In the age of digital, in which screens are the norm The appeal of tangible printed objects hasn't waned. No matter whether it's for educational uses and creative work, or just adding some personal flair to your home, printables for free are now a vital source. For this piece, we'll dive deep into the realm of "Electric Car Charging Station Tax Credit 2022," exploring their purpose, where they are, and what they can do to improve different aspects of your lives.

Get Latest Electric Car Charging Station Tax Credit 2022 Below

Electric Car Charging Station Tax Credit 2022

Electric Car Charging Station Tax Credit 2022 -

Verkko If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code

Verkko 25 elok 2022 nbsp 0183 32 The new Section 30C tax credit provides a headline credit for up to 30 percent of the cost of a qualified alternative fuel vehicle refueling station subject to a 100 000 per station limit

Electric Car Charging Station Tax Credit 2022 provide a diverse assortment of printable documents that can be downloaded online at no cost. These printables come in different forms, including worksheets, templates, coloring pages and much more. The appeal of printables for free is their flexibility and accessibility.

More of Electric Car Charging Station Tax Credit 2022

Inflation Reduction Act Commercial EV Charging Station Tax Credits

Inflation Reduction Act Commercial EV Charging Station Tax Credits

Verkko Electric Vehicle and Charging Station Tax Credits Assessing Proposed Changes Section 30D of the US Internal Revenue Code IRC provides business and

Verkko 27 helmik 2023 nbsp 0183 32 Helen Wilbers Editor Auto Loans You could save up to 1 000 on your federal 2023 taxes with the recently renewed EV charger tax credit Here s how to claim it

Electric Car Charging Station Tax Credit 2022 have garnered immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

customization: There is the possibility of tailoring printing templates to your own specific requirements whether you're designing invitations making your schedule, or even decorating your home.

-

Educational Use: Educational printables that can be downloaded for free offer a wide range of educational content for learners from all ages, making them an invaluable source for educators and parents.

-

The convenience of The instant accessibility to an array of designs and templates helps save time and effort.

Where to Find more Electric Car Charging Station Tax Credit 2022

Revving Up EV Adoption Expanding The 2022 EV Charging Station Tax Credit

Revving Up EV Adoption Expanding The 2022 EV Charging Station Tax Credit

Verkko The credit can only be applied once per vehicle The used EV tax credit will take effect January 1 2023 EV charging station credit The EV charger credit formally known

Verkko Electric charging stations for certain vehicles with two or three wheels Property of a character subject to an allowance for depreciation business investment use property

We've now piqued your interest in Electric Car Charging Station Tax Credit 2022 We'll take a look around to see where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in Electric Car Charging Station Tax Credit 2022 for different needs.

- Explore categories like interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets with flashcards and other teaching materials.

- Ideal for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a broad array of topics, ranging including DIY projects to planning a party.

Maximizing Electric Car Charging Station Tax Credit 2022

Here are some fresh ways to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets for free for reinforcement of learning at home for the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Electric Car Charging Station Tax Credit 2022 are a treasure trove of innovative and useful resources for a variety of needs and needs and. Their availability and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the many options of Electric Car Charging Station Tax Credit 2022 today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes, they are! You can print and download these tools for free.

-

Are there any free printables in commercial projects?

- It's contingent upon the specific conditions of use. Always read the guidelines of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns when using Electric Car Charging Station Tax Credit 2022?

- Some printables may come with restrictions in use. Make sure to read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- Print them at home with an printer, or go to any local print store for superior prints.

-

What program must I use to open Electric Car Charging Station Tax Credit 2022?

- Most PDF-based printables are available in PDF format. They can be opened using free software like Adobe Reader.

Inflation Reduction Act Commercial EV Charging Station Tax Credits

Electric Cars Versus Gas Cars ElectricCarTalk

Check more sample of Electric Car Charging Station Tax Credit 2022 below

EV Charging Station Tax Credit How Businesses Can Benefit Powered By

Extension Of Section 30C Tax Credit For EV Charging Stations Foley

The Long Term Benefits And Impacts Of The 2022 EV Charging Station Tax

Zooming In On The 2022 EV Charging Station Tax Credit And Its Impact On

BREAKING Electric Car Charging Station Tax Credit Extended But At

Electric Vehicle Incentive Programs Plug

https://www.foley.com/.../2022/08/ev-chargin…

Verkko 25 elok 2022 nbsp 0183 32 The new Section 30C tax credit provides a headline credit for up to 30 percent of the cost of a qualified alternative fuel vehicle refueling station subject to a 100 000 per station limit

https://energy5.com/revving-up-ev-adoption-expanding-the-2022-ev...

Verkko 22 marrask 2023 nbsp 0183 32 The current EV charging station tax credit which was first introduced in 2005 and extended in 2015 provides a maximum of 30 credit for the

Verkko 25 elok 2022 nbsp 0183 32 The new Section 30C tax credit provides a headline credit for up to 30 percent of the cost of a qualified alternative fuel vehicle refueling station subject to a 100 000 per station limit

Verkko 22 marrask 2023 nbsp 0183 32 The current EV charging station tax credit which was first introduced in 2005 and extended in 2015 provides a maximum of 30 credit for the

Zooming In On The 2022 EV Charging Station Tax Credit And Its Impact On

Extension Of Section 30C Tax Credit For EV Charging Stations Foley

BREAKING Electric Car Charging Station Tax Credit Extended But At

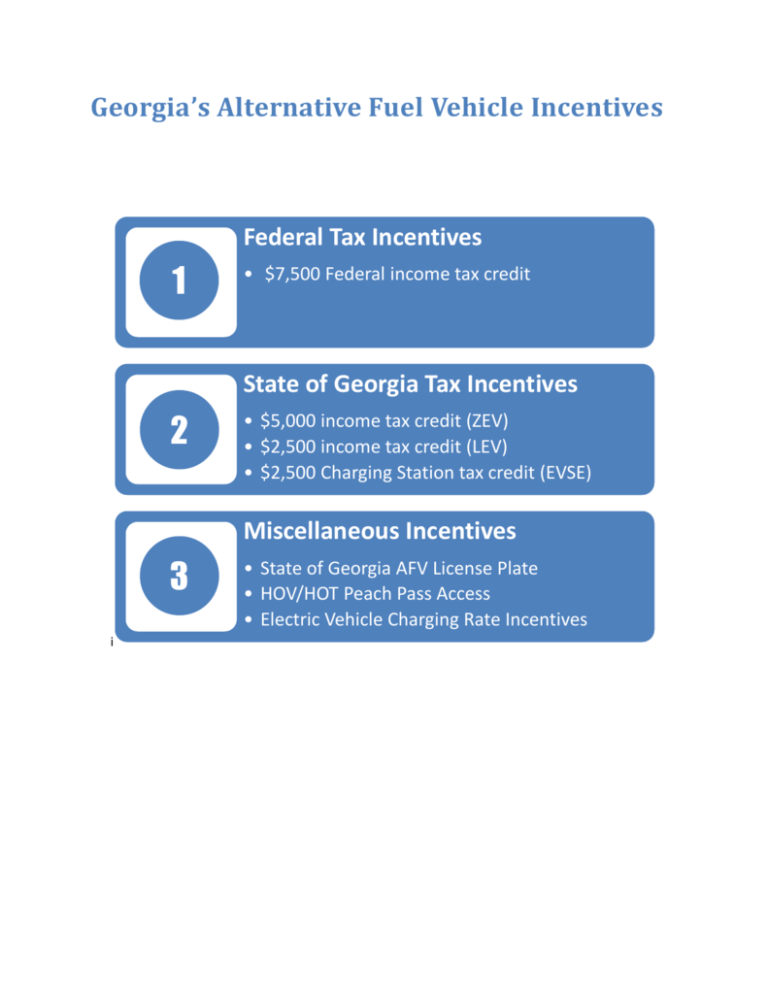

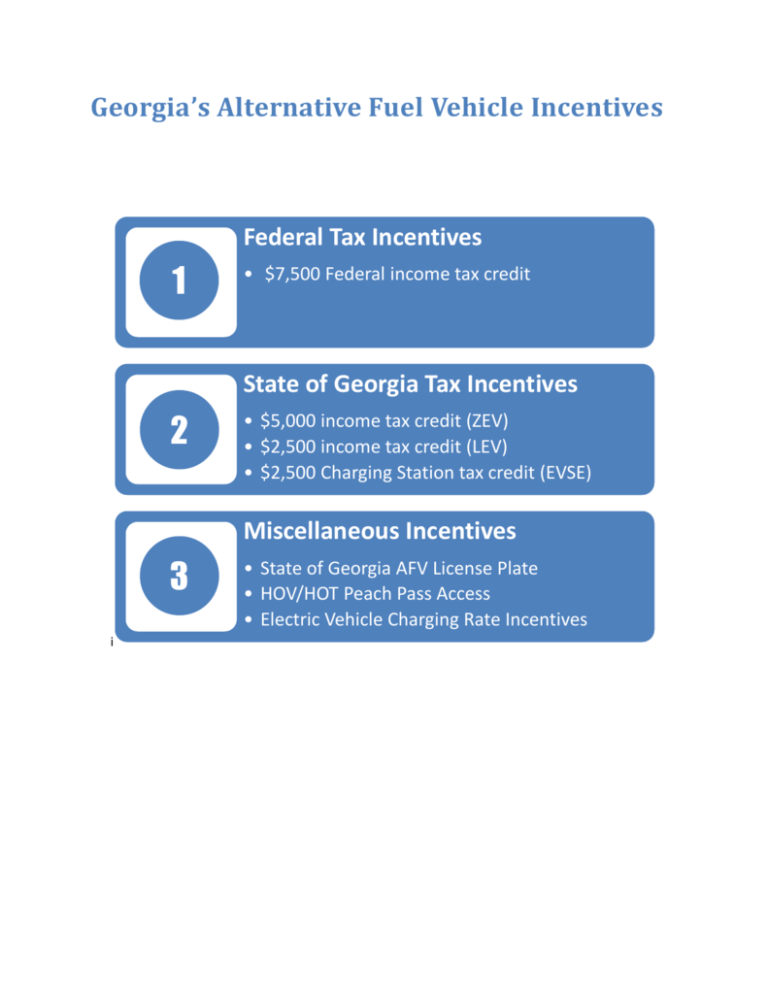

Electric Vehicle Incentive Programs Plug

Ev Charger Tax Credit California Expose Log Book Picture Show

Understanding The Differences Between The Federal And State EV Charging

Understanding The Differences Between The Federal And State EV Charging

An Analysis Of How The 2022 EV Charging Station Tax Credit Affects EV