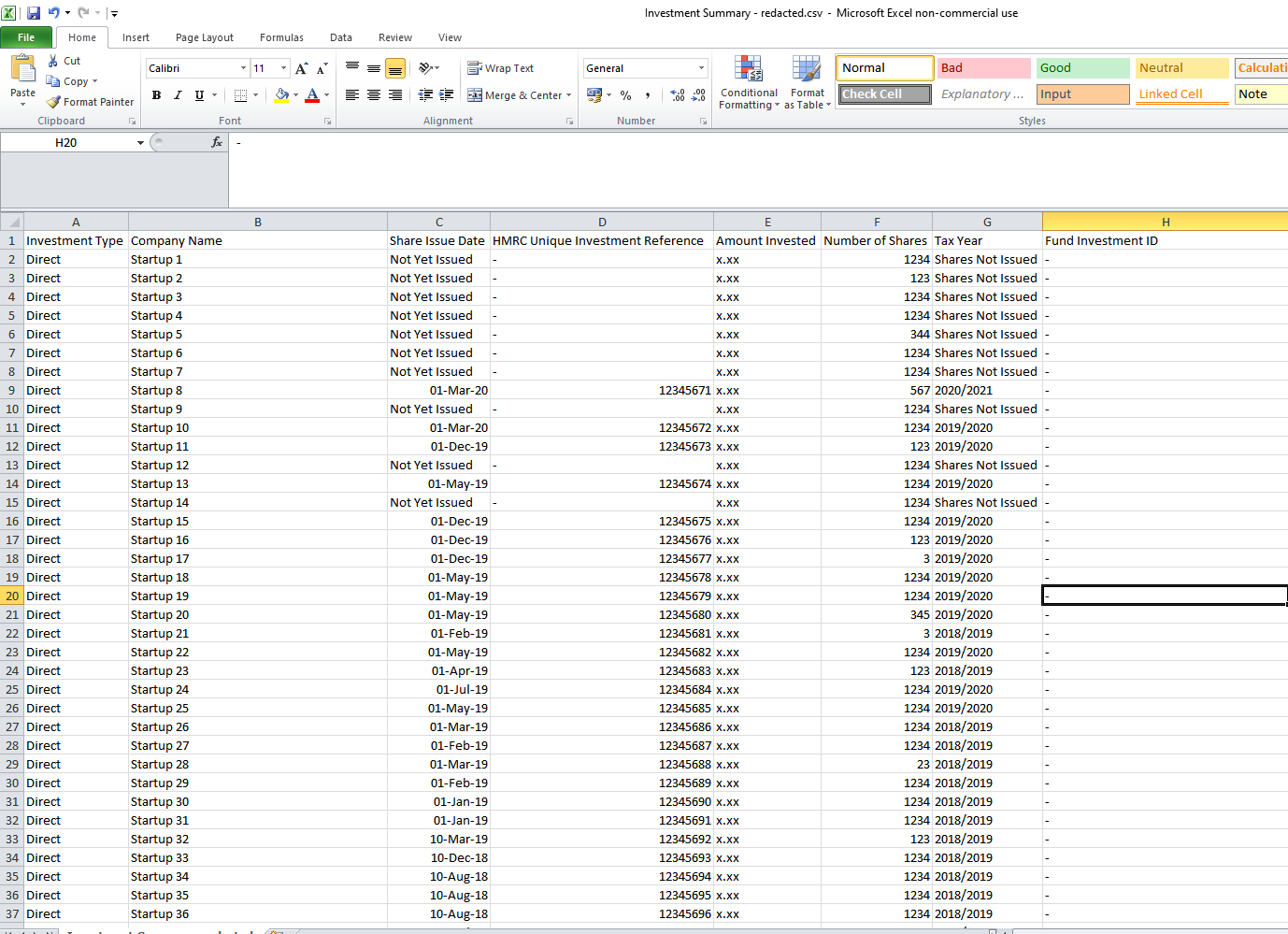

EIS Carry Back And Minimising 2020 21 Income Tax

How To Claim EIS Income Tax Relief During HMRC Self assessment

How Do I Claim An EIS Loss Relief On My Taxes KBC

How To Claim Eis Client Is Claiming Eis Relief And Has Given Me Form

How To Claim EIS Income Tax Relief A Step by step Guide

How To Claim EIS Income Tax Relief In 2022 Key Business Consultants

https://www.accountingweb.co.uk/any-answers/eis-carry-back-incom…

A qualifying investment is made in the first 6 months of 2005 06 tax year and it is desired to elect for 50 of it to be treated as if paid in 2004 05

https://www.accountingweb.co.uk/any-answers/eis-relief-carry-forwar…

Investment of 10k which provides 3k IT relief CY tax liability 1k PY tax liability 1k Following year tax liability 5k Can you reduce both CY PY tax to nil then carry forward the remaining 1k of IT relief to following year

A qualifying investment is made in the first 6 months of 2005 06 tax year and it is desired to elect for 50 of it to be treated as if paid in 2004 05

Investment of 10k which provides 3k IT relief CY tax liability 1k PY tax liability 1k Following year tax liability 5k Can you reduce both CY PY tax to nil then carry forward the remaining 1k of IT relief to following year

How To Claim Eis Client Is Claiming Eis Relief And Has Given Me Form

How To Claim EIS Income Tax Relief During HMRC Self assessment

How To Claim EIS Income Tax Relief A Step by step Guide

How To Claim EIS Income Tax Relief In 2022 Key Business Consultants

How To Claim EIS Income Tax Relief During HMRC Self assessment

How To Claim EIS Income Tax Relief Step by step Guide

How To Claim EIS Income Tax Relief Step by step Guide

How To Claim EIS Income Tax Relief During HMRC Self assessment